How Wipro is fighting to regain its mojo

Wipro, whose founder is as renowned for his philanthropy as for building a global IT business, is fighting for its spot among the top IT services companies out of India

When Wipro reported its fiscal first-quarter earnings results on July 19, it was once again the worst performer among India’s top IT services companies in recent memory. Revenue was down by almost 5 percent from the year earlier period, bookings were down nearly 12 percent and large contract wins were lower by close to 4 percent.

At the lower bound of the company’s projected range for the current quarter, revenues will continue to shrink. Top-ranked Tata Consultancy Services (TCS) grew Q1 revenues by almost 4 percent, and Infosys, India’s second-biggest IT company, reported June-quarter revenue growth of 2.5 percent. And Q1 staff churn at Wipro was higher than at its three larger Indian competitors.

Investors who purchased HCL Technologies five years ago would have seen the best returns over that period (217.7 percent as of August 2 close in Mumbai), followed by Infosys (134.5 percent) and TCS (94.3 percent), and then Wipro (90.4 percent).

At the turn of the millennium, when India’s back-office IT work first came to prominence with the Y2K work, the difference in scale wasn’t all that much between Wipro and TCS, and Infosys was the smaller of the three. Today, TCS is close to three times the size of Wipro, and Infosys is expanding its close-to-$8 billion lead over its Bengaluru rival.

At the turn of the millennium, when India’s back-office IT work first came to prominence with the Y2K work, the difference in scale wasn’t all that much between Wipro and TCS, and Infosys was the smaller of the three. Today, TCS is close to three times the size of Wipro, and Infosys is expanding its close-to-$8 billion lead over its Bengaluru rival.

Wipro, the once iconic Indian tech services company, whose founder is equally known for building a global IT outsourcing business as for his philanthropy, is fighting to get back its mojo.

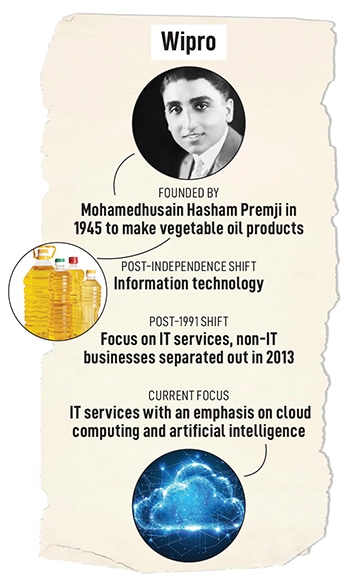

Wipro was born in December 1945 as Western India Vegetable Products and listed on the Bombay Stock Exchange in June 1947. The company’s name first changed to Wipro Products in 1977 and then to Wipro in 1982. Its current avatar, one could say, was born in 1979 when the then-managing director Azim Hasham Premji—and the founder of what Wipro is today—decided to diversify into information technology (IT).

He started an IT division the following year. Over the next 30 years, Wipro rose to become a $5 billion IT services business. Premji has always been interested in hardware as well. Wipro’s partnerships include one with Taiwan’s Acer, for computers, and another with America’s GE.

The joint venture with GE, started in 1990, is today known as Wipro GE HealthCare. Earlier this year, it announced a plan to invest an additional $1 billion in its CT scan and ultrasound manufacturing business in India.

Wipro Enterprises, which owns the privately held businesses that were separated from the IT business in 2013, includes everything from toilet soaps to light bulbs and electric kettles to office furniture to hydraulics equipment.

Through Wipro Ventures and via their family office, the Premjis (Azim Premji’s elder son Rishad Premji is now executive chairman of Wipro) have invested in a diverse set of ventures both in India and overseas—ranging from consumer products to hi-tech.

Azim Premji is also widely acknowledged as one of India’s biggest philanthropists. The first Indian billionaire to sign the Giving Pledge, by 2019 he had systematically transferred 67 percent of the economic ownership of Wipro, the listed IT services company, to the philanthropic endowment administered by Azim Premji Foundation. At that time, including that ownership, the endowment was worth $21 billion. By 2023, it was worth $29 billion.

The Wipro office buildingImage: Shutterstock

The Wipro office buildingImage: Shutterstock

Premji and Wipro have inspired generations of tech and business leaders who have gone on to lead other large organisations or start their own. Well-known names include Sridhar Mitta, Ashok Soota, Subroto Bagchi and N Krishna Kumar. Those who’ve been touched by Wipro also talk about its values that made an impact on their lives.

Anurag Behar, CEO of Azim Premji Foundation, who started his career at the company in the 90s, writes in the authorised history of the company, that the all-important reason he chose Wipro out of four job offers was that he would never be expected to bribe anyone to get a contract and so on.

Premji’s tough performance expectations have also meant a regular turnover of CEOs at Wipro—none has ever completed two full terms, which are typically for five years at a time, as industry norms go.

Srinivas (Srini) Pallia is the latest chief executive. A 30-plus-years Wipro veteran, Pallia took over from Frenchman Thierry Delaporte in April. Industry analysts said at the time that Delaporte did more right than wrong, in the way he tried to transform the company to get larger, and higher-value contracts.

Delaporte got four years. If macroeconomic factors change favourably from here on for India’s IT sector—say, the US Federal Reserve reduces interest rates soon and tech spending picks up—Pallia, and Wipro, might get longer.

First Published: Aug 30, 2024, 11:05

Subscribe Now