Freshworks 'kudumba' breaks, stock rises, growth beckons?

Girish Mathrubootham's Freshworks faces its first big painful change as a listed company as CEO Woodside pares the founder's extended family in reorg for the future

fre

What comes to your mind when you think of steps an incoming CEO will take in a company, in articulating and implementing a longer-term plan? Acquisitions and layoffs would probably be easy guesses. Dennis Woodside at Freshworks has now done both, part of a broader reorientation of the company as he attempts to make it a leaner software outfit.

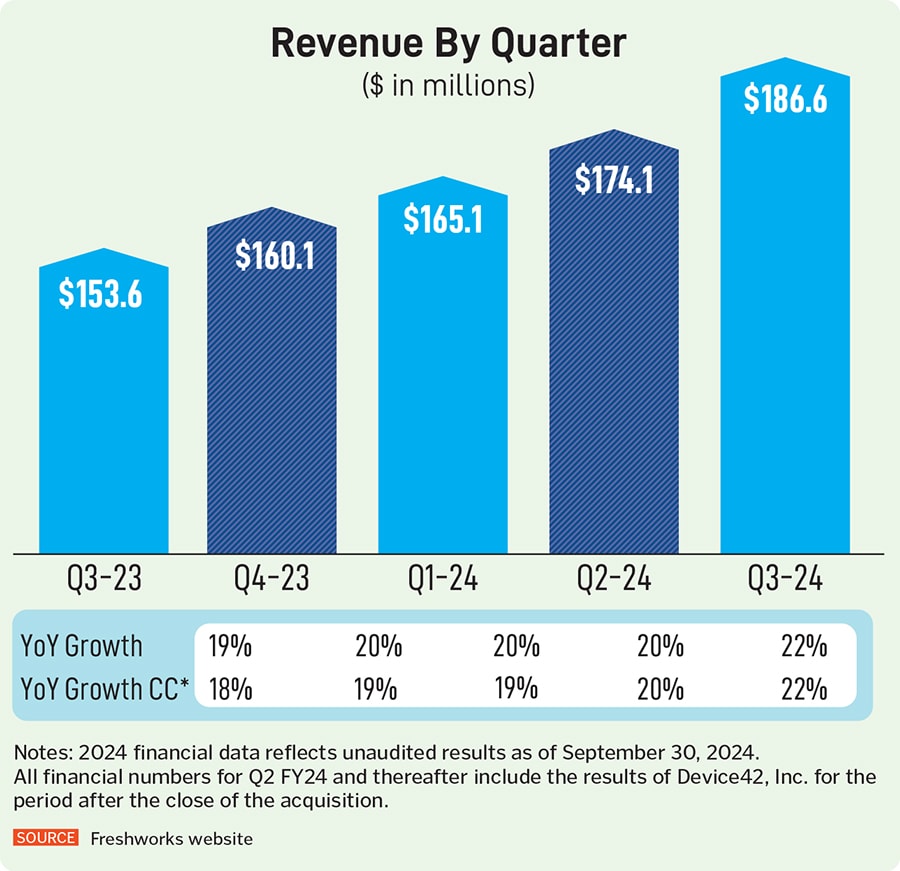

This is driven both by current market conditions and what Woodside sees as strategic opportunities in taking Freshworks to its next big target of a billion dollars in revenue. Profitably.

The new Freshworks is distinctly one run by a professional CEO. Founder Girish Mathrubootham’s beloved Freshworks ‘kudumba’ (family, or extended family and community in his native tongue Tamil) has given way to the harsh realities of capitalism. Especially, US-style capitalism, where even solid beats of expectations delivered by the biggest tech companies like Microsoft and Nvidia aren’t enough.

The acquisition of Device42, Freshworks’s first major purchase since its listing, was reported to the US Securities and Exchange Commission (SEC) on April 30. The company announced its completion in June – on Woodside’s watch as the new CEO. The deal was valued at $230 million, according to the company’s filing with the SEC.

That is roughly 21-times the $11 million in revenue from Device42 that CFO Tyler Sloat expects in 2024, based on his comments to analysts.

Key staff at Device42 will also get up to $20 million in retention fees in the form of restricted stock units. The acquisition brought Freshworks its first significant US-based engineering and developer team, as Woodside told Forbes India in an interview in June. More importantly, it brought Freshworks some useful capabilities in helping customers manage devices that were within their firewalls and not easily tapped by cloud tools.

The layoffs came next. Freshworks was laying off 13 percent of its workforce, impacting some 660 people, the company announced on November 3. Most of the software company’s 5,700-or-so staff are based in India, primarily in Chennai, but also in Bengaluru and Hyderabad.

The CEO’s letter to teammates, explaining why, was also posted on the company’s website. In it, Woodside hoped the “difficult decision" would pave the way for realigning the company along three areas – employee experience (EX), AI and customer experience (CX).

The decision, despite better-than-expected results for the September quarter, reflects the market conditions the Nasdaq-listed company continues to face. Even larger rivals and other cloud software companies – especially those dependent on single products as their main source of revenue – have taken a beating as their customers cut down on tech spending after the initial post-Covid surge.

CNBC pointed out in a September 5 report that several companies have all gone private, including Anaplan, Avalara, Coupa, Everbridge, Qualtrics, Sumo Logic and Zendesk. That report was about Salesforce acquiring Own Company, another startup that had seen its value erode due to the tech pull back.

At Freshworks, Woodside has said that EX, which includes IT service management, IT assets management and the broader enterprise service management solutions for teams like finance and HR etc., is Freshworks’s most promising and fastest growing one. At the end of Q3, EX had an annual recurring revenue rate of $390 million and some 17,800 customers.

“In EX, we are moving upmarket and winning more mid-market and enterprise deals," Woodside told analysts and investors on November 6, discussing the Q3 results. “We won 16 new and expansion deals over $100,000 in ARR in EX, including several against our largest competitor."

Customers in this segment include some well-known universities such as University of Pennsylvania professional sports teams, including Premier League football clubs, Major League Baseball teams, NFL franchises, and Formula 1 racing teams and in retail, customers such as Carrefour Belgium.

“We are prioritising more R&D investment for EX … in Q3, we shifted over 200 technical resources from other areas to our EX product and engineering teams," Woodside said in the earnings conference.

The customer experience (CX) product – the one that Mathrubootham started the company with – had an ARR of $360 million at the end of Q3. It faces greater exposure to the SMB customer segment, and competition from both larger rivals as well as new startups looking to reinvent the space. At about 40 percent year-on—year growth in Q3, the EX business grew more than four times as fast as CX.

And while its AI solutions have seen good early traction, they are new and the company doesn’t yet break out standalone revenue contribution from this segment.

Freshworks’s fiscal Q3 revenue beat, the layoff announcement, and board approval for a $400 million share buyback plan sent its shares surging 35 percent from its November 5 close of $12.44, the day before the earnings results announcement, to $16.82 at the end of November 7, the day after. Donald Trump’s historic win, in between, to become America’s president-elect also lifted US stocks and indices overall.

That jump on November 7 was Freshworks’s biggest gain since the stock fell 20 percent to end at $14.67 on May 2 after the announcement that Mathrubootham was stepping back, the day before. As of the close on November 22, Freshworks stock was $16.54. It remains well below the $23.6 high it saw in January or even the $18 dollar levels in the couple months before May.

On May 1, in response to a Wall Street analyst’s query on the transition, Mathrubootham described the move as “playing to our strengths". Freshworks stories have often carried references to his passion for product engineering and obsession with details.

Woodside is a seasoned operator—industry jargon for senior executives running large businesses – who’s run multi-billion-dollar businesses in the past including at Google and Dropbox.

At the time of the appointment too, Mathrubootham was clear about the division of labour. Woodside’s experience will help Freshworks become a much bigger company, while it would “allow me to focus on our company vision, culture and product innovation," he’d said.

Woodside, in his June interview with Forbes India, credited the founder for the big ramp up in Freshworks’s Freddy AI tools and solutions over the previous two years.

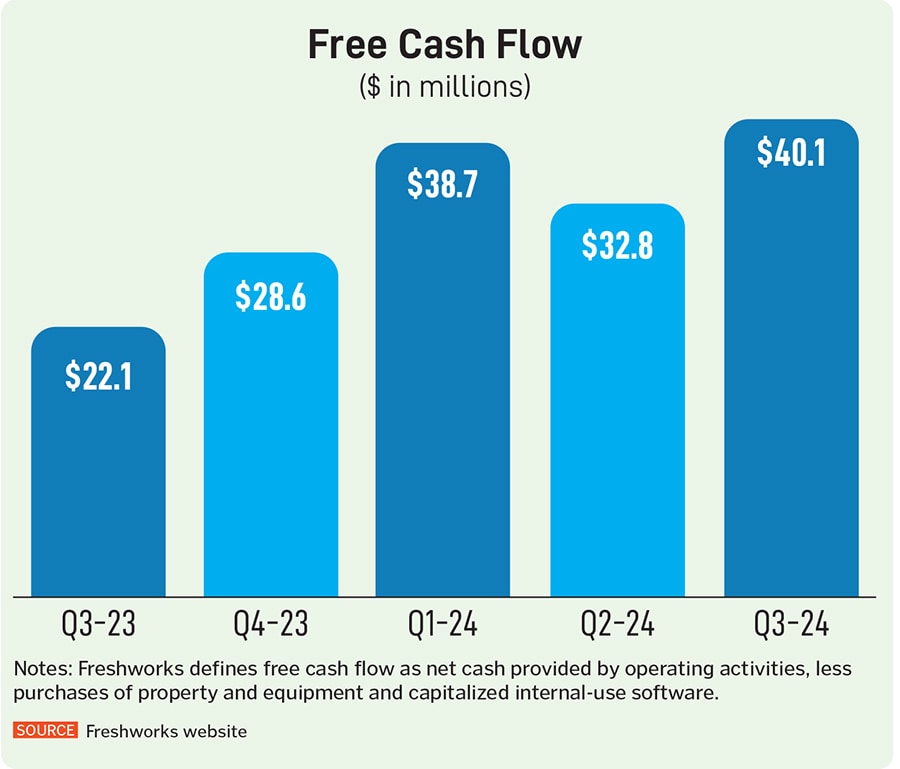

Woodside joined Freshworks when it was at half a billion dollars in annual revenues ($498 million, FY22). The next immediate goal was $1 billion in revenues and a clear line of sight to net profits. The company has grown roughly at 20 percent each year since. It is generating more cash each quarter (see table), on a non-GAAP basis, but it’s not net profitable yet.

Overall, “we"re large enough to deliver amazing products and have amazing customers, but we"re small enough to be nimble. It’s an exciting time to be at Freshworks," the CEO had said. Larger than was sustainable, perhaps, at least by employee count, as the layoffs now show.

For Mathrubootham, his ‘kudumba,’ the extended Freshworks family he took pride in, and wrote about in his IPO prospectus, has come asunder now. Freshworks expects to spend between $11 million and $13 million in implementing the layoff through December. The money will mostly go towards severance payments, employee benefits and other related costs, according to the company’s SEC filing.

Would Mathrubootham, who is still executive chairman of the board, have done this if he’d been CEO? Was the layoff necessary? It has come under criticism from some industry stalwarts, including Sridhar Vembu, founder of larger rival Zoho, whose brother Kumar was once Mathrubootham’s mentor.

Freddy AI can’t tell us if this was the right move, but we’ll know in the next few quarters.

First Published: Nov 25, 2024, 16:10

Subscribe Now