Budget 2023: Walking the tax tightrope

Simpler taxation and tariff structures, parity in taxes, and lowering the tax burden in capital markets are some of the top expectations from the Budget 2023

As the central government prepares to present the Union Budget for FY24 in February, the clamour for reducing the tax burden is getting louder. With the economy recovering gradually from the blows dealt by the Covid-19 pandemic, the Budget is expected to be taxpayer-friendly, to boost growth and investments.

Simplifying taxation and tariff structures, bringing parity in tax rates, identifying sunrise industries for tax exemptions, lowering the tax burden in capital markets and easing compliance requirements are some of the top expectations from Minister of Finance Nirmala Sitharaman.

According to EN Dwaraknath, partner, Price Waterhouse & Co, the government may consider measures such as bringing about parity in tax rates across entity forms and in the taxation of capital assets like equity, debt and immovable property. Dwaraknath feels the government could also clarify some of the ambiguity surrounding attribution of profits to permanent establishments, significant economic presence, equalisation levy, etc in keeping with the broader principles adopted by the G24 nations. “Additional measures to reduce disputes and speed up litigation would be welcome. Easing of withholding tax provisions through clarifications or a rationalisation of rates across various streams of withholding could be considered," he adds.

With businesses bouncing back from lockdown-led disruptions, direct tax collections showed a steady growth in FY23. According to Ministry of Finance data, direct tax collections jumped 24.26 percent to ₹8.77 lakh crore on-year in FY23 as of November, indicating 61.79 percent of total budget estimate of direct taxes for FY23. The Budget had estimated direct tax collection of ₹14.2 lakh crore this financial year.

“With Budget 2023-24 being the last Union Budget of the Narendra Modi-government before the 2024 General Elections, we can expect it to be tax payer-friendly. However, keeping in mind that the Indian economy has started recovering from the pandemic, the government will prepare a Budget that boosts economic growth in conjunction with expectations of taxpayers. Now that the economy is looking set to grow fast, one can hope the government will improve upon last year’s tax-related announcements," says Maneet Pal Singh, partner, IP Pasricha & Co.

The government is expected to focus on new-age industries such as ecommerce, startups and fintech, while critical sectors like infrastructure and health care may also continue to be on the radar. Production-linked incentive (PLI) schemes are likely to include new categories of products, such as leather, toys, chemicals and shipping containers. “The Union Budget will broaden PLI schemes or introduce phased manufacturing plans (PMP) for new products and consider upcoming industries, especially with India’s exports aiming to reach $1 trillion by 2025," says Mahesh Jaising, partner, Deloitte India.  India offers new manufacturing companies a globally competitive tax rate of 15 percent. However, the government should consider extending this benefit to companies that expand their operations significantly or other industries, such as research and development (R&D), startups, ecommerce, says Dwaraknath. “With competition for investment heating up among countries, this could be a good opportunity for the government to make a bold move and bring the rate for all corporates down to 15 percent, either immediately, or within a defined time period."

India offers new manufacturing companies a globally competitive tax rate of 15 percent. However, the government should consider extending this benefit to companies that expand their operations significantly or other industries, such as research and development (R&D), startups, ecommerce, says Dwaraknath. “With competition for investment heating up among countries, this could be a good opportunity for the government to make a bold move and bring the rate for all corporates down to 15 percent, either immediately, or within a defined time period."

Currently, there are different tax rates for different types of companies. In the previous Budget, the government had extended concessional 15 percent corporate tax rate for one more year till March 2024 for newly incorporated manufacturing units. “For domestic manufacturing units, the base corporate tax rates have been brought down from 30 percent to 22 percent, and from 25 percent to 15 percent if established after October 1, 2019. Whereas corporate tax rate for foreign companies is 40 percent. If India introduces a corporate tax rate of 15 percent for all companies operating in all sectors, then it will have one of the most competitive corporate tax rates in the world," Singh elaborates.

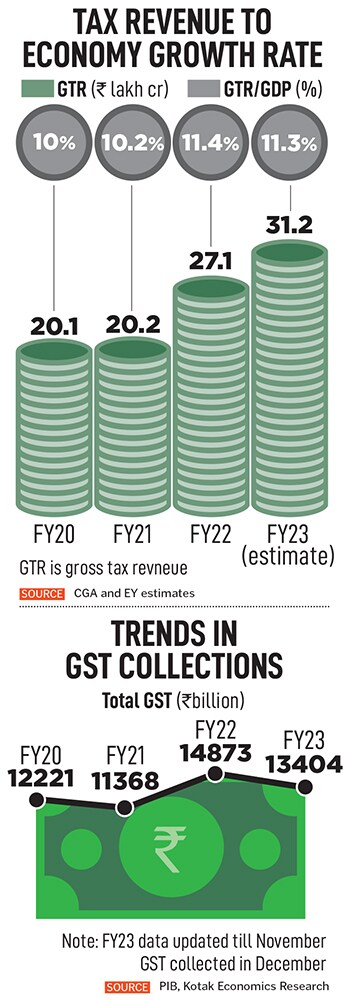

Tax revenue collected in FY22 at ₹27.07 lakh crore exceeded the Union Budget estimates by ₹5 lakh crore. It showed a growth of 34 percent over FY21 revenue collection of ₹20.27 lakh crore, led by 49 percent climb in direct taxes and 20 percent rise in indirect taxes.

“The government needs to incentivise and encourage equity investments," says Kamlesh Shah, president, Association of National Exchanges Members of India (ANMI), a representing body of around 900 stock brokers. According to ANMI, industry status is required for market intermediaries registered with the Securities and Exchange Board of India. This will remove unwarranted restrictions, and cost of funding and raising capital requirements for market intermediaries, and will help in creating financial services companies of global scale.

Recommendations from ANMI sent to the Central Board of Direct Taxes (CBDT) for the Union Budget 2024 include reduction in classification of income, lower securities transaction tax (STT) and commodities transaction tax (CTT), and tax exemptions in short-term capital gains (STCG). India is the only country that levies STT in cash markets and derivatives segment only one other market (South Korea) levies STT on cash market equities.

According to ANMI, the government should provide tax exemptions of up to ₹1 lakh in STCG. At present, STCG on equity shares (listed), which have suffered STT, are taxed at 15 percent plus surcharge, without any tax exemptions like in the case of long-term capital gains (LTCG).

“We want industry status for the intermediary, we also want reduction in CTT and reinstallation of the seven agriculture commodities that were banned in December 2021. There should be rationalisation in the cost of transactions," says Narinder Wadhwa, president, Commodity Participants Association of India (CPAI).

“The capital gains tax regime has become complicated and needs to be simplified. Currently, there are different holding periods specified for different asset classes, attracting different rates for tax, and hence asset classes are not taxed uniformly. This needs to be aligned," Singh adds.

First Published: Jan 20, 2023, 13:22

Subscribe Now