Two decades on, how Toyota finally found its footing in India

Its tie-up with Maruti Suzuki and focus on hybrids have given the company an exponential growth in sales and market share

It has been a long wait. But, finally, Japanese automaker Toyota seems to have found its footing in one of the world’s fastest-growing automobile markets, if its sales numbers are anything to go by. With a diverse portfolio ranging from small hatchback Glanza to hybrid mid-size SUV Hyryder and large MPV Hycross, Toyota has been posting record month-on-month growth this year, and is on track to deliver its best year since the company began operations almost three decades ago.

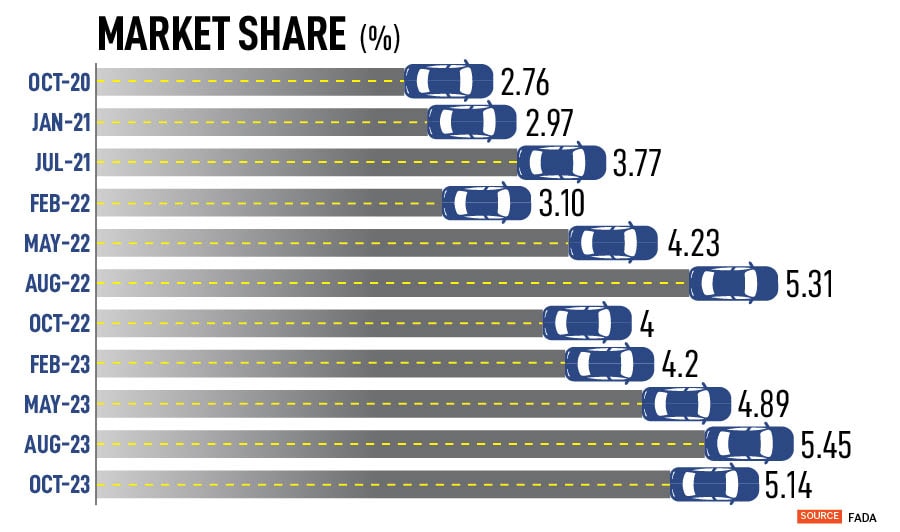

This year, sales between January and November stood at 210,497 units, up 40 percent over the same period in 2022, at 149,995 units. In September, the automaker posted its highest-ever sales at almost 23,000 units, and is now close on the heels of Kia Motors in the pecking order. Toyota has a market share of 5.14 percent compared to Kia’s 5.95 percent as of October.

All that has meant that the automaker is now gearing up to set up a third plant in Karnataka at an investment of Rs 3,300 crore, which will help the company ramp up its capacity to over 440,000 vehicles a year, and, in the process, also address some of the long waiting periods for its models. This is the first investment from the automaker in as many as 15 years.

“Basically, it all started last year," Atul Sood, the vice president of sales and strategic marketing at Toyota Kirloskar Motor, tells Forbes India about the change in fortunes at Toyota. “We"ve been working towards meeting the needs of a customer. Last year, we started with a full model change with the Glanza and followed that with the self-charging strong hybrid technology introduction of the Hyryder and followed by the Innova Hycross towards the end of last year."

Today, Toyota operates in India with a slew of models that cater to categories across the industry ranging from Glanza to MPV Rumion that rivals the Maruti Suzuki Ertiga, to its sub-compact SUVs Hyryder and Urban Cruiser and the large MPVs Innova Crysta and Hycross. The company also sells popular models such as the Camry, SUV, Fortuner, and Vellfire in the country.

“All our models have been doing well," Sood adds. “However, these models, which we introduced last year, further spurred the growth trajectory. We"ve also been working towards expanding our network reach to get closer to our customers." Among others, the company now offers five-year complimentary roadside assistance, compared to three years earlier, as part of its customer outreach programme.

“Toyota India story Is a classic case of persistence, uncompromising quality, and sustainable growth deployment," says Harshvardhan Sharma, the head of auto retail practice at Nomura Research Institute. “Its focus on the right segments, strong brand image, and strategic product introductions have put it on a strong growth trajectory in India. Overall, Toyota"s market share growth in India is a result of a multi-pronged approach that combines its global brand strengths with a deep understanding of the local market and customer preferences."

Even then, two key factors seem to have tilted the fortunes in Toyota’s favour lately. A global partnership with Suzuki has meant that the company now shares some of its portfolio with India’s largest automaker, Maruti Suzuki, but with the added backing of the Toyota branding, and a focus on offering multiple powertrain options at a time when automakers are quickly making the shift to electric.

With powertrain options such as petrol, CNG, diesel, and hybrids across models, Toyota is only a handful of automakers that offer such a variety. Glanza and Urban Cruiser models are offered in petrol and CNG, while the Hyryder and Hycross are offered in petrol and hybrid. Innova Crysta and Fortuner are offered in diesel while the Camry is offered in hybrid. Toyota says as much as 18 percent of the domestic market still uses diesel engines.

“We are totally technology neutral," says Vikram Gulati, country head and executive vice president of Toyota Kirloskar Motor. “We"d like to provide technology that is best suited for the local requirements as well as customer needs. We have to also recognise that post BS6, diesel is no longer a dirty fuel. In fact, the emissions from diesel are the same, irrespective of the fuel you use. So it doesn"t really matter if you have a large vehicle or a small vehicle and, if you look at carbon emissions, diesel is much more efficient as a fuel and has a lower carbon footprint."

But managing numerous powertrain options also have their own set of challenges. “It"s important to acknowledge that offering all technologies comes with its own set of challenges," adds Sharma. “Managing production lines, ensuring adequate service infrastructure for different powertrains, and effectively communicating the value proposition of each technology require careful planning and execution."

This November, Toyota completed 25 years in the country. Of this, much of its 24 years saw Vikram Kirloskar as the man responsible for bringing Toyota to India in the driver’s seat, and the Indian face of the Japanese brand. Kirloskar, who had been the vice chairman of the automaker since it began operation in India, passed away in 2022. “When Toyota came in 25 years ago, they came in actually with textile machinery as the first product, and then the car business," Kirloskar had earlier told Forbes India in an interview. “Then it got into components, a forklift business, and insurance and finance. So, there’s a whole variety of businesses."

In 2000, Toyota launched the Qualis, a multi-utility vehicle, a model that was largely uncommon in India, as its primary product. By 2003, the company had sold 100,000 units in the country and soon began selling the Toyota Corolla, which remains one of the world’s largest-sold vehicles. By 2005, when the company had put 200,000 vehicles on the road, it introduced the Toyota Innova, which has come to redefine the company’s operations in India. While the Innova did find a slot among fleet taxi operators for its value proposition, private buyers, too, were flocking to buy the multi-utility vehicle that had come to replace the Qualis.

That focus on the MPVs meant that Toyota remained a large carmaker in the country. While the company did dabble in the small car market with the Etios Liva, it was a shortlived proposition. Over the past few years, the company has also withdrawn some of its sedans, including the Etios and Corolla, as it turned its attention to SUVs. The only exception currently is the Glanza. Along the way, the company has also renewed its attention to the urban and rural markets in the country.

“We have definitely realised the growing potential of the semi-urban or the rural part of the country," Sood says. “Normally, one would expect the smaller segment vehicle to move (in those markets). But we"re pleasantly surprised that it"s not just Glanza or the Hyryder, even other models of the Innova Crysta or even the Hycross are getting good traction from the smaller locations as well."

But, despite all the focus on its renewed portfolio, the new launches are also seeing some phenomenal waiting periods. For instance, the Toyota Hyryder and Hycross have a waiting period that stretches up to 15 months, while in the case of the Rumion CNG, bookings are currently halted. The Hycross, Hyryder, and Crysta are the largest volume drivers for the automaker. That’s why the new plant assumes significance, even though it will likely only be complete by 2026.

“Overall, Toyota"s decision to offer a mix of technologies, with hybrids playing a central role, has been a strategic masterstroke," adds Sharma. “It has allowed them to shed their ‘diesel-only’ image, cater to a wider audience, and position themselves for the electrified future of the Indian car market. While managing this multi-pronged approach requires ongoing effort, the initial success suggests that Toyota is reaping the rewards of this bold move."

Meanwhile, it’s also a partnership with Suzuki that has enhanced Toyota’s game. In 2019, Toyota and Suzuki announced that the two companies had entered into a long-term partnership to promote collaboration in new fields, including autonomous driving.

“The larger spirit of the alliance is towards learning from each other so that we can move to mass electrification in a much more rapid manner," says Gulati. “The partnership has various facets, and product sharing is one element of it."

Between Toyota and Maruti Suzuki, the automakers manufacture each other’s products, and the new plant is expected to add a capacity of another 100,000 units a year. Last year, the company also began exports from India. “This particular plant is aimed at meeting our requirements," Gulati says. “As part of the partnership, we do manufacture some products for Suzuki as well. As they manufacture some products for us, it"s a part of the cross-badging activity."

Not surprisingly, Maruti Suzuki has also been chasing a strategy to focus on the SUV segment in the country, after losing out early in the fight. To put it in perspective, India’s SUV market is one of the world’s fastest-growing markets, and is expected to grow to some 50 percent in the next few years. That means, one in every two vehicles sold in the country will be an SUV. Last year, India’s SUV sales overtook that of hatchbacks and sedans for the first time.

The SUV market in India comprises various categories such as small, mid-size, and large SUVs. The likes of Tata Punch, Kia Sonet, Hyundai Venue, and Mahindra XUV 300 come under the small SUV segment even as manufacturers are busy creating newer segments within that category, such as mini, micro, and compact SUVs. The mid-size SUVs include cars such as Hyundai Creta, Kia Seltos, Volkswagen Taigun, Tata Harrier, MG Hector, and Mahindra XUV 700, among others, while full-fledged SUVs comprise the likes of Toyota Fortuner and Jeep Meridian.

“Toyota"s portfolio lacked strong presence in certain segments like compact SUVs, where Maruti Suzuki dominates," says Sharma. “The partnership allowed Toyota to fill these gaps quickly by rebadging Suzuki models like the Vitara Brezza as the Urban Cruiser. This caters to a wider range of customer needs and preferences, boosting overall sales."

So where does Toyota go from here now? “We"re going at about 40 percent, whereas the industry growth is about 9 percent," says Sood. While the company hasn’t set any particular market share ambitions, it says market share is a byproduct of its sales, and the new plant helps increase sales in the long run.

“While there might be room for debate about past strategies, it"s undeniable that Toyota is making a strong push to capture its full potential in the Indian market," says Sharma. “Their recent focus on hybridisation, localisation, strategic partnerships, and diversifying their SUV offerings are positive indicators of their commitment to long-term success in this dynamic and competitive landscape. Ultimately, the future of any OEM in India will depend on their ability to adapt to changing market dynamics, embrace new technologies, and continue delivering vehicles that resonate with the evolving needs and preferences of Indian customers."

After 25 years, Toyota is finally on the fast lane.

First Published: Dec 06, 2023, 13:18

Subscribe Now