The Indian film industry lost 24 million viewers during the pandemic, according to Ormax Media. The cumulative box office for Jan-Jun 2023 releases stands at Rs 4,868 crore, which is 15 percent lower than the same period in 2022. At this rate, 2023 is expected to end at Rs 9,736 crore, which will be 8 percent lower than the annual 2022 box office of Rs 10,637 crore, as per Ormax.

On the other end, digital media grew and increased its contribution to the Media and Entertainment (M&E) sector from 16 percent in 2019 to 27 percent in 2022. Digital media’s compound annual growth rate (CAGR) is seen at 14.7 percent, whereas the film industry’s CAGR is pegged at a much lower 9.8 percent between 2022 and 2025, according to an EY report.

In India, an average cinema-goer watches films in the theatre in 1.5 languages in one year. Hindi is the most watched language, with an audience size of 58 million. However, the Hindi cinema-going universe shrunk by 21.5 percent vis-à -vis pre-pandemic, Ormax says.

The success of K.G.F: Chapter 2 and RRR resulted in the combined language share of the four South Indian languages being 50 percent in 2022, and Hindi being only 33 percent (including a sizeable contribution from dubbed versions of the two films mentioned above).

In 2023 so far, Hindi language’s share has gone up to 37 percent, while the South languages’ share has dropped from 50 percent to 44 percent, largely because of a steep drop in Kannada language’s share.

So what’s going wrong?

A few things changed during Covid. The audience was forced to adapt to the comfortable OTT format, and along the way, discover high quality Indian and international content, including films from south India.

“Post the pandemic, the outlook for the movie industry has been extremely dynamic. As a country that is home to a passionate, cinema-crazy audience, always rooting for exceptional cinematic experiences, the pandemic played a part in dimming Indian cinema’s shine at the theatres," says Ashish Saksena, COO - cinemas, BookMyShow, a major ticketing platform.

“With many films cancelled or delayed in production during this time, the industry had to face several hardships with difficulty in shooting, while also impacting the industry’s economy. This period resulted in the evolution of an audience overexposed to content at home, seeking engaging storylines and quality content. Indian cinephiles in the post-Covid era are more vigilant, watching closely the balance between content, storylines and the pricing," he adds.

With a wide range of content across genres available to consume from the comfort of home, it is taking a lot more to convince the audience to get out. “Moreover, as this trend changes, the time a film takes to release from the cinema to an OTT platform is shortening: Now, in four weeks, you can watch the same film at home, so many would rather wait," Taurani says.

Audience preferences have changed too, gravitating more towards Hollywood, international cinema and regional flicks. While accessibility to content has been a vital driver of media consumption, there is a flip side too. “It has also created dire fatigue, with the frequency and scale of content being made available to audiences, week after week, platform after platform," Saksena says. “This has heightened discernment among audiences, for what to spend their time watching."

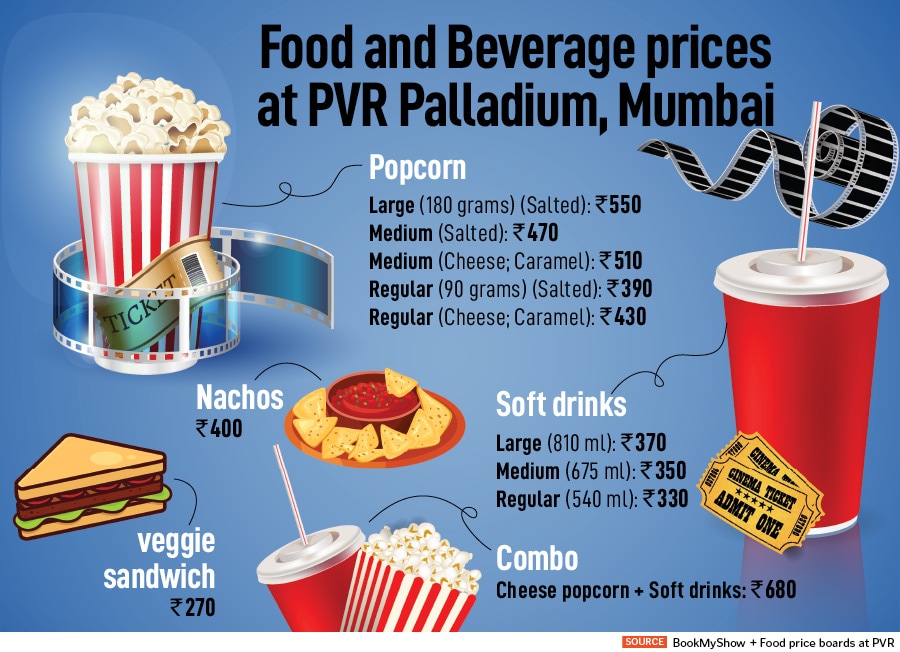

Soaring ticket, popcorn prices

Watching a movie out has become inordinately expensive: Forbes India looked at how a single cinema outing would cost more than a whole year’s OTT subscription, when you include food and beverage costs. So a movie has to offer an incredibly compelling experience to warrant that expense, of cost, time and of comfort.

![]() Graphic compiled Samidha Jain

Graphic compiled Samidha Jain

The most expensive tickets for Christopher Nolan"s latest, Oppenheimer, cost as much as Rs 2,850 for a single ticket at PVR Palladium in Mumbai. To add to that, food and beverage costs even more. For instance, a cheese popcorn and soft drink combo at PVR costs close to Rs 680 in Mumbai. In comparison, it costs Rs 1,499 for Hotstar’s premium, ad-free plan for a year, and Rs 649 a month for Netflix’s premium plan, which the whole family can enjoy.

PVR says it has noted the feedback, is experimenting with lowering its F&B prices and offering discount combos, to lure people in. A movie-goer can get a discounted popcorn combo at Rs 99 on weekdays, and on weekends, bottomless Pepsi.

“We’re going to follow trends and see what kind of traction this receives, so we get an idea of how to reduce prices," says Sanjeev Kumar Bijli, executive director, PVR INOX Limited. “The idea to reduce prices for anything is to encourage consumption, so we hope that this will cause our strike rate to go up. This means that more people actually end up going to the candy bar and buying food, versus what it was."

With soaring prices, the audience has to feel like their outing is really worth their time and money.

“We need to make cinema going more experiential," Bijli agrees. “The first differentiator is, of course, content. Barbie and Oppenheimer, the last two Hollywood blockbusters, for instance, are only available in theatres. But as a cinema exhibition company, we also have to focus on technology, sound and projection, and are therefore investing heavily in formats like IMAX and 4dX, which you can’t replicate at home. Along with that, we need to offer top-notch food and beverage, and service to match."

“We saw a staggering 116 percent increase in transactions for immersive movie experience across 3D, IMAX 2D, IMAX 3D, 4DX formats over regular cinema screens on our platform for 2022," Saksena says. “The fact remains that there are more Indian films that are being planned and are releasing in IMAX formats, than there were in the last 4-5 years across the board."

Is star power waning?

You know there’s trouble when a Salman Khan-starrer hits the cinemas on Eid, but still misses the mark. The tepid response to Kisi Ka Bhai Kisi Ki Jaan, which earned a little over Rs 100 crore domestically, and about Rs 175 crore globally, is perhaps the clearest sign: The Bollywood audience has changed, and so must the business. For context, the film was made with a production and marketing budget of Rs 132.5 crore. Many of Khan’s recent films have comfortably crossed the Rs 300-cr mark.

“Now, the Indian audience is unwilling to accept a half-baked project despite the star cast," BookMyShow’s Saxena says. “We have witnessed a variety of examples in the recent past with some films having failed to woo audiences despite having power-packed lead actors. This has been proof that unless the narrative has mass appeal and relatability, mere star presence won’t work alone."

Impactful storyline along with cutting-edge visuals take precedence over the star, and analysts say that the Hindi film industry might consider going down the franchise movie model that has worked for Hollywood. In fact, the rest of the year’s slate is looking promising, and includes many sequels to popular films. In just August, we will see the release of Gadar 2, Dream Girl 2 and OMG2. Later in the year comes Salman Khan’s Tiger 3.

As consumption habits change, the industry could do with rethinking its business models too. According to Taurani, as it currently stands, almost 70 percent of the film’s budget may be allotted to big star talent. “We need to move towards profit sharing, and a model that works for exhibitors, producers and the ecosystem as a whole," he says.

Can Karan Johar turn the tide?

While the second half of the year looks to have a solid line-up, including Shah Rukh Khan’s Jawan and Dunki, can we expect audience habits to change again? The industry hopes that the Ranveer Singh-Alia Bhatt starrer, Rocky Aur Rani Kii Prem Kahaani, will bolster confidence in the sector.

“At this point, Rocky aur Rani… is looking great. The trailer’s been well-received, the songs are well-received. Karan Johar is a great director who knows how to appeal to the masses," says Bijli of PVR INOX. “I am optimistic and hopeful that it does well, and I hope that this one does phenomenal business, because it’s got all the ingredients."

There’s been growing buzz around the film ever since it was announced, industry experts say.

“The Hindi movie industry could do well with a successful outing in Rocky aur Rani Kii Prem Kahaani to boost the confidence of all stakeholders, especially Indian cinephiles looking for good content for a movie outing experience on the big screen," Saksena says."‹

Graphic compiled Samidha Jain

Graphic compiled Samidha Jain