There was a time when Aiman Ezzat was dropped into the hot seat of CFO at Capgemini, the Paris-headquartered global IT services company.

“I was good with numbers, but I had no finance background. I’d done finance in business school, but that was the limit of my financial experience," Ezzat, who turns 60 next month, recalls in a recent interview with Forbes India. He had been included in a panel of internal and external candidates and went through a process that would see him become the Chief Financial Officer. It was in December, he recalls, with the end of the fiscal year coming.

Ezzat, who saw himself as an “operations guy," was thrown in at the deep end straightaway, to close the books for the year, prepare the financial communication that would go out to investors and regulators and also help the then CEO, Paul Hermelin, define the guidance for the coming year.

Would it be a matter of weeks before he was fired, Ezzat had wondered to himself. Then, instead of worrying about knowing everything about finance, he turned the role into one of leadership, and honestly sought out people who knew more than him in specific technical areas.

His success in the role over the next six years paved the way for the larger prize. The Chief Operating Officer’s role followed, and in May 2020, after two years as COO, Ezzat was named chief executive of Capgemini Group, a $19 billion technology services provider that offers everything from sophisticated financial services technology to digital twins of complex machinery, full-scale designs of electric and connected vehicles and the plans to manufacture them, migration to the cloud and digital technologies.

Over the last 15 years or more, Ezzat was also instrumental in building Capgemini’s Indian unit that went from a couple of thousand staff to over 46 percent of the 270,000-strong workforce at the company. And, as large corporations around the world boost their technology spending to change their business operations in the post pandemic world, Ezzat expects the Indian unit to play a strong role in innovating for its clients.

A More Global Company

“Capgemini has gone through a lot of transformation. We started as a fairly decentralised technology-oriented company with strong local skills," Ezzat tells Forbes India in a recent interview. The company grew through acquisitions, and even the current name Capgemini comes from the acquisition of two companies CAP and Gemini Computer Systems. Over the last 15 years, Capgemini has become a much more global company in terms of how it operates, manages its clients and partnerships, delivers its programmes, and even how it thinks as an organisation, Ezzat says.

“Capgemini has traditionally done a great job with innovation and transformation," Ray Wang, founder and principal analyst at Constellation Research, a tech consultancy in the US, tells Forbes India in an email. The company has a strong base of European and North American clients, and it has been able to effectively deliver on blended work, Wang explains—meaning a mix of consulting, technology, and onsite and offshore delivery.

Over the past three to five years, Capgemini has focused on scale in profitable areas, he says. The acquisition of Altran Technologies, concluded in April 2020, brought extensive capabilities in areas including cloud computing and 5G. Capgemini has also built out its business process outsourcing capabilities, which has helped it win more cross-functional accounts. It has been able to grow larger accounts on breadth and depth of services, Wang says.

The company’s transformation has tracked how IT has changed over those years. Traditionally, IT was more about helping clients run their companies better. It started in accounting and finance, and was about how to run companies more efficiently, focussed on finance, human resources, logistics, getting sales data and so on. ERP (enterprise resource planning) software took it to the next stage by making it possible to track sales on a daily basis.

Today, technology has become all pervasive and IT services has moved into helping large companies not only run their operations better—from designing to after-sales—but also manage their relationships with their end-customers.

Then there is the emerging area of ‘intelligent industry,’ which is about digitisation of industrial companies and how products and systems interact and send data around that needs to be captured, analysed and fed back into decisions. For example, once upon a time, a car was a standalone product — buy it from a dealer, fill petrol, use it, take it to a garage for maintenance when needed. “Today it is a plug-in object, like a smartphone," Ezzat points out. “Tesla’s electric cars are plugged into its software architecture. This is fundamentally changing everything in that ecosystem on an ongoing basis. It’s a lot of opportunity for the IT sector to grow fast."The challenge now is to become much more relevant to clients, he says. “You can’t just say I know how to code software. Nobody is interested in that. The question is, ‘can you help me build the software architecture as an auto company to operate electric vehicles and move towards autonomous mobility?’"

For that, IT providers need to understand the industry beyond the technology. Every discussion is about business, and IT services companies are not just talking to chief information officers of their customers, but increasingly engaging business heads. Discussions are about how tech can help deliver new revenue streams or help companies position themselves ahead of competitors.

For example, Capgemini has designed a complete electric vehicle for an auto manufacturer. Capgemini took inputs on certain costs and concepts from this customer and completely designed not only the electric vehicle but also the manufacturing plan for delivering the vehicle at that cost. This required a deep understanding of how cars are built and how they are used — deep knowledge of not only the auto industry, but also of the emerging electric vehicle ecosystem, including the technologies that might eventually lead to on-road autonomous vehicles.

Another example is that of Capgemini helping a client plan a future ‘giga factory’. The name giga factory is attributed to Tesla’s factories that would make large numbers of lithium-ion batteries, but it is increasingly being used to describe any such factory. For example, American automaker GM is building its own giga factory. To help its customer plan a future giga factory, Capgemini brings in extensive knowledge of how such modern factories operate. IT companies today need to know their clients’ businesses and processes very deeply be able to build software to support those businesses.

Near-term Shortage

This shift has been accelerated by the Covid-19 pandemic. Today, companies are moving to the cloud computing model much faster than before the pandemic. They see cloud platforms as vital to the changes that they need to bring about in their business operations. The pandemic has pushed people to skip three to four years of transition. Similarly, working from home was happening sporadically, but now it is across industries.

Even in places like factories, the ability to fix problems with digital technologies is becoming important. For example, the pandemic has made it very difficult for a technical expert to easily visit a plant in person. In such situations, tools like ‘digital twins’ that use software to mimic real, physical, objects are being employed. The pandemic has significantly accelerated the need for such digital technologies.

One of the first consequences will be that there will be inadequate supply in comparison with the heightened demand for the new tech services, Ezzat says. “I think there will be a supply shortage. The demand is much higher today than most companies are able to supply. It will create a bit of strain in the market." Over time, the capacity will build up, but in the next couple of years there will be some shortages.

Second, every product, system and operation will become ‘intelligent.’ In the example of the auto sector, companies will want to build their own software architectures for their cars and other electric vehicles. They will want to build their own software development and engineering teams.

The overall demand for software and product engineering — not just software applications, which was the traditional world of the IT sector — is going to explode, he says. “We are going to hit the shortage cycle in the next 12-18 months" for availability of skilled people in specific areas — not applications for finance or HR, but for connected cars, modern aircraft, smart grids, utilities and so on. The IT industry will hit shortages in terms of capacity across the world.

This means that companies will have to be laser-focussed on the specific areas in which they want to build solutions for their clients, and find ways of attracting and retaining talent in those areas.

The ‘up-cycle’ in tech spending will likely continue over the next three to five years, Ezzat says. “I do believe that we are going to have sustained demand in the coming years." Capgemini is gearing up by continuing to acquire companies, much as it has done throughout its 53-plus years of history.

Growth by Acquisition

“Capgemini has historically benefited from its European roots and its access to senior EU decision-makers," Peter Bendor-Samuel, founder and CEO of US-based IT consultancy Everest Group, tells Forbes India in an email. It has also had a strong commitment to consulting, which in turn has often positioned it well on the leading edge of many of the big innovations in the market place. For example, Capgemini was one of the early leaders in complex business process outsourcing. It also has a strong position in design and design thinking — an often iterative way of arriving at solutions based on better, deeper understanding of the end users.

However, “Perhaps its greatest strength has been its ability to grow through acquisitions and successfully integrate these components into to the larger group," Bendor-Samuel says.

The $4.3 billion acquisition of Altran, a product engineering and R&D specialist, added some 50,000 people to Capgemini, including about 15,000 in India. It added capabilities in cloud computing, edge computing, internet-of-things tech, artificial intelligence and 5G. With the Capgemini-Altran combination, “Today we have a very broad 5G capability," from network design to specific business applications for clients, Ezzat says.

The company has established a lab in Portugal to develop 5G technologies around network equipment, and labs in Paris and Mumbai to build end-user applications for 5G. Capgemini will use these labs to build proof-of-concept technologies and to collaborate with startups to bring multiple solutions in 5G to its clients.

Acquisitions are in the DNA of Capgemini, which in its earlier years expanded into markets like the Netherlands, Germany and Britain via acquisitions. An important difference between Capgemini and various rivals, which have also followed aggressive inorganic strategies, has been the sizes and quality of Capgemini’s acquisitions, Bendor-Samuel says. Other companies have followed a path of buying smaller, tuck-in targets or “bargain properties," he says, as in the case of DXC, which Capgemini’s smaller French rival Atos had proposed to acquire, but then ended the talks.

Capgemini has eschewed this approach and has looked to acquire premium properties of scale. To pull this off, it is willing to pay the premium required and also do the heavy lifting of large integrations. The result is, it emerges as an industry leader that can also offer scale, Bendor-Samuel says.

An important reason acquisitions work at Capgemini is, “It’s an open culture … and we don’t have the French going and dominating everywhere," Ezzat says. Local managers and those who come in via acquisitions have a lot of leeway to make their own decisions.

Solid Indian Base

Acquisitions have played an important role in growing the company’s Indian operations too. “I saw how India was being used by the US," recalled Ezzat, who was among the senior executives involved in a programme called Booster to turn around the company’s loss-making North American business in 2005. Part of the plan, was to increase the proportion of work delivered from India.

Capgemini would initiate a program called India 10,000 to take its staff strength from 2,500 to 10,000. Ashwin Yardi, CEO of Capgemini India today, was part of the programme. Yardi himself came to Capgemini via an acquisition, when the French company acquired Ernst and Young Consulting about 21 years ago.

When Capgemini completed the $1.25 billion acquisition of Chicago-based Kanbay, an IT services provider to financial clients, in February 2007, it added 7,600 staff and took its Indian headcount to 12,000. That made India the second largest Capgemini unit worldwide, with 18 percent of its workforce at the time. The $4 billion acquisition of IGate in 2015 took that further, adding some 33,000 staff to Capgemini, most of whom were in India.

Today, Capgemini has some 125,000 employees in offices including Mumbai, Pune, Bengaluru and Chennai. That is over 46 percent of the company’s total workforce. This year, Capgemini expects to hire another 30,000 people on a gross basis.

The Indian operation was never seen as just a back office delivery unit to win orders and reduce cost, unlike at some of the other western companies, Ezzat says. “From the inception, India became an integral part of Capgemini. Very quickly, we had Indian executives as part of our senior team."

The ‘one team’ model that Capgemini inherited from Kanbay became pervasive everywhere. Of course, in Europe at the beginning it was difficult. “In Germany, for example, it was very tough in the beginning for engineers to accept that there were people in India who could do work just as well as them" — it took time, Ezzat says.

India went from a delivery centre to being an integral unit for knowledge management. For example, when he was leading Capgemini’s financial services business, Ezzat moved a host of banking reports and insurance reports to India because he was convinced those skills could be developed in India. Capgemini also added various centres of excellence in India. Today, the Indian unit isn’t a global delivery centre but a global business platform, he says.

Many solutions are often seeded in India and developed by the Indian unit before it is deployed around the world, Ezzat says. India has become a fundamental part of the group. A lot of activity is happening in India for not just delivery, but innovation, sectoral knowledge, account management and support. Multiple platforms are run from India that support the performance of the whole group.

Over time, more Indian executives have also joined the senior leadership of the group. Yardi adds that the Indian unit is at the forefront of an Applied Innovation Exchange that Capgemini has built to manage the innovation it does for clients around the world. The Indian centres are also playing a strong role in Capgemini’s ‘Intelligent Industry’ programmes, he says.

Competition from India

![capgemini capgemini]()

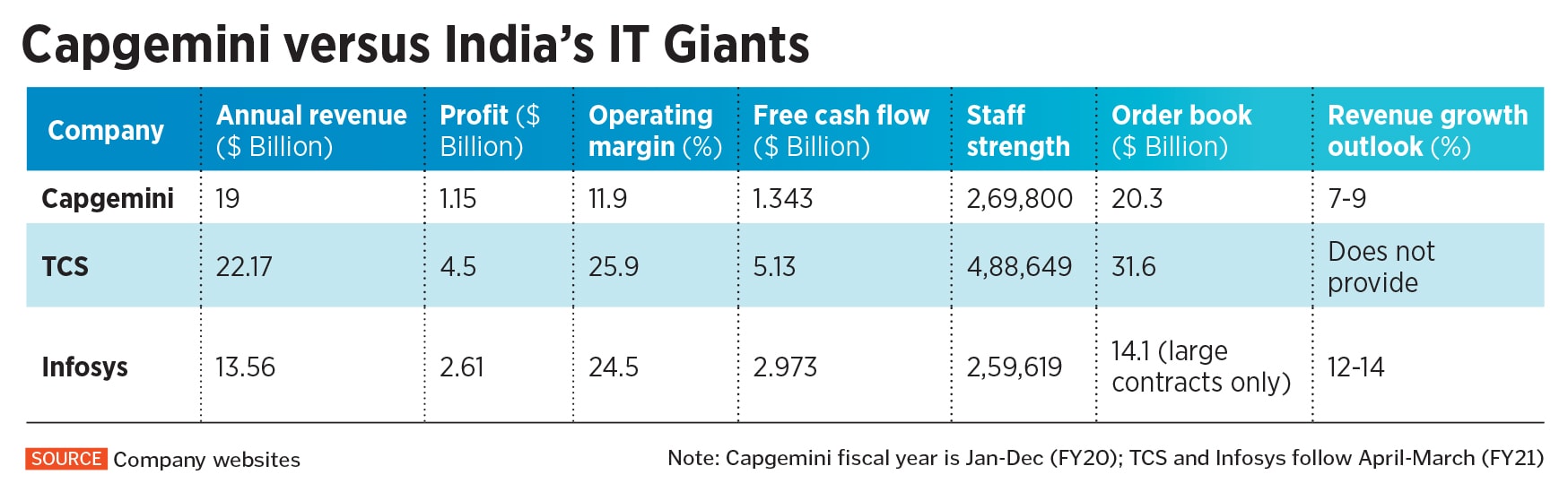

Expansion of delivery from India is perhaps inevitable, as Capgemini faces very strong competition from India’s own IT services giants, which are now among the world’s biggest IT providers. Larger rival Tata Consultancy Services now sees only Accenture as its real competition, and smaller rivals Infosys and Wipro — both led by former Capgemini executives now — are gunning for ever larger contracts, and landing them as well. With most of their workforce based in India, the Indian companies are also far more profitable — they bring very deep balance sheets to the hyper-competitive world of IT contracts.

India’s TCS has a grow-your-own approach, which is slower to build, but when successful often more profitable, Bendor-Samuel says. Infosys uses a combination of the grow-your-own approach and selective tuck-in purchases. Infosys’s efforts to build solutions in-house have been more successful than its acquisitions, although they are making gains on the acquisition front too, he says.

Constellation’s Wang adds: “Capgemini and TCS are very different organisations. In many places they are complimentary in services, in some it is head-on competition." Capgemini also has been more of a decentralised organisation, where vice president-level executives have a lot of latitude to craft creative, out-of-the-box solutions for application across the federated organisation. TCS has been more centralised and executed with precision and scale, he says.

“Aiman is an accomplished leader, who is personally charismatic and who has shown a flair for driving sales," Bendor-Samuel says. He has also shown that he is committed to the growth-by-acquisitions strategy which has propelled Capgemini to its current size and impact. “His greatest challenge is to break down internal silos and position the company as a strategic partner at the C-Suite.""‹

Image: Joel Saget/ AFP

Image: Joel Saget/ AFP