Down round for Paytm

With increasing losses, Paytm's investors may be unwilling to put money at a $13-15 billion valuation

Image: Shutterstock [br]When Paytm raised money from Berkshire Hathaway in August 2018, it marked a significant fundraising coup for the company. Although Warren Buffett, CEO of Berkshire Hathaway, wasn’t involved in the transaction, Paytm, then eight years old, had received the imprimatur of the world’s most successful investment firm. Todd Combs, Buffett’s lieutenant, who led the deal, would be on Paytm"s board.

Image: Shutterstock [br]When Paytm raised money from Berkshire Hathaway in August 2018, it marked a significant fundraising coup for the company. Although Warren Buffett, CEO of Berkshire Hathaway, wasn’t involved in the transaction, Paytm, then eight years old, had received the imprimatur of the world’s most successful investment firm. Todd Combs, Buffett’s lieutenant, who led the deal, would be on Paytm"s board.

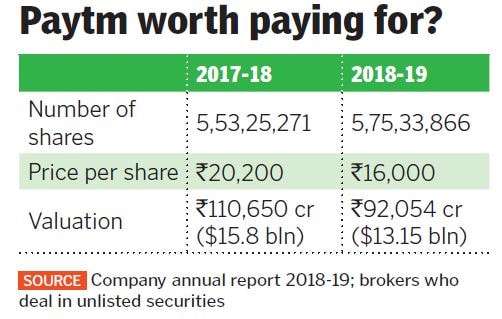

As Paytm prepares for a fresh round of fundraising, it’s likely that this could be a ‘down round’—where the valuation is lower than previous ones. Paytm is in talks with T Rowe Price and existing investors Alibaba and SoftBank. Its shares available with brokers who deal in unlisted securities have lost about 20 percent in the last year to quote at ₹16,000 a share, according to three brokers, implying a 20 percent cut in its valuation. The market for unlisted securities can be illiquid and there is no data on the number of shares that have changed hands at this price. A Paytm spokesperson declined to comment on the fundraising.“Its momentum is not what it has been,” says Jayath Kolla, founder and partner at Convergence Catalyst, a consultancy. After the initial increase in transactions post demonetisation, the company has seen its dominance challenged by Flipkart’s PhonePe and Google Pay. “If Google Pay launches after you and gets traction, then what is your competitive moat?” asks Kolla. Other divisions like Paytm Mall and Paytm Payments Bank have also failed to turn a profit. The company lost ₹4,217 crore in the year ended March 2019, up from the ₹1,604 crore it lost the previous year.

In 2016 and early 2017, Flipkart investors Morgan Stanley, Fidelity and Valic marked down the company’s valuation to under $10 billion. In May 2018, Walmart acquired the company for $22 billion. It remains to be seen if the Paytm story has a similar ending.

First Published: Oct 22, 2019, 15:59

Subscribe Now