Alembic Pharma: Shaking Things Up

With a legacy of over 100 years, Alembic Pharma's fourth generation Pranav and Shaunak Amin are running the show with an innovation-led approach

[br]

Vadodara, Gujarat. Alembic City, home to the Alembic Group, is a lush mini city spread across 200 acres. The Group has a rich history dating back more than 110 years, with this campus at the centre of all its innovations. Back then, this ‘city’ had practically everything on-campus, from a school to a bakery, and the focus was to be self-reliant. Over the years, much like their business, the many generations of Amins have preserved and reinvented a lot of the campus. For instance, what was once a distillery, is now a space for various events.

A company with a glorious past of nation-building through focusing on manufacturing indigenously and led by technocrat-innovators—rather than growth-obsessed leaders—suddenly found itself in the midst of a fresh bunch of competitors who emerged post-economic liberalisation.

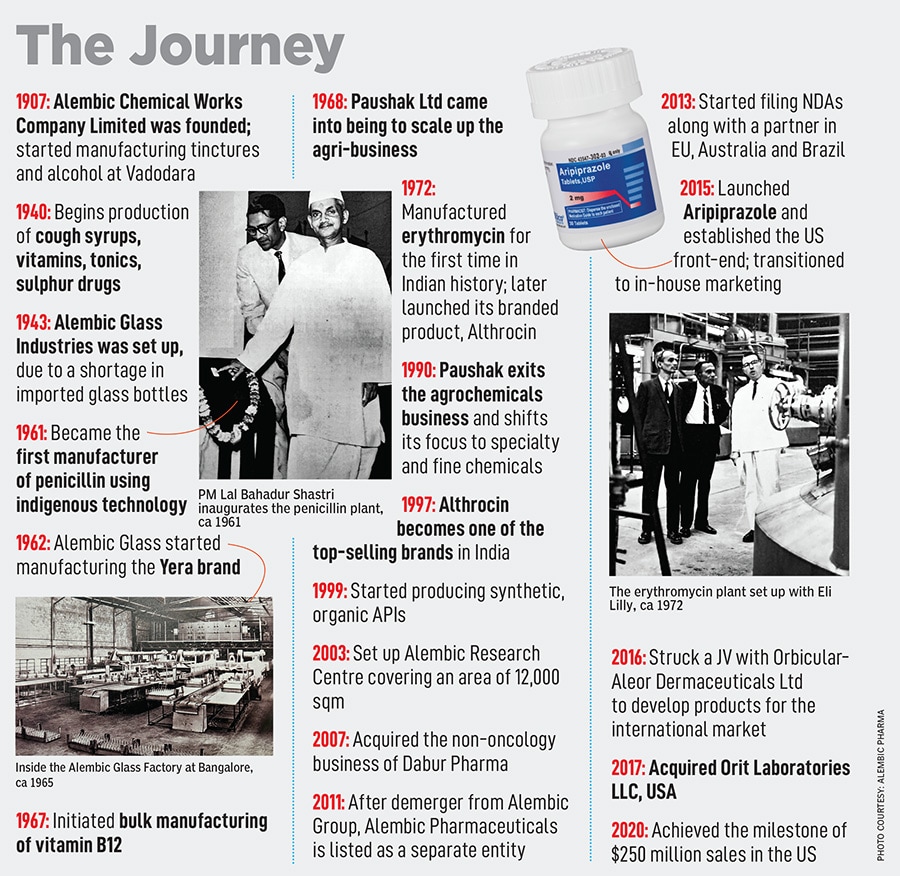

The Alembic Group started off by manufacturing alcohol in 1907 under the name Alembic Chemical Works. Later, when Ramanbhai B Amin—son of one of the founders BD Amin—joined the business, he expanded Alembic further. Amin’s mindset was ‘what can we bring that India doesn’t have?’ That’s what led to the manufacturing of antibiotics such as penicillin, cough syrups like Glycodin, bulk manufacturing of vitamin B12, and much more. As Alembic grew, the technocrat’s focus was on trying to be indigenous and building everything in-house. For instance, glass bottles for the cough syrups were being imported which made Amin think: Why not manufacture the bottles in-house? This led to Alembic Glass Industries in 1943. Eventually, the Amins diversified into engineering, fabricator units, agri-businesses and a lot more.

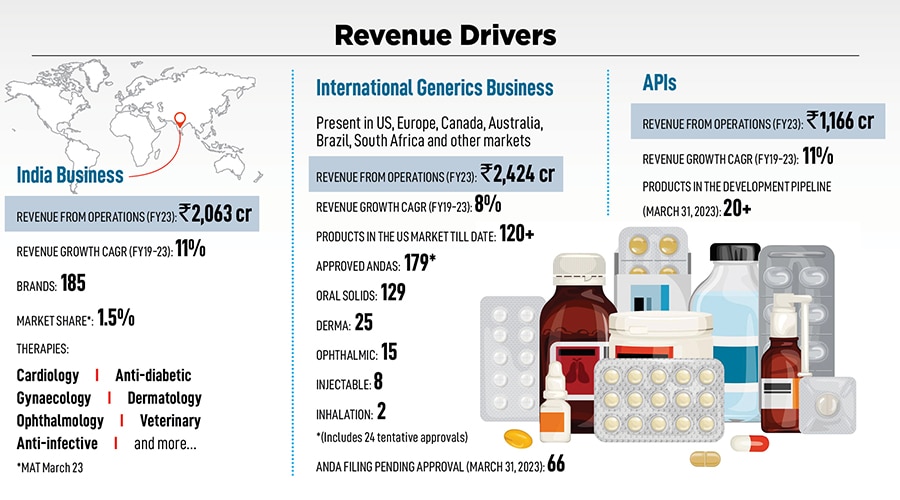

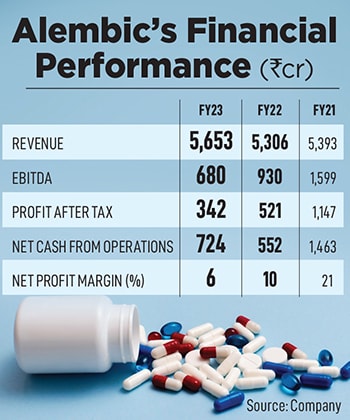

Today, Alembic’s pharma division remains at the core, and the fourth generation—Pranav and Shaunak Amin—drive the business. Despite being late in refreshing their Indian and international product portfolios, the siblings have grown Alembic Pharma into a formidable Rs 5,653 crore business, with a market capitalisation of Rs 15,036 crore.

Over the years, a lot of these verticals were shut, but the pharma business remained strong. “At the time, the domestic market was our main focus and we were trying to produce molecules under the patent laws of that time. Our fight was with the multinationals mainly, but now they are pretty insignificant the Indian industry gave them a good run for their money," says Chirayu Amin (77), chairman and CEO.

As the License Raj became history, and globalisation became a buzzword, newer players like Dr Reddy’s, Sun Pharma and Aurobindo Pharma were quick to seize opportunities for export and overseas manufacturing of generic medicines and APIs.

Alembic’s research center at Baroda

At the same time, opportunities to build brands locally in newer areas like heart disease, diabetes and cancer emerged. The challenge for Alembic’s fourth generation was to make a transition in the portfolio (more towards chronic diseases from anti-infectives), orientation (from local to glocal), and priorities (aiming for growth, and keeping investors and stakeholders happy). And all this without compromising on the values inherited from their forefathers.

In essence, Pranav and Shaunak had to take a call on what from the past was dispensable, and what could be replaced not an easy task as the previous generation may not always be aligned. “I think being an old company, sometimes you get a little complacent. We needed to shake up the systems in the ’90s, since we lost some ground," says Pranav. Alembic Glass, which in 1962 started manufacturing tableware under the brand name Yera is one such example. Now being run by a professional CEO, the division doesn’t add much value to the group. But as the legacy brand remains close to the earlier generations, the division remains operational.

But the pharma business has remained the core. As the industry was moving towards chronic therapies, Alembic wasn’t geared up for it. API commodities, penicillin, Althrocin and other verticals were taking up a lot of management bandwidth. Pranav is candid when he says they may have been slow in making the transition: “We were so engulfed with antibiotics and acutes, that we were fairly late to the party."

The pharma division demerged from Alembic Limited in 2011 and listed as a separate company, Alembic Pharmaceuticals Limited. “The demerger," says RK Baheti, group CFO, Alembic Pharmaceuticals, “helped streamline our operations, realise untapped potential, increase shareholder value, and have a more focussed and competitive approach in the market."

Pranav joined the international business division around 2000, and in 2005, Shaunak joined the India vertical. “Both of us worked under presidents of our respective divisions for close to 10 years. It was only in 2010 that we took over," says Pranav.

At the time, Alembic was not too active in the regulated markets. “Our international portfolio was fairly rudimentary," he adds. “It was time to start rebuilding the international business and increase R&D spends go big into the US and European markets and build FDA approved facilities." A little late to the game, but Alembic went all out in forming a robust international vertical, and rebuilding the API business.

To understand the international business better, Alembic started contract manufacturing for other companies, and moved on to developing their own abbreviated new drug applications (ANDAs), or proposals for new versions for generic drugs. Soon, Pranav realised that “competing on the commodity generics was going to be very tough against companies with massive scale such as a Lupin, Aurobindo and Hetero."

For some time, Alembic shifted focus to looking at more paragraph IV filings, where a company can seek FDA approval to market a generic drug before the expiration of patents related to the brand-name drug that the generic seeks to copy. Though risky, the bet paid off for Alembic.

In 2015, it was one of the four generic drug makers to receive regulatory approval to sell generic versions of Abilify (or Aripiprazole), an antipsychotic from Japan’s Otsuka Pharmaceuticals and Bristol-Myers Squibb to treat schizophrenia and bipolar disorder. “It was a massive opportunity for us, and we decided to stick with the US business," says Pranav. Till two years ago, the US business accounted for $200-210 million of the company’s total revenue and continues to be in that range in spite of massive price erosion and a competitive landscape.

In the last two years, with mounting pricing pressures, Alembic, like most of its peers, has taken a hit. In FY23, the company closed the US business at $193 million. Additionally, a robust supply chain has helped Alembic survive better. “We have large inventory levels. Reason? If someone there with a large market share faces a US FDA issue, we can immediately fill in that gap because we’ve built multipurpose plants and have a nimble supply chain," he explains.

With a Rs 3,570-crore international business, Pranav has been a stickler for compliance. But why do Indian companies get pulled up often by the US FDA? “High attrition at the grassroots is one main reason. When the manufacturing team keeps changing it gets challenging. Attrition is often at 30 to 40 percent, so we’re trying to control it," says Pranav. Alembic holds regular workshops with team members across levels—from senior team members to the grassroots—to ensure all regulations are followed. “Even the FDA has been increasing its benchmarks over the years. Every time a peer is pulled up by the US FDA we study what went wrong to understand what we can do better and stay ahead of the game," he adds. This obsession over compliance measures probably has the company better placed as opposed to many of their rivals, who might’ve grown faster but at the cost of quality and inviting the regulator’s rap.

With a Rs 3,570-crore international business, Pranav has been a stickler for compliance. But why do Indian companies get pulled up often by the US FDA? “High attrition at the grassroots is one main reason. When the manufacturing team keeps changing it gets challenging. Attrition is often at 30 to 40 percent, so we’re trying to control it," says Pranav. Alembic holds regular workshops with team members across levels—from senior team members to the grassroots—to ensure all regulations are followed. “Even the FDA has been increasing its benchmarks over the years. Every time a peer is pulled up by the US FDA we study what went wrong to understand what we can do better and stay ahead of the game," he adds. This obsession over compliance measures probably has the company better placed as opposed to many of their rivals, who might’ve grown faster but at the cost of quality and inviting the regulator’s rap.

A few weeks ago though, Alembic issued voluntary recalls of 82,400 bottles of the anti-bacterial eye infection treatment tobramycin, according to an advisory posted on the FDA website. In its notice, the company said the action was taken due to “failed impurities/degradation specifications". This voluntary recall was from one of their third-party contract manufacturing facilities. Pranav doesn’t think much of this: “I think industry-wise, the US FDA does quite a few recalls, especially when you have a large portfolio. In case of a voluntary recall, there are no penalties."

Despite uncertainties in the US market, Alembic remains bullish on the US market. Pranav says, “We are looking at products that have less competition and shortages. For instance, complex and long-acting injectables, ophthalmics, even in dermatology there are a lot of opportunities." At the same time, the company is also extending US-focussed portfolios to other markets including Canada, Australia and Europe.

Even though Alembic is involved in drug discovery research at a very rudimentary level, Pranav doesn’t think the company will go all the way in, “because the investment required is quite a bit". They plan to licence it out, or work with partners on the same.

Over the years, one of its legacy verticals, the API business, has scaled up immensely, accounting for Rs 1,166 crore in FY23. Alembic supplies APIs to formulators in over 60 countries. “Competing with China on their extremely low-priced finished products and depending on them for raw materials remains a challenge. However, though we can’t compete in terms of price, we do compete on compliance, quality and a robust supply chain," adds Pranav.

In 2005, Alembic was stuck with an outdated portfolio of legacy brands, with barely any “molecules of choice". Today, after reorganising the portfolio, “we are 80 percent where we need to be," says Shaunak. Currently, the India business accounts for Rs 2,063 crore of the company’s total revenue, growing at a CAGR of 11 percent (FY19-23).

Three elements went into reorganising the India business. First, eliminating some legacy brands, followed by the acquisition of Dabur’s non-oncology portfolio, entering chronic lifestyle therapies and speciality drugs, which incorporated anti-diabetics, cardiovascular, gastrology segments, and gynaecology. Today, these account for “45-50 percent of our total sales and it has been a high growth contributor to our business," says Shaunak.

The third was to expand in under-serviced areas such as urology, orthopaedics, dermatology, veterinary and ophthalmology. Shaunak plans to grow more organically: “Just last year, we entered the heart disease segment, which is heavily under-serviced. We are also looking to grow further in the veterinary sector, with enzyme-based nutritional products and more." Shaunak is also working on incorporating a lot more digitisation and data analytics in the India division to improve efficiencies.

Analysts believe the generational transition has worked well for the company. As the transition to the US markets happened around 2014-15, and “the US business started to meaningfully materialise for them, it became very profitable. They made a fortune out of some very good products, until 2019-20. No one thought Alembic would be this successful in the US," says Vishal Manchanda, senior vice president, Institutional Research, Systematix Group. “After the successful launch of Aripiprazole in 2015 the stock multiplied manifold. That marked the beginning of investors making humongous returns on Alembic Pharma’s stock." After a slump from November 2022 to March 2023, the stock has been seeing a steady rise.

The company has seen a drop in its net profit margins recently mostly due to the US market’s competitive pricing. “Of late the financial performance has been a little off-track because they have been investing quite heavily in the US markets, both in terms of capacity expansion as well as R&D. But the pay-off from this has not been that up to the mark. That has also led to a recent fall in the stock price," says Abdul Kader Puranwala, analyst, pharma and health care, ICICI Securities.

Pranav and Shaunak run completely independent teams, except for the finance team which is the only overlap. Pranav runs operations from Vadodara with a team of about 7,000, and Shaunak sits in the Mumbai office, where he has a team of 7,700 people. In dealing with two very different businesses, the brothers have fairly contrasting leadership styles. Pranav says, “I give a lot of autonomy to my team, because I like to pursue a lot of new things even though a lot might not work well for me." On the other hand, Shaunak is fairly hands-on. “The India business is challenging from an execution point of things, so I need to be on top of things," he says. At the board level, they complement each other: When Pranav is aggressive about a certain decision, Shaunak reins him in.

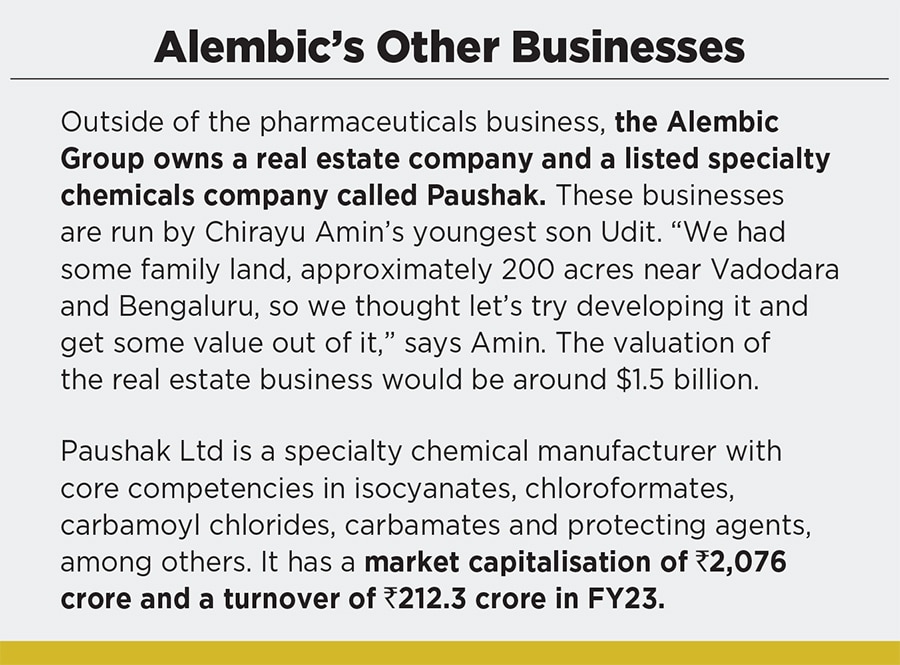

Amin has his succession plan for the multiple companies under the Alembic Group all set. Pranav and Shaunak are looking after the pharmaceuticals business and his youngest son, Udit is looking at real estate and the specialty chemicals business, Paushak. The patriarch says, “At the moment, whatever was possible within the ambit of business, we have settled… the succession plan is working well."

First Published: Sep 13, 2023, 13:33

Subscribe Now