Food tech companies: The face-off intensifies

Swiggy going public is a threat to the monopoly Zomato enjoyed in the listed space as now the competition is not restricted to food delivery business and quick commerce alone

Even as Zomato celebrated arch rival Swiggy’s debut in the Indian stock markets on November 13, exemplified as two men in their signature orange and red T-shirts looking at the iconic BSE building on Dalal Street Mumbai, the reality is distinctly different.

Though it is indeed rare to see such camaraderie among competitors in stock markets, Swiggy going public is obviously a threat to the monopoly Zomato enjoyed in the listed space as now the competition is not restricted to food delivery business and quick commerce (QC) alone considering the money chasing the listed food tech biz will now likely be bifurcated.

Shares of Swiggy were listed at Rs 420 a piece on the BSE, a mere 8 percent premium over the issue price of Rs 390.

Both Swiggy and Zomato operate identical businesses, but valuations and financials differ, two critical aspects which are part of investors’ assessment before buying any share in the stock markets. What investors are curious about is if operating in an oligopoly market with only two players grabbing most of the market share in the food delivery business and QC space will open up opportunities for the two players to create niches for themselves. Or will the competition make space for other arch rivals like Zepto and Big Basket to grow further?

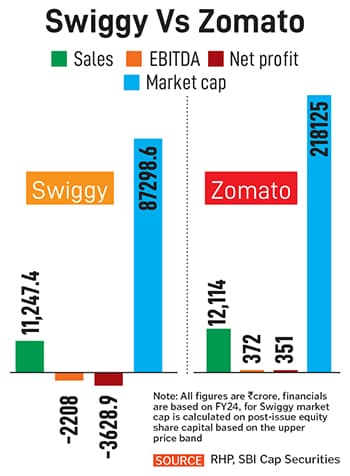

Concerns are aplenty. Loss-making Swiggy has a long way to convince public markets investors on its business growth plans. That task may not be as difficult for Zomato which has at least tasted profitability while its 10-minute quick commerce Blinkit continues to show strong growth despite increasing competition, with a 20 percent (quarter-on-quarter) growth in the September quarter of financial year 2025.

Web Story: Will Swiggy’s stock markets debut challenge Zomato’s edge?

“Public market investors would expect Swiggy to demonstrate a path to sustainable profitability in the business—which could mean it will have to trade-off on growth," says Swapnil Potdukhe, analyst, JM Financial.

According to Potdukhe, Blinkit remains the best placed quick commerce platform to take on emerging competition based on strong execution by management and a robust balance sheet. However, he adds that a successful initial public offering (IPO) and leadership revamp at Instamart could be just the catalyst Swiggy needs for a successful turnaround in its fortunes.

He explains that Swiggy’s recent execution issues may be a thing of the past because they were partly attributable to the pressures of going public and/or lack of experience of running a retail business.

Swiggy’s only listed peer Zomato went public on July 23, 2021. Shares of Zomato debuted on the stock exchanges at 51 percent premium over the issue price of Rs 79. Moreover, Zomato’s entry into the stock markets with its Rs 9,375 crore-IPO was subscribed 38 times. The ride in the stock markets had been rather bumpy thereafter.

Its shares almost halved in just a year, falling to its lowest level at Rs 41.65 a piece on July 26, 2022. It plunged 47 percent from its issue price and 67 percent from its stock markets debut of Rs 125.85 leaving investors high and dry. Lack of profitability made it difficult for Zomato to attract public markets investors. It is only from the beginning of this year that Zomato shares started gaining investors’ attention on its better business growth prospects and QC business Blinkit grabbing major market share.

Its shares almost halved in just a year, falling to its lowest level at Rs 41.65 a piece on July 26, 2022. It plunged 47 percent from its issue price and 67 percent from its stock markets debut of Rs 125.85 leaving investors high and dry. Lack of profitability made it difficult for Zomato to attract public markets investors. It is only from the beginning of this year that Zomato shares started gaining investors’ attention on its better business growth prospects and QC business Blinkit grabbing major market share.

Shares of Zomato have jumped 118 percent in this year so far, hitting a life high of Rs 291.65 on September 24 this year. Quarterly growth in the business of Zomato drove its shares higher while Swiggy’s public debut also had a rub-on effect.

“While on an absolute basis Swiggy offers a decent upside, we would prefer Zomato if asked to pick only one due to its superior execution in the past and market leadership across key segments," Potdukhe says.

Swiggy raised around Rs 11,327 crore via IPO in the three-day sale that ended on November 8. It proposed to utilise the money of the fresh issue for the expansion of dark stores, brand marketing, technology upgradation and debt repayment. The issue was subscribed 3.6 times in a wobbly market which has been seeing a major correction in the last few months on foreign institutional investors’ (FIIs’) withdrawal from India.

Analysts expect the IPO proceeds will support Swiggy’s expansion plans, especially in its newer segments, which could eventually balance its revenue portfolio and improve its financial position.

“Swiggy’s IPO price band implies enterprise value (EV)/revenue multiple of 6.5 times based on annualised FY25 financials. The valuation is at a discount to Zomato, which trades at an EV/revenue multiple of 11.3 times based on FY25 consensus estimates. Internal controls, as reflected in the auditor’s qualified opinion and increased competitive intensity, are the key downside risks," says Abhishek Shindadkar, analyst, InCred Equities.

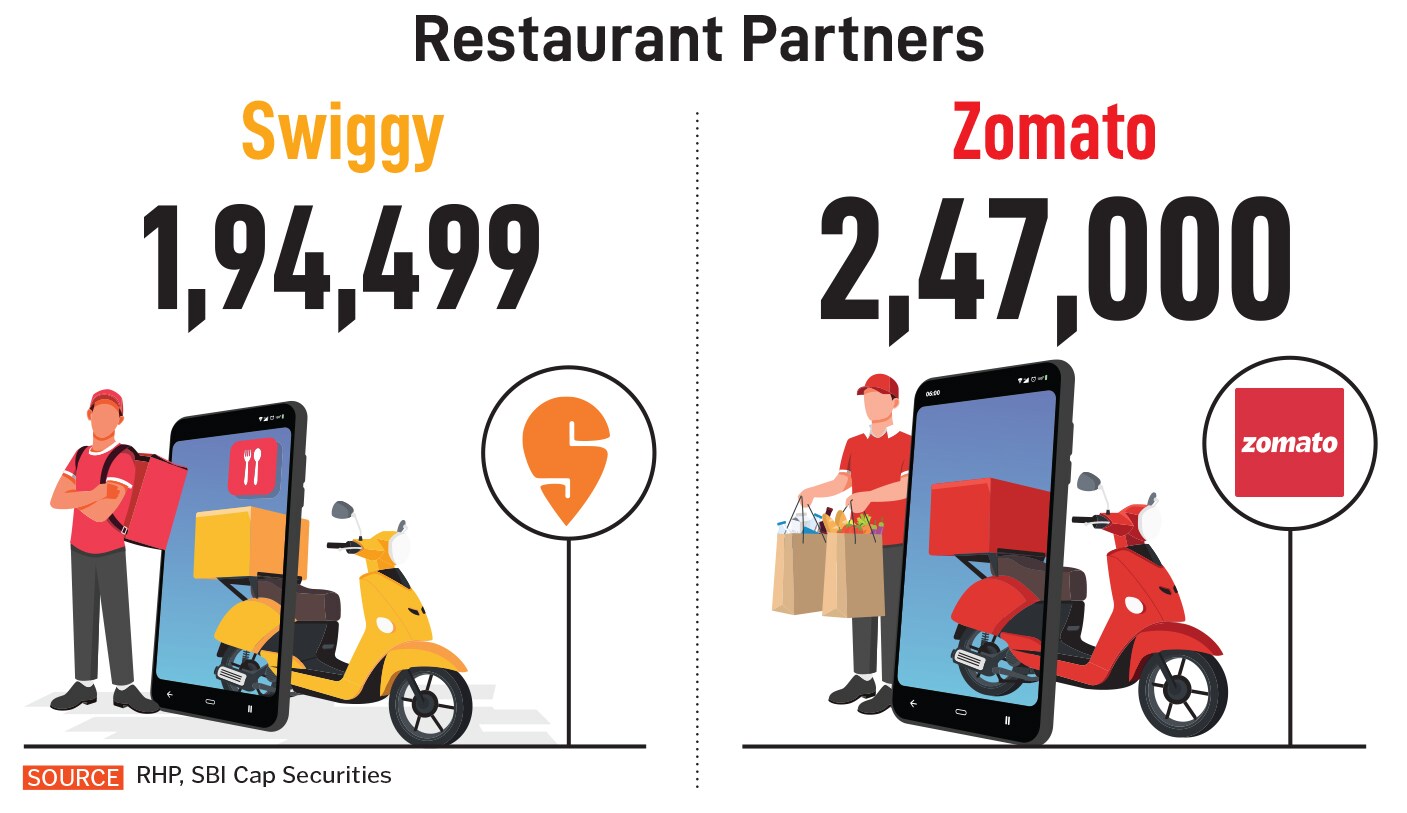

India’s online food delivery market is broadly a duopoly between Zomato with 57 percent and Swiggy 43 percent roughly. However, from inception Swiggy is still loss-making at an aggregate level, and overall profitability may be some time away.

“At a headline level, Swiggy appears four-six quarters behind Zomato in food delivery and QC," says Aditya Suresh, head of equity research at Macquarie Capital.

Overall, revenues from operations of Swiggy expanded to Rs 11,247.4 crore in FY24 from Rs 5,705 crore in FY22. Though Swiggy is not profitable, it has been able to cut its losses to Rs 2,350.2 crore in FY24 from Rs 3,629 crore in FY22. In FY23, its loss was at Rs 4,179.3 crore. Swiggy’s food delivery business has turned Ebitda positive in Q1FY25 with adjusted Ebitda of Rs 57.8cr. In the first three months of FY25, Swiggy’s loss was at Rs 611 crore while revenue from operations was at Rs 3,222 crore.

“For Swiggy, the path to catch-up in food delivery is relatively more straightforward, while that for QC is more complex. For Blinkit, the key dynamic is to maintain current breakeven unit economics in the face of sharply rising competitive intensity and its geographic expansion outside NCR," Suresh explains.

Zomato’s adjusted Ebitda/ gross order value (GOV) margin increased to 3.5 percent in 1QFY25 from (-) 3 percent in FY22. Zomato posted a net profit of Rs 351 crore on a net revenue of Rs 12,114 crore in FY24. In the first quarter of FY25, the revenue of Zomato was Rs 4,206 crore while net profit was at Rs 253 crore.

According to Suresh, Swiggy lags Zomato by 100 basis points (bps) at the contribution margin level, and a larger 260 bps at the adjusted Ebitda margin level due to higher employee and marketing costs. Contribution margin is a cost-accounting calculation that measures the profitability of a product or revenue that is left after covering fixed costs.

“In our view, 5 percent adjusted Ebitda margin implicitly assumes a sustained duopoly market structure. We believe the medium-term risk to this assumption is skewed to downside related to industry structure changes with ONDC," he elaborates. Open Network for Digital Commerce (ONDC) is an initiative aiming at promoting open networks for all aspects of exchange of goods and services over digital or electronic networks. ONDC is expected to make e-commerce more inclusive and accessible for consumers.

Swiggy pioneered the hyperlocal commerce industry in India, launching food delivery in 2014 and quick commerce in 2020. Swiggy operates in five segments, of which the first three are food delivery, out-of-home consumption (covering dining out and events) and quick commerce for the on-demand delivery of grocery and household items. The fourth segment is its supply chain and distribution, covering business-to-business (B2B) supplies, warehousing, logistics and distribution for wholesalers and retailers. Last are the platform innovations, covering its new initiatives and offerings, such as Swiggy Genie, Swiggy Minis, among others.

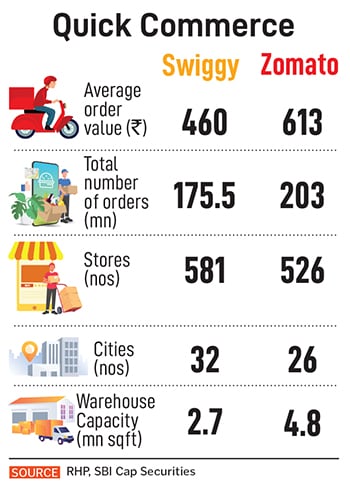

Swiggy’s Instamart has been a significant revenue driver and is their second largest business segment by revenue. The company plans to deploy Rs 1,179 crore up to FY28 for expansion of its dark store network across India. As of the first half of FY25, Instamart operated 605 active dark stores across 43 cities. While Swiggy tested the dark store-led business model first, a sudden rise in competition and better execution by the competition did lead to market share erosion. As of 1QFY25, Instamart is behind Blinkit, in terms of both scale as well as unit economics.

Swiggy’s Instamart has been a significant revenue driver and is their second largest business segment by revenue. The company plans to deploy Rs 1,179 crore up to FY28 for expansion of its dark store network across India. As of the first half of FY25, Instamart operated 605 active dark stores across 43 cities. While Swiggy tested the dark store-led business model first, a sudden rise in competition and better execution by the competition did lead to market share erosion. As of 1QFY25, Instamart is behind Blinkit, in terms of both scale as well as unit economics.

The incumbent food-techs are expected to prioritise their QC ventures, as there is not much to differentiate in food delivery in terms of service quality for a large set of overlapping consumer base.

“In fact, barring scale differences, even their cost structure is broadly similar. Therefore, meaningful share shifts between the food-techs is unlikely even after factoring in Swiggy growing a tad below the market on account of a few historical imbalances such as lower membership subscriptions, lesser presence in lower tier towns and cities, and inferior depth of supply," says Potdukhe.

For a like-to-like basis, average monthly transacting users for Swiggy was 127 lakh for food delivery and 184 lakh for Zomato in FY24. In QC, average monthly transacting users for Swiggy was 42 lakh and 51 lakh.

First Published: Nov 25, 2024, 14:33

Subscribe Now