Rupee on slippery slope may hit margins of companies

A depreciating rupee, combined with slowing demand and growth in developed economies, could hit the revenues of export-oriented sectors such as IT, pharma and auto components

The continuing slide in the Indian rupee is anticipated to be a double whammy for companies that draw a major chunk of their revenues from exports. Weakness in the Indian currency is likely to be followed by lower demand, as most developed economies are apprehensive of witnessing significant slowdown in growth, which may hit revenues of information technology (IT) firms and auto exporters, say experts.

Indian IT, pharmaceutical and select auto ancillary companies earn a large part of their revenues in US dollars. Typically, these companies see their margins improve with currency depreciation. “Rupee depreciation has been generally beneficial for exporters, including IT services firms, pharma firms, textiles, and auto exporters. Generally, most firms in these sectors hedge at least part of their exposure, so the benefits of the rupee depreciation should accrue after two quarters of depreciation," says Nishit Master, portfolio manager, Axis Securities PMS. However, he adds that this time around the rupee depreciation is expected to be followed by lower demand, with developed economies looking at a slowdown in growth.

The Indian rupee, and other emerging market currencies, have been on a slippery slope for the past few months due to a strong US dollar index, which has been pumped up by aggressive tightening by the US Federal Reserve to tame inflation despite growing signs of an impending recession. Rising prices of commodities have also been attributed to the falling rupee. Only commodity-linked, high-yielding emerging currencies like the Russian rouble, Mexican peso and Brazilian real have been strengthening this year so far.

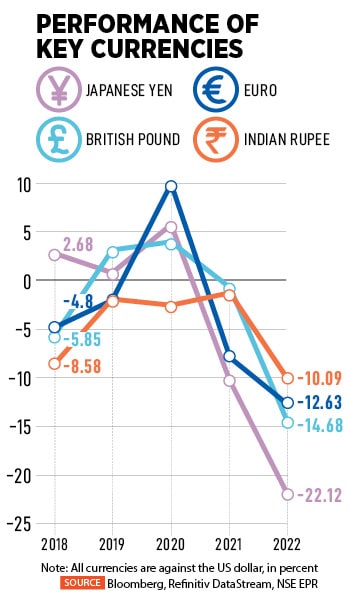

According to Manish Jain, fund manager, Coffee Can PMS, Ambit Asset Management, rupee depreciation is beneficial for the margins of some export-oriented sectors like IT services, auto, and pharma. However, what dampens the spirit is the adverse impact of two things: Growth slowdown due to impending recession in the USA and European Union, as demand and spending fall and the impact of cross-currency movement, with the rupee strengthening against the euro and British pound. “This means that even for export-oriented companies, the positive impact shall be largely limited, which is reflected in limited excitement in the markets. Over the medium term, we expect things to settle down as India remains on strong footing and the US should recover soon enough. We would maintain our positive stance on IT services and auto," says Jain.

Currency fluctuation, largely caused by tightening by the US Fed, has been a major cause for worry globally, not just emerging markets like India. While the Reserve Bank of India (RBI) has done a commendable job of managing inflation as well as the currency, there is limited dry powder left. According to Jain, markets will not be surprised if the rupee reaches 85 against the dollar within a short while.

With Europe expected to witness a deep recession, auto, IT, and pharma companies catering to European markets may get negatively impacted, say experts. “With the rupee appreciating against the euro, these companies will face a double whammy, since on the currency front also they are not well placed if they bill their revenues in euros," says Master.

With Europe expected to witness a deep recession, auto, IT, and pharma companies catering to European markets may get negatively impacted, say experts. “With the rupee appreciating against the euro, these companies will face a double whammy, since on the currency front also they are not well placed if they bill their revenues in euros," says Master.

Predominantly, companies that depend on imports for revenues get hit by rupee depreciation. “Typically, oil market companies are the ones to get directly impacted by rupee depreciation, especially if they are not able to pass on the complete price increase to their clients. Fertiliser companies importing urea for the domestic market could get impacted due to higher working capital requirements. Cement companies also get indirectly hit due to rupee depreciation as fuel cost for them is dependent on the USD/INR rate," says Jain.

Analysis of September-quarter earnings of major Indian IT companies show that despite a higher probability of recession in key European countries and an energy crisis, revenue growth in Europe on a constant currency basis continues to be strong. “The US dollar growth has been impacted by cross-currency headwinds. Companies are watchful of developments in the region," says Kotak Institutional Equities Research, adding that companies may have to scope out price increases, which is challenging in existing businesses but possible in new contracts.

Infosys retained revenue growth guidance at 14 to 16 percent in constant currency for FY2023. HCL Tech increased FY2023 revenue growth guidance to 13.5 to 14.5 percent in constant currency from 12 to 14 percent earlier. Wipro guided for 0.5 to 2 percent constant currency quarter-on-quarter growth in the December 2022 quarter. The rupee depreciated by 3.6 percent for the quarter versus the US dollar, while it has appreciated by 1 to 5 percent against other currencies, such as the pound, euro and Australian dollar.

In 2022 so far, the Indian rupee has slipped 10 percent, hitting a low of 83.29 against the US dollar on October 20. This follows consistent depreciation of the rupee over the past few years. In 2021, the rupee lost 1.5 percent in, both, 2019 and 2020, it slipped over 2 percent in 2018 it weakened 8.6 percent. In 2022, so far, major currencies such as the pound, euro, and yen have also significantly weakened against the dollar: The yen has dropped 22 percent, the pound 14.68 percent, and the euro 12.63 percent.

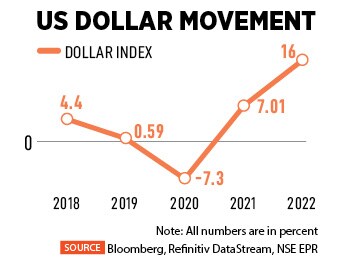

In contrast, the dollar index has been getting strong. This year, it has gained 16 percent, while it jumped 7 percent in the previous year, after a fall of 7.3 percent in 2020.

In contrast, the dollar index has been getting strong. This year, it has gained 16 percent, while it jumped 7 percent in the previous year, after a fall of 7.3 percent in 2020.

The depreciation seen across low- yielding currencies against the US dollar has been quite substantial, relative to the emerging markets pack. Despite being a non-commodity linked currency, the rupee is fairly placed among peers due a considerable improvement in external vulnerability metrics, say experts.

“History suggests that the spill-over effects of a recession in the US and Eurozone invariably result in growth slowdown in the economies that have close trade and financial linkages with them. India is unlikely to remain immune, as also seen during past recessions. On balance, an unfavourable global backdrop in the wake of monetary tightening, geopolitical tensions, and Chinese slowdown is likely to weigh on domestic growth via the trade channel and through foreign capital flows," says Tirthankar Patnaik, chief economist, National Stock Exchange of India, in a monthly review report.

Patnaik adds that higher input prices would weigh on discretionary spending. Healthier corporate and bank balance sheets bode well for the private investment recovery that’s currently underway weakening global demand, subdued consumer sentiments, rising rates and margin pressures are most likely to act as key deterrents.

First Published: Nov 01, 2022, 17:25

Subscribe Now