You’ll also stumble upon this nugget setting up a chapter called ‘Middle India’s Next 500 million’ in Bala Srinivasa’s book from last year, titled Winning Middle India that the venture capital (VC) investor co-authored with TN Hari, corporate executive turned management guru and co-founder of Artha School of Entrepreneurship.

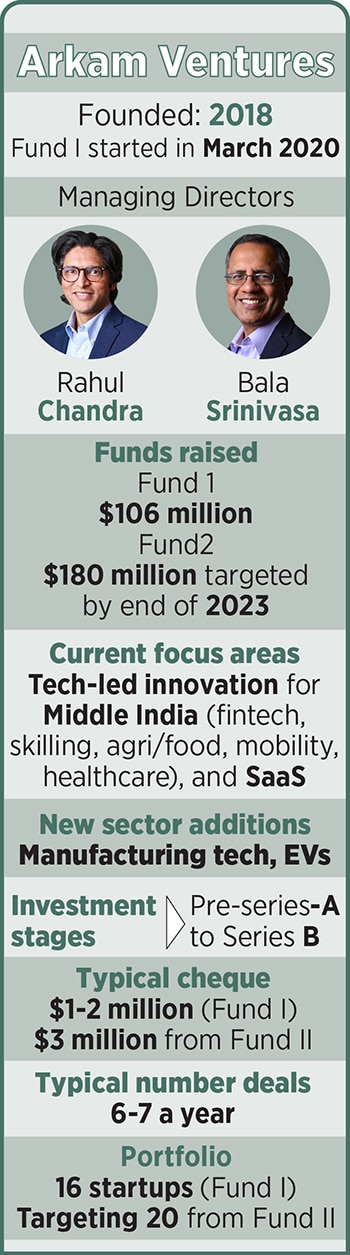

For about four years now, Bala, as everyone calls him, and Rahul Chandra, founding managing directors of Arkam Ventures have backed entrepreneurs solving problems for that half-a-billion population in Bharat, beyond the metros.

“We started calling it ‘Middle India’ … an opportunity for a new VC firm focused on the 400-500 million Indians making between three lakh rupees and 20 lakh rupees a year," Bala says. “Arkam itself means limitless in Sanskrit, and we were meeting all these founders who had audacious plans and that became kind of the dream that led to starting of the firm."

Today, they are ready to announce their second fund.

Limitless Founders

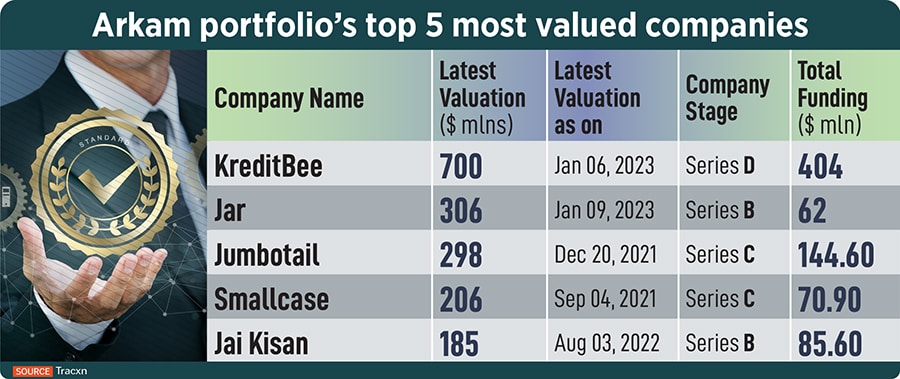

With their first fund, which was $106 million, they’ve invested in 16 startups so far with maybe another two or three to go. Several of them have gone on to raise next rounds of funding, further validating Arkam’s thesis, and some of them, especially in fintech – the biggest theme in the firm’s first set of investments – have successfully scaled their innovations to millions of users.

“Today, we collect EMIs from four million active borrowers," says Madhusudan Ekambaram, co-founder and CEO of KreditBee. “Arkam invested in us when were valued at around $50 million," in 2019, Madhu, as everyone calls him, says. “We have grown over 10X since then."

KreditBee impressed Arkam with the ability to provide loans quickly and efficiently through an app. The Bengaluru venture caters to individuals who require small-ticket loans – a previously underserved segment. Today, it facilitates over a million loans per month with a billion-dollar book, Bala says.

![]()

At Smallcase Technologies, founder and CEO Vasanth Kamath is revolutionising how people invest in India, making expert-curated baskets of instruments, such as stocks, accessible to anyone with a smartphone and an internet connection, requiring almost no knowledge of the capital markets.

At Jar, Nishchay Ag and Misbah Ashraf have found a way to entice people to save small amounts, daily, by buying digital gold. They went from a few WhatsApp groups to 10 million users in two years.

“Companies such as KreditBee, Smallcase, and Jar wouldn"t have existed a few years ago," Bala points out. “We seek out companies that leverage the digital infrastructure in India, not just limited to Aadhaar and eKYC, but also the advancements made with UPI" (Unified Payments Interface).

True innovation is coming from founders building on top of these digital rails, he says.

“We are interested in founders who target essential markets for middle-income Indians." These consumers prioritise financial services, health care, mobility, and education for their children. With UPI facilitating layers of services to be built for ordinary Indians, Arkam is backing entrepreneurs who are bringing innovation on top of this digital infrastructure.

At Arkam, they think of themselves as a “thesis-centric" investor. So, at Smartstaff, another portfolio company, the digitalisation play is about disintermediating the process of workers and employers finding each other. At Signzy, it’s about helping small businesses get their know-your-customer verifications (KYC) done really quickly and most major banks in India are using this company’s tech, Bala says.

Cusmat’s virtual reality (VR) technology shows how a targeted solution can make a big difference. Its founders have built a VR solution around an Oculus headset to simulate open-pit mining with excavators – training the driver-operators on a monster from Caterpillar, say, and bringing the skilling time down from three months to a couple of weeks.

“Our underlying theme is the digitalisation of Middle India, a generational trend," Bala says.

Arkam has also backed some pure-play software-as-a-service (SaaS) companies that are taking advantage of the India cost structures and building sophisticated software for the world. Spotdraft in Bengaluru is an example, where the company is making contract lifecycle management for businesses easy – customers include Airbnb and Notion.

A Traditional VC

Chandra’s roots in venture capital go back to 1997 when he joined Walden in Silicon Valley, a time of tremendous growth due to the internet and the dotcom boom, leading to the emergence of many new VC firms. There was plenty of capital chasing groundbreaking opportunities that aimed to change the world.

The experience helped him answer an existential question about the value VC firms provide and the opportunities in which they are best suited to invest. For example, although Walden was not considered a Tier I firm in the Valley, it excelled at facilitating entry into Asian markets for Valley companies, he recalls.

Many companies found their initial customers in Korea and Japan, which were ahead in the telecom sector compared to even the US. The strength in semiconductor technology also played a significant role.

![]()

This experience taught him that regardless of how commoditised the venture capital industry becomes, the value and associations a firm offers are crucial for standing out. So “I align myself with the traditional VC approach, where the desired outcome is achieved by following a measured pace that allows for adding value over time," he says.

“We aim to identify companies that would benefit from working with us and where we can genuinely add value. This requires a deep understanding of their operations and the potential for value creation."

Therefore, in building Arkam, the partners have brought in other individuals too whose expertise is highly valued. Arkam’s Head of Finance Vishnuhari Pareek, for example, brings experience from two unicorn startups in addition to stints at ITC and KPMG.

“His background helps us to establish a standard of governance, benchmarking, and reporting, which can be invaluable to startups that often struggle to afford high-quality talent in finance management, especially in the initial stages," Chandra says.

Next, Arkam focuses on organisation design and scaling, drawing on the expertise of Dhruv Prakash, for example, who worked with founder Deep Kalra in building the leadership team at MakeMyTrip. Prakash’s HR experience helps founders navigate the transition from a startup to a mature organisation, Chandra says.

The third area where Arkam can provide value is in go-to-market strategies, especially with Bala’s experience in selling to US enterprise customers. The firm also has two seasoned company builders based in the US who assist its portfolio companies in establishing a presence and sourcing top talent in the US.

Overall, they aim to differentiate Arkam by offering tangible value and expertise in finance, organisation design, scaling, go-to-market strategies, and a deep understanding of the target markets.

And, while they are an early-stage investor, “we enter at the first floor, not the ground floor and aim to support companies until they become mature organisations with predictable cash flows," he says.

They also like to follow a “portfolio approach", which involves making primary investments and then allocating follow-on capital as needed.

Arkam typically invests between $1 million and $3 million as a first cheque and can go on to invest up to $8 million in a given company. The firm sees about 1,200 companies a year, conducting 60 to 80 deep dives, and invests in six or seven of them.

Successful VCs

Being a successful VC investor requires, first, having a good sense of the potential outcome"s scale. “This is crucial," Chandra says. Understanding what will move the needle for the entire fund and ensuring that each investment meets the criteria is also important.

To Arkam, the two partners together bring more than 40 years of experience covering industry, sales, product management, tech and venture capital. Before Arkam, Chandra co-founded Helion Venture Partners, which went on to become one of India’s best-known homegrown VC firms.

VC investors love to talk about investing in “category creators" and at Helion, Chandra shepherded investments into startups including Shubham Housing, Equitas Finance, Spandana Sphoorty Finance, MoEngage, UnitedLex and SMSGupshup.

![]() Bala was previously a partner at Kalaari Capital, where he invested in fintech, health care, SaaS, and food and grocery. He was on the board of companies like Upstox, Jumbotail, Credit Vidya and Mettl.

Bala was previously a partner at Kalaari Capital, where he invested in fintech, health care, SaaS, and food and grocery. He was on the board of companies like Upstox, Jumbotail, Credit Vidya and Mettl.

Before Kalaari, he led global sales, marketing and product at Amba Research, a financial research and analytics provider that was acquired by Moody’s. He also ran sales and marketing at Vistaar Technologies, a US SaaS analytics company. He started his career as a Wall Street analyst covering the software sector and was partner and senior software analyst at Pacific Growth Equities in San Francisco.

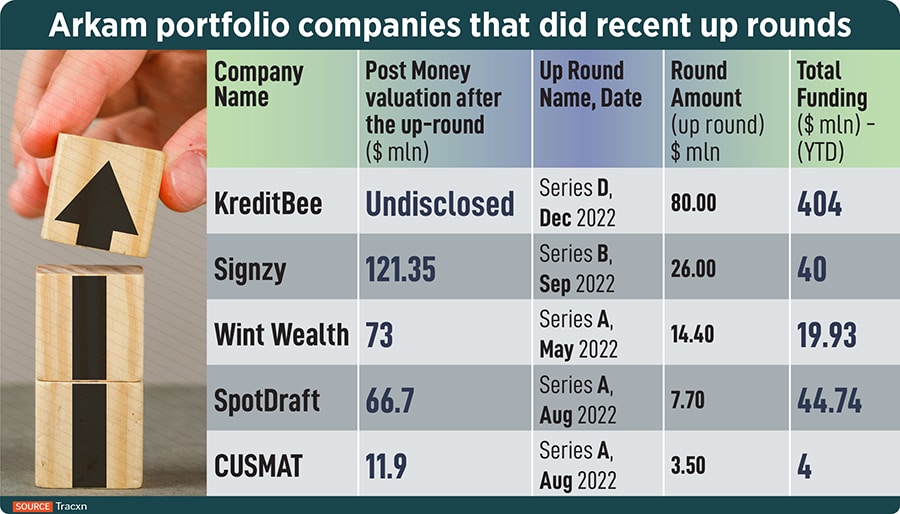

“In the second half of 2022, when the market was relatively slow, eight of our companies secured up rounds, collectively raising about $220 million," Chandra says. “This demonstrates the strength and appeal of our portfolio even in challenging market conditions."

“And many of our middle India companies have scaled profitably," Bala adds. For example, KreditBee is “profitable on a monthly basis on a run rate of a couple of hundred million dollars a year in revenue."

Their cost of customer acquisition is 10X lower in comparison to a bank’s cost to acquire a credit card customer, Bala says.

Arkam’s partners have “this great ability to not only identify companies, but also come in at the right point," KreditBee’s Madhu says. “They are also taking a lot of risk, because it’s not like the companies are mature, and they are still just about getting the product market fit and trying to scale."

That 76 percent of KreditBee’s borrowers are from non-metro locations maps onto Arkam’s middle India thesis, Madhu says. He had first met Bala when the investor was still at Kalaari. They had kept in touch.

“Even now, he’s the one I can call anytime."

These companies also stand out in terms of how they’ve reimagined an opportunity, Bala says. For example, Jar certainly wasn’t the first to think of digital gold, but the company excelled at eliminating the friction involved in saving via gold, through its smartphone app to the point of it becoming almost without thought, each day.

Smartstaff is now allowing factory workers to cash their paychecks every week, even though the customers, the companies that own the factories, pay them every month. In some cases, Smartstaff is convincing the employers that weekly or biweekly payments will reduce attrition.

Spotdraft, a contract automation and management software platform provider, has grown more than eight times by revenue since Arkam’s first investment in December 2021, with customers like Airbnb, Notion, Snowflake, OnDeck, and Chargebee.

“We’ve been lucky to have a great cap table, but what stood out with Bala was prior experience, the deep understanding of running SaaS businesses and scaling India-US GTM, which is the number one growth-stage-company help that we look for," says Shashank Bijapur, co-founder and CEO of Spotdraft.

So far, Arkam has invested close to $5 million in Spotdraft, but “they started showing value to the business even before they had given us a term sheet," Bijapur says.

Arkam brings both strategic and tactical insight, he says. Meaning they are sounding boards for both “the x-to-10x journey" and for what’s needed today, like recruiting a subject matter specialist.

The aggregate market value of the Arkam portfolio exceeds $2.5 billion, according to Arkam’s press release announcing the second fund today.

“These founders are using technology to find a way to change the industry itself," Bala says. As of December 2022, “our companies had an average cash runway of 40 months, aligning with our philosophy of ‘cash is king,’" Chandra adds.

Second Fund

The plan for the second fund is more of the same, with a couple of additions. With Fund II, within middle-India digitalisation, Arkam will continue to focus on financial services, skilling, food, agriculture, healthcare, mobility, and SaaS, going deeper in these sectors.

“Fintech and health care, in particular, offer immense potential for growth, and our focus is on building full-stack businesses that can cater to a customer base of 100 million or more," Chandra says.

The firm will add investments in “promising areas like manufacturing tech and EVs," Arkam said in the press release.

With Fund II, Arkam will build a portfolio of 20 tech startups. Top-tier global institutional investors and family offices will form the limited partner base for it. Current investors include British International Investment, SIDBI, Evolvence, Quilvest, US Institutional Investors, and large family offices.

“We typically engage with fund managers a year or two prior to starting a relationship. We were impressed with the conviction and track record that Arkam’s partners brought to the platform," says Chirantan Patnaik, director, venture capital at BII.

“More importantly, the team has a clear vision to build an equitable and enduring investment firm – this is absolutely critical for long term success in this business," Patnaik adds.

The target for the second fund is $180 million, which the partners expect to raise by the end of this year.

Limitless Demand

Chandra, by his own account had an idyllic childhood, attending a St Joseph’s school in Dehradun, which – run by Jesuits – was very disciplined, but also “a place where you could be yourself," he recalls in an interview with 1947 Rise, in February 2022. And even as a kid, it was safe enough for him to walk home, taking shortcuts through some verdant patches, jumping over streams.

It was also “an island of a very cosmopolitan population," a Dehradun that was very different from what the hill station town is today, he says. It had several research institutions with people from all over India.

So, he found himself in a group of youngsters that was highly motivated to do something worthwhile, mostly based on academics, and when he “ended up in the desert" he was again part of one of the largest groups of students from Dehradun to join BITS Pilani.

Later, he was one of two students from BITS’s Master of Management Studies programme to be sent to the Securities and Exchange Board of India (SEBI) as part of a “practice school," – something like an industry internship.

At SEBI, the then young institution’s first chairman, the late GV Ramakrishna, could be seen stalking the corridors with his trademark cigars in his mouth, Chandra recalls – the young interns never found out where the legendary official ordered his cigars though.

Bala was already at BITS, when Chandra joined. He studied engineering, but pretty much right out of college he knew it wasn’t for him “much to my father’s chagrin," he recalls. After longish stints in finance and then product management in the US, he came back to India and ran sales at Amba Research, which was supplying outsourced high-end markets analysis to some of the biggest banks, brokerages and hedge funds on Wall Street – founded by ex-Deutsche Bank executives.

When people say “small world" this is how the universe operates: Chandra had returned to India, co-founded Helion Ventures and Amba Research was one of the firm’s portfolio startups. After Moody’s bought Amba Research, Bala joined the VC firm Kalaari as a partner. By 2020, the two had kicked off their first fund.

“I"ve got a small group of very close friends. We meet very often just to talk about everything but work – including life, philosophy, meditation, everything," Bala says.

And “I"ve been playing the guitar for about seven, eight years now. I can play a few songs … mostly old-school rock" on an acoustic guitar, but “I can"t sing for nuts, so that"s a big drawback," he says.

Through all of this, from jet setting corporate executive to VC investor, one of Bala’s biggest takeaways is “be more forgiving of yourself." Another is “try and work for people from whom you can learn a lot."

Chandra loves to dance and can show off some moves whether his friends want it or not, he recalls in that same conversation last year with 1947 Rise.

On a more serious note, it’s futile to ask if anyone would do anything differently. Time and space don’t allow it. But when it comes to VC investing, Chandra is clear on some things he won’t repeat.

One is a mistake from 2006, when, at Helion, he passed on an investment in BookMyShow. “Until BookMyShow, I used to rely on Excel models to understand market size. The results were usually uninspiring, leading to a rejection of the startup due to (lack of) market size," he says in his award-winning 2019 book The Moonshot Game.

Today, assessing a founder and an opportunity carries “a hundred nuances for me," he says. And, taking the liberty of turning his comment into present tense, “as long as there is an inherent ability to grow non-linearly, India’s teeming masses will always provide limitless demand."

Bala was previously a partner at Kalaari Capital, where he invested in fintech, health care, SaaS, and food and grocery. He was on the board of companies like Upstox, Jumbotail, Credit Vidya and Mettl.

Bala was previously a partner at Kalaari Capital, where he invested in fintech, health care, SaaS, and food and grocery. He was on the board of companies like Upstox, Jumbotail, Credit Vidya and Mettl.