How Zerodha's young founders, Nithin and Nikhil Kamath, made their way to the Ri

Powered by the broking platform, brothers Nithin and Nikhil Kamath are the Forbes India Rich List's youngest new entrants

(Left to right) Brothers Nithin and Nikhil Kamath had been active traders for a decade before they founded Zerodha

(Left to right) Brothers Nithin and Nikhil Kamath had been active traders for a decade before they founded Zerodha

Image: Nishant Ratnakar for Forbes India[br] A decade ago, high brokerage charges were a bugbear for active traders in the market. They were priced on the value of the trade. For those with heavy daily volumes, these charges added up.

Yet, if one looked at the broker end of the transaction, the work they needed to do was the same irrespective of the size of the trade. With physical order slips giving way to computers all that was needed were programmes to run the trade. The size of the trade by an individual client didn’t matter and the incremental cost for the broker due to new clients was marginal. Trading costs had ceased to be linear.

And yet, for brokers, there was no reason to shake up this cosy arrangement. Clients with high volumes and good relationships would often negotiate rates with their preferred brokers that were cheaper than those advertised. Those deals were not available to everyone. They were dependent on how much commission the broker wanted to part with for a particular client.

In addition to executing trades, brokers provided other services like research, call and trade and margin funding. The money made from brokerage was used to subsidise these divisions. In short, there was no reason for them to reduce prices on what was a steady and dependable profit centre.

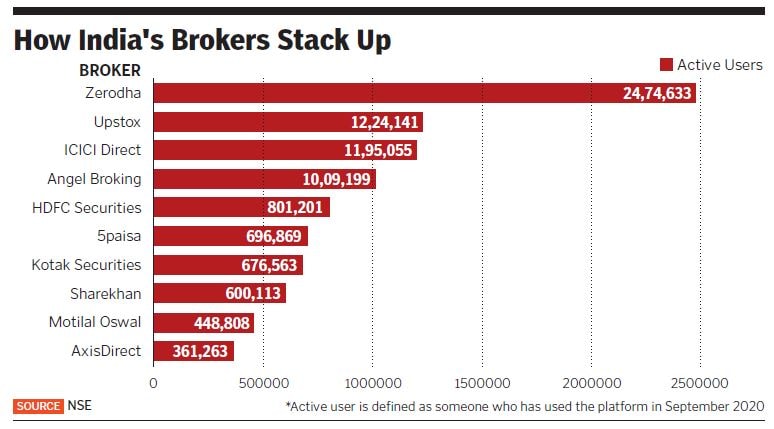

As it often happens in business, the disruption in the industry came from outside. In Bengaluru, brothers Nithin, 41, and Nikhil Kamath, 34, had been active traders for over a decade. They went on to start Zerodha, a broking platform with a flat fee that was aimed at traders. A decade on, with 3.5 million users, they are the largest brokers in the country, taking them past number two, ICICI Securities. They enter the 2020 Forbes India Rich List at rank 90 with a net wealth of $1.55 billion. (As a private business, they declined to share numbers on revenue and profitability.)

The story of the Kamath brothers is one of spotting an opportunity for disruption, taking it with both hands and then working over the past decade to enhance their competitive moat, which in any technology business is always razor thin. Nithin admits, “When you are number two, there is something to aspire to… when you are number one, there is always the risk of falling back.” Setting up Zerodha

Setting up Zerodha

Both Nithin and Nihkil had been trading since their teens. The sons of a veena teacher and a Canara Bank manager grew up in Basavanagudi in Bengaluru, a neighbourhood with a lot of active traders. Nithin admits that it was “greed” that initially got him interested in trading. (Both didn’t graduate, but say that may not be the right example as there is a fine line between passion and foolishness. “If you succeed, it is passion, if you don’t, it is foolishness.”)

They’d become sub-brokers for Reliance Money and Way2Wealth respectively. Their trading success had resulted in them setting up a firm, Kamath Associates, to manage money for others.

At the back of their mind, the trader brothers knew that the business was ripe for disruption. “If the work done per trade is the same, then why should fees be based on the value of the trade?” was a question Nithin often asked himself. Nithin knew that the industry was not very transparent. What brokers charged as securities transaction tax or brokerage was often not clear to the client.

This was also the time when technology was increasingly entering into stock broking. Algorithmic hedge funds were making their mark in India and exchanges were becoming more and more digitised. Their traditional roles of being mere marketplaces for a broker had been surpassed. Technology now allowed anyone to become a broker and trade with a software provided by the exchange or by the broker.

This was also a time when a battle between the National Stock Exchange (NSE) and Financial Technologies that had been started by Jignesh Shah was getting heated. Financial Technologies had signalled its intention to start a rival exchange MCX. While the NSE had been using software from Financial Technologies for a vast majority of its trades, news of the new exchange had it scrambling to support rival Omnesys, which was later bought by Thomson Reuters. Omnesys’s API was better for traders and the software soon caught on among them.

In 2008, the Kamath brothers became members of NSE, which allowed them to become a broker using the NSE’s Now platform. By 2010, all traders had to do was download Zerodha’s software, which was based off NSE’s Now platform (Omnesys) and trade directly with the NSE. This was the birth of Zerodha. NSE took care of the back-end infrastructure like sending stock ticks. As a result Zerodha was spared the cost of building a full-fledged client software from scratch.

Its fees were the game changer. Traders paid ₹20 per trade. It started small and had a core following of about 10,000 users in the first year, but for users who had been used to paying many times that, the lower brokerage fees were an instant attraction. There was no advertising and word-of-mouth was the only publicity Zerodha relied on. Till today, the brothers haven’t advertised their service.

Deepak Shenoy, who runs Capitalmind, a portfolio management service, was one of the early converts. He remembers evangelising the service in its initial days, carrying the 20-page enrolment forms in the back of his car and passing them to other brokers. He then worked at a hedge fund in Gurugram and there was a fair amount of scepticism around the fact that if the product is so cheap, it must not be the best. Securities could be misused and the company was run by two unknown brothers. (It was a partnership and not a limited company.) The word on the street was that this was good for trades, but if one wanted to invest and hold for the long term, it was better to use a big-name broker like Kotak or ICICI Securities. Zerodha wasn’t a registered depository participant (these are agents who hold securities on behalf of CDSL or NSDL) and used IL&FS’s services.But Nithin and Nikhil were well-known in trading circles. Nithin, the more extroverted of the two, was active on trading forums and their service served the needs of traders. Soon people who bought and held shares (these are known as delivery trades) also came on and were offered a flat ₹20 per trade deal. In 2013, they had their first competitor when RKSV, another discount broking platform, set up shop.

That was when, as Nithin explains, they realised their moat would soon cease to exist. What began was a quick exercise to roll out their own platform called Kite. The aim was to remove the clutter, provide the best user interface, order matching and analytics. Aiding them was chief technology officer Kailash Nadh, who is now an integral member of the team.

Scaling Up

As word-of-mouth spread, the company received a steady stream of customers to both trade and invest. But its differentiation was no longer there as several brokers started offering flat ₹20 trades. In late 2015, while waiting for a delayed flight to Kochi, Nithin had a brainwave. Why not make delivery trades free? At Zerodha, there is no stock research and no employee in the organisation has any sales targets

At Zerodha, there is no stock research and no employee in the organisation has any sales targets

Image: Courtesy Zerodha[br] Users who invested for a longer period were eight to nine million as compared to 0.5 million active traders within the country. (Traders, however, contribute to 98 percent of daily volumes on the exchange.) Making delivery trades free gave Zerodha virality for the first time and its user base of 75,000 at that point has grown by 50 times since then.

The next turning point came around demonetisation when Zerodha was able to make use of Aadhaar-based authentication to complete know your customer requirements. This allowed them to sign on users within hours compared to the seven days it would take earlier. There was also a move towards financial assets which opened up opportunities for brokers. Zerodha was able to ride this trend. “More recently, the decline in interest rates has resulted in more people exploring equities as on option,” says Nikhil.

As things stand, it is the day traders that subsidise users who buy and hold whose trades are free. Investors in its newly launched mutual fund platform Coin can buy direct plans without paying commission. While Zerodha acknowledges that the latter is a loss centre for them, Nikhil says their trades result in data that is valuable. “Plus even investors sometimes engage in speculative trades,” he says. The company is planning a product to lend against securities and this could make these users a profitable segment.

Over the last year, the company has come in for criticism when its systems have been down. For active traders, a snapped link to the exchange can result in a significant loss. The more vocal ones have taken to social media to criticise the company. While not defending the outages, both Nithin and Nikhil say their downtimes have been far less than those of other brokers and they are working on fixing the issues quickly.

There is also the threat of disruption. In the 1930s, Merrill Lynch was ridiculed for taking out a full-page newspaper advertisement, saying anyone can now buy a mutual fund. Till then it was considered a product for the rich and well heeled. Then in the 1970s, Charles Schwab came in and disrupted Merrill. In the 1980s, it was ETrade with its $1 per trade brokerage, which in turn got disrupted by Interactive Brokers. Most recently, Robinhood has turned out to be the hottest new broker.

In India, Paytm has launched its own mutual fund and ETF platform where it is targeting users that traditional brokers have ignored. Paytm’s tagline is buy a Nifty ETF for ₹16. “It wants users who can invest just ₹100 a month and this is a segment traditional brokers have neglected,” says Shenoy. This could prove to be a disruptive force.

Despite the pandemic Zerodha has had its best year with 1.5 million users signing on. It is now India’s largest broker by number of customers and the largest worldwide by volume of trades. The steady upward march of the markets since the collapse in March has helped in getting people interested in trading. Last year, Nihkil launched his own fund, True Beacon, that invests for high net worth individuals. With a corpus of ₹380 crore, it is still small, but has notched up an impressive 35 percent in gains in the last 14 months.

For now the Kamath brothers are focusing on what they know best: To provide the best experience to traders and a free option to investors. There is no stock research and no employee in the organisation has any sales targets as that leads to misselling. They’ve launched Varsity by Zerodha, which has tutorials on the markets. And there is still no advertising for the core broking service. Within the company, Nithin—who is CEO—takes the product decisions and is responsible for building them while Nikhil—who is CIO— handles risk management and trades on their account. They’ve bought stakes in several startups in the investing space and also given money to solutions to tackle climate change effectively channelising their broking profits for a worthy cause.

First Published: Nov 09, 2020, 18:27

Subscribe Now