Is the FII influence on equities waning?

Backed by strong retail inflows into mutual funds and insurance plans, DIIs have been able to counter foreign outflows

August was an eventful month for Indian financial markets. Yet another Reserve Bank credit review went by without a rate cut. Inflation numbers released soon after the RBI meet showed the Wholesale Price Index (WPI) consolidating in negative trajectory in June, while the Consumer Price Index (CPI) fell to a fresh low of 3.78%. On the Manic Monday of August 24, the Sensex plummeted over 1,600 points. This followed rising concerns of an imminent US Fed rate hike, the desperation with which China is trying to prop up growth and the lingering effects of the Eurozone crisis.

In times of such global volatility, every market participant dreams of decoupling—an illusory feeling that tells you India is an island of calm amid stormy seas an oasis of plenty, a place with a moat so big that it makes the place unshakeable. This decoupling illusion has been shattered many times since India opened its financial markets to foreign investors.

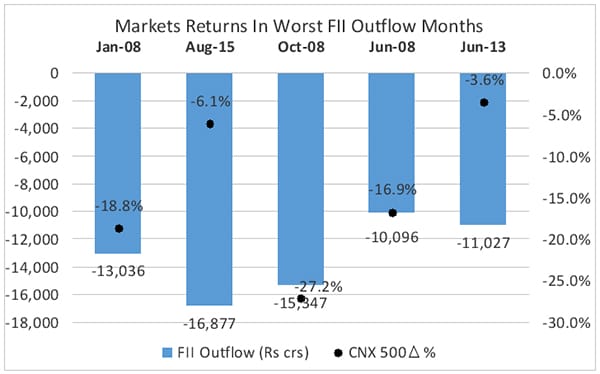

This time around though, there seems to be a semblance of domestic strength in ultra-stressed times. Indian markets have been relatively immune to the global devastation wrought on currencies, equities and bonds this time around, compared with similar stresses in the past. Not least among the encouraging indicators is the impact of FII inflows. While these flows still determine broad market direction, the impact seems to be relatively muted this time around. Data source: SEBI / NSE

Data source: SEBI / NSE

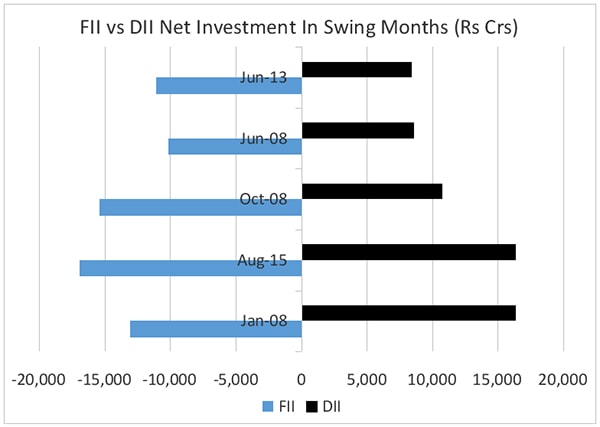

As seen, the worst sell-off months in the post-crisis period (August 2015 and June 2013) have seen less adverse reaction from markets.

August saw the heaviest FII outflows in recent times and yet, market contraction was contained at just over 6%.

The primary reason is that DIIs (Domestic Institutional Investors) have stepped up buying on the back of stronger retail inflows into mutual funds and insurance plans.

Despite the rising volatility, net inflows into equity mutual funds in June were second only to January 2008, just before the financial crisis took hold, according to data from the Association of Mutual Funds in India. August was most likely the 16th straight month of net positive inflows into equity funds, suggesting a strong retail appetite for equities.

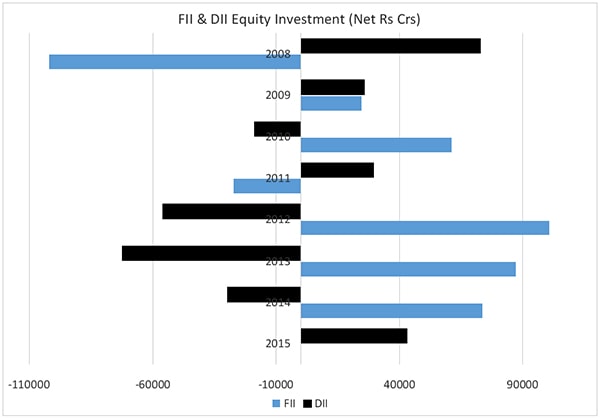

The fact is that, barring 2009, the last eight years have seen huge contrasts between FII and DII investments. FII outflows have been matched almost dollar for dollar by DIIs and vice-versa.

This shows that domestic institutional depth in India is developing to the extent of being able to provide a counter to, at times fickle FII investment flows.  Data source: SEBI

Data source: SEBI

A couple of trends have accentuated the widening and deepening of participation in equities. These trends are likely to remain in play for some time to come:

As market paradoxes go, in every equity transaction, there is a buyer and seller and both think they are the smarter of the lot. Between FIIs and DIIs, who is smarter is impossible to tell without the benefit of hindsight. However, two things are clear – a) market depth is a function of participation by both, making each an essential cog and b) the diametrically opposite strategies of the two are providing a much needed cushion for markets in these volatile times.

(The writer is an independent consultant and research analyst. Twitter: @cynical_ujval)

First Published: Sep 02, 2015, 15:20

Subscribe Now