How Route Mobile became a darling of investors

The cloud communications platform provider which started with an investment of $2,000 in 2004 and a second-hand computer, has seen its stock listed at an 86% premium, and has risen over 92% over the p

(From left) Brothers Rajdip Gupta and Sandip Gupta took home only Rs 12,000 as salary for 10 years after the launch of Route Mobile in 2004

(From left) Brothers Rajdip Gupta and Sandip Gupta took home only Rs 12,000 as salary for 10 years after the launch of Route Mobile in 2004

Courtesy: Route Mobile

A second-hand computer. That’s all it took to turn around Rajdip Gupta’s fortunes.

It all began sometime in late 2003, when Gupta, a bespectacled software developer, returned to India to start something of his own, after spending a few years in the UK. Gupta was tired of being an employee, often finding himself at odds with his seniors at the workplace. To be taken seriously, his mentor told him, he had to become his own boss and not remain an employee.

But quitting a well-placed job to start something of his own wasn’t going to be easy, especially since he came from a middle-class family where money was important. So even as he began drawing up plans for his entrepreneurial venture, he also began freelancing, doing odd jobs developing software to bring in extra income.

“I did some consulting work with one of the top fashion designers in India today,” Mumbai-based Gupta told Forbes India over a Zoom call. “I will not take the person’s name. He didn"t pay me, and instead said I could take a computer that he wasn’t using that was lying in a corner.” As barter payment, Gupta picked up that computer, with 4 MB RAM on an Intel 486 processor with 16 GB of hard disk, for Rs 6,500. To put the specifications in perspective, most smartphones today boast over 4 GB of RAM, 10 times that of Gupta’s second-hand computer, and some 64 GB of space.

“That"s luck,” says Gupta, who didn’t have a computer then. “I took the computer, and I built a whole group.”

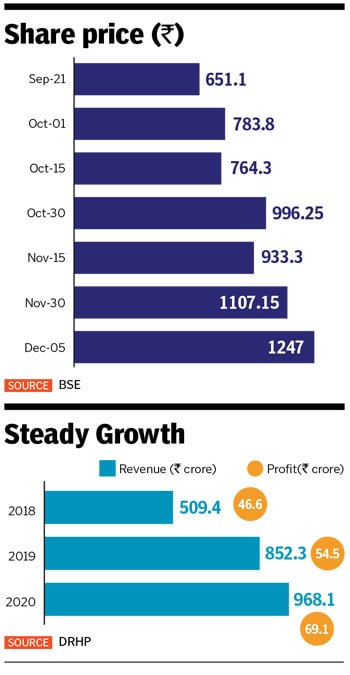

That group, Route Mobile, has had a phenomenal run on the bourses since its IPO in September this year. The stock listed at an 86 percent premium, and over the past two months, has risen over 92 percent.On December 11, the company’s share price on the BSE stood at Rs 1,127, with a market capitalisation in excess of Rs 6,400 crore. With over 66 percent stake in the company, the Gupta family’s net worth is well in excess of Rs 4,200 crore. Rajdip, 44, is the group CEO and managing director, while his brother Sandip Gupta, 45, is the chairman of Route Mobile.

Route Mobile calls itself a cloud communications platform provider, catering to enterprises, over-the-top players, and mobile network operators. Quite simply, a significant part of the company’s business involves being the middleman between a mobile operator and an enterprise, helping deliver messages or other communication services to the end user.

For instance, a one-time password for a financial transaction is often generated by a bank, that is then delivered to the end customer by a telecom operator, such as Airtel or Jio. Route Mobile is the go-to person in between, who has tied up with the operator and delivers those messages to the end customer.

“We are in between the operator and the enterprise,” Rajdip says. “We have connectivity established with over 250 operators globally and we are the largest CPaaS (Communications platform as a service) based out of India and we are the largest in Asia, Africa, and the Middle East in terms of connectivity and in terms of customers.” That means, Route Mobile’s Application Programming Interfaces (API) are connected to an enterprise, which then generates the data that needs to be transmitted. It is passed through Route Mobile’s API to the telecom operator for final delivery. APIs are essentially software intermediaries that allow two applications to talk to each other.

Route Mobile’s clientele today includes India’s largest public sector bank, SBI, ICICI Bank, Bank of Baroda, Facebook, Google, and Samsung, among others.

"For instance, you get a Facebook recovery password, or an alert when you transact using Google Pay or the two-factor authentication of Google for your email," Gupta explains. “All of that is provided by us.”

In all, the company has over 3,000 monthly billable clients across the world and provides everything from messaging, voice, email, and SMS filtering and analytics to clients across banking and financial services, aviation, retail, ecommerce, logistics, health care, hospitality, media and entertainment, pharmaceuticals, and telecom. Last year, the company delivered over 31 billion messages. “I have always believed that anything you create can get better and much larger,” Gupta says.

Being the Boss

Route Mobile started out as Route SMS Private Limited, from Gupta’s bedroom in Mumbai. That decision to start out, he reckons, was an attempt at being taken seriously by his seniors, and also due to his contrasting views on how technology would emerge. “I used to have heated discussions with my seniors on technology,” the 45-year-old says. “One of my mentors [in the UK] told me that the problem with being a developer was that the seniors would not take me seriously. If you really think you have a much better understanding of technology, he said, you must build something of your own.”

That was the trigger Gupta needed. Soon, he packed his bags and left the UK for Mumbai, where he had grown up, to try his luck. A physics graduate from the National College in Mumbai, Gupta had also completed his diploma in software engineering from Aptech Computer Education in the 1990s after which he had begun working for companies that included Gurukul Online Learning Solutions and UK-based Spectrum Network. Working with Spectrum Network in the UK, which counted companies such as IBM and Orange among its clients, gave Gupta an insight into the world of communications.

“I realised that mobile communication will go beyond voice,” Gupta says. “But, back then, there was no ecosystem where you could go and raise funds with an idea. We wanted to make sure that whatever we start should generate revenue and profits.”

With the second-hand computer that he had bought in the barter, Gupta began coding for the platform from his bedroom. “I was very clear that I"m not going to start this with a focus only on India,” Gupta adds. With Rs 1 lakh ($2,000) that he had saved, Gupta set up Route SMS private Limited in 2004, the only investment that he has made in the company so far.

In the first year, the company tied up with clients in the Middle East, for whom Gupta provided the backend support, while the API was sold to clients. “There were small scale SMEs who wanted to have this kind of solution where they could rebrand the entire platform as their own brand,” Gupta says. “So, I created a reseller programme where we put their logo to go and sold our solution in the market.”

Within a year, the company had between 40 and 50 retailers. The company would provide a username and password to clients for about $1,000, allowing them to send one lakh messages. “We only managed

the operator connectivity,” Gupta says. “Later on, we started focusing more on enterprise and that’s all about APIs. All enterprises have their own IT team, and what they need is an API plug-and-play user platform.”

By 2005, Sandip Gupta, Rajdip’s brother, and a chartered accountant who was a consultant with PwC, joined him in the business. “Till today, we have never raised funds and we were very conservative,” Gupta adds. “Whatever we earned, we reinvested in the company. We started focusing more on designing and developing a solution for the end user. The very first year we made Rs 1 crore in revenues and Rs 50 lakh as profit.”

It also helped that the brothers were rather frugal. For 10 years after the company was founded, the brothers took a salary of only Rs 12,000. “If you have that vision to create something larger, you always reinvest back into the company,” says Gupta.

Scaling Up

By 2011, the company opened its first international office in London, and in 2012 launched its enterprise business in India. Much before that, since its launch in 2004, the company had largely focussed on the European market, where it pioneered the application to peer (A2P) messaging format, before turning its attention to India.

“We have over 24,000 customers across the globe from the US to New Zealand and Russia,” Gupta says. “Being a cloud-based platform makes it very easy for people to integrate. Over the last 16 years we have built a steady network on the operator side of the connectivity, as well as a great customer base,” Gupta says.

Today, a bulk of the company’s business involves assisting companies in their digital communication strategy through multiple channels. That includes an omnichannel platform, using messaging, email, RCS messaging, voice, and OTT business messaging, allowing enterprises to reach customers. So far this fiscal, the company has processed some 6.95 billion billable transactions.

The company follows a mark-up model for revenue where it pays the operator, and adds their mark-up before it is sold to the enterprise. “So, whatever price we buy from an operator we add a mark-up, and we sell to the enterprise,” Gupta says. “So there is no fixed pricing as such in the market.” Companies now looking to improve their user engagement and customer experience has helped ventures like Route Mobile ramp up their business. “I think RBI mandates every bank to send messages,” Gupta says. “Everyone wants to have more engagement with the end-user.”

Today, the company’s gamut of offerings includes application to person messaging, RCS messaging that includes video, audio and images, Viber business messaging, apart from emails and voice services.

Meanwhile, over the past few years, the company has begun to diversify its business after it acquired Mumbai-based Call2Connect and Malta-based SMS Firewall solution company, 365squared. 365squared provides a solution to monitor SMSes, more specifically where they are originating, and therefore charge a termination fee for it. The concept is relevant for regions such as Africa, Latin America, and Asia where operators don’t have termination contracts with other global operators, and therefore free messages can be landed on their networks.

“We put a firewall within the operator network, which allows us to start rejecting all the messages coming from other operators who are not a partner with this operator,” Gupta says. “We did the first deployment in India with Idea Cellular in 2018. It was losing almost 100 crore in revenue leakage and we have been able to generate over100 crore revenue for Idea during the last two years.”

Last month the company also tied up with debt-laden public sector telecom operator BSNL to offer the same services, and has also extended the same to some 10 operators globally, which now contribute about 16 percent of the company’s revenue. In October 2020, the company also acquired Bengaluru-based TeleDNA, which specialises in the development of telecom-related solutions like MMSC (Multimedia Messaging Service Center), SMSC (Short Message Service Center) platforms, SMS HUB, and SMS firewall.

“Route Mobile is going to focus more on the enterprise side of the business, while 365squared will focus on the operator side of the business,” Gupta says. He adds that their business model is hard to replicate, including by operators, who could possibly undertake the same business that Route Mobile does, without having to engage with a third party.

“We have maybe four or six operators based out of India. We are already buying from these operators and giving them the revenue. So why should they get into this business where they have to actually set up a 400-people team for support and logistics for this business?” Besides, the regulatory nuances involved in the business are rather complex, helping Route Mobile ward off any imminent threats from internet giants.

“If Google wants to do what we are doing, they have to go to each and every operator in every country,” Gupta says. “Plus, there is a different regulatory aspect for each and every country. As a company our core business is communication. We try to understand each and every law of the land and accordingly build a platform. So, for Google, Facebook, or any enterprise sending data to our platform, we first try to see that the data passing through our platform is compliant with that country.”

Big Plans

Going forward, Gupta has laid out some elaborate plans to focus on new-age technologies, as digital adoption and penetration increase on the back of the ongoing pandemic.

To begin with, the company has begun shifting its focus from SMS to other platforms including WhatsApp and Viber. “Viber or WhatsApp for business is the next adoption,” Gupta says. “So, most of the enterprise will adopt two-way communication-based solutions. We will offer the same layers of communication to existing customers.” Among others, the company is already a global partner with WhatsApp, allowing it access to WhatsApp’s API.

The decision is also due to India’s growing internet and smartphone penetration that has seen significant growth over the past few years. “The number of messages being sent nowadays, whether it’s Flipkart or Amazon or transactions through Google Pay, Paytm and WhatsApp Pay will all see significant growth,” Gupta says. “So, every transaction or interaction will have some kind of alert.”

“So, my provider will change, but my revenue mark-up is going to be the same, but the margins are much higher as compared to SMS on all these new-age technologies,” Gupta adds.

Gupta also reckons that virtual contact centres will see more traction. “Most of the contact centres require a lot of broad-based solutions like chatbots,” Gupta says. “Today, bots handle 50 percent of the queries. So we will focus on bots, AI, and the virtual contact centre.”

That means, more acquisitions are in order, particularly in machine learning, chatbots, and artificial intelligence. “We provide backend support, but as a company, I would like to have these offerings too,” Gupta says. “Right now, we have the API story where we are doing well. Now, if I want to create a billion-dollar revenue company, I think I need to have more customers and a wider variety of offerings to my end user. That’s exactly what my focus is and we’re working on that right now.”

And it seems well poised to cash in on the growth. A recent study by research and advisory firm Gartner estimates that by 2023, 90 percent of global enterprises will rely on CPaaS offerings to enhance their digital competitiveness, up from 20 percent in 2020.

“RML’s cloud-based delivery platform enables it to build and manage applications without having to create and maintain the underlying infrastructure for each client,” research firm HDFC Securities said in a report in September. “It is, therefore, able to provide enterprises with solutions to operate applications without purchasing, configuring, or managing the underlying hardware and software. It currently operates at a throughput capacity of over 10,000 messages per second. Its six strategically located data centres provide its operations with the resilience required to meet the requirements of its clients.”

For Gupta, however, all this is only the beginning. Over the next few years, the brothers want to touch a billion dollars in revenue. “From starting out with $2,000 to almost reaching $200 million in revenue this year, we have had a pretty good run,” Gupta says. “But there is a long way to go.”

First Published: Dec 14, 2020, 12:23

Subscribe Now