On March 27, when the two announced a merger deal, they created the largest multiplex chain in the country. Currently, out of the 9,500 screens across India, PVR and INOX have a network of almost 1,500 screens. Of these, PVR operates close to 871 screens at 181 properties in 73 cities, whereas INOX runs 675 screens at 160 properties in 72 cities. Carnival Cinemas and Cinepolis India follow with 450 and 417 screens, respectively.

But why now, after all these years? “The pandemic," INOX director Siddharth Jain says simply. “We were shut down for almost 12-18 months. We were interacting very closely on industry-related issues and it’s during this period of time that it dawned upon us that it really makes sense to come together." Nevertheless, the move came as a surprise. According to sources, PVR was reportedly in advanced talks with the local unit of Mexican company Cinépolis for a possible merger. When asked about this, Cinépolis said, “We are not commenting on this."

According to a report published by Media consulting firm Ormax Media, compared to a gross box office of almost Rs 11,000 crore in 2019, the cumulative revenue across 2020 and 2021 put together stood at only Rs 5,757 crore—a loss of almost Rs 15,000 crore.

The film exhibition sector saw no growth at all in the last two years and many single screens and multiplexes shut down entirely, but larger players like PVR and INOX managed to survive. “However," adds Ajay Bijli, chairman and managing director, PVR, “both of us [PVR and INOX] saw massive burn rates. There were no revenues whatsoever. This merger is not just about the survival of our companies, but also the survival of the whole sector, which can get revived."

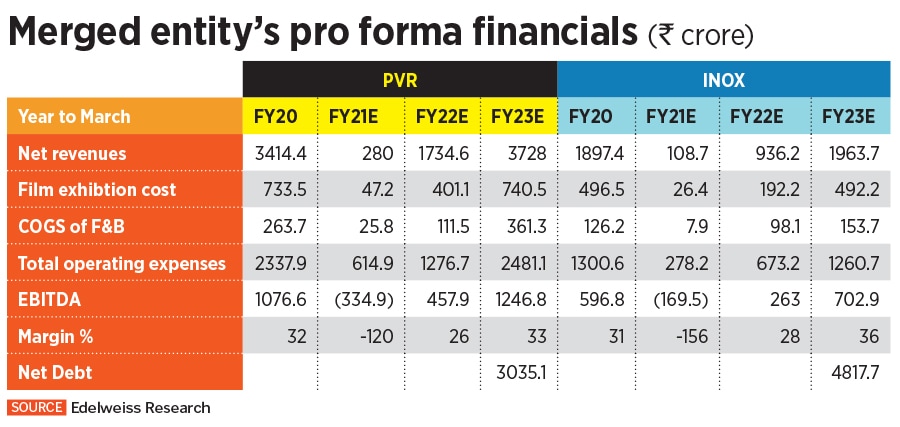

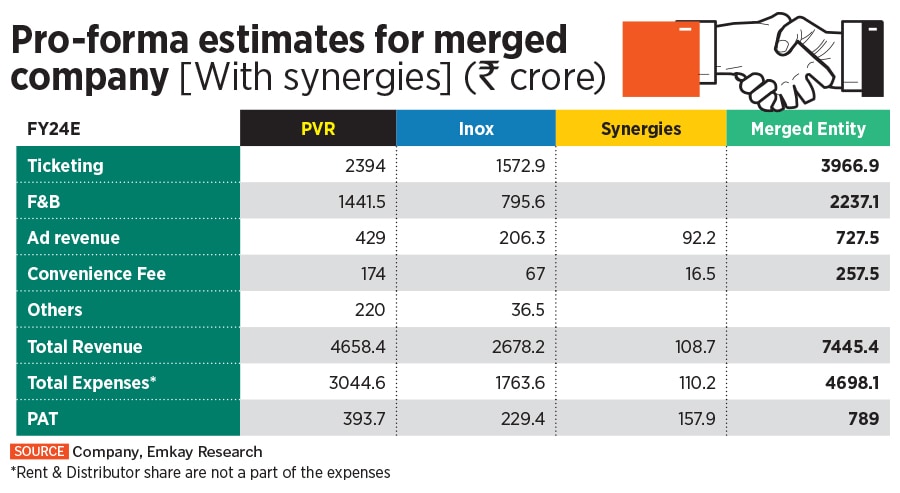

The main objective of this merger for Bijli and Jain is to create revenue synergies and grow this merged entity. According to Emkay Global, PVR INOX will have revenue synergies from advertisements and convenience fees. As a merged entity they are likely to have better negotiating power with aggregators such as BookMyShow and PayTM.

![]()

Additionally, in terms of expenses, Naval Seth, Research Deputy Head at Emkay Global Financial Services says, “PVR and INOX have been growing and fighting for premium locations, which led to higher rentals—now the same will get rationalised, F&B sourcing along with vendor consolidation and savings in corporate overheads." In total, as per Emkay Global, the estimated revenue and cost synergies would be Rs 110 crore for each, resulting in EBITDA accretion of Rs 210 crore, excluding any savings on rental and film distributor share. But given the kind of losses both have individually incurred, analysts feel it will take at least three years for the merged entity to reach pre-pandemic levels.

A monopoly in the making?

There are a lot of positives for both PVR and INOX. “This merged entity will have a significant increase in bargaining power vs content producers, mall owners, advertisers and also consumers. Pricing power in tickets, F&B and advertising rates will further increase in favour of PVR INOX," says Abneesh Roy, executive director at Edelweiss Financial Services.

But does this mean it’s a monopoly in the making? “Yes, it will create a monopolistic body within the trade, though I don’t think one can do much about it. But now, everyone will play to their strengths," says Arijit Dutta, who runs Priya Entertainment in West Bengal. PVR INOX would also potentially be open to further consolidation and more acquisitions, though that doesn’t bother Dutta. “This is not a threat for us. Our theatres are in certain places where there are no other theatres, like the single screen in my location—no INOX or PVR can ever have that in Kolkata. In Rajarhat, where I have one of my multiplexes, the closest INOX is 8-9 km away," adds Dutta who owns two multiplexes and three single screens in Kolkata.

![]() People wait to buy tickets at an INOX movie theatre in Mumbai, India, March 29, 2022.Image: Francis Mascarenhas / Reuters

People wait to buy tickets at an INOX movie theatre in Mumbai, India, March 29, 2022.Image: Francis Mascarenhas / Reuters

Another such single screen theatre owner from Guwahati Chinmoy Sharma believes that they have created a niche for themselves and are at par in providing the same experience as any of the national multiplex chains, but at reasonable rates. In fact, Sharma, the owner of Anuradha Cinemas, adds, “Sometimes large production houses give exhibitors a lot of trouble, post this merger that might reduce, since now PVR and Inox have more strength. It might be a big positive for the exhibition sector."

Other stakeholders in the industry though, such as distributors and producers, are not very happy about the merger. Harish Janiani, partner at Sunil Enterprises, who are distributors in Central India and distribute to 45 theatres in the region says, “This will not protect our interest, on the contrary, they will have an upper hand and I will be more dependent on them for showcasing my films." Emkay Global’s report highlights the same--that the merged entity might want to use its muscle power to negotiate lower revenue share with movie distributors. A lot of producers too have raised similar concerns around the merger.

![]()

Though Akshaye Rathi, a film exhibitor owning 17 screens across Madhya Pradesh, Maharashtra and Chhattisgarh, and director of Aashirwad Theatres, believes otherwise. “There is nothing for the producers to worry about. In fact when this entity merges and becomes leaner, and more operationally efficient, it will basically be able to generate better returns for producers."

On a Zoom call with Forbes India, Bijli and Jain too dismiss the fears. Bijli says, “Such fears are not warranted at all. We need a pipeline of movies to come in, since cinemas cannot run without films. And every ticket that gets sold, gets split between us and them. We have to look at the bigger picture, rather than focusing on changes in commercial terms." When it comes to negotiating power, he adds, “A movie like RRR has done more in single screens over multiplexes. So where does the negotiating power come? We will only be 1,500 screens, there are still another 8,000 screens that we don’t own."

Both PVR and INOX hope to focus more on the revenue synergies and not antagonise their relationship with anyone in the industry. “Imagine, for instance we do act funny," explains Bijli, “They have the option to sell to an OTT platform straightaway—we are only one of the channels. So we have no additional power."

Another fear in the industry is that of ticket and F&B prices rising post this merger. Ashim Sanyal, COO of Delhi-based NGO Consumer VOICE says, “Any merger and acquisition leading to monopoly or near monopoly is harmful for consumers’ right to choice. So is this. So one has to carefully observe and monitor the situation and complain to authorities if they find it detrimental to consumers either in choice, prices, processes, quality or availability."

The average ticket price in India is a lot lower than what most multiplexes would like to charge. “Going for movie should not be given a second thought, which is why we keep our ticket rates more affordable. We hope that post the merger, PVR Inox don’t increase the ticket rates further, because the overall mindset of a movie-goer shifts when planning a movie outing," says Himani Shah Manek, director, Gold Digitech Theaters that has about 60 screens pan India, including franchisees.

Bijli of PVR claims the average ticket price (ATP) in India is Rs 200 and the spend per head (SPH) for F&B is Rs 92. “But people take our prices for high-end malls like Atria and think that’s the average price. India is a very disparate market, the input cost in each location is very different. For instance, in places like Latur and Aurangabad our input costs, capex, opex is less, and thus the price is adjusted accordingly. Where the input costs are high, the tickets and F&B will be priced accordingly. We are a listed company and we still have to give a return on investment," he says. The merged entity is looking to expand further in tier III, IV & V cities and reach every nook and cranny of India, and look at a potential international expansion, too.

![]()

What next?

INOX and PVR both have always had technology and innovation at the core of their business, and post the merger this is only expected to grow. “Them collaborating and improving their innovations will just make it a great standard for the industry, which would improve the overall experience for the movie-goer because every exhibitor would want to match that," says Shah of Gold Digitech Theaters.

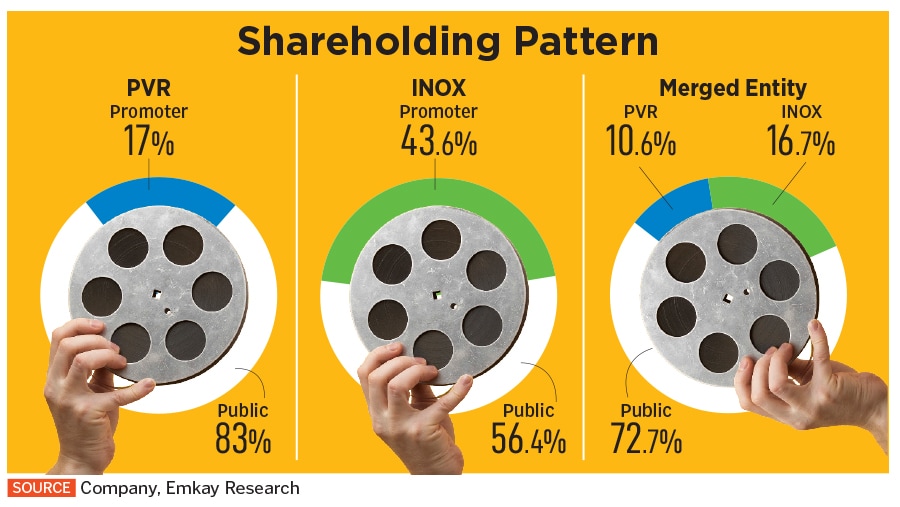

Post the merger, INOX promoters will hold a 16.7 percent in the merged company, while those of PVR will now have 10.62 percent, as opposed to the earlier 17 percent. The merger will take another nine months, according to Jain. There are approvals pending from the National Company Law Tribunal (NCLT), Securities and Exchange Board of India (SEBI), Competition Commission of India (CCI), stock exchanges and shareholders. According to Roy, there would ideally be no need for the CCI’s approval as the threshold of Rs 1,000 crore won’t be exceeded, given the damage to the sector caused by Covid-19, which closed theatres for months on end. According to the CCI, a transaction is exempt from the notification requirement if the assets in India are not more than Rs 350 crore or turnover is not more than Rs 1,000 crore. Currently, the combined revenues of the two companies are well below Rs 1,000 crore due to pandemic-led disruptions.

As per Emkay Global’s analysis, the potential challenges going forward would include another Covid-19 wave, structural increase in the revenue share to producers/distributors, lack of quality content, faster-than expected shift of eyeballs to OTT platforms and regulators rejecting the merger.

Yet, the hope with this merger, according to film exhibitor Rathi, is not just to benefit from the economies of scale, but further grow the sector. “India is a market of 1.4 billion and having only 9,500 screens is a joke. So even if we add 9,500 screens per year for the next seven years, we’ll reach where China is today, in terms of the screen density." He feels there is a lot of potential for not just PVR and INOX, but even smaller players to grow further in the Indian market. “In my opinion," he adds, “this PVR-INOX merger is the first of many to come. It might not all be M&A, but consolidation of operations is definitely on the cards."