Is coworking built to survive the socially-distanced world?

Co-working spaces, with flexible rentals and policies adapting to the new realities of work, are finding favour with large corporations and their employees

Rishi Das and Meghna Agarwal, co-founders of IndiQube, are now allowing client companies to offer their employees a pass to work from any of its co-working spaces close

Rishi Das and Meghna Agarwal, co-founders of IndiQube, are now allowing client companies to offer their employees a pass to work from any of its co-working spaces close

to their homes

Image: Selvaprakash Lakshmanan for Forbes India

Last year, when the Covid-19 pandemic pushed companies and their employees into the new world of work-from-home (WFH), one of the biggest questions that gathered steam over the months was about the future of offices and co-working spaces. As both emptied of occupants, it was uncertain how and when they would fill up again.

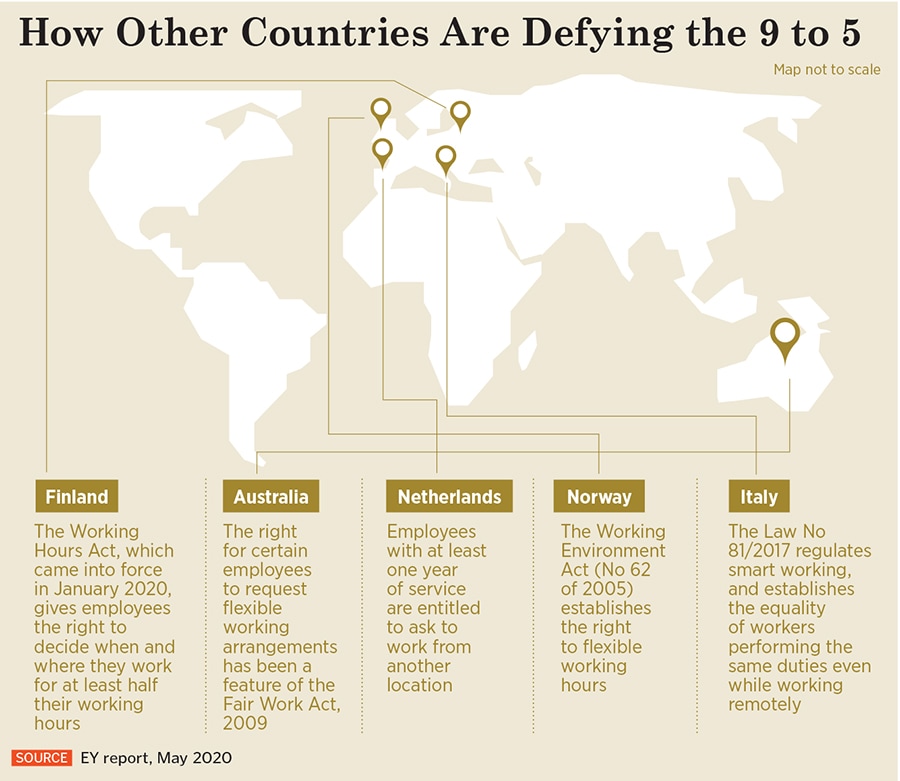

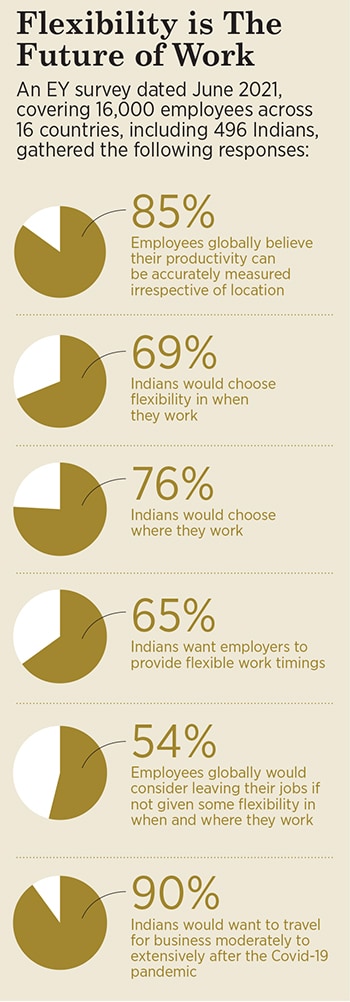

A year—and a second wave of the pandemic—later, what seems to be emerging is a model in which both companies and employees prefer flexibility. While companies prefer the flexibility of office sizes, rent tenures and costs, given the economic uncertainties and the need to reduce overhead expenditures, employees prefer flexibility of when and where to work, given their need to cut out the daily commute and work closer to home. And co-working spaces—also referred to as ‘flexible spaces’—are likely to emerge as the winner, as they adapt their business models and offerings to suit both these needs. What was once considered options for startups and freelancers, is now gaining the attention of businesses of all sizes.

“The Covid-19 pandemic has shown that flexibility can work for both employees and employers, and flexible working is the new currency for attracting and retaining top talent," says Anurag Malik, partner, people advisory services, EY India, a consultancy firm. “Employers who want to keep the best people now and in the next normal will need to put flexible working at the centre of their talent strategy, and accordingly redesign their work models to increase flexibility for their employees."

A team from Simpliwork holds a maintenance meeting at their space in Gurugram, which houses the MasterCard office. Originally offering ‘built-to-suit’ flexible spaces, Simpliwork is now keeping spaces with 100 to 300 workstations ready for companies to move in as soon as they need to

A team from Simpliwork holds a maintenance meeting at their space in Gurugram, which houses the MasterCard office. Originally offering ‘built-to-suit’ flexible spaces, Simpliwork is now keeping spaces with 100 to 300 workstations ready for companies to move in as soon as they need to

Image: Madhu Kapparath

Therefore, unlike the fate of commercial realty, which has been facing falling demand, these unprecedented circumstances are giving rise to a new style of working that is expected to boost demand for the co-working segment. “With companies becoming more conscious about capital expenditure due to an uncertain economy and no recovery in sight, flexible workspaces not only offer easy options to accommodate any type of working schedule, but also financial flexibility," says Karan Singh Sodi, managing director, Mumbai Metropolitan Region at JLL India, a real estate services firm.

According to a May 2020 study by JLL, compared to a handful of players in 2010, today there are more than 300 flexible space operators in India, with enterprises comprising nearly 50 percent of the demand in most markets. One of the biggest reasons, says Sodi, is that these spaces help businesses conserve capital, concentrate on their core business activities and save costs between 20 and 40 percent, compared to traditional office spaces in similar properties. “Pre-Covid-19, bigger companies wouldn’t sign contracts with flexible space operators for more than a year, assuming they will move out. But now, we’ve seen them signing the same deal for 18 to 24 months to secure their cash flow," he adds.

Preparing to (re)launch

Preparing to (re)launch

After surviving a rough couple of quarters last year—when they saw demand fall significantly—co-working spaces are now feeling optimistic about the future, are expanding their footprints, and tweaking their business models and offerings to attract a wider range of clients.

“Unlike last year, when the lockdown was announced suddenly, the impact of the pandemic’s second wave on our business has been moderate," says Rishi Das, co-founder of IndiQube, which has 50 properties across six cities and more than 70,000 seats, and had seen demand fall by 75 percent in the first two quarters of last year. “Last year, there was a notion that companies would embrace WFH completely, and surrender their office spaces. But now, most companies are talking about embracing a hybrid workspace model, particularly from a long-term perspective."

Currently, IndiQube’s occupancy levels stand at 80 percent (compared to 90 percent in pre-Covid times) and about 90 percent of the current occupants are enterprises. There has also been a 50 percent increase in inquiries from enterprises, compared to pre-Covid times. “Neither have we seen any significant exits from our portfolio clients, nor have we seen any major downsizing. The only change is, our prospective clients who were supposed to close deals this quarter have postponed their decisions and are closely monitoring the pace of vaccinations to finalise the deals. However, we are positive that we would be reaching our pre-pandemic occupancy levels by the end of next quarter," Das adds.

IndiQube is now allowing client companies to offer their employees a pass to work from any of its spaces close to their homes, in addition to being flexible about the number of seats required and length of tenures. Das is also hopeful that in the next two years, the company will reach a capacity of 1,20,000-plus seats from the current 70,000-plus, along with expanding into tier II and III cities.

IndiQube is now allowing client companies to offer their employees a pass to work from any of its spaces close to their homes, in addition to being flexible about the number of seats required and length of tenures. Das is also hopeful that in the next two years, the company will reach a capacity of 1,20,000-plus seats from the current 70,000-plus, along with expanding into tier II and III cities.

Simpliwork, another provider of flexible working spaces that houses companies such as semiconductor company MosChip Technologies, US-based Appstek Information Services, and Canada-based Tower Automotive, has also seen changes in demand. Before the pandemic, it was managing 850,000 sq ft of space and now manages close to 2.7 million sq ft, with large enterprises and multinational corporations forming most of its clientele. “The pandemic was a trigger," says CEO Kunal Walia. “Opportunities for flexible spaces have been fairly high since the last quarter of 2020. We witnessed significant sales closures and uptick in space take-ups."

The second wave, however, has stalled some discussions, and clients are asking for more time. “We are witnessing strong demand from IT/ITeS and financial services firms, and while decision-making is taking longer, over 70 percent of the discussions are still going forward," Walia says. “I expect delays only by a quarter or so, as companies may adopt a wait-and-watch approach. But with the vaccine rollout underway, things will change for the better."

Although Simpliwork originally offered ‘built-to-suit’ flexible spaces, it is now keeping spaces with 100 to 300 work stations ready for companies to move in as soon as they need to. “Many corporates are looking to start operations within a month, and do not want to wait for three to six months for their offices to be ready. Now, 10 to 15 percent of our portfolio will include ready-to-occupy spaces," says Walia.

[qt]Employers will need to put flexible working at the centre of talent strategy, and accordingly redesign work models."

Anurag Malik, partner, people advisory services, EY India[/qt]

At a time when WeWork Global lost $2.1 billion in the first quarter of FY21, 200,000 or a quarter of its customers, according to media reports, and exited over 100 underperforming locations, WeWork India has a different story to share. With 10,000 desks and more than 7 lakh sq ft of area rented out, CEO Karan Virwani says FY21Q1 quarter has been one of their most successful. “It shows the growing influence and acceptance of flexible workspaces in the country," he says.

The first quarter of 2021 has been one of WeWork’s most successful in India, seeing a 10 percent jump to constitute 60 percent enterprise clients

Image: Courtesy WeWork

Until March 2020, WeWork India was present in 35 locations, providing 60,000 desks across six cities. Virwani says demand from enterprises has continued to be strong, and has seen a 10 percent jump to constitute 60 percent enterprise clients in India. “We will focus on efficiently running each of our existing spaces, and attain profitability by this year," he says. “Moreover, in June 2020, we also received $100 million in a fresh round of funding from WeWork Global, reinforcing the confidence and potential that they see in the flexible workspace category in India."

Similar to IndiQube, WeWork is also offering a WeWork All Access by which members can work at any WeWork location in the country with no extra credit charge. They’ve also launched WeWork On Demand, a pass that lets an individual pay `500 for a day’s access to any of the centres. “The sales of the daily pass is seeing a month-on-month increase of 39 percent, and 50 percent of users have returned for the offering," says Virwani.

Also witnessing a revival in demand and inquiries, after the second wave of the pandemic, is Dextrus, which offers 560 seats in Mumbai. “We have not seen any significant drop in demand for our spaces. Before the second wave, our existing clients, who had resumed operations over the past two quarters, were continuing to work from our spaces, albeit with reduced strength and enhanced safety measures," says founder Robin Chhabra. “I believe there is increased acceptance that permanent WFH will not be a sustainable long-term solution, but just a stop-gap measure in the road to normalcy."

Before the second wave, Dextrus’s existing corporate clients, who had resumed operations over the past two quarters, were continuing to work from their spaces, but with reduced strength and enhanced safety measures

Image: Neha mithbawkar for Forbes India

Chhabra says established companies have always seen value in this workspace model, and now 70 percent of his clientele range from mid-sized enterprises to conglomerates. “We are very bullish on the days ahead as these [lockdowns] are temporary measures. After the first lockdown, we saw the sentiment and confidence steadily climb back up, with it beginning to return to normal around March 2021. In fact, we saw more types of companies inquire about [flexible] spaces than before the pandemic. I do think that it will be up and down till September, but we are quite confident about the second half of this year," he says. Dextrus has rolled out a pay-as-you-go option for clients, rather than asking them to commit to longer-term leases.

Here to stay?

Here to stay?

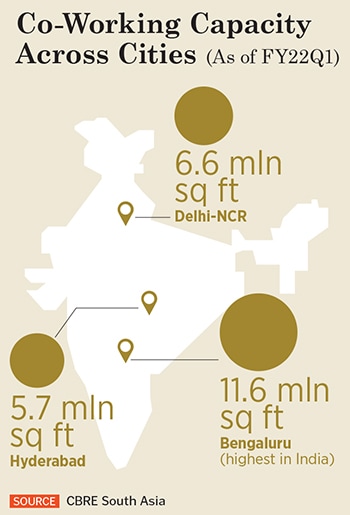

Experts say new ways of working, and a mix of work from office and home are here to stay. Further, flexible working as a concept has been evolving across the globe, and is rapidly gaining acceptance in India by both the employers and the employees. A May 2021 report by CBRE, a commercial real estate services and investment firm, says that while in 2020, 75,000 seats in flexible spaces were leased in India, the country’s flexible space stock could grow 15 percent (year-on-year), from the current 36 million sq ft, over the next three years.

“Although the situation is very fluid right now and it is difficult to predict how the market will evolve, with the gradual lifting of lockdown restrictions and vaccinations underway, we can expect businesses to display an increased inclination towards co-working and flexible spaces to meet evolving real estate requirements," says Anshuman Magazine, chairman, India and Southeast Asia, Middle East and Africa, CBRE.

With an increasing acceptance that the future of work may be a hybrid model, with companies looking at an upgraded office with better amenities, and more predictability, “the balance will tilt in favour of co-working spaces over traditional commercial offices," says Chaitanya Seth, partner, business consulting, real estate sector, EY India. “Organisations are drawing up new commercial real estate and workforce strategies, and flexible workspaces will help them achieve a balance between employee productivity, cash flows, employee mental wellbeing and safety," he adds.

“The pandemic has made us realise that the office space, albeit in a different form and shape, will continue to remain an integral part of professional life, and co-working spaces are at an inflection point to cater to the evolving needs of enterprises," says Das of IndiQube.

First Published: Jun 24, 2021, 16:55

Subscribe Now