Schierencbeck, global CEO of Switzerland-headquartered Hitachi Energy who was in Delhi earlier this year, says this in the context of the new Rs 2,000 crore (around $250 million) investment the company is making in India over the next five years.

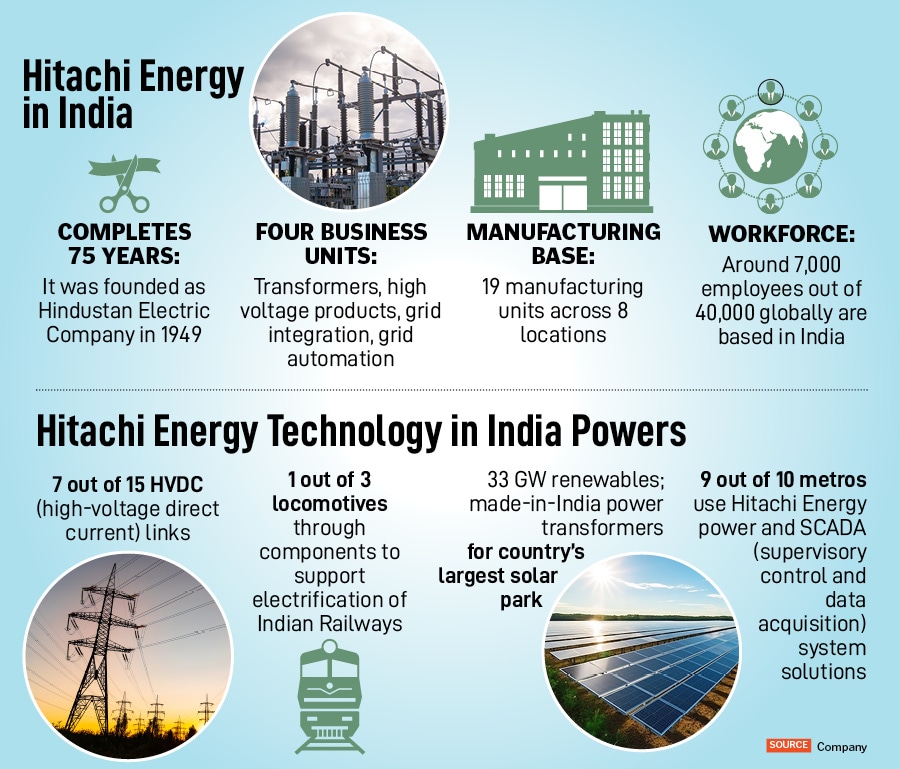

The company, which operates in the power sector and is in the business of making transformers, high-voltage products, and providing solutions for grid integration and automation, has been investing in India steadily over the past few years, adds N Venu, MD and CEO, India and South Asia, Hitachi Energy. He tells Forbes India that the new investment will mainly go towards expanding their manufacturing capabilities. This investment is going to be part of the larger $6 billion investment the company is making towards manufacturing, engineering, digital, R&D, and partnerships across major markets globally.

The company, which is celebrating its 75th year in India, has 19 manufacturing units across eight locations, employing close to 7,000 people. They are looking to add 30 percent more to the workforce, Venu says, as part of which they are collaborating with academic institutions to drive skilling programmes, and providing internships.

The key focus areas for Hitachi Energy in India include building power transmission systems, especially high-voltage direct current (HVDC) technology for which it is one of the leading suppliers in India, charging solutions for electric mobility, and grid transmission solutions for renewable energy projects, particularly upcoming offshore wind energy projects.

“As the energy transition gathers pace with increased electrification and integration of renewables, power grids are becoming significant, both from a capacity and complexity perspective," says Schierencbeck, adding that India is an important market for the company towards making the world’s energy system more sustainable, flexible and secure.

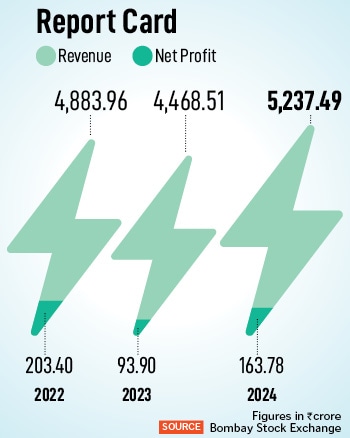

![]() In its September-ended quarter results that it announced on October 29, Hitachi Energy reported a 111 percent increase in net-profits to Rs 52 crore, led by higher revenues. According to a company statement, the revenue for July-September 2024 was Rs 1,553.8 crore, which was 26.5 percent higher than Rs 1,229.2 crore a year ago. The orders totalled Rs 1,952 crore, up 11.7 percent year-on-year, from Rs 1,747 crore the previous year.

In its September-ended quarter results that it announced on October 29, Hitachi Energy reported a 111 percent increase in net-profits to Rs 52 crore, led by higher revenues. According to a company statement, the revenue for July-September 2024 was Rs 1,553.8 crore, which was 26.5 percent higher than Rs 1,229.2 crore a year ago. The orders totalled Rs 1,952 crore, up 11.7 percent year-on-year, from Rs 1,747 crore the previous year.

The new Rs 2,000 crore investment, Venu tells Forbes India, will go towards expanding capabilities of the large power transformer factory, and upgrading testing capabilities for specialty transformers at the small power transformers, and relocation of the bushings factory. These are largely geared towards transmission projects in India in the wake of the increasing energy demand. “Eighty percent of our portfolio is being produced in India, and 75 percent of that, we use in the local market. There is huge market potential and we want to be successful in the Indian market," he says.

Such a Long Journey

Hindustan Power Grids was incorporated in 1949, which, through acquisitions and joint ventures over the years, went from being Hindustan Brown Boveri, ABB Power Grids, and Hitachi ABB Power Grids. Hitachi Energy was formed as a standalone entity in 2019, and, a year later, was listed in the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

The company set up its first manufacturing facility, a circuit breaker factory, in Maneja, Vadodara, in 1965. It was in 1989 that the company commissioned the first back-to-back HVDC (high voltage direct link) transmission link for the National Thermal Power Corporation (NTPC) at Vindhyachal in Uttar Pradesh, connecting northern and western grids.

![]()

Its India operations centre, the second-largest base of HVDC engineers, was set up in Chennai in 2002, after which the company installed end-to-end power solutions for Delhi Metro, and SCADA (supervisory control and data acquisition) to monitor and control the power network. The company has been working with the Indian Railways since 2018, providing them with equipment for their electrification projects. Today, according to data shared by the company, one out of three locomotives in India are powered through components provided by Hitachi Energy. Around 720 km of railway line covering 18 cities run on their technologies, with another 1,058 km of rail network in 27 cities being an additional area of play for the company.

Schierenbeck also sees “massive growth of data centres in Asia, along with North America and the Middle East". From a revenue standpoint, Asia is in third place for the company, after Americas and Europe.

“I expect a lot of growth in Asia compared to other areas based on a few assumptions. With India moving to renewables, building up the grid…from an engineering point of view, it is spectacular to see how India has developed and stabilised the grid, which was an issue 10-15 years ago," he says, adding that India is also developing “highways of energy", both AC and DC, to connect to renewable capacities.

From Project to Programme

The power sector in India has mostly been regulated, but privatisation and competitive bidding mechanisms were encouraged and streamlined through the Electricity Act, 2003, and the Tariff Policy, 2006. “Private participation started in the transmission sector post 2006, and we saw several companies like Adani, Hitachi Energy, Sterlite trying to get into the segment," says Rashika Gupta, senior director, gas, power and climate solutions, S&P Global.

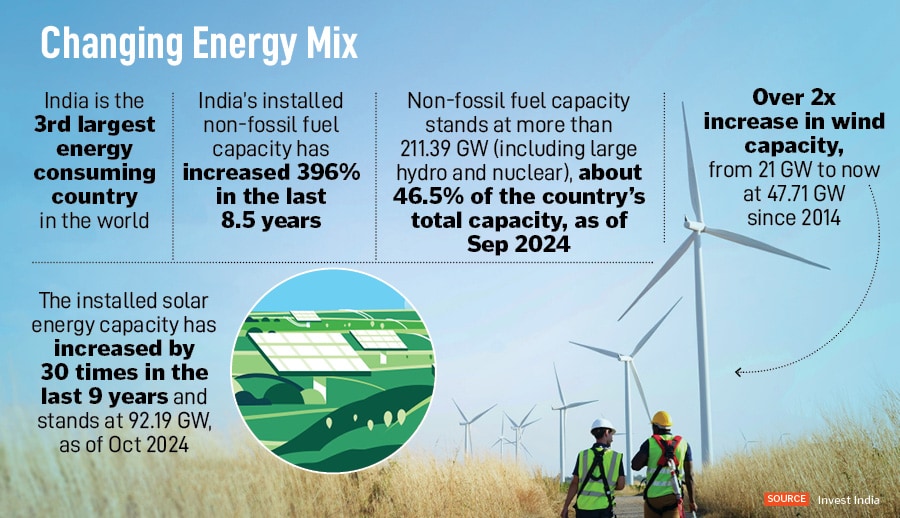

Coal remains dominant in the energy mix because of the increasing energy needs of the growing economy, and also energy security and competitiveness. As per data from the Ministry of Power, fossil fuels account for 54 percent of total installed generation capacity in India as of September 2024, followed by 46 percent of non-fossil fuel capacity, including solar, wind and hydro.

![]()

The cost of renewables has come down since 2017, which has contributed to its competitiveness, says Gupta. “Coal additions to the energy mix, which were around 20GW per year between 2012 and 2017, are less than 5GW per year now. Renewables addition, which was 3-4 GW previously, is now more than 10GW. This year, we might even touch 20GW of renewables addition."

India has a target of reaching 500 GW of non-fossil fuel capacity by 2030. Anujesh Dwivedi, partner, Deloitte India, who leads the power and utilities, had told Forbes India previously that the country is facing concerns around peak demand as it navigates energy transition. “Hence, you can see investments in transmission systems for green energy corridors in India, which will integrate renewable energy into the country’s power grid," Dwivedi said, adding the electric grid is attracting investments in trillions of dollars world over, in the US, Europe, UK and Canada. “I don’t think the 500 GW goal will be possible without massive commensurate investments in the grid, so we should expect more investments in the grid going forward."

Gupta says the grid has to adapt and change as per the intermittency of renewables, which means the planning philosophy also needs an overhaul. As of today, India has around 210 GW of non-fossil fuel capacity today, including hydro, which we have to expand to 500GW, Gupta explains, adding that this would require a lot of effort and coordination between central and state governments, and other stakeholders.

Schierenbeck and Venu, through the course of our conversation, agree the changing nature of the energy mix in India will require more long-term planning. “India, compared to Europe and North America, still has a tender-by-tender, project-by-project approach. We have been working with both regulators and customers. If we need to reach 500GW target by 2030, we need two-three times more capacity every year, so we cannot keep doing what we’ve been doing so far. We need to plan, design and execute and compress the whole cycle," says Venu.

For example, he says, the customer will place an order for five transformers, for which the company will go through the tendering process. After three months, the customer will need another five transformers, for which there is tendering process all over again. This cycle repeats itself every few months. “To avoid the repetitions, we can bundle the demands for the next two-three years, frame agreements, reserve capacities, and standardise and optimise the entire process, right from the tendering stage to the commissioning phase," Venu explains.

Schierenbeck adds that without visibility on what is coming, “I cannot go to my shareholders and ask for more investments just because I believe there will be need. I have to show them what is coming, and if I cannot see that, I do not get the investment money, even if it’s available. That’s why a lot of regions are going from project to program-based framework agreement, giving you a visibility on what is to come," he says.

Gupta says the government has been working towards removing bureaucratic hurdles to improve ease of business for companies, with more centralised agencies like the National Open Access Registry for doing single-window clearances. “But, in certain areas, there is still a historical mindset. There are regulatory and market risks for companies," she says. “For businesses, particularly foreign players coming into the market, the ease of doing business needs to be improved. This will help reduce prices further and improve competitiveness."

Venu says India has been a mature market from a technological adoption standpoint, and believes that now there is sustainable demand, where the project pipeline is visible over a longer horizon than before. The expectation now is for things to move from project to programme-based approach, which will help the company improve localisation, skilling, and investments.

In its September-ended quarter results that it announced on October 29, Hitachi Energy reported a 111 percent increase in net-profits to Rs 52 crore, led by higher revenues. According to a company statement, the revenue for July-September 2024 was Rs 1,553.8 crore, which was 26.5 percent higher than Rs 1,229.2 crore a year ago. The orders totalled Rs 1,952 crore, up 11.7 percent year-on-year, from Rs 1,747 crore the previous year.

In its September-ended quarter results that it announced on October 29, Hitachi Energy reported a 111 percent increase in net-profits to Rs 52 crore, led by higher revenues. According to a company statement, the revenue for July-September 2024 was Rs 1,553.8 crore, which was 26.5 percent higher than Rs 1,229.2 crore a year ago. The orders totalled Rs 1,952 crore, up 11.7 percent year-on-year, from Rs 1,747 crore the previous year.