The man behind the over-45-year-old company Tega Industries was beaming with joy. “It was a proud moment for me and the Tega family," recalls Madan Mohanka.

Mohanka, 81, is promoter and chairman of the company that manufactures heavy-duty engineering and mechanical product design for the mineral processing, mining and material handling industries. The Kolkata-based company, which started in 1976, took years to be in the shape and form it is today, built through strategic decisions and some acquisitions.

“It was not easy. I have seen tough days, but I have never disappointed my employees. Even when the company was going through a rough phase in the initial years, I made sure my employees’ salaries were given out on time. I never missed out," says Mohanka.

But he felt isolated there. “Having studied in a vernacular school in Jamshedpur, my English was weak. I couldn’t speak or participate in the class," Mohanka says. So, he bought a tape recorder and learnt the basics of speaking English by listening to English conversations. “I knew that would open more doors for me," he adds.

Just as the lack of conversational English didn’t daunt his spirit, his determination to explore more seeded the idea of Tega Industries. Those days, becoming an entrepreneur was not a popular option. Seeking a government job or working in a private organisation was considered ‘successful’, especially after an MBA from IIM-A. Mohanka went against the grain.

After his education, Mohanka joined his family business, but wanted to do something different and started scanning international trade journals in sectors such as mining, coal, steel and power industries. The year was 1971, and in one of the mining journals, he spotted an advertisement of Sweden-based Skega. Skega specialised in design, development, and manufacture of abrasion-resistant rubber products for the mining and cement industries.

He immediately wrote to Skega for a partnership or agency in India. It took only a few months for Skega to agree. However, Mohanka had to wait for six years to take the partnership with Skega to start operations in India.

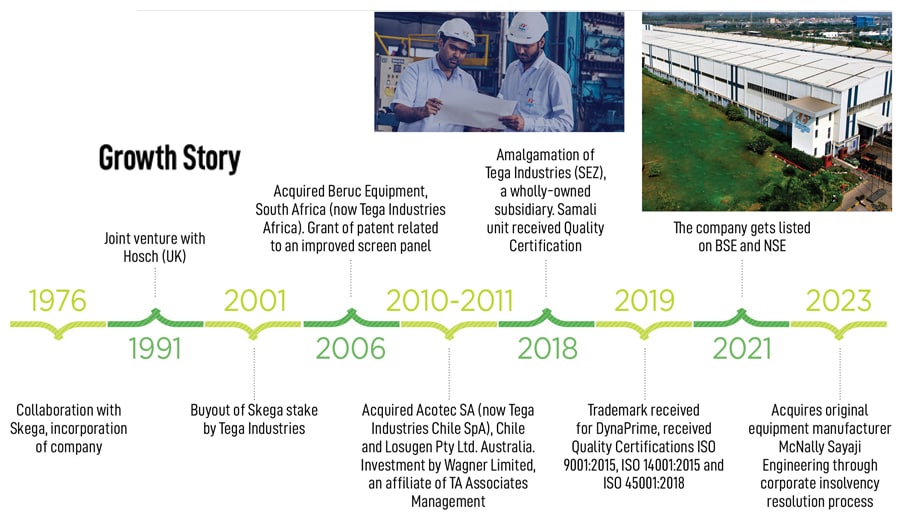

Tega Industries was incorporated on May 15, 1976, and commenced operations in 1978 in India with a foreign collaboration with Skega, Sweden. What Tega Industries essentially did was bring a unique technology to India by replacing steel with rubber in the mill lining industry. Though it took some time for customers to understand the product, the company steadily grew. Later, in 2001, Mohanka acquired the entire equity stake of Skega. In 2011, Tega Industries received funding from Wagner, an entity affiliated with TA Associates, a global private equity (PE) firm. Wagner exited from the company after selling its stake in the offer-for-sale (OFS) in the IPO.

“We operate as a multinational corporation with a vast global presence, boasting manufacturing facilities in strategic locations worldwide," says Mohanka.

![]() An early photo of Madan Mohanka (standing, second from left) along with his father Arjun LalMohanka (centre, sitting) and family in their house in Jamshedpur, Bihar, in 1962

An early photo of Madan Mohanka (standing, second from left) along with his father Arjun LalMohanka (centre, sitting) and family in their house in Jamshedpur, Bihar, in 1962

A new life

Mohanka’s younger son Mehul joined the business in 2001 as a whole-time director, later to become managing director and group CEO of Tega Industries.

“For me, it was a whirlpool of emotions," says Mehul, who holds an MBA from the University of Pittsburgh–Joseph M Katz Graduate School of Business, USA and was granted a Certificate in Advanced Management from Harvard Business School, USA.

“I wanted to work on Wall Street. It looked attractive with my newfound passion for finance. But a dinner table conversation with my father after my postgraduation in Pittsburgh changed that perspective. I took the right decision in joining Tega," says the 49-year-old.

Mehul’s contributions led to Tega’s exceptional growth with the business growing predominantly from a small Indian player to a dominant global market leader, with six plants in four countries and an employee base of over 1,600 people across 18 countries.

“He is the craftsperson behind taking Tega to a new global level. It was achieved through his dynamic leadership and passion to take the organisation to the zenith," beams the proud father.

The father-son still discuss business, with Mehul looking to his father whenever he hits a hurdle. “But we make sure those conversations are not at the dinner table as my mom does not permit them. At dinner, we talk and discuss everything except Tega," says Mehul with a smile.

Mohanka’s elder son Manish is a musician and also a promoter of Tega Industries holding 10.95 percent in the company.

![]()

Spreading its wings

Originally, Tega Industries had six manufacturing plants, three of which were in Australia, Chile and South Africa. Its plants in India are at Dahej in Gujarat and two in West Bengal (Samali and Kalyani). After the acquisition of McNally Sayaji Engineering, in March 2023, its plants expanded to an additional four new locations (Vadodara in Gujarat, Bengaluru in Karnataka, Asansol in West Bengal and Kumardubi in Jharkhand).

Their facilities in India cater to the domestic and overseas markets across mineral processing and materials handling industries, while their facilities in Chile, South Africa and Australia cater to their respective local and regional mineral processing and materials handling industries.

Tega acquired McNally Sayaji Engineering (MSEL) in National Company Law Tribunal (NCLT) at a reported amount of ₹165 crore, making its first acquisition in India and fourth worldwide.

![]() “The Tega-MSEL combination will enhance synergies related to shared technology, technical knowledge, larger product profile, after-sales service and efficient working capital management. Besides, the acquisition is likely to translate into quicker growth, improved capital access and attractive long-term value-creation for our stakeholders," says Mehul.

“The Tega-MSEL combination will enhance synergies related to shared technology, technical knowledge, larger product profile, after-sales service and efficient working capital management. Besides, the acquisition is likely to translate into quicker growth, improved capital access and attractive long-term value-creation for our stakeholders," says Mehul.

MSEL previously had a rich track record of installed equipment in India, Russia, Kenya, Mozambique, Zambia, South Africa, Indonesia, UAE, Oman and Saudi Arabia. Tega Industries intends to build existing MSEL competencies and extensive global presence to graduate it into one of the leading equipment manufacturing players the world over.

Tega’s product range includes mill liners, wear products, conveyor components, screens and trommels, and hydrocyclones for the rigorous demands of various sectors such as mining, power generation, construction, cement and steel.

The company has an extensive network spanning over 70 countries with a strong partnership with over 700 customers. It offers solutions to marquee global clients in mineral beneficiation, mining and bulk solids handling industry, through a product portfolio of specialised abrasion and wear-resistant rubber, polyurethane, steel and ceramic-based lining components. These are used by their customers across different stages of mining and mineral processing, screening, grinding and material handling, including after-market spends on wear, spare parts, grinding media and power.

“Their engineering capability, which has evolved over decades, has enabled them to consistently offer their quality, complex manufactured products within stipulated timelines, allowing them to reduce downtime and maximise operational efficiency for their customers, and forge robust relationships with their customers leading to high recurring revenues," analysts at Kotak Securities said during its IPO.

In order to expand operations globally, it acquired Beruc Equipment Proprietary in 2006. As Beruc Equipment, based in South Africa, is a manufacturer and distributor of grinding mill liners and screen media, the acquisition gave Tega access to manufacturing capabilities and customers in Africa’s mining and industrial markets. Its facilities in South Africa also gave Tega access to the member countries of the Southern African Development Community (SADC).

Continuing its expansion in 2010-11, Tega Industries acquired Chile-based Acotec which manufactures pumps, screen media and wear products. The facilities in Chile gave them access to the South American markets, including Chile, Peru and Bolivia. Latin American countries contribute 40 percent of the global copper production and 8 percent of the global gold production output.

In the same year, Tega Industries acquired Perth-based Losugen which specialised in the design, distribution, installation and wear monitoring of wear liners, rubber lining, screens for mining handling industries. The acquisition increased their market share in Australia while allowing access to a ready platform to launch their conveyor accessories and screens in that market.

Financial health

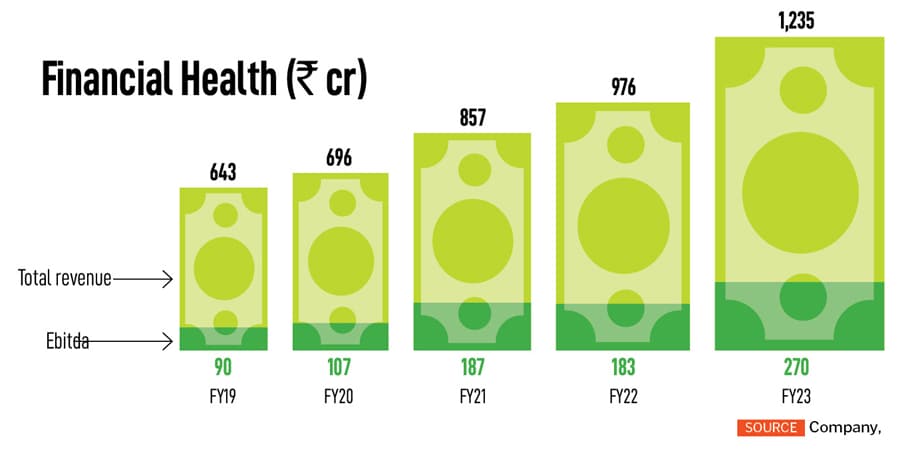

In the last five years, Tega Industries’ revenue has grown at a compound annual growth rate (CAGR) of 14 percent to ₹1,235 crore from ₹643 crore. During the same period, its Ebitda growth is at 25 percent—₹270 crore from ₹90 crore. It closed FY23 with a revenue growth of 26.5 percent (year-on-year) while Ebitda increased 40.59 percent (YoY). Net profit in FY23 was at ₹184 crore, increasing from ₹117 crore.

The company currently draws over 85 percent of its revenue from outside India.

![]()

The global mining market grew to $2,145.15 billion in 2023 from $2,022.6 billion in 2022 at a CAGR of 6.1 percent. The Russia-Ukraine war disrupted the chances of global economic recovery from the Covid-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions on multiple countries, a surge in commodity prices and supply chain disruptions, causing inflation across goods and services, and affecting many markets across the globe. The mining market is expected to grow to $2,775.5 billion in 2027 at a CAGR of 6.7 percent, says the company in its annual report.

The five key mill liner consuming regions include North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America. Faster growth in the mining industry (metal mill liner and rubber mill liner) is the major growth driver of this industry.

In the December quarter of FY24, its revenue grew 15 percent YoY to ₹340 crore, which was impacted to the tune of ₹45-50 crore in consumable business due to the disruption in the Red Sea and delay in product off-take by customers. In Q3, its net profit was at ₹35.6 crore and order book at ₹670 crore.

“The management is confident of meeting its revenue growth guidance of 15 percent in consumable business with Ebitda margins of 20 to 22 percent for FY24.

Equipment business integration is progressing as per expectations and likely to clock 15 percent CAGR over the next two to three years with margins improvement. We expect revenue and earnings CAGR of 20 percent and15 percent respectively over FY23-26," says Deepak Agarwal, analyst, JM Financial Institutional Securities.

![]() Tega Industries’ material handling chutes play a pivotal role in facilitating the efficient transportation of bulk materials within industrial facilities

Tega Industries’ material handling chutes play a pivotal role in facilitating the efficient transportation of bulk materials within industrial facilities

IPO and thereafter

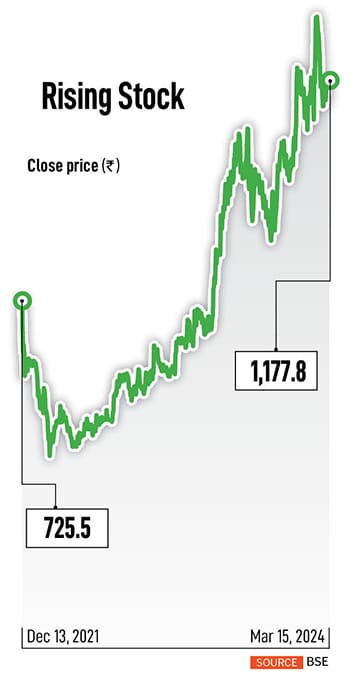

On December 13, 2021, shares of Tega Industries debuted on the stock exchanges at 66 percent premium over its issue price of ₹453. The issue had received an overwhelming response with an overall subscription at 151 times at a price band of ₹443-453 during the sale from December 1-3. HNI bids for the issue were one of the highest at 659 times. The company raised ₹619 crore via the IPO.

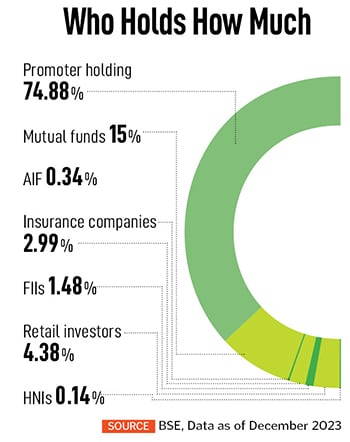

The IPO was entirely OFS of up to 13,669,478 equity shares for a complete exit to private equity investors Wagner and a few promoters cutting exposure. Post IPO, promoter shareholding was trimmed from 85.17 percent previously.

“Tega’s strong market position, innovative products and higher entry barriers are likely to help maintain its margins while consistent growth with high repeat business (74 percent) would augur well in the long run," analysts at ICICI Securities had said during the pre-IPO.

![]()

Even as Mehul oversees the daily operations, his father has gradually moved to social service activities for education and development of the underprivileged. Mohanka is a patron and chairman of an art group called Ranan, consisting of young artists, and guides and helps them in promoting traditional Kathak, choreography and dance-theatre. He is also chairman of Disha Foundation, implementing new pedagogy in schools to improve the quality of education. Under CSR activities, they run various schools.

Mohanka has also written two books. Professor Extraordinaire is a tribute to his mentor DVL Mote, co-authored by Prof Jahar Saha. The other book is his biography, I did what I had to do.

Mohanka wants to give back to society through CSR activities while envisioning a bigger canvas for the company he built in the 70s. “Tega is not a company, it is a child to me. I have nurtured it, just like my child," he says.

But for Mohanka, a first-generation entrepreneur, it was not an easy task to build an engineering company with no experience or exposure. English was one of his early challenges that he took on head-on. After an engineering degree from the Birla Institute of Technology, Ranchi, Mohanka was one of the few early MBAs from the Indian Institute of Management (IIM), Ahmedabad in 1967.

But for Mohanka, a first-generation entrepreneur, it was not an easy task to build an engineering company with no experience or exposure. English was one of his early challenges that he took on head-on. After an engineering degree from the Birla Institute of Technology, Ranchi, Mohanka was one of the few early MBAs from the Indian Institute of Management (IIM), Ahmedabad in 1967.

“The Tega-MSEL combination will enhance synergies related to shared technology, technical knowledge, larger product profile, after-sales service and efficient working capital management. Besides, the acquisition is likely to translate into quicker growth, improved capital access and attractive long-term value-creation for our stakeholders," says Mehul.

“The Tega-MSEL combination will enhance synergies related to shared technology, technical knowledge, larger product profile, after-sales service and efficient working capital management. Besides, the acquisition is likely to translate into quicker growth, improved capital access and attractive long-term value-creation for our stakeholders," says Mehul.