India's Goldilocks economy: Will the RBI change its policy stance?

The RBI's MPC is widely expected to keep the repo rate unchanged at 6.5 percent on the back of better-than-expected GDP numbers and 18-month low inflation

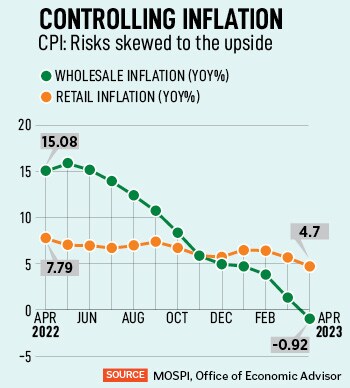

The Reserve Bank of India’s (RBI) year-long battle to rein in inflation—within its target of 4 percent with a margin of plus or minus 2 percent—has borne results for weary policymakers. In April, retail inflation cooled off to 4.7 percent from 7.8 percent in the year-ago period. To control inflation, in FY23, the benchmark interest rate was raised by 2.5 percentage points, and this exerted a toll on growth. But a GDP growth rate of 6.1 percent in the January to March period sprung an unexpected surprise as it beat market estimates and pushed growth to 7.2 percent for FY23.

On the face of it, this puts the Indian economy in a Goldilocks situation: Strong growth momentum and low-price inflation. It is during such times that the RBI’s six-member rate-setting team will meet for its bi-monthly credit policy deliberations between June 6 and 8.

Most analysts and economists believe the Monetary Policy Committee (MPC) will keep the benchmark repo rate on hold at 6.5 percent. There is a clamour for rate cuts from India Inc but the central bank is unlikely to relent. Rather, the discussions are likely to weigh on the central bank’s stated policy stance of “withdrawal of accommodation".

Santanu Sengupta, Goldman Sach’s chief India economist, believes there is considerable uncertainty around the commodity prices path and global growth and expects a status-quo on rates till December. “We expect the domestic banking system liquidity to remain flush, with the RBI’s decision to withdraw Rs2,000 notes, the recent variable rate repo auction, and our view of a flat balance of payments this year. Given this, the RBI is likely to retain the liquidity tightening stance, as signaled by the comment that the MPC will remain focussed on withdrawal of accommodation," he adds.

Deepak Agrawal, CIO-debt, Kotak Mahindra AMC, points to the prevailing ambiguity surrounding the future path of the US Federal Reserve’s decision on interest rates in the coming months and expects a dovish tone from the MPC to signal that the rate cycle has peaked. He explains, “India is in a Goldilocks situation with strong GDP data, cool-off in inflation. The forthcoming decision of the MPC transcends the usual deliberations of interest rate hikes or pauses. Instead, it hinges on whether the MPC will pivot towards a ‘neutral’ stance or persist with the current stance of ‘withdrawal of accommodation’."

Jayanth Varma, member, MPC, reiterated that the RBI must change its policy stance to send a clear signal to the street on the rate trajectory. In the April credit policy meeting, according to the minutes, he said, “Turning to the stance, I must confess that I fail to comprehend its meaning. My colleagues in the MPC assure me that the language is crystal clear to market participants and others. But I am unable to reconcile the language of the stance with the simple fact that no further “withdrawal of accommodation" remains to be done since the repo rate has already been raised to the 6.50 percent level prevailing at the beginning of the previous easing cycle in February 2019. It is of course possible to undertake further tightening, but that would not constitute a “withdrawal of accommodation" by any stretch of the imagination."

Many on Mint Street are hopeful that, in light of recent developments, the RBI would consider changing its policy stance from “withdrawal of accommodation" to “neutral" in the upcoming meet this week.

“The key thing to watch in the upcoming monetary policy would be the RBI’s policy stance. Till last year, the monetary policy was ultra-accommodative with the policy repo rate significantly below their normal levels and banking system flooded with liquidity. Now, the repo rate at 6.5 percent is very close to its long-term average. Liquidity is still in surplus, but it has come down to a level that can be taken as close to normal and as non-inflationary. So, there is a strong case for the RBI to retire the phrase ‘withdrawal of accommodation’," says Pankaj Pathak, fund manager-fixed income, Quantum AMC.

But Pathak also reasons that RBI’s decision on stance will be more dependent on manging market’s perception than inflation and liquidity outlook. “The fear is that the change in stance could be taken as a declaration of victory over inflation and could hamper the transmission of earlier tightening which is required to keep inflation under check. At this juncture, the RBI cannot be seen as getting complacent on inflation," he adds.

The latest consumer price index (CPI) inflation at an 18-month low of 4.7 percent was mainly due to a favourable base. Goldman Sachs expects the RBI to revise its inflation forecast for FY24 to 5 to 5.1 percent from 5.2 percent, but cautions that upside risks persist. “Delayed onset of monsoon and voluntary production cuts announced by OPEC members to support crude oil prices might exert upward pressure on commodity and domestic food prices," Sengupta adds.

Although the MPC does not take wholesale price index (WPI) into account for determining interest rates, again, largely on account of the high base effect, WPI inflation numbers are expected to continue to remain benign. Also, inflation of manufactured products is expected to remain low due to weakness in global commodity prices.

Monsoon in Kerala—which normally begins from June 1—missed its June 4 deadline. Now, the IMD expects it to be delayed by two to three days and warns that low-pressure conditions may impact its progress. “This will have an impact on domestic food prices and rural demand. The RBI will await more details on status of actual rainfall before taking any action," says a Bank of Baroda report.

Monsoon in Kerala—which normally begins from June 1—missed its June 4 deadline. Now, the IMD expects it to be delayed by two to three days and warns that low-pressure conditions may impact its progress. “This will have an impact on domestic food prices and rural demand. The RBI will await more details on status of actual rainfall before taking any action," says a Bank of Baroda report.

In April, international crude oil was trading at $85.1/bbl. Currently, it has climbed down by 10.6 percent to $76.1/bbl. “Worries of global growth slowdown led by China and the US, and US narrowly averting a debt default dragged the crude prices down. In addition, a strong US dollar [+2.2 percent during the same period] also acted as a drag on dollar-denominated oil prices," the report adds.

Against the backdrop of a global slowdown, which has compressed global oil prices, the OPEC met on June 4 to mull production cuts and changes to the baseline levels that determine the output level of each member. The members decided to leave their production target unchanged for this year even as Saudi Arabia announced it would go ahead with an additional voluntary one-month decline in production of 1 million barrel per day from July. The 23-country alliance said in a statement that its combined oil production would be limited to 40.463 million barrels per day over January-December 2024.

According to Motilal Oswal Financial Services, another factor affecting oil prices is rampant short-selling which has also been putting a lot of pressure on the markets. “Speculative positioning in crude oil is back to its March bearish extreme despite the OPEC+ cuts taking effect," it says. In April, the OPEC surprised markets with its announcement to cut around 1.16 million barrels per day.

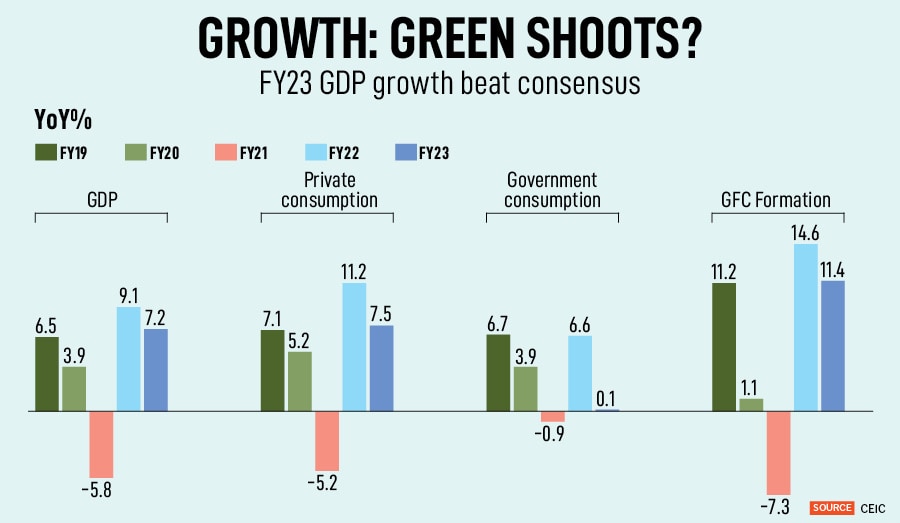

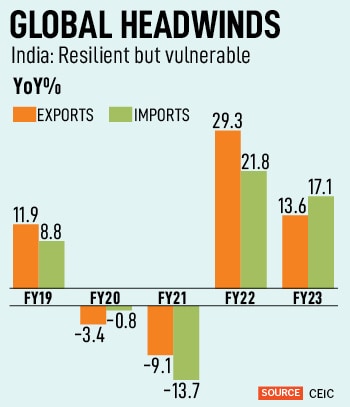

Government spending and the strongest quarter-on-quarter investment growth in 23 years helped real GDP to rise to 6.1 percent in the January-March quarter and 7.2 percent for FY23. In May, India manufacturing PMI rose to a 31-month high of 58.7 from 57.2 in the previous month. Analysts note a significant increase in service exports, driven by software and business services, and remittances is likely to support India’s current account deficit.

Yet, the Index of Industrial Production (IIP) growth slumped to a five-month low of 1.1 percent in April, below street estimates. Madan Sabnavis, chief economist, Bank of Baroda, believes the IIP numbers do not gel with the PMI data. “The year-end phenomenon, which goes along with production being ramped up in March, did not happen this time. High build-up of inventory in the previous months to meet pent-up demand is one reason why companies were cautious in expansion as the working capital costs have gone up. We need to view the PMIs with caution," he explains.

Sabnavis points out that there have been several base effects at play in the last few years due to the lockdown. “To get a fair picture, we have looked at the compound growth rate over FY19 which was a normal year. The picture is less startling as growth has been 2.7 percent per annum only. Further we have observed that these estimates also change over time as more data is obtained," he adds.

Many economists agree that the FY23 GDP growth is not broad-based and largely influenced by statistical base effects due to the pandemic. An India Ratings and Research analysis finds out that GDP grew at a CAGR of 3.3 percent during FY20-23 in comparison to 5.7 percent CAGR during FY17-20 and 7.5 percent during FY13-17. Paras Jasrai, senior economic analyst, India Ratings and Research, opines, “Recovering the lost economic ground would require a sustainable recovery in consumption, which post-pandemic has been driven by a skewed demand from high-income bracket households."

Importantly, private consumption remained weak at 2.8 percent year-on-year and global macroeconomic headwinds pose a challenge, though the domestic economy has been resilient.

“While it is possible that [private consumption at 2.8 percent] will be revised up in subsequent revisions, it is also possible that it is a sign of the slowdown that could follow. India cannot be immune to slowing global growth and weaker trade flows. Tighter domestic fiscal and monetary policy is also likely to slow the growth momentum," argues Pranjul Bhandari, HSBC’s chief India economist. In effect, HSBC expects GDP to grow 5.5 percent in FY24. It expects the RBI to be on hold for the rest of the year, and cut the repo rate by 25 basis points in Q1 2024.

Bank of Baroda believes the RBI may cut its inflation forecast of 5.2 percent for FY24 by 10 to 20 basis points, but it does not expect the central bank to tweak its GDP estimates as of now.

“We expect economy to moderate by 6 to 6.5 percent in FY24 against the headwinds of global economic slowdown, weaker exports, lower services sector due to waning pent-up demand and dwindling agriculture growth, assuming the monsoon is not normal or spatially distributed and aggravating heat wave conditions (El Nino). These remain key risks to our growth projections," it states.

“We expect economy to moderate by 6 to 6.5 percent in FY24 against the headwinds of global economic slowdown, weaker exports, lower services sector due to waning pent-up demand and dwindling agriculture growth, assuming the monsoon is not normal or spatially distributed and aggravating heat wave conditions (El Nino). These remain key risks to our growth projections," it states.

Globally, the US economic indicators are a mixed bag: Weak manufacturing sector activity, tepid consumer confidence, high inflation expectations, pick up in real estate activity, conflicting surge in payrolls and unemployment rate. The Bank of England and the European Central Bank have signalled a possibility of further rate tightening to tame stubborn inflation. China is grappling with weak consumer and business confidence due to a lukewarm recovery. Its government, reportedly, is likely to announce stimulus measures to revive growth.

In April, in a surprise move, all six members of the RBI’s MPC decided to keep the key lending rate unchanged at 6.5 percent, and five out of six members voted for a continued focus on withdrawal of accommodation. The RBI bucked consensus as it marginally trimmed its inflation forecast and raised its growth outlook by 0.1 percent to 5.2 percent and 6.5 percent respectively.

“The monetary policy actions taken since May 2022 are still working through the system. Accordingly, the MPC decided to keep the policy rate unchanged to assess the progress made so far, while closely monitoring the evolving inflation outlook. The MPC will not hesitate to take further action as may be required in its future meetings," RBI Governor Shaktikanta Das asserted as he announced the first bi-monthly credit policy of the current fiscal year in the previous meet.

First Published: Jun 06, 2023, 13:30

Subscribe Now