“Everything was so confusing," recalls Chaturvedi. “The only comforting thought was that I was not alone." There was exaggerated optimism that things would improve in a quarter or so. “Everybody was hoping against hope," he says.

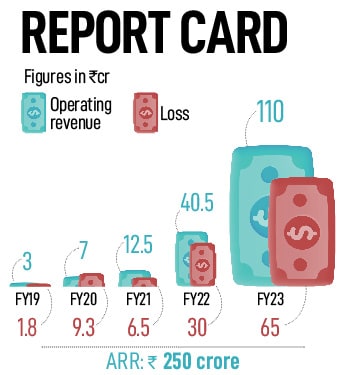

The situation, though, worsened. Things slipped from confusion to chaos. The reason was a no-brainer. Overseas flights had stopped, travel came to a screeching halt, and students abandoned immediate plans to study abroad. Much like the travel and hospitality sectors, which got hit by fierce pandemic headwinds and were wrestling to survive on zero revenue, Chaturvedi too was struggling to stay afloat. A low operating revenue—Rs7 crore in FY20—was not of much help in the fight.

![]()

“I felt cheated," he says, recounting his trauma. The firm courted Chaturvedi for months, took all his business data, won his trust by assuring that it will lead the funding round, and in the end, stabbed the greenhorn. “It jolted me to the core," recalls Chaturvedi. ‘Jolted’ and ‘cheated’ were words he was using after years. Born and brought up, and fed on English classics, the only dream of his middle-class parents from Uttar Pradesh was that their son could master the English language. And Chaturvedi did that.

What the young founder missed was an IIT and IIM tag. During the formative years, one of the VCs—he had spent years with McKinsey, faked an American accent and was notorious to back entrepreneurs flaunting their Ivy League tags—verbally roughed up Chaturvedi for being ambitious. “Fluent English se kya hoga, IIM degree hai? [What’s the point of speaking fluent English, do you have a degree from an IIM?]," he asked. Chaturvedi had completed his MBA from ISB, Hyderabad, and had stints with EY and KPMG. All he had to show, not flaunt, was a less-than-modest business which had clocked Rs1.6 crore in revenue in the first year of operations. “Even the guys from IIT and IIM can’t scale this business. Stop dreaming," advised the VC, thrashing the business model.

![]()

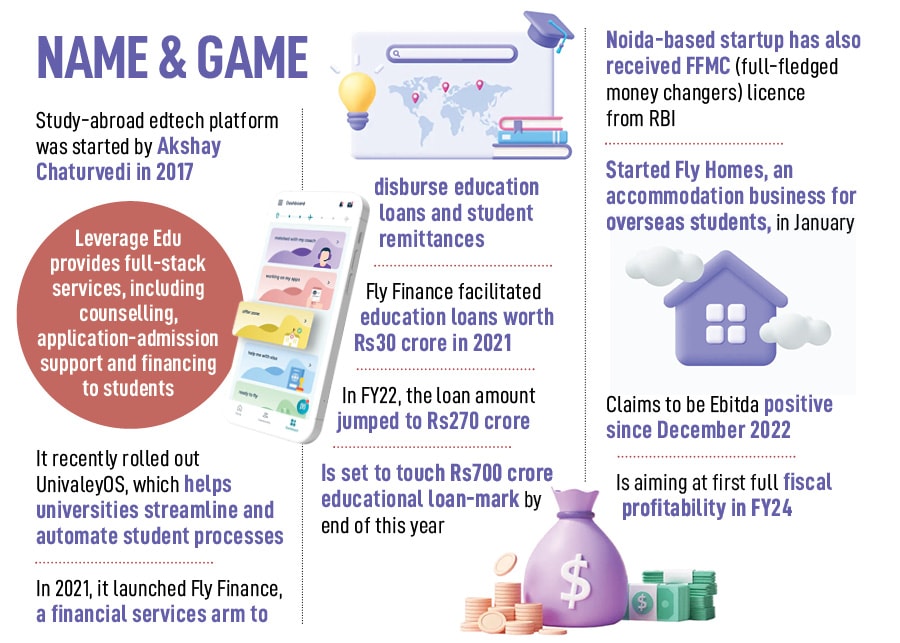

The journey of rejection and dejection continued. A few months down the line, a bunch of VCs were shocked by the ‘slow’ pace of growth. In FY19, LeverageEdu had posted Rs3 crore, and had a loss of Rs1.8 crore. “Learn from guys like WhiteHat Jr," commented one of the funders. “Their scale is impressive. That’s how you must grow to get VC money." Chaturvedi was baffled. During the first six months of his business, LeverageEdu had some Rs50 lakh in revenue and was profitable. “Did you say that you are profitable?" asked a VC who was hearing the funding pitch. “Gadhe mat bano [don’t be a donkey]. Profitable businesses are lifestyle businesses that never scale," he underlined to the founder, who thought there was ample merit in the lessons imparted by the learned man. Now, in FY19, LeverageEdu had posted losses, and Chaturvedi thought he had ticked the right boxes to get the backing of VCs.

![]() He was wrong, though. The goalpost had changed from 2018 onwards. Aggressive scaling was now the name of the game. “But was this a sustainable game?" wondered Chaturvedi, who had worked with Snapdeal and Babajob (which was later acquired by Quikr). At both the places, there were priceless lessons. The first set revolved around ‘what to do’ as a founder, and the second set of lessons came from ‘what not to do’ as a founder. Hyper scaling, definitely, was a big no. Chaturvedi had seen a bunch of startups chasing growth at all costs, and the unit economics was all over the place. For example, some had CAC (customer acquisition cost) as high as Rs22,000 and ARPU (average revenue per user) at Rs2,000. There was another problem. “Raising continuous money was the only way to survive," he says.

He was wrong, though. The goalpost had changed from 2018 onwards. Aggressive scaling was now the name of the game. “But was this a sustainable game?" wondered Chaturvedi, who had worked with Snapdeal and Babajob (which was later acquired by Quikr). At both the places, there were priceless lessons. The first set revolved around ‘what to do’ as a founder, and the second set of lessons came from ‘what not to do’ as a founder. Hyper scaling, definitely, was a big no. Chaturvedi had seen a bunch of startups chasing growth at all costs, and the unit economics was all over the place. For example, some had CAC (customer acquisition cost) as high as Rs22,000 and ARPU (average revenue per user) at Rs2,000. There was another problem. “Raising continuous money was the only way to survive," he says.

In fact, Chaturvedi was witnessing another way to survive. Quikr was playing true to its name, and was in the midst of high-octane growth. By June 2017, it had raised close to $350 million, was a unicorn and valued at around $1.5 billion. Babajob happened to be its 11th acquisition, and the online classified player had spread itself wide by entering into real estate, jobs, automobiles and services. Keeping a firm foot on the accelerator and charting a bullish growth by raising big money were other ways to grow. A singular message that Chaturvedi took home was that ‘one can’t grow a business if it’s not venture-funded’.

![]()

The learning, though, clashed with what Chaturvedi’s parents had ingrained in their lad. “You can learn quickly, but you can’t get education quickly," was the lesson from her mother, a school teacher. His father always underlined the value of money. “You will start valuing it most when you don’t have it," he reminded his son. “Always choose people over money."

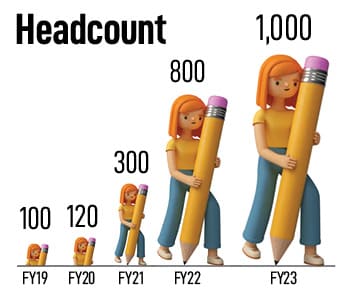

Back in June 2020, Chaturvedi didn’t have money. And he had to make a cruel choice: Layoff or bleed to death. With around 120 people on the rolls, and no business in sight, the founder had to do what everybody in the ecosystem was doing. A month after the ‘VC betrayal’, Chaturvedi was sitting in his deserted office. There were empty chairs, bare desks and haunting silence. It was a Saturday again, and the young founder was in an introspection mode. One predominant theme which he noticed in his life was his lust for validation. And you can’t blame him. As a son, he yearned for praise from his parents. As a student, he used to look forward to appreciation from his teachers. As an employee, he would do anything to hear ‘great work’ and ‘well done’ from his bosses. Now, as a founder, Chaturvedi continued his hunt for validation. This time, from VCs.

![]() Weeks of soul searching on Saturdays helped. Saturdays, he explains, gave me time to step back, reflect and learn. The biggest learning that emerged was cathartic. “I started looking for internal validation," he says. “There were no layoffs during the pandemic," he claims. “We survived the storm together." He also proactively started picking up suggestions and advice from his mentors, some chased and handpicked by him such as Karthik Reddy of Blume Ventures, VC and entrepreneur Heidi Roizen and Karan Khemka, a private equity veteran, and some selected by destiny. One such example of the second kind was Ireena Vittal. One of the leading consultants and advisors in India, Vittal became Wipro’s first woman board member in 2013. Almost nine years later, she was having a conversation with Chaturvedi, who was elated with his efforts to send students from around 850 cities and towns to study abroad.

Weeks of soul searching on Saturdays helped. Saturdays, he explains, gave me time to step back, reflect and learn. The biggest learning that emerged was cathartic. “I started looking for internal validation," he says. “There were no layoffs during the pandemic," he claims. “We survived the storm together." He also proactively started picking up suggestions and advice from his mentors, some chased and handpicked by him such as Karthik Reddy of Blume Ventures, VC and entrepreneur Heidi Roizen and Karan Khemka, a private equity veteran, and some selected by destiny. One such example of the second kind was Ireena Vittal. One of the leading consultants and advisors in India, Vittal became Wipro’s first woman board member in 2013. Almost nine years later, she was having a conversation with Chaturvedi, who was elated with his efforts to send students from around 850 cities and towns to study abroad.

Vittal brutally tempered the enthusiasm of the entrepreneur. “Are you profitable?" she asked. In FY20, LeverageEdu had posted a loss of Rs9.3 crore, a big jump over Rs1.8 crore it had on its books in the previous fiscal. “Of the 850 cities and towns, which ones have the lowest CAC and highest conversions?" she lobbed another question, and dished out a priceless suggestion. “Focus on micro markets, and start working towards profitability."

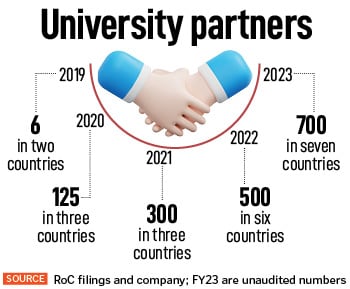

![]() Fast forward to July 2023. LeverageEdu has a promising report card. Revenue has jumped from Rs7 crore in FY20 to Rs110 crore in FY23. The company is striking an ARR (annual run rate) of Rs250 crore. The losses during the same period have increased from Rs9.3 crore to Rs65 crore. “We are Ebitda positive since December 2022, and will have the first full year of profitability in FY24," claims Chaturvedi.

Fast forward to July 2023. LeverageEdu has a promising report card. Revenue has jumped from Rs7 crore in FY20 to Rs110 crore in FY23. The company is striking an ARR (annual run rate) of Rs250 crore. The losses during the same period have increased from Rs9.3 crore to Rs65 crore. “We are Ebitda positive since December 2022, and will have the first full year of profitability in FY24," claims Chaturvedi.

The backers are delighted with the performance. Karthik Reddy of Blume Ventures explains what made him take a look at this study-abroad edtech. Cross-border education and facilitating the best combination of choice and matching were still underserved and inefficient for a very large percentage of Indians who want a global education and opportunity for themselves, underlines the co-founder and partner at Blume. Commenting on the growth of LeverageEdu, Reddy reckons that Chaturvedi’s evolution as a founder gets reflected in the journey of his startup. While he was catering to the high-end colleges and students in the early days, he was honest enough to realise that the size of the opportunity was 20-30x when one looked at the aggregate number of Indians looking for opportunities of education abroad. “And India is probably a small sliver of the aggregate market one can serve," he says, adding that LeverageEdu is on a mission to solve problems for everyone in this space.

![]() What the VC prides most in is not the mission but a sustainable vision. “If this downturn hasn’t taught the Indian ecosystem, I don’t know what else will," says Reddy. When the industry you’re disrupting has certain economics, he underlines, your job is to catch up quickly and then outpace them on growth and profitability, and not make excuses to not get there. “Akshay understands this about his business and, therefore, the accelerated path to profitability and hopefully an IPO," he adds.

What the VC prides most in is not the mission but a sustainable vision. “If this downturn hasn’t taught the Indian ecosystem, I don’t know what else will," says Reddy. When the industry you’re disrupting has certain economics, he underlines, your job is to catch up quickly and then outpace them on growth and profitability, and not make excuses to not get there. “Akshay understands this about his business and, therefore, the accelerated path to profitability and hopefully an IPO," he adds.

Chaturvedi, for his part, now seeks another kind of external validation. This time from the public market. A picture frame hangs in his office, and it reads: ‘We ain’t going to stop at anything less than an IPO. IPO 2025’. As the three-hour meeting with the entrepreneur comes to an end, coincidentally it"s the second Saturday of June. Chaturvedi gets ready to sing and dance with his employees. “Thank God, it’s Saturday," he smiles, alluding to the name of the weekly Saturday ritual of bonding with his employees which started last year. “The only thing I have leveraged is the power of my employees," he signs and mingles with the crowd.

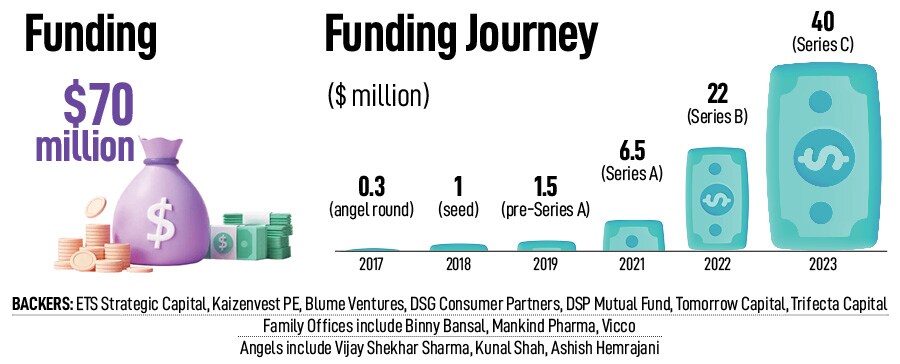

There was hope, though. For seven months, the rookie founder had been in talks with one of the top dogs in the VC (venture capital) world for funding. For three consecutive years starting 2017, Chaturvedi had raised three tiny rounds of funding—$300,000 as angel money, $1 million in seed capital and $1.5 million in pre-Series A. The impending Series A funding was supposed to be substantial. Diligence had been done, talks had concluded, and the investment committee of the VC fund had given its nod. The only thing left was signing the deal.

There was hope, though. For seven months, the rookie founder had been in talks with one of the top dogs in the VC (venture capital) world for funding. For three consecutive years starting 2017, Chaturvedi had raised three tiny rounds of funding—$300,000 as angel money, $1 million in seed capital and $1.5 million in pre-Series A. The impending Series A funding was supposed to be substantial. Diligence had been done, talks had concluded, and the investment committee of the VC fund had given its nod. The only thing left was signing the deal.

He was wrong, though. The goalpost had changed from 2018 onwards. Aggressive scaling was now the name of the game. “But was this a sustainable game?" wondered Chaturvedi, who had worked with Snapdeal and Babajob (which was later acquired by Quikr). At both the places, there were priceless lessons. The first set revolved around ‘what to do’ as a founder, and the second set of lessons came from ‘what not to do’ as a founder. Hyper scaling, definitely, was a big no. Chaturvedi had seen a bunch of startups chasing growth at all costs, and the unit economics was all over the place. For example, some had CAC (customer acquisition cost) as high as Rs22,000 and ARPU (average revenue per user) at Rs2,000. There was another problem. “Raising continuous money was the only way to survive," he says.

He was wrong, though. The goalpost had changed from 2018 onwards. Aggressive scaling was now the name of the game. “But was this a sustainable game?" wondered Chaturvedi, who had worked with Snapdeal and Babajob (which was later acquired by Quikr). At both the places, there were priceless lessons. The first set revolved around ‘what to do’ as a founder, and the second set of lessons came from ‘what not to do’ as a founder. Hyper scaling, definitely, was a big no. Chaturvedi had seen a bunch of startups chasing growth at all costs, and the unit economics was all over the place. For example, some had CAC (customer acquisition cost) as high as Rs22,000 and ARPU (average revenue per user) at Rs2,000. There was another problem. “Raising continuous money was the only way to survive," he says.

Weeks of soul searching on Saturdays helped. Saturdays, he explains, gave me time to step back, reflect and learn. The biggest learning that emerged was cathartic. “I started looking for internal validation," he says. “There were no layoffs during the pandemic," he claims. “We survived the storm together." He also proactively started picking up suggestions and advice from his mentors, some chased and handpicked by him such as Karthik Reddy of Blume Ventures, VC and entrepreneur Heidi Roizen and Karan Khemka, a private equity veteran, and some selected by destiny. One such example of the second kind was Ireena Vittal. One of the leading consultants and advisors in India, Vittal became Wipro’s first woman board member in 2013. Almost nine years later, she was having a conversation with Chaturvedi, who was elated with his efforts to send students from around 850 cities and towns to study abroad.

Weeks of soul searching on Saturdays helped. Saturdays, he explains, gave me time to step back, reflect and learn. The biggest learning that emerged was cathartic. “I started looking for internal validation," he says. “There were no layoffs during the pandemic," he claims. “We survived the storm together." He also proactively started picking up suggestions and advice from his mentors, some chased and handpicked by him such as Karthik Reddy of Blume Ventures, VC and entrepreneur Heidi Roizen and Karan Khemka, a private equity veteran, and some selected by destiny. One such example of the second kind was Ireena Vittal. One of the leading consultants and advisors in India, Vittal became Wipro’s first woman board member in 2013. Almost nine years later, she was having a conversation with Chaturvedi, who was elated with his efforts to send students from around 850 cities and towns to study abroad. Fast forward to July 2023. LeverageEdu has a promising report card. Revenue has jumped from Rs7 crore in FY20 to Rs110 crore in FY23. The company is striking an ARR (annual run rate) of Rs250 crore. The losses during the same period have increased from Rs9.3 crore to Rs65 crore. “We are Ebitda positive since December 2022, and will have the first full year of profitability in FY24," claims Chaturvedi.

Fast forward to July 2023. LeverageEdu has a promising report card. Revenue has jumped from Rs7 crore in FY20 to Rs110 crore in FY23. The company is striking an ARR (annual run rate) of Rs250 crore. The losses during the same period have increased from Rs9.3 crore to Rs65 crore. “We are Ebitda positive since December 2022, and will have the first full year of profitability in FY24," claims Chaturvedi. What the VC prides most in is not the mission but a sustainable vision. “If this downturn hasn’t taught the Indian ecosystem, I don’t know what else will," says Reddy. When the industry you’re disrupting has certain economics, he underlines, your job is to catch up quickly and then outpace them on growth and profitability, and not make excuses to not get there. “Akshay understands this about his business and, therefore, the accelerated path to profitability and hopefully an IPO," he adds.

What the VC prides most in is not the mission but a sustainable vision. “If this downturn hasn’t taught the Indian ecosystem, I don’t know what else will," says Reddy. When the industry you’re disrupting has certain economics, he underlines, your job is to catch up quickly and then outpace them on growth and profitability, and not make excuses to not get there. “Akshay understands this about his business and, therefore, the accelerated path to profitability and hopefully an IPO," he adds.