How Bombay Shaving Company found its core in the middle of the pandemic

Starting with a single-minded focus on a shaving kit for men, the company has now transformed into a unisex brand, with a range dedicated to women's grooming

November 2016, Gurugram

The lover went over the top to proclaim his adoration. “It’s the most beautiful thing in the town," Shantanu Deshpande unabashedly bragged about his passionate obsession for his maiden product. Just three months into his first venture, the former McKinsey executive and IIM Lucknow alumnus had rolled out an exquisite six-part shaving kit, a first product from the stables of Bombay Shaving Company, a men’s grooming startup that he founded in June 2016. The product was priced at around Rs 3,500, which critics labelled as ‘costly.’

Deshpande found the adjective insulting. “It is much more than costly. It is uber-expensive, and ultra-premium," he scoffed at detractors, who wondered whether the rookie founder had created an object of art or a product for the masses. The lover, for his part, was sure about his creation, and also where it stood when contrasted with rivals. “Gillette sells you Reynold’s ball pen," he took a dig at the American razor maker. “I will give you Waterman fountain pen," he vaunted with an exaggerated swagger, alluding to his kit.

To be fair, the shaving pack indeed possessed flaunt value. The precision safety razor consisted of a weighted metal handle that helped in gravity-assisted glide action. The Japanese-engineered stainless steel blades gave a smooth shave. “The metal razor was our equity driver," recalls the man who packed the kit with articles that looked like handcrafted.

To be fair, the shaving pack indeed possessed flaunt value. The precision safety razor consisted of a weighted metal handle that helped in gravity-assisted glide action. The Japanese-engineered stainless steel blades gave a smooth shave. “The metal razor was our equity driver," recalls the man who packed the kit with articles that looked like handcrafted.

Take, for instance, pre-shaving scrub. This was meant to gently exfoliate the skin and eliminate all dead skin cells. Then there was shaving cream, which was enriched with superfoods, had zero chemicals and prevented post-shave irritation. Not to forget, the box had post-shave balm to pamper the skin. It was alcohol-free and had anti-irritant properties. “Consumers would just fall in love with this," Deshpande had said to himself.

Two years later, his ego got bruised. “Kahan jaa rahe hain? Akal nahin hai kya? (Where are the buyers going? Don’t they have brains)," Deshpande wondered about the low repeat rate of 10 percent. For the next two years, he couldn’t figure out what was going wrong.

The Bombay Shaving Company clocked on an average Rs18 lakh per month in the first year of operations. The next year, the number increased to Rs30 lakh per month. But still it was not substantial for a company which didn’t believe in selling products individually. It all came in one pack of a six-piece shaving kit, and was only available on D2C channels. “We had this weird belief that the product was good enough to be exclusive," recalls Deshpande. In FY18, the turnover was around Rs5 crore. It was clear that consumers were not falling in love.

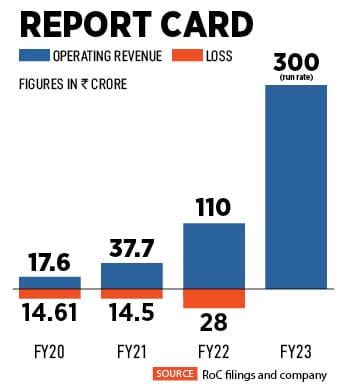

Fast forward to August 2020. The country was in the midst of a raging pandemic. The Bombay Shaving Company, which closed FY20 with an operational revenue of Rs17.6 crore and a loss of Rs14.61 crore, had made progress since the starting days of their six-part shaving kit. The brand was now selling single units of products, had entered into multiple categories such as hair oils, beard trimmers, shampoos, face washes and moisturisers, and other men’s grooming products, and the company overall had over 60 products. “We were clocking a revenue run rate of Rs2 crore a month in July 2020," recalls Deshpande.

The pandemic gloom had not spelled doom for the Bombay Shaving Company. Given the D2C and a sharp online focus of the company, the brand was better equipped than many of its traditional peers to tide over the crisis. In fact, the company was clocking a steady growth in numbers, making most of the pandemic tailwinds. The founder, though, was still discontented. There was something that had been continuously bothering Deshpande.

The company lacked another critical element: A wide appeal. The reason was simple. Bombay Shaving Company was a men’s grooming brand, and so the consumers understandably were only men. Jain hit the nail on the head. “We are a grooming company. But why we don’t have any products for women," she questioned.

The company lacked another critical element: A wide appeal. The reason was simple. Bombay Shaving Company was a men’s grooming brand, and so the consumers understandably were only men. Jain hit the nail on the head. “We are a grooming company. But why we don’t have any products for women," she questioned.

For two reasons, it was a valid point to ask. First, though the company had been growing, the uptick was nothing close to spectacular. Second, the pandemic shut down spas and parlours, and women didn’t have much option for hair removal. Though there were a bunch of products in the market, Jain said, there didn’t seem to be many made keeping women’s bodies and needs in mind. “Some were too painful, some too expensive, and most were ineffective," she rued.

Deshpande spotted a massive opportunity. A quick internal research, and consumer insight, by his team pointed out the blind spot that the founder had either not spotted or ignored.

Women’s hair removal market was at staggering Rs20,000 crore. In contrast, the corresponding market for men stood at a pony Rs6,000 crore. Around 95 percent of the women’s hair removal market was sitting at salons and parlours till March 2020. In terms of competition, there were not many women razor rivals too. Owned by Reckitt, Veet was a Rs600-crore brand and Gillette-owned Venus was around Rs150 crore.

Suddenly, the pandemic changed dynamics. Deshpande launched Bombae, a women"s hair removal and personal care brand, in the third quarter of 2020. He beefed up his men’s trimmer catalogue by having four price points at Rs699, Rs999, Rs1,299 and Rs1,999, and furiously doubled down on expanding offline presence during the pandemic. Results were encouraging. Trimmers took off, women razors sold like hot cakes, and Covid helped the entrepreneur find the core of his business. “We are into the hair removal business," Deshpande stresses. “We are neither men’s shaving nor women’s shaving. We are a hair-removing company for all."

Deshpande explains the new structure. There are two businesses that make the core of the company. The flagship one happens to be Bombay Shaving Company, which caters to men, and makes up for around 75 percent of the revenue. “Those who want to trim, we have trimmers. Those who want to shave, we have shavers," he says.

The other part of the core, he says, is Bombae, which now makes up 25 percent of the business. The gambit seems to be paying off. Revenue has jumped from Rs37.7 crore in FY21 to Rs110 crore in FY22. The strike rate for FY23 now stands at Rs300 crore.

For Sandeep Singh, managing director at Alkem and an angel investor at Bombay Shaving Company, the move from Bombay to Bombae was a bold one. “I believe in betting on the jockey and not the horse," he says, referring to his move to back Deshpande. If you bet on the right person, he underlines, then the founder will certainly figure it out. “You got to back the entrepreneur’s instincts," he says. Singh, however, is quick to add that the road ahead won’t be easy. “Growing profitably is the new challenge. You can grow, but can you grow profitably is the question to answer," he says.

Nagar too points out the potential hiccups. One of the biggest challenges for the Bombay Shaving Company and others in the segment would be to deliver high growth while keeping a tab on expenses and improving profitability. “In addition, Deshpande must keep building offline distribution network, which is always a challenge for a young company," he says. The founder, he adds, also needs to capitalise on the investment in Bombae, and deliver on its potential without the overt support of the mother brand.

Marketing and brand experts highlight yet another challenge. “India is a price-conscious market, and value for money market," says Ashita Aggarwal, marketing professor at SP Jain Institute of Management and Research. In a category like razors and shaving, the founders must realise that the product can’t have a flaunt value. “Can you brandish razors to your friends and brag about the brand," she asks. All such products are functional in nature, and will always remain so. “A product used in bathroom stays in bathroom and the house," she adds.

Deshpande, for his part, concedes his mistake. “I have realised that consumers don’t owe us anything," he says. “The product just needs to be effective." Another realisation was around price. “Even a billionaire won’t buy an uber-expensive razor. It’s a product, and needs to be sharp," adds the founder who runs a company that is the only one to get an investment from Colgate and Reckitt in India. In fact, back in 2018, Colgate’s investment in Bombay Shaving Company happened to be a turning point for the entrepreneur. The global biggie made the founder realise the value of right pricing, and having products across segments and price points.

Another interesting learning for Deshpande has been around liquidating his stake. An advice by Nikhil Vohra of Sixth Sense Ventures, a consumer brands-focused VC fund, had a profound impact on him. “I don’t want a hungry shark running the company," the VC had said. “I would much rather have a shark who has tasted blood."

The idea to dilute a part of the stake was just to ensure that the founder is not under perpetual financial stress. “Selling around three-four percent won’t change your skin in the game," was the suggestion. Deshpande, who owns around 26 percent in the company, attributes the success of the company to his team. “This is what differentiates us from others," he says. “The company is about ‘he, she and we.’ That’s the beauty," sigs off Deshpande."‹

First Published: Dec 19, 2022, 15:40

Subscribe Now