Markets stare at $14.5 billion outflow risk

A slew of companies is slated to set free their pre-listing shareholder lock-ins, amounting to an estimated value of $14.5 billion, in next three months. How can it change the course of markets post e

With stock markets already navigating through pockets of turbulence and anxiety, mostly related to elections, there seems to some more trouble brewing up. This time, the wreckage could be possibly led by primary markets. Markets could be facing an outflow of $14.5 billion in the next three months as clutch of shares will be released from their respective lock-in period after these companies had launched their initial public offerings (IPOs) for fresh listings in the stock markets.

Stock markets in India are already feeling intense pressure of sell-off with foreign money exodus due to multiple factors such as election and unsteady corporate earnings in March quarter. Another blow of liquidity drain out may not be reassuring for those hoping to see a rally in Indian markets.

A total of 53 companies are slated to set free their pre-listing shareholder lock-ins amounting to an estimated value of $14.5 billion in the period May 20 to August, shows an analysis by Nuvama Alternative & Quantitative Research. Typically, companies face sell-off by existing shareholders in different categories (including promoters and non-promoters) once the mandatory lock-in period is lifted. The analysis considers companies that went public until May 15, 2024.

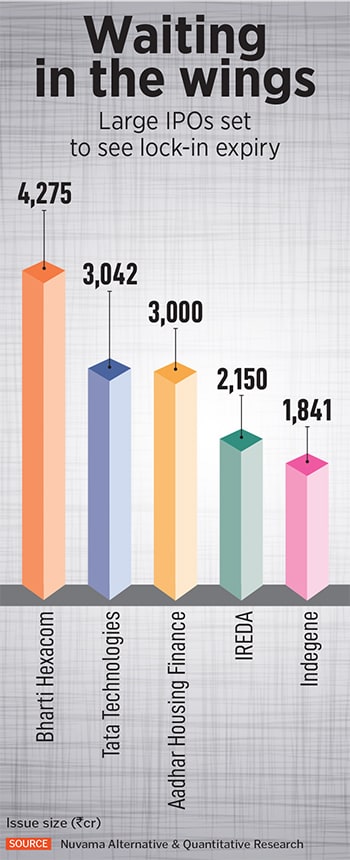

Of the total, 13 companies will see their lock-in period of shares expiring in May itself with maximum outflow expected in August. The analysis indicates that among the companies under consideration, only four had raised funds worth above Rs2,000 crore. The largest issue in the lot is Bharti Hexacom, which raised Rs4,275 crore via IPO and went public in April. The listing of the company, which offers consumer mobile services, fixed-line telephone, and broadband services in Rajasthan and the Northeast circles, was subscribed 30 times. Its three-month lock-in will expire in July, freeing up 17 million shares or three percent of the total outstanding shares to be sold.

Of the total, 13 companies will see their lock-in period of shares expiring in May itself with maximum outflow expected in August. The analysis indicates that among the companies under consideration, only four had raised funds worth above Rs2,000 crore. The largest issue in the lot is Bharti Hexacom, which raised Rs4,275 crore via IPO and went public in April. The listing of the company, which offers consumer mobile services, fixed-line telephone, and broadband services in Rajasthan and the Northeast circles, was subscribed 30 times. Its three-month lock-in will expire in July, freeing up 17 million shares or three percent of the total outstanding shares to be sold.

In terms of size, next in line is Tata Technologies, which raised Rs3,042 crore through IPO before going public in November last year. The issue was subscribed over 69 times with QIB (qualified institutional buyers) at 203 times. Its five-six months share lock-in will expire in May freeing up 262 million shares which is 65 percent of the total outstanding shares.

“One thing to note is not all of these shares will come for sale as a sizable portion of these shares is also held by promoter and group," Abhilash Pagaria, head, Nuvama Alternative & Quantitative Research says.

He explains that the value pertains to the total lock-up opening shares, but not all shares will be sold at a same time. Opening up of the lock-in period post listing enables shareholders to exercise the right to trade and option to sell as per market conditions but it is not necessary that all shares will be dumped on same day.

Sebi has mandated different lock-in periods for separate categories of existing shareholders in a company that is listed on the stock exchanges via the IPO route. The lock-in filters are meant to arrest immediate decline in stocks after listing. For instance, there is a lock-in of 30 days for 50 percent of the portion allocated to anchor investors, and a lock-in of 90 days for the remaining portion. Earlier, the lock-in period for anchor investors was 30 days, which caused a drastic decline in share prices after the window of selling opened.

A silver lining to all the sell-off in Indian equities is the MSCI rejig, as the index provider included 13 Indian stocks and dropped 13 in the MSCI Standard/EM Index in its latest review. The changes are expected to fetch $2.5 billion passive foreign institutional investors (FII) money, as per Pagaria’s estimates. The changes in MSCI Standard/EM Index, which will be implemented as of the close of May 31, will result in a total of 146 Indian stocks in the index. Additionally, there will be a net inclusion of 14 stocks in the Smallcap Index, bringing India"s total stock count in the small-cap index to 497.

“India has once again achieved a major milestone in this rejig, as its representation in the MSCI EM Index is set to increase from the current 18.3 percent to closer to 19 percent. This increase in weight, in terms of basis points, is the highest among any EM Index in this rejig," says Pagaria.

Currently, India’s weightage in the MSCI Standard/EM Index is 18.3 percent. The highest representation in the MSCI EM index is China, with a weight of 25.7 percent and 703 stocks. Typically, foreign passive index funds allocate money to stocks depending on their weightage and constituents, hence a reduction in the weightage results in a direct outflow of funds from those stocks and vice versa.

However, India is currently facing sell-off by FIIs in last few months in both equity and debt segments. FIIs have drained out $3.53 billion in Indian equities in the first half of May, highest monthly withdrawal in this year so far. They had sold off Indian shares worth $1 billion in the previous month.

Lower voter turnout in the first four phases of Lok Sabha polls have also made market investors nervous with the India volatility index (VIX) heating up. The India VIX has increased 42 percent since the beginning of January, and has spiked 60 percent in May alone. The India VIX, often referred to as a fear gauge or fear index, has an inverse correlation with rising markets.

The VIX is most closely watched by traders as a measure of the expected volatility of stock markets over the ensuing 30-day period and is the primary tool for traders to protect themselves against, or bet on, sharp moves in stocks. Investors, research analysts and portfolio managers assess VIX values to measure markets risks, fear and stress before they make investment decisions.

The polls started on April 19 and the last voting phase will take place on June 1. Markets have priced in expectations for the incumbent party to continue, as policy continuity remains crucial.

The lower voter turnout can be attributed to several factors, including searing heat, voter apathy or possibly disenchantment with the incumbent and challenging parties, especially given the number of high profile defections from the opposition camp to the ruling Bharatiya Janata Party (BJP), says Nomura. The turnout in a number of BJP stronghold states has been lower than in other states and relative to past elections, prompting a rethink in expectations of a clean sweep for the incumbent BJP and leading to some market concerns.

“The lower voter turnout seems to have caught markets by surprise, given the wider expectation that the BJP would be able to garner an overwhelming groundswell of support, as was the case in the previous 2019 elections. The shift in election rhetoric of the BJP from governance-centered themes to religious and sectarian issues also seems to have spooked markets, with participants trying to comprehend the reasons behind this shift in strategy," says Nomura.

First Published: May 20, 2024, 17:56

Subscribe Now