Alkem Laboratories: From pharma distribution to a Rs 11,600 crore pharma major

As Alkem Laboratories turns 50 years, Forbes India traces its journey from its humble beginnings as a pharma distribution company to a Rs 11,599 crore pharma major

[br]

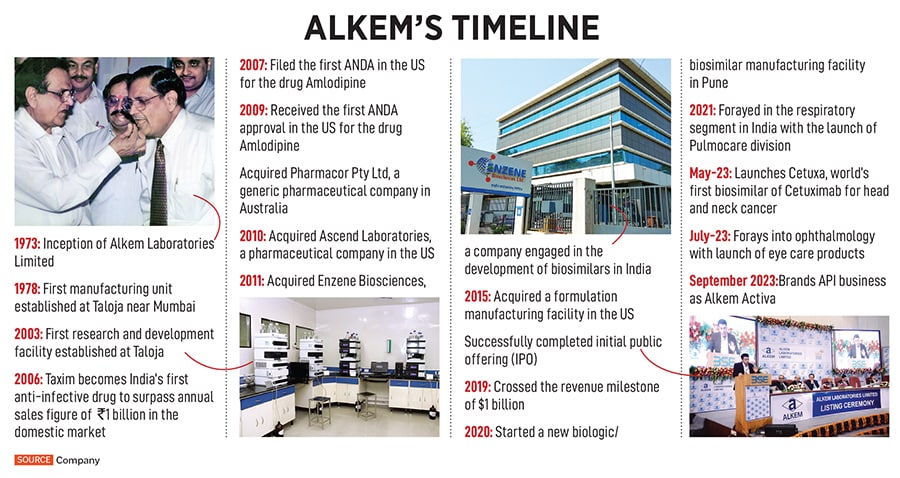

August 8, 1973, remains etched in Basudeo Narayan Singh’s memory. “It was the day we got our company registration licence in Mumbai, and Alkem Laboratories was born," recalls the 83-year-old.

Samprada Singh, his cousin, was the entrepreneurial genius behind Alkem. As a commerce graduate, despite having an existing farming business, he tried his hand at multiple ventures, including selling umbrellas. Finally, he roped in his cousin, Basudeo—who was a professor then—to join him in starting a pharma distribution business in Patna, Bihar.

Once the business was flourishing by 1962, the Singh brothers saw potential in the sector and decided to set up their own pharma company. “With this agenda in mind, we moved to Mumbai with Rs5 lakh," he tells Forbes India, in an exclusive interview on August 9, 2023—exactly 50 years after the company was founded—at Alkem’s Mumbai headquarters.

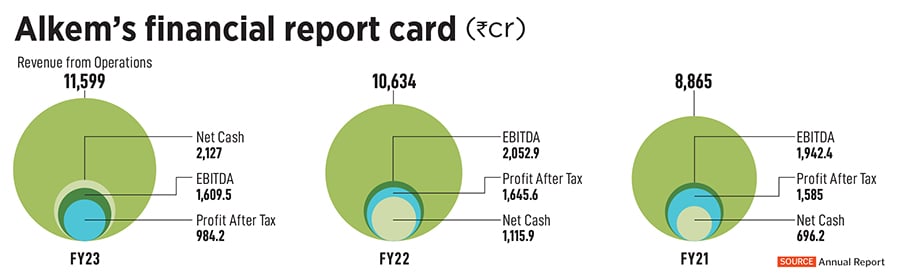

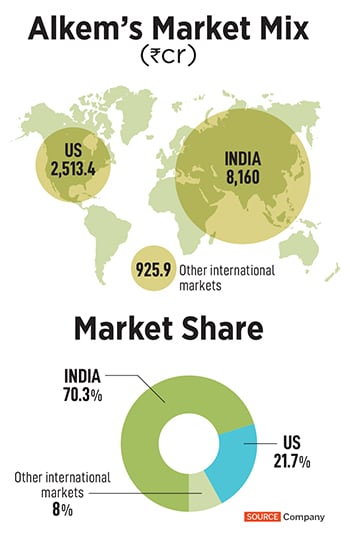

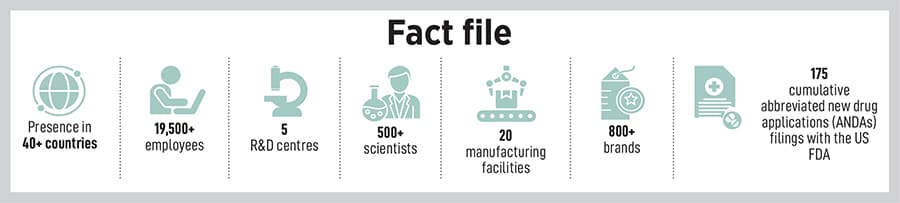

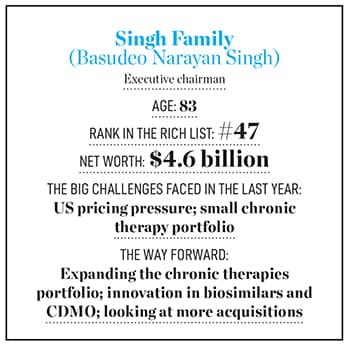

In FY23, the company had a market capitalisation of Rs44,500 crore, and a turnover of Rs11,599 crore. This year, the Singh family has also made it to the 2023 Forbes India’s 100 Richest list at Rank 47, with a net worth of $4.6 billion. With an impressive product mix for anti-infective and chronic therapies, Alkem Laboratories remains an India-focussed business 70 percent of its revenue come

from India, 21 percent from the US market, and the remaining 8 percent from other international markets. In the last few years, Alkem’s trade generics play has been a growth driver too.

As the Singh brothers continued to grow Alkem, they still ran their distribution business as Nalanda Pharma. While Samprada took care of the Mumbai operations, Basudeo would travel to the grassroots trying to get doctors to sample Alkem’s medicines. “From day one, our focus was on high efficacy and good quality," adds the executive chairman.

Finally, in 1978 they bought land in Taloja, 35 km from Mumbai, to set up their own manufacturing unit, instead of relying on third-party contractors. At the time Alkem was manufacturing half a dozen products, including capsules, tablets, oral liquids and more. But it was only in 1984 that the company touched a revenue of Rs10 crore.

The inflection point was launching Taxim (cefotaxime), used to treat a variety of bacterial infections. In 2006, it became the first anti-infective drug to cross annual sales of Rs100 crore in the domestic market. “This product won us a lot of prestige, particularly among doctors," recalls Singh. By 2008, Alkem crossed the Rs1,000-crore revenue mark. At the time, the focus was on anti-infective drugs, “since the demand for these was far more as compared to chronic drugs and it was a lot easier to manufacture as well."

Distribution has remained a strength for the organisation, given that they had years of experience running the business, particularly in rural markets. “Most of our peers rely on clearing and forwarding [CNF] agents, who work with multiple companies. However, we have our in-house agents. This helps us get direct contact with retailers and good first-hand feedback," explains Singh.

In 2003, Samprada Singh’s grandson Sandeep joined the organisation right after his graduation. As a commerce graduate, he started working in the CNS division to get a better understanding of the pharma industry. As an established Indian pharma player, it was time for Alkem to shift gears and expand globally. “There was an angst among the promoters, that in spite of doing well, Alkem’s name wasn’t being taken in the same breath as say a Sun Pharma or Dr Reddy’s," reckons Sandeep, who then took charge of the international business, which was fairly small-scale at the time.

In 2010, Alkem acquired a US-based company, following which it also increased the research and development budgets for abbreviated new drug applications (ANDAs). “Gradually, there was a shift in mindset, and the board could see the kind of potential US had to offer," he adds. After Alkem turned into a publicly limited company, finally in 2017, Basudeo and Samprada Singh passed on the reigns to Sandeep, who took over as managing director.

Late Samprada Singh (seated) and Basudeo Narayan Singh (standing on Samprada Singh’s right) with their core team in the initial days at the Alkem office

Late Samprada Singh (seated) and Basudeo Narayan Singh (standing on Samprada Singh’s right) with their core team in the initial days at the Alkem office

The Indian market has always been Alkem’s core focus. It is a dominant player in acute therapy areas such as anti-infectives, gastro-intestinal, pain management, and vitamins/minerals/nutrients. The product portfolio also includes mega-brands such as Clavam, Pan, Pan-D, and Taxim-O, all of which rank among the top 50 pharmaceutical brands in India. Earlier this year, the company also announced its foray into ophthalmology. “We are a pharma company, but we operate like an FMCG company because we have multiple brands," reckons the managing director. One of its biggest strengths has been its widespread network of doctors.

This September, the company announced the branding of its active pharmaceutical ingredients (API) business as ‘Alkem Activa’ to bring focus to the business. According to Sandeep, Alkem Activa plans to expand its capacity, incorporating cutting-edge technologies like biocatalytic and continuous manufacturing technologies to consolidate its position in this field.

In 2018-19, Alkem was one of the early movers in the trade generics market. “Leveraging on their dominance in the acute space, they ventured into the trade generics segment—more of a distributor-led business—which has turned into a key driver of revenue for them," says Abdul Kader Puranwala, analyst, pharma and health care, ICICI Securities.

Trade generics are branded medicines that are not promoted to physicians, and are directly sold through retailers and distributors. The sector only has two large players currently—Alkem and Cipla. Demand for these picked up during the Covid-19 pandemic, when access to medicines in tier 2 and 3 cities became a challenge. The domestic business, which was roughly around Rs3,000 crore in FY15 has scaled up to close to Rs8,100 crore in FY23. “Of which a sizeable revenue of Rs2,400 is from trade generics," he adds.

In Alkem’s portfolio, chronic therapy remains fairly small. Over the last few years, it has also been expanding its presence in chronic therapy areas such as neuro/CNS, cardiovascular, anti-diabetes, and dermatology. “We need to focus more on this area. Currently, we are not even among the top 20," adds Sandeep. Recent launches such as heart failure drugs Valsartan and Sacubitril, and anti-diabetes medications Sitagliptin and Dapagliflozin, have garnered decent market shares. He hopes to have chronic therapies contribute to at least 25 percent of the total revenue.

For the Indian market, the Department of Pharmaceuticals (DoP) amends the Drugs (Prices Control) Order to add drugs to the National List of Essential Medicines (NLEM). This was done most recently in 2022. “This will boost cost-effective, quality medicines and contribute towards reduction in out-of-pocket-expenditure on health care for citizens," said Union Minister for Health and Family Welfare Mansukh Mandaviya, when he launched the NLEM 2022. However, Sandeep says, “that’s not really a free market for the drugs that are on that list".

For the Indian market, the Department of Pharmaceuticals (DoP) amends the Drugs (Prices Control) Order to add drugs to the National List of Essential Medicines (NLEM). This was done most recently in 2022. “This will boost cost-effective, quality medicines and contribute towards reduction in out-of-pocket-expenditure on health care for citizens," said Union Minister for Health and Family Welfare Mansukh Mandaviya, when he launched the NLEM 2022. However, Sandeep says, “that’s not really a free market for the drugs that are on that list".

As compared to peers, Alkem hasn’t made any large acquisitions yet. Sandeep agrees: “We are a little conservative when it comes to entering new areas or acquiring companies or brands." But is he hoping to change that going forward? Only to an extent. “I wouldn’t want to change that completely, since we have been managed very prudently. I think for aggression and top line, one should not do something foolhardy."

As for the US market, Alkem clocked in a turnover of Rs2,513.4 crore in FY23. “But growth in the US over the last few years has been flat, as with most pharma companies in the US," explains Puranwala. While 2014 was a golden year for generics makers in the US market, the last four years have been tough. Customer consolidation has led to only three buyers controlling 90 percent of the market, which has added to the pricing pressure.

Alkem is scaling back on its investments in oral solids in the US. “It is tough for generic companies to make money from oral solids since gross margins aren’t adequate. The only way out is to find niches," reckons Sandeep. In this, Alkem’s India-centric approach has been a blessing in disguise for the firm. The company also has two manufacturing facilities in the US, which they are hoping to shut soon. “Running a facility in the US is four to five times more expensive, especially in terms of labour cost."

In early September, Alkem’s subsidiary Ascend Laboratories recalled 99,516 sachets of Fosfomycin Tromethamine Granules for Oral Solution (antibiotic used to treat bladder infections in women) in the US market. The reason for the voluntary recall was stated as, “out-of-specification results observed for the organic impurities test at 6 months, RT (room-temperature) stability". However, experts believe that as compared to its peers, Alkem hasn’t faced as much flak with the US FDA. Regulatory issues with the US FDA are a major concern with Indian pharma giants, but Sandeep feels, “It comes down to the organisation’s culture. The top management needs to develop a culture, which focusses on doing what is right over pure economics."

“I think innovation is going to be very important, not for just for Alkem but for everyone. Because, with the slowdown in

US generics, companies will have to really innovate and take the leap of faith if they really want to be relevant 10 years down the line," says Sandeep.

Alkem’s focus for the next few years will be investing in the space of biosimilars and contract development and manufacturing organisations (CDMO). In doing that though, Sandeep is clear, “I will not take the percentage of revenue dedicated for R&D to anything beyond 5.5 percent."

Alkem’s focus for the next few years will be investing in the space of biosimilars and contract development and manufacturing organisations (CDMO). In doing that though, Sandeep is clear, “I will not take the percentage of revenue dedicated for R&D to anything beyond 5.5 percent."

Alkem has invested more than Rs1,000 crore in its wholly-owned subsidiary Enzene Biosciences, a Pune-based biotech firm that’s developing biosimilars and has also built CDMO capabilities. In May 2023, the company announced the launch of Cetuxa, the world’s first biosimilar of Cetuximab used for the treatment of head and neck cancer, researched and manufactured indigenously by Enzene.

Reflecting back on the journey of 50 years, Sandeep says, “My late grandfather’s leadership style taught me that it was necessary to empower people to make their own decisions. This is a value that remains core to Alkem." In the next few years, he says, “I want Alkem to be known as a science and innovation-led company."

First Published: Nov 16, 2023, 11:42

Subscribe Now