All along, he had expected that he would probably run a large agri-based company, and stints at Syngenta and Godrej Agrovet seemed to be preparing him for that. However, he got frustrated seeing the incremental, and sometimes ineffectual, changes happening in a sector that was 25 percent of the economy and accounted for 50 percent of the country’s population.

He wanted something that would bring step-jump change for the better, to the sector, and improve the lives of the millions of farmers in the country. But, back then, over a decade ago, “If you were an Indian startup and you were focused outside of what was conventional, which in those days was urban consumer or B2B software-as-a-service, you just couldn’t get funding. And we felt that that was insane."

In 2010, Kahn teamed up with Jinesh Shah, who came from Nexus Venture Partners and really understood the lay of the land in the startup ecosystem, and started Omnivore. Kahn had been working in India from 2007, and the two knew each other because when Kahn was an EVP at Godrej Agrovet, Shah, who was CFO at Nexus, had contacted him while studying the agri business sector in India.

“Despite our personalities being very different, we really hit it off and decided to work together," Kahn, 42, recalls.

At Omnivore, the idea was to try and transform the agricultural ecosystem through innovation. It didn’t seem like the big companies were really being able to do it, and they weren’t investing in R&D and everything was incremental. Kahn wanted to “shock the system".

“I think it was my frustration with a slow moving status quo that forced me to go from operating an agri business to where we are today," he tells Forbes India.

Omnivore’s first fund was $35 million and the firm invested in 13 startups, and 10 of those ventures are still doing business. One example is Stellapps Technologies, founded by five former Wipro executives to bring technology, data and analysis to the dairy supply chains in India.

“They have done a fantastic job, digitising, building a base layer of information across the dairy sector." The Bengaluru-headquartered company works with almost all of the large private dairies and dairy cooperatives in India and has brought its technologies to around 50,000 village collection centres so far.

Ranjith Mukundan, co-founder and CEO at Stellapps, recalls meeting Kahn in 2012, perhaps, at an ‘Action for India’ conference and the following year Omnivore became the first institutional investor in Stellapps. Omnivore continued to invest in follow-on rounds and has invested about $4.5 million in the company.

“As perhaps the first ag-tech focused institutional fund in India, they have done some pioneering work," Mukundan says. “They are very well networked in India, and internationally too, where they have some very good limited partners." This helps portfolio companies to connect with good names in both Europe and the US and not only for finance but also to strike agri supply chain and technology partnerships, he says.

Another portfolio company from the first fund was MITRA Agro Equipments, which was eventually acquired by Mahindra Group. Dev Bajaj, who founded MITRA to make precision farm equipment, later on joined VC firm Kalaari, and is now is the head of investments as chief corporate development officer at Dream Sports. The automatic precision sprayers that MITRA made helped farmers reduce their usage of pesticide by half. And now it"s effectively the sprayer division of Mahindra, Kahn says.

![]() One of the problems that Omnivore set out to tackle is to try and radically increase the profitability of farmers

One of the problems that Omnivore set out to tackle is to try and radically increase the profitability of farmers

Kahn backed an IoT company called Eruvaka focused on the aquaculture sector. “I always say I was the first VC to ever do a deal in Vijayawada," he says, because Eruvaka is headquartered there. And the company, founded by Sreeram Raavi, a semiconductor design engineer, has become really global and sizeable, and 90 percent of its sales are outside India. And Eruvaka went on to raise more funds after Omnivore’s first investment, and became profitable as well.

“It’s kind of the dream of make in India, right? So you’ve got a company that’s employing people in coastal Andhra where the products are actually 90 percent being exported to Latin America and Southeast Asia for use in aquaculture farms," Kahn says. Eruvaka builds sophisticated sound-based sensors to help monitor shrimp ponds.

![]()

Direct to farmer

The first fund from which Omnivore invested from 2012 to 2016 was largely deployed along three themes. One was, innovative hardware for farmers. Another was food processing and a third theme was business-to-business digitalisation, because in those days, direct-to-farmer digitalisation was simply not possible.

Typically, the startup had to go to a corporate agri business or a cooperative and they would give access to the farmers on their networks. That has changed over the last few years. Starting in 2018-19, “if you look at the deals that we’ve done, a lot of it is now direct to farmer," he says.

While rural mobile internet penetration in India still has some ways to go, there are many more farmers today with smartphones, more 4G connections, especially with Reliance Jio Infocomm expanding around the country, and reaching farmers directly is more of an option today. As a result, investors like Kahn are seeing many more platforms and marketplaces with embedded fintech and the ability to build much more full-stack models, meaning bringing internet-led services spanning the supply chain—from inputs to finance to market access.

And the inputs aren’t just about seeds or fertilisers. Stellapps and Eruvaka, for example, have built technologies to collect and analyse data and give useful information back to the farmers, from alerts to forecasts.

Omnivore’s second fund coincided with this change. Kahn and Shah raised their second fund in 2018-19, and one of the best known examples of this full-stack approach is DeHaat. Omnivore invested in the startup in 2019 and Sequoia Capital came in a year later. Today the venture counts Prosus and RTP as investors as well.

Shashank Kumar, co-founder and CEO at DeHaat had been in touch with Kahn from 2012, while the VC firm invested in the startup in March 2019 as co-lead of the venture’s first institutional funding round of $4 million. Omnivore has invested in each of DeHaat’s follow-on funding rounds as well.

“They have a great understanding of the agri scene in India, but also the ground-level reality," says Kumar.

Last year, Omnivore invested in Animall, which is a platform to help dairy farmers trade cattle. Founded by women who grew up in rural north India and met at IIT Delhi. “They are trying to transform the world that they knew as children," Kahn says. Co-founder and CEO Neetu Yadav’s father is a small dairy farmer in Rajasthan. Yadav was previously a product manager at Pratilipi in Bengaluru.

Another company Omnivore has backed recently is Reshamandi, which is working in India’s silk sector. Omnivore did the deal together with Strive Ventures. India has 6-7 million silk farmers in a $7 billion industry. And it has no digitalisation and no tech-driven supply chain integration of any kind, Kahn says. Reshamandi is probably the first venture to try and change that—from the inputs to farmers all the way to the silk retailers.

Breaking the shackles

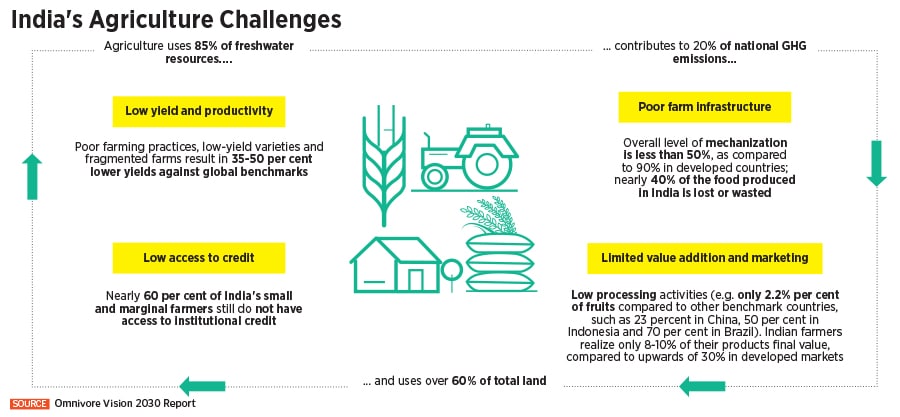

The problems that Omnivore set out to tackle persist, and there are four ways in which the VC firm is working on them. One is to try to radically increase the profitability of farmers. With very small and fragmented land holdings, effectively bringing agricultural extension in is difficult. And attempting to increase yield in itself won’t be enough if there’s no clear market for that extra yield, Kahn says.

“If you double the tomato yield in India, the streets of rural Bharat will be paved in tomato sauce," because there isn’t an existing export market, for example, that can take up the extra produce. And domestic consumption isn’t going to double either.

So part of the solution is in improving the terms of trade, in reducing costs, input costs, and costs of finance. And the portfolio companies at Omnivore are working on all of them.

Another major task is building resilience against the huge variability from year to year. This is one of the things “that makes being a farmer so frickin awful" in India, Kahn says. Even affluent farmers such as, for example, those with “hyper-irrigated lands growing fantastically profitable crops like bananas," face this problem, he says.

![]() Investors like Kahn are seeing many more platforms and marketplaces with embedded fintech and the ability to build much more full-stack models, meaning bringing internet-led services spanning the supply chain — from inputs to finance to market access

Investors like Kahn are seeing many more platforms and marketplaces with embedded fintech and the ability to build much more full-stack models, meaning bringing internet-led services spanning the supply chain — from inputs to finance to market access

“If you’re coming out of the IIMs and you have a choice between a job at McKinsey or 20 hectares in Jalgaon, take the second deal every time. You will never want for money." But because of the variability of crop yield, “the reality of that existence is, even those farmers don’t want their children to stay in agriculture".

Therefore the second task is to build income resilience for the farmer, getting him better credit, insurance, and access to parts of the ‘value chain’ that can help him sell his produce when the price is right and not straight after harvest, for instance, when an ‘arthiya’ (commission agent middleman) is looking to rip him off.

Arya is an example of a startup from Omnivore’s portfolio that is relevant to this problem. The Delhi-based startup is building a network of post-harvest services including warehouses, and financial services including loans against the value of the commodities the farmers store in the warehouses.

The third area is agricultural sustainability. For example, with much of the water in the country going into agriculture, how the water is spent ought to be scientific. A glaring example of how not to do that is the sugar industry, Kahn says. “We are the world’s second largest sugar producer, we are effectively taking our scarcest natural resource and converting it into diabetes."

Food wastage, soil depletion, overuse of pesticides—which is leading to resistance among weeds and bugs—are other critical problems that affect sustainability.

And the fourth area is tackling the effects of climate change. “Do you want to think about climate change in the world 50 years from now? Well, Canada and Russia have it pretty good. We’re screwed." When global warming bumps up temperatures, the Russians will be able to say, ‘it"s all right. I’m growing wheat in Siberia’," he says. In India, if it’s 45 degrees for months on end and one can barely walk outside, “we’re talking Blade Runner levels of dystopia," he says, referring to the Hollywood sci-fi movie.

Expert team

Omnivore should know, because it comprises not just financiers, but experts who know the agri sector deeply. Kahn, who has an MBA from Harvard Business School, where he graduated as a Baker Scholar, is the co-chairman of the Confederation of Indian Industry (CII) Task Force on Agri Startups. He is also a member of the governing council of the Maharashtra State Innovation Society.

Subhadeep Sanyal, a partner, in Delhi, has a BSc in agricultural science and an MBA in agri business management. Reiham Roy, who runs the firm’s Chennai office, began his career as an analyst at the United Nations International Fund for Agricultural Development.

Abhilash Sethi, a principal with the firm in Bengaluru, was a founding member of Mahindra Group’s precision farming team. At Mahindra, he mapped the global landscape of precision agriculture technologies and developed partnerships with multiple agri-tech startups.

S Nagarajan, a venture partner with the firm, in Bengaluru, was previously the managing director of Mother Dairy, one of India’s largest dairy and food processing companies. From 2010 to 2017, he led the turnaround of Mother Dairy, growing revenues from Rs 2,900 crore to Rs 7,900 crore.

“So what you get when you get Omnivore, for better or worse, is a bunch of people that really understand agriculture and food in India, and are globally connected in the agri business ecosystem." And this deep expertise in the sector complements the experience of generalist VC firms in areas like fintech platforms and online marketplaces.

10 million farmers

Thus far, there are probably north of 10 million farmers who have been touched in some form by Omnivore’s portfolio companies, Kahn estimates. However, much of the impact is only beginning to accelerate now, and the best is yet to come. This is because other factors like deeper internet penetration are now coming together. And greater access to cheaper finance as against the ‘arthiya’ (commission agent middleman), who often also lends money at exorbitant rates.

At DeHaat, “the way we have built this full-stack solution for the farmer, he benefits at every touchpoint," CEO Kumar says. When they buy seeds, fertilisers or pesticides, they get 8-12 percent savings. And DeHaat also ensures that these are available when the farmers really need them—timing is crucial in agriculture.

Then they get a “super-customised advisory" on everything from preparing the field to managing pests and irrigation, which increases their yield by 12-20 percent. Then the market linkages via DeHaat give the farmers 5-10 percent better prices along with fair weighing and payment terms. In total, farmers can get an over 50 percent increase in their income, Kumar says.

Further, another important advantage is that the DeHaat village centres are typically within a 5km distance of any given village that the startup is currently servicing. This brings time and cost savings as well, as farmers can avoid trips to the nearest district centres.

So far, DeHaat has built a network of more than 1750 micro-entrepreneurs who provide various inputs and services—such as delivering seeds and fertilisers—to over 500,000 farmers who are using DeHaat. The startup is present in Bihar, UP, Jharkhand, Orissa and West Bengal and it has recently expanded into Madhya Pradesh and Rajasthan.

At Arya, the founders came out of the commodity finance department at ICICI Bank. They’ve built out the largest network of farm level, village warehouses across India—so they can give farmers high quality, low-cost storage for their crops. That means farmers don’t have to sell right at the point of harvest, when prices are at their lowest.

And to help farmers meet their household and other essential financial needs, Arya also embeds finance into its services. You can, for instance, store your maize at Arya and the same day, you can get a 70 percent loan-to-value on that maize," Kahn says. That gives the farmer the option of selling a few months down the line when the prices are better.

“So the game is to break the bonds that prevent the farmer from making much more," Kahn says.

Omnivore has done two strategic exits from its first fund. It has also done two secondary exits and a partial one. It’s not far from full exits either, Kahn says. At least one exit is currently being negotiated, but for now, Kahn isn’t ready to divulge names or details.

What he does say is this: “Our first fund was $35 million, which is very different than having $350 million. You can turn $35 million into a hundred million, much easier. So thankfully, yeah, we"re well on our way there… to good returns."

“And our second fund is performing absolutely brilliantly," he adds.

Omnivore is now planning to raise about $150 million as its third fund. Most of that will be next year. And “we will continue to help build this ecosystem and back entrepreneurs in this space and transforming Indian agriculture and food systems".

Mark Kahn, Managing Partner, Ominvore

Mark Kahn, Managing Partner, Ominvore One of the problems that Omnivore set out to tackle is to try and radically increase the profitability of farmers

One of the problems that Omnivore set out to tackle is to try and radically increase the profitability of farmers

Investors like Kahn are seeing many more platforms and marketplaces with embedded fintech and the ability to build much more full-stack models, meaning bringing internet-led services spanning the supply chain — from inputs to finance to market access

Investors like Kahn are seeing many more platforms and marketplaces with embedded fintech and the ability to build much more full-stack models, meaning bringing internet-led services spanning the supply chain — from inputs to finance to market access