Bitter Dose & Harsh Reality: Why are online pharmacies and healthtech platforms

PharmEasy, Practo, Tata 1mg and Mfine are in heavy losses. For offline rivals, though, it's a profitable and healthy story. Can the online players find their magic pill?

Greater Noida, Uttar Pradesh. Alok Singh was unequivocal in his conviction. “I knew it won’t have any impact," says the 36-year-old entrepreneur. “But I had to do it to make the boys happy," he says, alluding to the constant pestering by his half-a-dozen young employees—he calls them boys—to hang a big, bold neon display board outside his compact chemist shop. “Paagal ho? (Are you nuts?) Who buys medicines for discounts?" he argued with his boys who were influenced by a battery of online pharmacy players that had bombarded the television, social media and online world with their commercials wooing users with discounts, cashbacks and quick delivery. “We anyway charge less than the MRP," he tried his best to instil some realism. “And we also deliver for free. Don’t we?" he continued with his futile pitch.

Nothing worked though. Three years ago, Singh yielded, and got a board perched next to the name of his shop ‘Saurishti Pharmacy.’ “12% FLAT DISCOUNT," the advertising banner screamed, with ‘flat’ and ‘discount’ printed in capital letters. Two more chemist stores at the shopping complex in Gaur City Arcade in Greater Noida West followed suit. Both upped the ante by offering “15 percent" and “20 percent" discounts on prescription medicines. Singh, however, remained composed. “Bhedd chaal hai. Kuch kaam nahin karega (It’s a herd mentality. Nothing will work)," he proclaimed.

Some three kilometres away, in another shopping mall, there are four chemist shops, one of which is Apollo Pharmacy. “All of us are in business," says Sanjay Gupta, owner of Fit&Cure medicine store, which has three stores in Greater Noida. “There are hundreds of chemist shops in Delhi-NCR," he claims. There are at least two such stores, he lets on, close to every gated residential society and housing colonies. All chemist stores, he underlines, are open seven days a week, take orders on WhatsApp as well, accept all modes of payments, deliver for free, and have tied-up with diagnostic labs for blood tests.

There are four things, Gupta reckons, that are peppered across all top cities: Kiranas, convenience outlets, liquor shops and medicine stores. Unless one has a compelling reason—like the pandemic and shutting down of offline stores—nobody shops for such items online. “Look around, you will find at least half a dozen health clinics," he says, adding that after the onset of the pandemic, all doctors made themselves available on calls and WhatsApp. “Everybody is making money," he smiles. If one is losing money by selling food, medicine and liquor, Gupta reckons, there can be only one reason. “It’s simple. You don’t know how to do business," he says. “How can one be in losses and still be in business?" he wonders.

Not surprisingly, there are businesses—and they happen to be online competitors of Gupta—that are bleeding heavily. Have a look at a bunch of online pharmacy and healthtech players that offer easy access and convenience of services like online doctor consultation, lab tests, wide assortment of medicines, quick and free delivery, and heavy discounts.

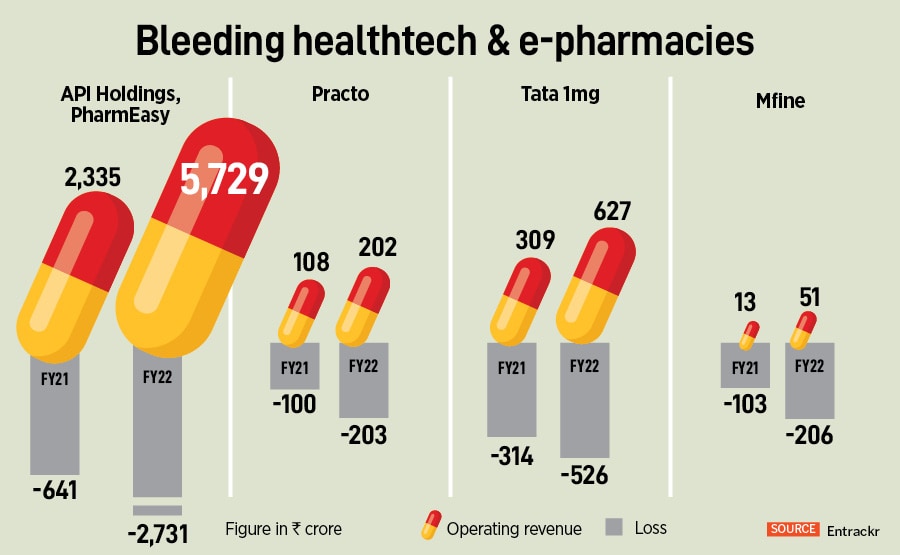

Let’s start with API Holdings, the parent company of PharmEasy. For FY22, it posted an operating revenue of Rs5,729 crore, and had a loss of Rs2,731 crore. While revenue more-than-doubled from the last fiscal, losses leapfrogged over four times. Then there is Practo. The online healthtech platform logged an operating revenue of Rs202 crore and a loss of Rs203.3 crore. Another bleeding startup is Tata 1mg. It had an operating revenue of Rs627 crore and a loss of Rs526 crore. Mfine also followed the trend: An operating revenue of Rs50.5 crore and a loss of Rs206 crore (see box).

Why are online pharmacies and the ones offering doctor consultation and other services bleeding? With the onset of the pandemic and the world moving to online, such businesses were supposed to sprint. They, however, have turned obese. With the ease of ordering medicines from mobile, and the convenience of quick and free delivery as well as hassle-free doctor consultation, it was a no-brainer for such ventures to be in the pink of health. But they are in the red. And the reasons are many. Industry analysts and experts point out the top three culprits for the disorder.

First, the online pharmacies started with a wrong diagnosis. Consumers don’t buy medicines because of discounts. It’s not a buy-one, get-one free soap, pizza or ice cream. “There was no need to give discounts," reckons Vaitheeswaran K, serial entrepreneur and best-selling author of Failing to Succeed. Discounts, he underlines, can’t be a pull as in the offline world, the chemists had always offered some discounts. “They took the wrong route," he says, adding that the online players should have focussed on convenience rather than freebies. “They should have focussed on fast delivery irrespective of order value," he adds.

With offline stores too matching or even exceeding discounts offered by online players, there came another related-but-unanticipated problem. “The online players didn’t realise that offline never had any burden of delivery costs," says Vaitheeswaran. Suddenly, epharmacies are stuck with huge discounts, delivery costs and poor loyalty.

Second, the online players tried to disrupt retail pharmacy. Sadly, there was nothing to disrupt. Ankur Bisen explains. “There was never any broken chain in medicine delivery in the top cities," reckons the senior partner and head (retail, consumer products and food), at Technopak. “So, what were they trying to disrupt and reform?" he asks. The larger question to ask, Bisen underlines, is why players like PharmEasy are in heavy losses, but the offline and traditional counterparts like MedPlus and Wellness Forever are making money.

Let’s have a look at MedPlus. India’s second-largest pharmacy retailer got listed in December 2021. Started in Hyderabad in 2006, MedPlus had a network of over 2,000 stores across Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, Odisha, West Bengal and Maharashtra in 2021, and till FY21, physical stores made up 91 percent of sales. In FY23, while the consolidated income from operations stood at Rs4,557.58 crore, it posted a profit of Rs50.11 crore.

Contrast this with PharmEasy, which bought a 66 percent stake in Thyrocare in June 2021 for a staggering Rs4,546 crore. In FY22, PharmEasy had an operating revenue of Rs5,729 crore and a loss of Rs2,731 crore. If a company is not able to make money at a scale of Rs7,000 crore, argues Bisen, then even a scale of Rs10,000 crore or Rs20,000 crore won’t make any difference. Players like MedPlus and Wellness Forever, he reasons, never tried to disrupt anything. “They knew the reality of pharma retail and tried to capture incremental market share," he adds.

Third, if the value proposition of offline and online remains the same, cashbacks, discounts and freebies can never tilt the balance in favour of online players. There are, however, proponents of the ‘long-term’ game, and play for online players. Navin Honagudi, co-founder and managing director of Elev8 Venture Partners Fund, is one of them. If one looks at health care from a macro environment perspective, the venture capitalist argues, it is gaining strong ground. The sector has been growing significantly over the past several years, and will continue to grow. There are only a few pharmacy companies that have scaled beyond a hundred million dollar revenue such as Apollo and MedPlus. Even in the diagnostics segment, there are not many like SRL, Dr Lal and Metropolis. “So, there is a large opportunity for companies like PharmEasy and 1mg," he says, adding that the ecosystem is getting mature and investors should be patient. “Over a longer period of time, epharmacy companies will definitely deliver results," he says.

Back in Greater Noida, Singh of Saurishti Pharmacy still believes that the pharma retail game can’t be played and won on discounts. Over the last 10 years, he underlines, consumers have walked into his store not for discounted medicines. “What brings them here is convenience, trust and assurance," he says. “Online or not online, I will continue to make money," he signs off.

First Published: Jun 29, 2023, 12:08

Subscribe Now