What Aneesh Reddy is getting right about Capillary Technologies' push in the US

The Benglauru-based SaaS company is on the cusp of becoming a more global vendor of sophisticated software products focused on customer loyalty management

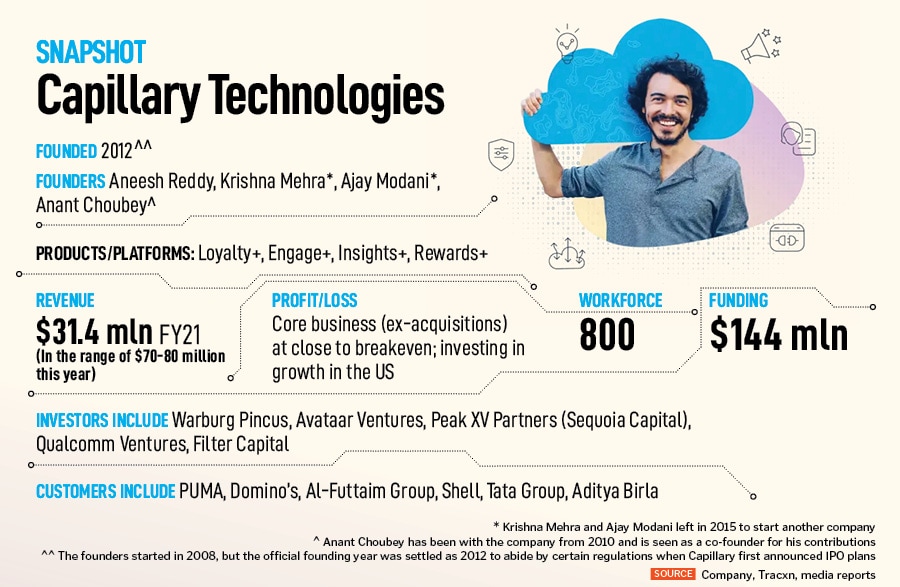

Some ten years ago, Aneesh Reddy was at a Retail Week conference, the largest retail industry trade show in the UK, trying to network with potential customers for his three-year-old software company. Back then they’d started out with a fairly simple mobile-based CRM (customer resource management) product.

“I was trying to introduce myself to one of the speakers who’d just finished … his first reaction was ‘we don’t outsource to India,’" Reddy recalls. “Even before I could say we are a product company from Bengaluru."

“Today, we have 16 Fortune 200 companies as customers in the US and UK," he says. “The world has changed."

And so has Capillary Technologies. Today, it is on the cusp of becoming a more global vendor of sophisticated software products sharply focused on customer loyalty management. Capillary’s customers include the Tata Group, Walmart, Adidas, Marks & Spencer and Shell.

Overall, the company has more than 250 customers who account for some 120,000 stores around the world, touching a billion end-consumers in over 30 countries, who collectively make about five billion transactions a year.

For example, the Tata Neu loyalty programmes run on Capillary’s platform. After that initial attempt to sell in the US and UK, Reddy decided to focus more on India and nearby Asian markets—Southeast Asia became one of the company’s biggest markets. Now, multiple factors are coming together that make the timing ripe for Capillary to expand more aggressively in the US, which is the world’s biggest technology market.

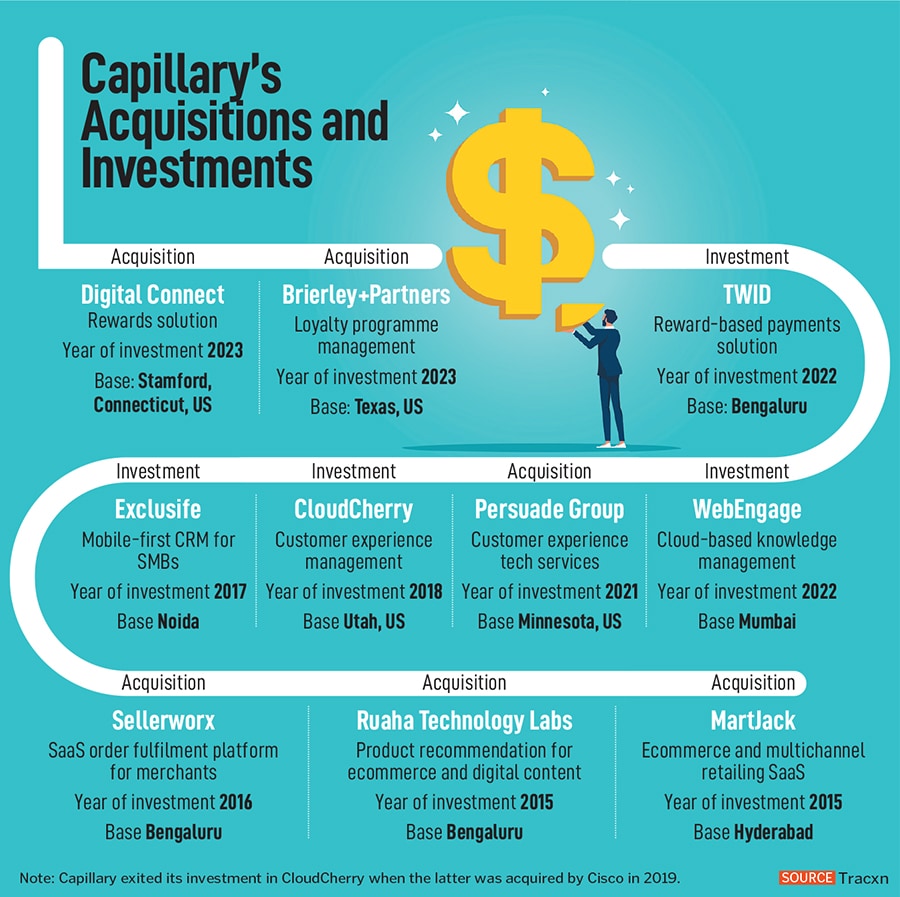

This time the US push started in 2021, with a small acquisition of a company called Persuade Group, in September of that year.

It was generating about $3-3.5 million in sales, and since then has grown fourfold. “Our objective was to gain market entry, secure referenceable customers, and acquire a talented workforce," Reddy says.

The loyalty management solutions market is worth more than $10 billion, Capillary noted in its annual report for the fiscal year that ended March 31, 2022, so the opportunity is big. Therefore, “rather than waiting for the next request for proposal, we opted to acquire companies in the loyalty management space and migrate their customers to our superior tech platform."

This year, those efforts were recognised as Capillary was placed in the “leader" segment within the loyalty management category by Forrester Research, one of the two most widely recognised market research and consulting companies that advice large businesses on their tech purchases. The other is Gartner.

Capillary was one of “12 providers that matter the most" for customer loyalty management tech, Forrester noted in its ‘Forrester Wave’ report on this segment in March.

Loyalty+, Capillary’s flagship product, “outpaces many in this competitive set because of robust functionality and a flexible data model," according to Forrester. “It excels in both loyalty program management and marketing, as well as creating actionable insights from both customer and business data."

And the platform’s “nudges" feature uses artificial intelligence (AI) and machine learning (ML) to give marketers prescriptive advice on everything from program optimisation to campaign management. “Brands seeking deep and broad technical expertise should consider Capillary," according to the Forrester Wave report.

One area the Forrester analysts called out where Capillary lagged competitors was that it wasn’t yet seen as a “thought leader" with respect to certain aspects of the technology. This is an area that the acquisitions will change. Capillary is acquiring old loyalty solutions providers with a solid customer base and approaching customers with a proposition to upgrade them to its platform for free.

This year, the company announced two more acquisitions in the US—Brierley + Partners, purchased from Nomura Research Institute, and the Digital Connect assets from a company called Tenerity.

Large enterprise customers expect “deep products," Reddy says. Capillary has these, but it is still an unknown brand in the US. “We were coming second in a lot of deals, but in the enterprise world there are no prizes for that," COO Anant Choubey says. On the other hand, often coming in a close second in a consideration set of vendors validated the depth of Capillary’s product, he says.

This is where the endorsement of Forrester, combined with the established reputation of local companies such as Persuade and Brierley, is helping the Indian company make inroads into the US market.

For example, Harold Brierley is respected figure who was previously founding CEO at Epsilon, a marketing solutions specialist, which was acquired by Publicis Group in 2019 in a close to $4 billion deal.

Brierley founded Brierley+Partners in 1985, serving as its chief loyalty architect for some 175 major brands, including American Express, AT&T, Ford, Hertz, Hilton, Lufthansa, Neiman Marcus, Office Depot, 7-Eleven, Sony and United Airlines. He served as CEO through 2006 and chairman through 2015, when Brierley+Partners was acquired by Nomura Research Institute, one of Japan’s largest technology services firms.

“He"s quite the expert, having been involved in creating the loyalty programs for American Airlines Advantage and Hilton Honors," Reddy says. Brierley pioneered the measurement of “emotional loyalty," Reddy says, with his Brierly loyalty quotient.

Where Capillary completed the picture was on the technology front, complementing Brierley’s consulting and analytics strengths. “Our goal at Capillary is to become the best loyalty company globally," focusing on one outstanding platform, he says.

Digital Connect is a rewards platform that Capillary is rebranding as “Rewards+." The acquisition has given the Bengaluru company an opening in the UK and Europe, with multiple existing customers and entry into new verticals including banking and telecom.

“It’s a great time to buy if you have the money," Reddy says, and that’s working out as well for Capillary.

Reddy, 39, started with a degree in manufacturing science and engineering from the Indian Institute of Technology Kharagpur in 2006, and worked as a manager at ITC before starting Capillary. He and two other co-founders, Krishna Mehra and Ajay Modani, started Capillary in 2008.

The latter two left in 2015 to start another company. COO Choubey, who’s been with the company from 2010, is also recognised as a co-founder for his contributions.

Mehra was the coding genius and Reddy was the sales rainmaker, Choubey recalls. And “I"m the guy who opened the most number of geographies for Capillary and I"m also the guy who closed the most number of those," he jokes. He worked from Singapore for the first several years and returned to India in 2016.

Between 2018 and 2020, he played a central role in taking Capillary from negative 60 percent EBIT margins to breakeven, he says. And then, Covid struck.

The company cut its workforce by a third in one early deep cut—while helping 80 percent of those employees find other jobs within months, as tech was still booming—jettisoned some products and raised some bridge money from existing investors. As a result, “we weren’t dying by a 1,000 cuts," Choubey recalls, and there was actually time to reflect on what next and prioritise and strategise.

They set aside $1 million to experiment, and talk to a lot of people. It became clear that it was time to expand into the US, and also diversify to reduce the dependence on the retail sector.

Barring the two years of Covid, Capillary had done well, and in recent quarters, the company is growing strongly again. In fact, this year for sure, Reddy expects to grow the business by 80 percent with Capillary and the acquisitions contributing about half and half.

Reddy declined to be specific about numbers, but says the company is “well past" the $50 million revenue mark, and “hopefully in the next two years, we"ll get to $100 million."

“Capillary’s transformation around the strategy of diversifying from Asia to the US and Europe has been impressive," Mohan Kumar, a partner at Avataar Ventures, said in the funding press release. “The move has catapulted Capillary into leadership position and there is immense potential ahead," he added.

The entrepreneurs have the target of consistently hitting sales growth in the mid-30s with 10 percent free cash flow in the coming 18 months to two years. That might trigger Capillary’s IPO plan again, which was deferred last year as the global macroeconomic conditions worsened.

Building for Asian customers all these years has meant that Capillary has had to offer products that were rich in features. That’s paying off now in the US and Europe as “it’s amazing the number of times in a customer demo we can say ‘you can also do this.’"

For a big customer in the football industry, Capillary’s tech has helped the company to run football games on a smartphone app. The feature attracted 100,000 players on the day it was launched, Reddy says.

Generative AI is, of course, already being included in Capillary’s products. For example, Capillary’s tools assist marketing managers with pre-generated messages tailored for different audience segments.

On the business front, Reddy stepped back to bring in a professional CEO, which has allowed him to focus much more on the acquisition aspects. Reddy remains the managing director of Capillary.

Sameer Garde was already an advisor and a member of the company’s board. As Capillary prepared for its initial public offering (IPO), it became apparent to Reddy that “this guy was very good," and they were spending more time together running the business.

For his part, Garde says he was “bit surprised" that Reddy asked him to be full-time CEO. However, having heard from many customers about the strengths of Capillary’s product and the opportunity to take it to the US and Europe attracted him. “We’d spent way too much time in Asia and taking an Indian company global is exciting," he says.

Garde points to how Siebel Systems, once a CRM leader, was eventually acquired by Oracle as that market segment was overhauled by Salesforce. There is a similar opportunity in the loyalty management space, he says, with only a couple of large vendors today who rely on people on the ground and software that isn’t on the cloud.

In that not-on-the-cloud world, making a small tweak in a loyalty programme can take months, he says. With Capillary’s tech, and SaaS approach, it would take very little time.

“Customers deserve better technology and faster go-to-markets and much better TCO (total cost of ownership)," Garde says. “I would like to look back after five years from now and say we revolutionised the US loyalty industry."

Garde, who took over as CEO in January, brings the experience of running large operations, including previously as president of Cisco India, senior VP at Samsung, and president of Philips’s healthcare division and president and managing director at Dell India.

Now Reddy is going to focus on two large immediate priorities. The first is to ensure that the integration of the companies that Capillary has purchased happens smoothly. So the first goal is integration of the two new acquisitions to everyone’s satisfaction.

“And if we do that right, then every year we can repeat this formula."

First Published: Jul 10, 2023, 12:36

Subscribe Now