Freshworks' top lineup takes shape amid hope that NRR will bottom out

CFO Tyler Sloat hopes recent "company best" performance on lowering churn, new initiatives taking root and enterprise push all augur well for the future

Even when Freshworks was a much smaller startup, with Girish Mathrubootham just beginning his foray into the US market, one thing reporters always got to hear was about his ability to surround himself with exceptional colleagues and soak up everything he could learn from them.

Mathrubootham, in the past, has described such people as those who’ve “been there done that," whether it’s someone who’s helped take a software company in the US to its IPO or a senior executive who’s seen what a global technology business looks like with $20 billion in revenue.

The appointment of Mika Yamamoto as the company’s new chief customer and marketing officer looks like another win for Mathrubootham in that tradition. It also comes at a time when the company is decidedly shifting towards enterprise customers from its traditional customer base of SMB buyers, seeking stability and then expansion towards the stated aim of $1 billion 2026 revenues.

Yamamoto, and the recent appointment of Johanna Jackman as chief people officer, seem to more or less complete the top leadership lineup for Mathrubootham, for Freshworks’ next phase of growth, alongside president Dennis Woodside, chief product officer Prakash Ramamurthy, and CFO Tyler R Sloat.

Jackman led people teams at Pure Storage, LinkedIn, Microsoft and most recently served as chief people officer at Airtable “during a hyper growth phase", according to a Freshworks press release from August 28.

Jackman and Yamamoto replace respectively Suman Gopalan, who quit as CHRO, and Stacey Epstein, who left as CMO, independently of each other earlier this year.

Yamamoto, who will be responsible for leading the company’s global marketing and customer experience teams, comes to Freshworks from F5, also a Nasdaq-listed company, specialising in application security and cloud management software. Her 30-year career includes Microsoft, Amazon, SAP and Adobe.

At F5, she most recently served as executive VP and chief marketing and customer engagement officer, according to Freshworks’ press release. She led the company’s data, marketing, digital transformation and customer experience efforts for products, segments, channels and geographies.

Yamamoto joined the executive team at Freshworks on November. 20 and reports to Mathrubootham, founder and CEO, and president Dennis Woodside.

“Mika’s combined CMO and CXO roles have given her a unique perspective that has ultimately led to innovative, measurable changes for employees, customers and prospects," Woodside said in the press release. “She has a longstanding track record of leading global and diverse customer experience teams and delivering exceptional go-to-market results at large public technology companies with multi-domain businesses serving customers big and small."

The name Yamamoto in Japanese means one who lives in the mountains or one who dwells at the foot of a mountain. That’s perhaps a good place to start, as Freshworks looks to double its revenue in the next few years and then go beyond that.

Woodside, for example, who once ran a $17.5 billion Americas sales operations at Google, has said that Freshworks has the chance—with large market opportunities in areas like IT services management—to become a multi-billion-dollar revenue company. Getting there, of course, is nothing short of climbing a mountain, or several mountains.

Freshworks expects to end 2023 with revenues in the range of $593 million to $595.5 million, representing a growth of 19 percent to 20 percent, the company said on October 31 in its Q3 earnings press release.

The current global economic slowdown, however, has been a dampener on tech growth. “Our net dollar retention rate was 106 percent, which was a decrease from 107 percent as of September 30, 2022, primarily due to lower expansion within existing customers driven by macroeconomic pressures," Freshworks said in its SEC filings for Q3 earnings for the three months ended September 30, 2023.

This retention rate (NDRR or NRR) is an important metric tracked by the software-as-a-service (SaaS) industry. In general, the higher the number above 100 percent, the stronger the growth of the company.

And the slower rate is also an indication that a SaaS company, which largely relies on subscriptions to its software from customers hasn’t been able to expand the number of seats within existing customers that it can bill.

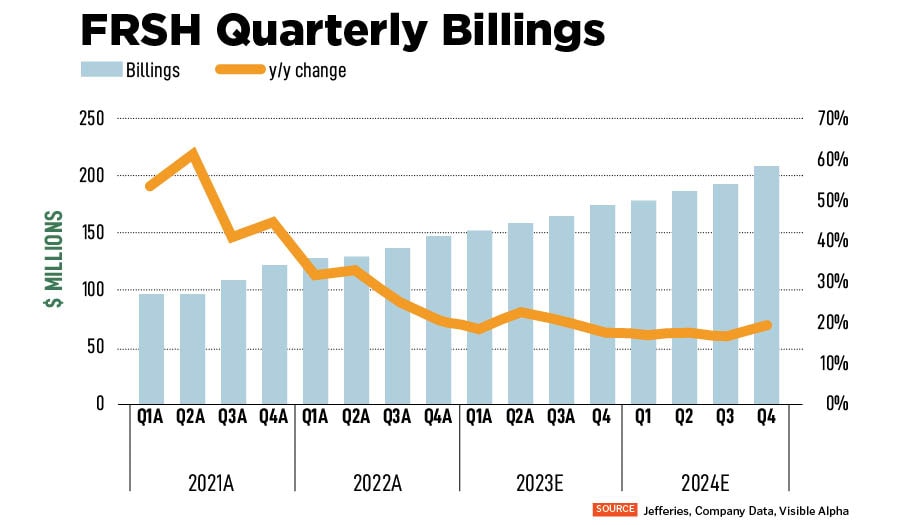

The third quarter numbers came in ahead of street expectations, analysts at the brokerage Jefferies in the US, said in a note on November 1. They wrote they were encouraged by Freshworks’ higher profitability (operating cash flow of $23.9 million, versus street expectation of $20.4 million), billings outperformance and continued multi-product adoption.

On the other hand, they pointed out that the beat on street estimates was narrower than during the previous quarter, and the fiscal Q3 of 2023 was the sixth straight quarter of revenue deceleration. And the large exposure to small and medium businesses, which are historically more vulnerable in tough times, was also a concern, the Jefferies analysts wrote, who have a “Hold" rating on the stock.

The Q3 numbers played out as expected and there weren’t any surprises, Freshworks CFO Sloat told analysts at a conference organised by UBS on November 28. On the net retention rate, Sloat pointed out that the company had forecast six months ago that it will likely go further down to 105 percent, but it hasn’t so far.

“Based on what we see today, we do think 105 percent is going to be kind of the bottom," he said at the conference. “I don"t think it"s going to immediately rebound. I think it might remain stable there. And then, we"re figuring out how to grow."

The company wasn’t facing any incremental pressure, in particular outside the SMB segment, which is about 40 percent of Freshworks’ business, he said. Freshworks defines an SMB customer as a business with 250 employees or less.

As things stand today, the company’s IT services management product Freshservice is doing “really, really well", Sloat said.

However, Freshdesk, the company’s customer service product, remains its biggest business and that’s “definitely the one that"s been impacted the most", and it has been under pressure for some 18 months now because of the macroeconomy, he said.

Currently, the focus is on cross-selling of new products, with 25 percent of the company’s customer base now using more than one product. And on selling them new products such as a customer service suite the company introduced earlier this year.

Mathrubootham has also announced a slew AI (artificial intelligence)-based assistants across the company’s product portfolio and he expects this all to be monetised at higher rates starting next year.

Sloat added that Q3 2023 was the best quarter in terms of reducing customer churn in the company’s history since listing, reducing it “from the low-20s when we went public down to mid-teens now" in percent terms.

This is evidence that customers see value in Freshworks’ products, he said, adding that newer initiatives are beginning to take root. “We"re optimistic that we have a chance to actually accelerate growth once these things start playing out… I do think we"ve weathered the storm."

First Published: Nov 30, 2023, 15:43

Subscribe Now