For IT services, BFSI a bright spot

Financial services clients, the biggest source of revenue for TCS and Infosys, held steady through Q4 of the fiscal year gone by, even adding AI solutions

Tata Consultancy Services and Infosys, India’s two biggest IT companies, entered their new fiscal year on a relatively strong footing, despite the global macroeconomic uncertainty. One important reason for this was that clients in the financial services sector, who account for the biggest chunk of revenue at the Indian IT giants, did well, and as a result handed out robust contracts to them—including in Q4 of FY25.

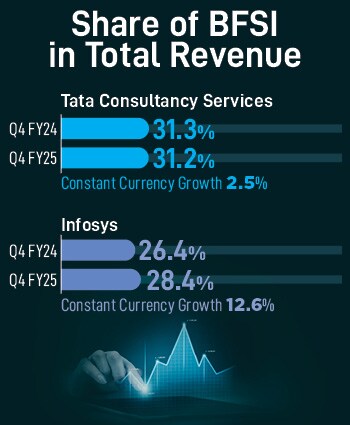

At TCS, for instance, BFSI (banking, financial services and insurance) was the second fastest growing vertical in the company’s biggest markets during Q4 FY25. The energy, resources and utilities segment, which grew faster, is however one-sixth the size of BFSI in terms of its contribution to overall revenues at India’s biggest IT and consulting company.

At Infosys, financial services accounted for 28.4 percent of total revenue for Q4 of FY25 (Jan – March period of 2025) versus 26.4 percent for the same quarter a year ago. Revenue from the vertical rose 12.6 percent in constant currency (which eliminates the effect of currency-rate fluctuations.)

“Over the course of the year, reduction in uncertainties, our strong market position, reflecting in robust deal wins and improvement in discretionary spend in financial services led to better growth than our initial projections," Jayesh Sanghrajka, CFO at Infosys, told analysts and investors at the company’s Q4 earnings conference on April 17.

Of the 24 large contracts won by Infosys in Q4, with a total contract value of $2.6 billion, seven deals were in Financial Services, Sanghrajka said.

At TCS, total contract value for BFSI was $4 billion, which was roughly the same as a year ago. In the latest Q4, BaNCS, the company’s core banking software product, won four contracts and saw four go-lives, Samir Seksaria, the company’s CFO, said on the company’s earnings call on April 10.

In addition to the perennial demand for saving money and consolidating the number of vendors, banks and financial institutions are proactively addressing tech obsolescence, Seksaria said. For example, they have invested in core platform upgrades in payment operations and improved lending experience.

Data and AI initiatives are seeing significant adoption to raise operational efficiency and improving customer experience, he said. Resilience and availability are being prioritised through cloud adoption and cybersecurity investments.

“BFSI, and most importantly large banks, have been a bright spot for the industry," Peter Bendor-Samuel, founder and CEO at Everest Group, which advises multinational companies on their IT outsourcing strategy, told Forbes India in an email on April 28. “Growth started returning to this sector early in 2024 and has been building slowly ever since."

US banks were profitable as they had added significant service revenue while interest rates were low and now that the rates are high again, and allow for a good spread, they have both good loan revenue and service revenue, Bendor-Samuel said. This strong financial position has allowed them to invest significantly in technology and AI which has created a strong demand for tech services.

Overall, in financial services, “budgets are flat to slightly higher in AI, regulatory compliance and cost management," according to Sanghrajka. He anticipates steady growth in segments such as capital markets and cards and payments in large global banks as well as US regional banks.

Overall, in financial services, “budgets are flat to slightly higher in AI, regulatory compliance and cost management," according to Sanghrajka. He anticipates steady growth in segments such as capital markets and cards and payments in large global banks as well as US regional banks.

The mortgage sector will see an uptick in spend if interest rates reduce going forward, he adds. Infosys expects its investments in AI solutions, and tech for regulatory compliances, risk mitigation and cost management to create growth opportunities.

And demand for IT from financial sector clients was seemingly not impacted by the turmoil caused by US President Donald Trump’s tariff war. Analysts at Japanese bank Nomura noted that “sectors impacted by tariff-induced uncertainty are auto and industrial manufacturing and retail," in a note on Infosys on April 17, after the IT company’s earnings call.

Financial sector clients have also taken the lead in experimenting with and deploying AI-led services.

“We are helping a large US financial services company navigate the AI transformation to deliver hyper-personalised conversational AI-powered customer experience with accuracy of over 80 percent," Salil Parekh, CEO at Infosys, said on the company’s earnings call.

“We have been selected as an AI partner for many of our clients," Sanghrajka adds.

In most sectors AI has been more of a headwind than a tailwind as most companies have struggled to find constructive and significant uses for it, Bendor-Samuel said.

“The BFSI segment is the exception, and the large banks in particular have led the way in making significant investments in AI."

In other industry segments, the service providers have been faced with pressure to deliver productivity savings from AI but have not been able to generate large AI project revenues, he added.

BFSI companies are doubling down on consolidated contracts across the full services portfolio with companies such as TCS, Ray Wang, founder and principal analyst at Constellation Research, told Forbes India in an email on April 30.

“They are seeking assistance with AI at scale," Wang added.

Tech services providers need to demonstrate the ability to deliver on productivity, exponential efficiency, and innovation with guard rails for regulation, he said.

“AI Agents today will replace human work 10:1. In the next 24 months that will be 100:1. BPO is dead. The old model of service delivery will move from $400,000 per employee to $1 million per employee by end of 2026," he said. Meaning there might be fewer humans in IT and software overall, but the ones in it will likely be sought after for their higher-order skills and experience.

The biggest challenge is balancing public cloud exposure with air-gapped solutions for AI, and cost reduction must be exponential (to justify deployment of an AI solution), he says.

Today, most pilots or proofs-of-concepts fail to go into production as the return on investment in AI projects is low to often non-existent, according to Bendor-Samuel. “However, we are starting to see tangible benefits emerge and we expect that significant opportunities will start to emerge in the coming months," he adds.

First Published: May 02, 2025, 11:44

Subscribe Now