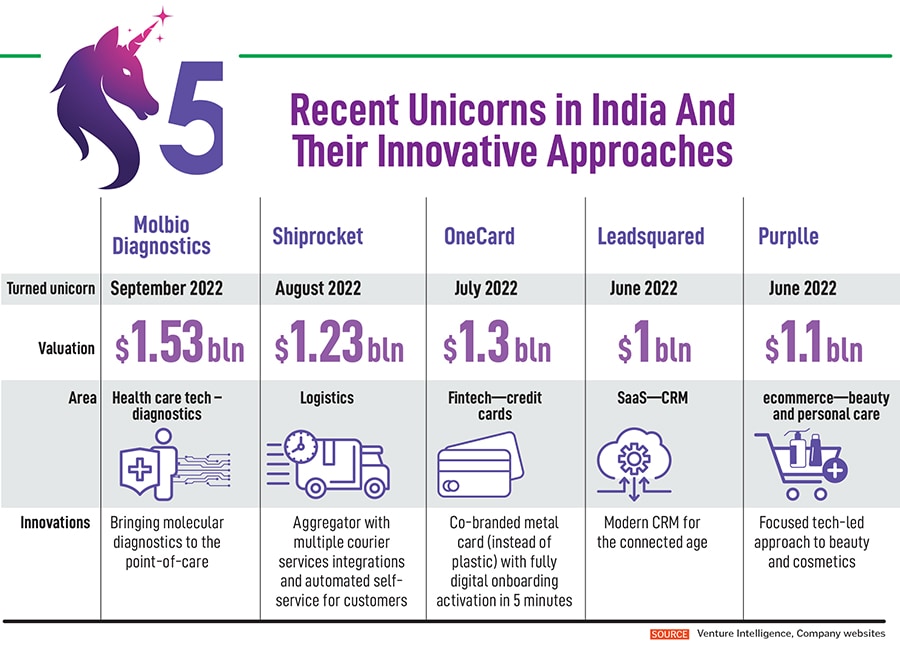

How valuable companies are driving change with innovative approach

From Moglix to Purplle, some of India's bestknown unicorns are becoming dynamos of innovation by harnessing it to what their customers need

Despite the crazy valuations that India’s startups saw in 2021, there is little doubt that many of those ventures with the unicorn badge are turning into genuinely valuable companies for their ability to solve real, large, and difficult problems in the market through their innovations.

The next question is, how do they keep that innovation engine humming as they seek the scale and positive cash flow needed to become long-term sustainable businesses.

In the words of one of the first-generation tech entrepreneurs in India, Nandan Nilekani, chairman of Infosys, who was quoting his boss NR Narayana Murthy, “happiness is a positive cash flow".

Now that the time has come for the current crop of startup founders to take that mantra to heart, their ability for real innovation—when a new product/service meets strong market demand—will be tested.

Someone who seems to be passing with flying colours is Rahul Garg, founder and CEO of Mogli Labs, whose B2B marketplace Moglix is set to double its revenue to between $600 million and $700 million this year.

“Innovation for us is how do you bring the business process and the technology together," Garg says. “A lot of our product innovation comes from how you drive change using technology. You have to make the technology easy enough for people to use, and then you have to make sure that, in the business context, they feel that they have not compromised anything," he adds. “If not, they will not change."

Therefore, the biggest innovation that Moglix has done is in business process innovation, changing how businesses buy products to make those processes more efficient and effective in a multi-stakeholder environment, from the CFO down to the worker on the factory floor who will use that product.

Garg says Moglix’s innovation is informed by the idea of “data for action." The company gathers data from its own supply chain continuously. And one of the challenges is, “there’s no data analytics guy sitting in a manufacturing plant".

When Moglix offers a transformation that delivers a 30 percent reduction in inventory, “that’s a massive free up of working capital". That’s one simple example of how innovation needs to always be harnessed to what customers need, which is the only way everyone wins.

The big opportunity is in the data. “I would say enterprises and businesses do not use even one percent of the principles that a consumer company like Google or Amazon would use today in terms of using data to advantage, and for optimisation across the entire value chain," Garg, formerly a Google senior VP himself, says.

Ben Mathias, a veteran techie-turned-VC investor, who is the managing partner for India and Southeast Asia at Vertex Ventures, echoes the idea that in India, the innovation required is around business models.

“It’s a lot about execution and technology plays a part, of course, but technology can only go so far in this country," says Mathias, who has led investments in companies such as Licious and FirstCry, which then spun out Xpressbees, all of which are unicorns today.

Consider Ace Turtle, he says, of one his portfolio investments. It is a company most people have not heard of because they’ve not raised a lot of capital, he says. Ace Turtle started out as a pure software-as-a-service company, selling a software solution to brands that were historically offline brands, but looking to tap ecommerce.

They did so well that some of the brands asked “Hey, can you take over the whole thing for us," Mathias says.

“That was a hard pivot because they went from being just purely a technology provider to also an operator." After much debate at the company’s board and with investors, they took the plunge, he says.

“That’s worked out very well for Ace Turtle," he says, which has operations in India, Singapore and Malaysia today. “They now have Wrangler, they have Lee, they’re launching Toys R Us, they are launching Babies R Us and a few other brands in the pipeline."

Now if we turn to how to foster innovation, at Razorpay, another prominent Indian unicorn, in the fintech arena, co-founder Shashank Kumar points to the company’s culture of being “engineering first" and fostering “bottoms-up innovation" as the reason for the venture’s success.

Some eight months ago, Kumar even stepped back from day-to-day management of engineering so that he could focus on the products. He brought in Murali Brahmadesam, who has previously spent years working in and leading large teams at Amazon Web Services and Microsoft.

“Now we are at a stage where we have close to a thousand engineers, with quite a few senior engineering leaders," Kumar points out. “If you look at the next five years of the company, we’ll continue scaling up and we felt like we need someone from an engineering leadership perspective who has seen tremendous scale, who has seen large ops operate and can help shape the direction of the company."

Razorpay’s ambition is to expand the innovations the company has delivered in payments to banking. The plan is to elevate the bank account from a commoditised utility to a highly personalised financial product for business executives, Kumar says.

“It will be much more software-first and tech-first… raising the banking experience to the same level as what people expect from say WhatsApp or Instagram," he says.

A second area of innovation over the next five years will be to make Razorpay the bedrock of trust in any ecommerce transaction for any business or merchant the same way that companies like Amazon and Flipkart have established trust that a purchase will result in the delivery of the product or there will be trustworthy processes for returns, refunds and so on.

At the engineering organisational level, as the company became bigger, “we have been able to maintain the focus on our people, our culture, the focus on engineering excellence as part of our DNA," Kumar says.

While the need for trust and security can slow down a financial company, Razorpay’s differentiation has come from its ability to still stay nimble—by building that culture across the organisation, from fresh recruit to CEO, he says.

“We are able to execute in a decentralised fashion, in various pods, in various groups without like a top-down focus," he says.

“We usually go with the approach that hey, these are our goals, and the product managers and the engineers can work together to figure out what they need to build to achieve those goals. I think that’s something that has scaled well for us as a company."

Brahmadesam adds: “The core value is being customer-focused, working backwards from the customer needs. The ideation becomes like you have a bullseye that you throw the dart at because the bullseye is the customer that is ready to use it, rather than throwing the dart at an empty board and then drawing a bullseye wherever the dart lands."

“How do we do this continuously while we grow bigger? That is the big challenge and I think one of the ways we can adopt is to build mission-oriented teams where a single threaded leader focuses on a single mission, and it is not over funded," Brahmadesam says.

“That way they focus on building only the right things for the customers," he says.

Razorpay has business units but also several “pods" where each one focuses on a particular mission. For example, there is a mission team that focuses exclusively on the unified payments interface. And sub-teams are added if needed.

“It’s like a collection of companies, with each one acting as a startup looking at its customer needs and innovating on behalf of that," he says. “That culture exists at Razorpay and my intent is to pour more into that."

First Published: Feb 22, 2023, 10:59

Subscribe Now