India's Richest 2019: What makes Uday Kotak Mr Bankable

Uday Kotak has steered the Kotak Mahindra group successfully through three decades, and some tumultuous times

Uday Kotak, Managing director and CEO, Kotak Mahindra Bank

Uday Kotak, Managing director and CEO, Kotak Mahindra Bank

Imag: Vikas Khot [br]Several banks in India are going to end this decade financially weak, disoriented in their corporate strategy and averse to risk, hurt by either injudicious lending or unscrupulous business practices. One, Kotak Mahindra Bank (KMB), the institution managing director and CEO Uday Kotak has built since 2003—alongside several subsidiaries including asset management and insurance businesses—stands out as an exception.

Years of rising bad loans, a slowing economy and a spate of banking frauds have seen banks turn risk-averse. But KMB has proved that appropriate risk evaluation and a conservative approach can bring success in an extremely challenging environment. This comes from one of Kotak’s business mantras: “Do not take an equity type of risk which could bring you debt type of return.”

It is this prudence that has seen his stature rise at a time when leadership skills and mentoring in India’s banking space are in major deficit. Kotak is now India’s fifth richest Indian with a net worth of $14.8 billion. KMB, in which Kotak and the promoter group own a 29.97 percent stake, is India’s fourth largest private bank by asset size.

His abilities as an institution builder have been evident over the three-decade journey of transforming the non-banking financial company (NBFC) Kotak Mahindra Finance (from the earlier bill-discounting business started in 1985) into a bank in 2003, and also growing its various subsidiaries within the group, whose total assets are worth ₹400,342 crore.

“The bank is poised for its next growth phase, and that can be either inorganic growth like the acquisition of ING Vysya [in 2015-16], BSS Microfinance [in 2017], or organic, like riding on the back of game-changing digital products like 811,” says Kotak. “The premise of our business model is ‘concentrated India, diversified financial services’. Our growth has been organic as well as inorganic. It need not be either or.”For Kotak, lending is rooted in the belief of being a custodian of depositors’ money, and providing returns for years. In an uncertain lending scenario, KMB has chosen to be cautious in lending in the corporate and business banking segment (small and medium enterprises). So advances grew 7.47 percent year-on-year in the September 30, 2019 quarter, compared to a 16.06 percent year-on-year jump in the September 2016 quarter, after the ING Vysya Bank merger. The conscious decision to curb lending to these segments has helped the bank, at a time when other corporate-centric banks such as ICICI Bank, Yes Bank and IndusInd Bank have suffered because of injudicious decisions to lend more aggressively.

This is not the first time KMB has taken this approach: In 2010-2012, it had shied away from infrastructure financing, even as other banks and financial institutions had dived in. “These projects promised higher yields, but it was a space we did not understand and has been known to often cause asset-liability mismatches,” explains Jaimin Bhatt, CFO, Kotak Group. For those who did lend to the sector, time and cost overruns showed up in a few years, resulting in huge non-performing assets (NPAs) that they are still struggling to recover from.

Conservative, but nimble

Conservative it might be but risk-averse it is not. KMB was a pioneer in the asset-reconstruction division (ARD) and started buying NPAs from other banks and financial institutions. Today Phoenix ARC, with assets under management of around ₹7,000 crore, is an independent company sponsored by the Kotak Group, which has a 50 percent stake in it.

KMB also emerged as an early mover in the digital banking space when Indians took to their smartphones to make online payments, fueled by the launch of the Unified Payments Interface (UPI) app. On March 30, 2017, KMB launched their digital banking service called 811—one of the first banks to do so—with an app and a zero-balance account. The app helped the bank acquire customers at a faster pace within 18 months it doubled the number of customers to more than 16 million. At present, it adds half a million customers each month.

This July, the bank partnered with cab-hailing application Ola to enable its customers to directly book, track and pay for their rides through the banking app. Dipak Gupta, KMB’s joint managing director, says the strategy is not about introducing features frequently, or increasing the number of merchants. “It’s dishing out age-old products in a convenient way,” he says. “When the marketplace is in trouble, bullets will fly around, some will even hit you. You just have to ensure that not too many do.”

“When the marketplace is in trouble, bullets will fly around, some will even hit you. You just have to ensure that not too many do.”

Dipak Gupta, Joint Managing Director, Kotak Mahindra BankThe forays into both asset reconstruction and digital banking are proof that KMB has been nimble in identify opportunities and taking quick and significant steps forward, explains Gupta, who has worked with Uday Kotak for nearly 27 years.

“The basic tenets of our philosophy continue to revolve around low-cost and stable liabilities, lower financial risk but high franchise value businesses and growing the risk book without diluting risk-adjusted returns,” Kotak summarises.

“We will ensure our Finance 101 is perfect. There will be no compromise for short-term benefits,” says Gupta, whose words find reflection in the bank’s handling of NPAs in recent years. All these practices have only made shareholders content. ₹1 lakh invested in Kotak Mahindra in 1985 will be worth more than ₹2,500 crore as on date, provided all subsequent rights issues were subscribed to.

KMB, which completed a successful merger with ING Vysya Bank in May 2016, ensured that its NPAs did not balloon, although about 6 percent of the ING Vysya book (funded and non-funded) was in various forms of stress. Jaimin Bhatt, CFO, Kotak GroupKMB formed a “bad bank” under their ARD and most of the stressed assets were transferred to it for the team to work on, while making an additional provisioning of 0.5 percent to the combined book in FY16. “When the marketplace is in trouble, bullets will fly around, some will even hit you. You just have to ensure that not too many do, and that the few that hit you do not kill you,” says Gupta. While not disclosing the actual exposure of the bank to troubled corporate borrowers such as Dewan Housing Finance, Indiabulls Housing Finance, Reliance Group, Essel Group and Adani Group, Bhatt says their exposure is “insignificant”. The bank’s net NPAs are at 0.85 percent.

Jaimin Bhatt, CFO, Kotak GroupKMB formed a “bad bank” under their ARD and most of the stressed assets were transferred to it for the team to work on, while making an additional provisioning of 0.5 percent to the combined book in FY16. “When the marketplace is in trouble, bullets will fly around, some will even hit you. You just have to ensure that not too many do, and that the few that hit you do not kill you,” says Gupta. While not disclosing the actual exposure of the bank to troubled corporate borrowers such as Dewan Housing Finance, Indiabulls Housing Finance, Reliance Group, Essel Group and Adani Group, Bhatt says their exposure is “insignificant”. The bank’s net NPAs are at 0.85 percent.

In 2017, the bank acquired a near-100 percent stake in BSS Microfinance, for ₹139 crore, strengthening its reach into rural India. BSS Microfinance, which was operative largely in Karnataka, has since expanded to Maharashtra, Bihar and Madhya Pradesh. “The loan book has doubled to ₹1,200 crore, and this gives us enough comfort that we can expand to different geographies,” says Bhatt.

Bhatt and Gupta agree that while they are not averse to looking for mergers, they are low on the priority list. “We are quite open to growing our branch network in a measured manner. And simple bang for the buck. Bang for the buck not in six months or one year, but over three years to four years,” Kotak told analysts at an earnings call meeting in June. Mind the gaps

Mind the gaps

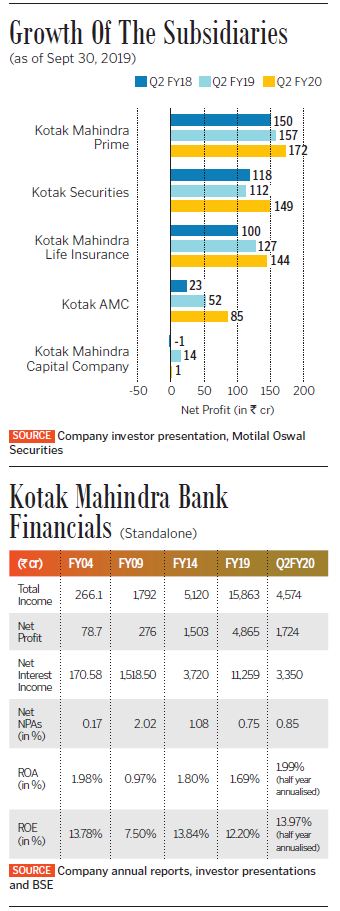

While the bank constitutes 71.6 percent (₹1,724 crore) of the Group’s total profit, Kotak Mahindra Prime (car finance) contributes 7.14 percent (₹172 crore), followed by Kotak Mahindra Life Insurance (5.98 percent at ₹144 crore), Kotak Securities (6.19 percent at ₹110 crore) and Kotak AMC (3.53 percent at ₹85 crore). In terms of size, however, some of these businesses are small with plenty of scope to grow: Kotak Life has assets under management (AUM) of over ₹30,358 crore while in the mutual fund business, its AUM are ₹168,118 crore.

In its retail lending franchise—whether it be personal, auto and home loans, or credit cards—too, it is nowhere close to being a top player in terms of market share. While HDFC Bank dominates the personal and auto loans segment, State Bank of India and HDFC Bank dominate the credit cards space.

The same applies to crop loans and small and medium enterprises (SMEs), where the Kotak top management admits they have been “very cautious” despite the strength the ING Vysya merger brought. “It is something we have consciously moved away from,” Kotak told analysts in the earnings call in June, as the business practice in the industry essentially became real estate financing under the disguise of crop loans.

While loan growth demand is still sluggish, there is little clarity at this stage what KMB or other banks could do differently. Even in a low interest rate regime, the feel-good factor is still a while away, with consumers confident that loans could come cheaper in coming quarters. “The [KMB] management has in recent years been focusing mainly on growing the current and savings accounts franchise,” says Nitin Aggarwal, banking analyst with Motilal Oswal Securities. Average year-on-year growth of accounts in both these segments is 20 to 22 percent as of September 2019, double the industry average of 10 to 12 percent.

Both Gupta and Bhatt believe there is room to grow faster in all the three areas of SME and agri loans, corporate loans, and retail loans. “In the SME space we will chase customers but it will be done digitally,” says Gupta.

Kotak adds that they have launched digital banking initiatives for instantly disbursing business loans to existing SME customers. “Our digital-first strategy ensures that credit is easily accessible to them,” he says adding that when consumers use multiple products their engagement increases exponentially driving up loyalty.

“Return-of-investment is more important for us than only return-on-investment,” Kotak recounts one of his mantras. “Hence, we avoided riskier longer-term project finance in favour of shorter duration loans and secured working capital loans in order to ensure taking only lenders’ risk and not equity-type risks for lending returns.”

Over the short term how KMB grows—inorganically or organically—might depend on which way the promoter shareholding case goes. A hearing is expected in early 2020. Kotak might want to consider an acquisition, analysts say, which could trim his stake and meet the Reserve Bank of India’s (RBI) promoter holding requirement. (The RBI wants promoters of banks to trim their stakes in banks to prevent unrestrained control.) Since the matter is sub-judice, the bank declined to comment.

But Kotak’s legacy is here to stay. The bank has a consolidated net worth of around ₹62,653 crore as on September 30 and about 60,000 employees. Entrepreneurs in the financial services space do not hesitate to highlight Kotak’s leadership skills.

“Uday [Kotak] has the ability to pace himself and play a long innings. KMB has also been through different avatars and he has the ability to learn and reinvent,” says Rashesh Shah, chairman and CEO of the ₹59,530 crore Edelweiss Group. Shah says Kotak’s leadership is consistent, where the aim is not to become the largest bank, but focus on quality.

Today, KMB is the only Indian private sector lender to retain the names of its promoters, and the institution has come to be known for its credibility. A slowing economy and weak consumption spending is going to make it more difficult for KMB to rapidly increase its loan, making it difficult for it to catch up with larger peers like HDFC Bank and ICICI Bank. It will need to do more of what it has been doing right over the last couple of decades: Take small prudent steps and not eye just short-term gains.

It is now that Kotak’s vision will be tested, more so than ever before.

First Published: Nov 20, 2019, 12:27

Subscribe Now