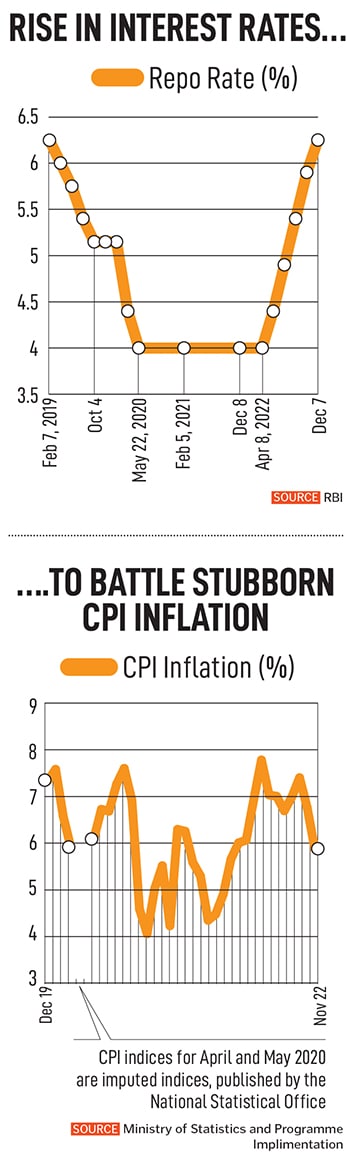

It is the first normal budget after the Covid-19 pandemic and also the first in the midst of rising fears of a global recession as central banks have aggressively tightened monetary policy and increased interest rates to battle stubborn inflation and slow down growth.

The impact on economies across the globe can be seen from the fact that nearly half of the 15 fastest-growing economies in the world in 2022 were island countries. Growth almost became a scarcely used word for policymakers and central bankers last year.

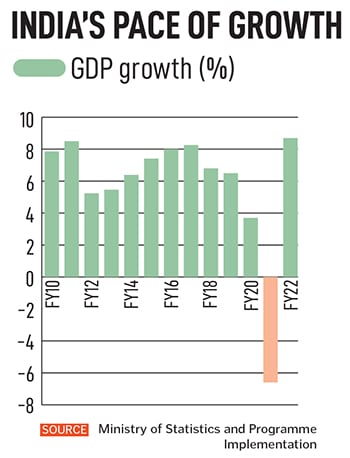

Yet, India has emerged as an outlier among all major economies—an 8.7 percent Gross Domestic Product (GDP) growth for FY22, the fifth-highest forex reserves in the world at $562 billion as of December 23, 2022, trailing China, Japan, Switzerland and Russia, and one of the best performing stock markets of 2022—behind Indonesia and Singapore—with a 4.7 percent rise for the BSE Sensex index.

Various global investment banks and research firms, including Barclays, Bank of America and UBS Group, besides the International Monetary Fund (IMF) have warned of growth slowing further in 2023. Global growth is forecast to have grown by 3.2 percent in 2022 and 2.7 percent in 2023, according to an IMF projection. A war that shows little sign of lessening, further monetary policy tightening on the cards, and with the US and China battling their own set of problems, there are more question marks on growth than in 2022.

Still Led by Services

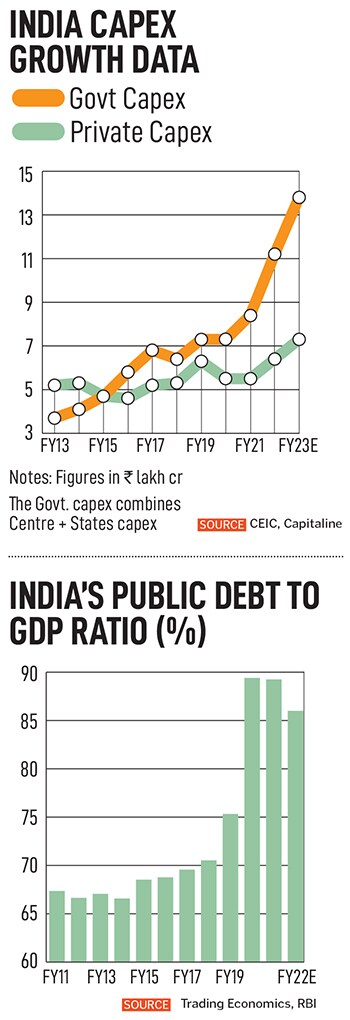

Will India realistically achieve at least 6 percent growth in FY24? Experts Forbes India spoke with say it is likely, but led by the services sector, which commands between 55 percent and 60 percent to India’s GDP, followed by manufacturing and then agriculture. The government wants the manufacturing sector to start doing the heavy lifting and corporates to start providing the necessary push to private capex growth. This is starting to happen as capacity utilisation rates are improving, but it is slow and uneven.

![]() It is going to be a tricky road ahead for Sitharaman and the Reserve Bank of India (RBI) to press the accelerator for growth even if the worst of inflationary pressures might be behind us.

It is going to be a tricky road ahead for Sitharaman and the Reserve Bank of India (RBI) to press the accelerator for growth even if the worst of inflationary pressures might be behind us.

India’s growth in 2022-23 will best be remembered as a tale of two halves. The first quarter saw GDP accelerate to 13.5 percent, but that was mainly on account of the low base effect in the year earlier on account of the lockdowns imposed by the spread of the Delta variant of the coronavirus. For the first half of FY23, growth stood at 9.7 percent.

While this has meant that India is the world’s fastest-growing large economy, the full year estimate of 6.8 percent for FY23 points to a veritable growth slowdown in the second half to 4.4 percent. Sachchidanand Shukla, chief economist at Mahindra & Mahindra, points out that this is on account of the fact that the composition of growth has changed.

While agriculture is expected to have grown at 3 percent and services activity remains strong at 8 percent, manufacturing has proved to be a drag with exports slowing. A lot of the FY24 growth potential depends on how much the West slows down, but Shukla expects India to clock a 6-percent plus number assuming there are no external shocks either from Covid-19 or the war in Ukraine.

While preparing the Budget, one issue tying the hands of the government will be the high fiscal deficit number and the consequent drag on its ability to spend. As a result of the pandemic, the government was forced to delay its fiscal glide path and the deficit expanded to 9.3 percent in FY21 before falling to 6.7 percent in FY22. “There is no doubt that the debt situation is unsustainable," says Abheek Barua, chief economist at HDFC Bank. He points to the combined central and state debt levels at 84 percent of GDP as the highest ever.

A large part of debt was manageable due to low interest

rates and the GDP deflator being high for FY23. Both those factors are unlikely to aid the deficit in FY24. Already, the India 10 year bond quotes at 7.3 percent and with rates in the US expected to stay high at least through 2024 (the current forecast is for the Fed funds rate at 5.1 percent in 2024), it is unlikely that Indian bond yields will fall back to the 6 percent at the start of the pandemic.

In an election year, keeping expenses down will be tricky. As the government has shown with an extension of the free food scheme, there is every chance of the subsidy bill going out of control. At ₹532,446 crore, the subsidy bill for FY23 is the second highest since ₹706,006 crore was spent in FY21. The war in Ukraine is likely to add ₹2.2 lakh crore to the fertiliser subsidy bill for FY23. As a result, economists are unanimous in saying that there is little scope for the government to provide any relief in the form of lower taxes or a stimulus.

In fact, Shukla of Mahindra says there should be a concerted effort to not provide any stimulus assuming there are no external shocks or a monsoon failure. Barua is certain that the correlation between fiscal expansion and an election year will not hold true this time as “there is a deep realisation in the government that the debt situation is untenable".

![]()

Interest Rate Cycle Close to Peak

In order to get growth up, there are few avenues the government could explore. First, ramp up capital expenditure. While there are signs that private sector capex is picking up, government capex will have to do the heavy lifting, as it has done in the past few years. Secondly, attract companies relocating from China with incentives for setting shop in India. This would again come with tax incentives. Third, keep the services engine running, with domestic tourism and hospitality being key drivers.

![]() Barua believes one of the tricky issues of whether rates would continue to rise more in 2023 has been answered. “Most of the rate increases are done," Barua says.

Barua believes one of the tricky issues of whether rates would continue to rise more in 2023 has been answered. “Most of the rate increases are done," Barua says.

Banks are sensitive to the fact that the demand for credit could contract and you could attract low-quality borrowers, something which the RBI and banks do not want. Barua is not ruling out a reversal in the interest rate cycle by mid-2023, where falling commodity prices and global recession are real factors to deal with.

One of the factors making Barua positive is that capacity utilisation rates for companies have increased to 74 percent from sub-70 percent. Cement, automobile, electronics manufacturers have been approaching banks seeking term loans, without being too sensitive to currently high interest rates. “They appear to have built-in margins on interest rates," Barua says. The strategy towards borrowing at this stage could be that by the time capacity comes on stream, the worst of global recession would have been behind them.

Whether this borrowing will translate into a deep and sustained private sector capex cycle is still unclear and a while away. Mahesh Vyas, the managing director and CEO of the Centre for Monitoring Indian Economy (CMIE), says “the saga of corporates remaining reticent of investing into new capacities has apparently continued into 2022-23", in a December 1, 2022, column on CMIE’s website.

“Financial statements of 3,110 listed companies show their net fixed assets grew by a meagre 3.5 percent year-on-year in nominal terms as of September 2022. It seems likely that 2022-23 would be the third fiscal year in which corporates will have stayed away from expanding their productive capacities," Vyas adds.

Domestic Consumption Story Intact

There are, however, some positives playing out on growth, particularly in fast-moving-consumer goods (FMCG) and the housing sector. Saugata Gupta, managing director and CEO of Marico, believes that the domestic consumption story for India remains intact after disruptions like the pandemic, and even inflation.

“The slowdown was inflation-led and food constitutes a significant portion of the consumption basket. Whenever there is food inflation, people tight rate or down trade on FMCG. During 2021 and 2022, the alternative channels of consumption were not available the share of wallet got transferred into healthy hygiene, immunity boosters. As the economy opened up, spending has shifted towards travel and hospitality," Gupta tells Forbes India. Marico, whose best-selling brands include Saffola cooking oil and Parachute coconut oil, is in a silent period and Gupta could not comment on the specific strategies being drawn out for consumer brands in 2023.

![]() But in rural India, during the slowdown, families down trade in high consumption categories such as soaps, detergents and hair oil. In the case of low penetration items, they would usually tight rate on items such as nutrition drinks, or at least not up trade from non-branded to branded products. This trend which was seen for the past two to three quarters, is now easing.

But in rural India, during the slowdown, families down trade in high consumption categories such as soaps, detergents and hair oil. In the case of low penetration items, they would usually tight rate on items such as nutrition drinks, or at least not up trade from non-branded to branded products. This trend which was seen for the past two to three quarters, is now easing.

“The consumption story is recovering and the worst of the inflation is mostly over. The consumption trends are gradually stabilising. I am fairly optimistic about growth in 2023," says Marico’s Gupta. It will be a gradual improvement in consumption, but the trend will not be a hockey stick graph. “Though not insulated, we are in a far better space then the rest of the world," he adds.

Despite rising interest rates—of 225 basis points for 2022—and costlier home loans, the demand for housing has rebounded across various segments of real estate, including high-end, from an obviously sluggish trend during the pandemic. The real estate market would normally appear challenged due to costlier home loans (where interest rates have ranged between 6.75 percent to 8.4 percent) and a delay in closure of transactions, as potential buyers would wait to determine home loan EMIs, as rates rise.

“The on-the-ground reality is slightly different. Demand for real estate is very high and people want to buy homes, and not remain limited to rental property. We saw bullish trends in 2022 and I am confident that it will continue into 2023," says veteran real estate developer Niranjan Hiranandani, who has co-founded the Hiranandani Group.

![]()

His optimism has been backed by the fact that home loans and loans against property have been some of the fastest-growing verticals within retail banking for most banks in the April to September 2022 period. HDFC, the country’s largest mortgage lender, reported a 20 percent growth in its individual loan book on an assets under management basis and a 36 percent growth in individual disbursements for the half-year ended September 30, 2022.

Hiranandani is confident that the real estate sector will grow at a “minimum of 10 percent in any of its segments" in 2023. He expects interest rates to rise a further 50 bps beyond which it would be counter-productive. “Any further increase in interest rates beyond 50 bps will be counter-productive and will cause inflation, as there is a cost input," Hiranandani says.

Business leaders and economists would wish that the interest rate cycle is near its peak, but the minutes of the last monetary policy meeting of the RBI suggested that the central bank will remain vigilant and, as per RBI Governor Shaktikanta Das, there was “no room for complacency" against inflation.

Sitharaman’s task to push further for growth is going to be an arduous one. She will have to hope for sustained push for growth from the services sector, even as manufacturing seeks to get its act right. The news from the Western economies is likely to impact her best intentions.

It is going to be a tricky road ahead for Sitharaman and the Reserve Bank of India (RBI) to press the accelerator for growth even if the worst of inflationary pressures might be behind us.

It is going to be a tricky road ahead for Sitharaman and the Reserve Bank of India (RBI) to press the accelerator for growth even if the worst of inflationary pressures might be behind us.

Barua believes one of the tricky issues of whether rates would continue to rise more in 2023 has been answered. “Most of the rate increases are done," Barua says.

Barua believes one of the tricky issues of whether rates would continue to rise more in 2023 has been answered. “Most of the rate increases are done," Barua says. But in rural India, during the slowdown, families down trade in high consumption categories such as soaps, detergents and hair oil. In the case of low penetration items, they would usually tight rate on items such as nutrition drinks, or at least not up trade from non-branded to branded products. This trend which was seen for the past two to three quarters, is now easing.

But in rural India, during the slowdown, families down trade in high consumption categories such as soaps, detergents and hair oil. In the case of low penetration items, they would usually tight rate on items such as nutrition drinks, or at least not up trade from non-branded to branded products. This trend which was seen for the past two to three quarters, is now easing.