Nestle India: Inside the city slicker's rural gambit

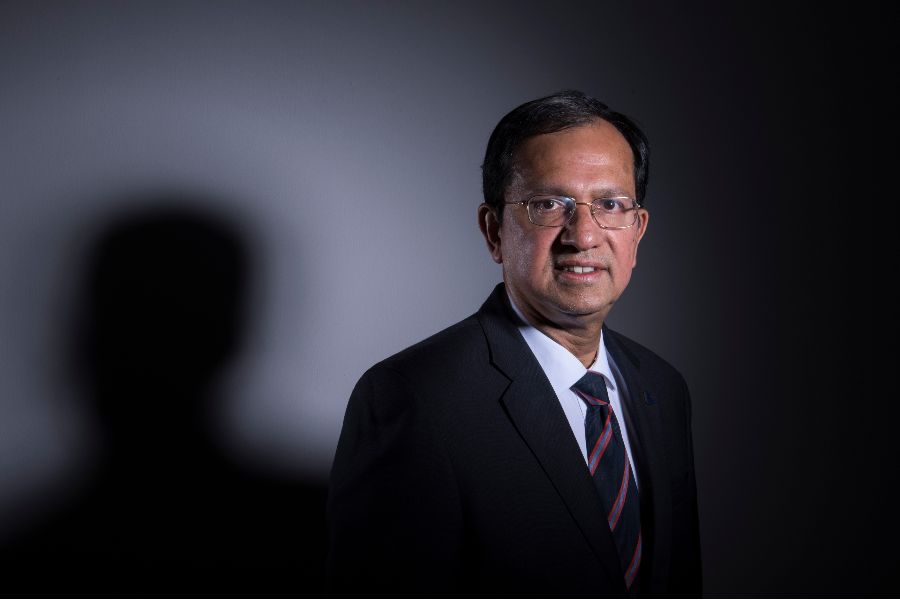

The Suresh Narayanan-led company is aggressively fanning across rural India in search of its next leg of growth. Nirvana for the maggi maker, for sure, won't be a two-minute gig

Image: Amit Verma

Chittawala Khaddar village, Meerut, Uttar Pradesh

Papi Mandal doesn’t know how to pronounce diaper. The 36-year-old can’t get the spelling right, and in all probability, doesn’t even know the names of the top diaper brands. But what the gritty homemaker, who looks after a teeny-weeny store whenever her husband is out in the fields, knows for certain is one singular reality. In her sleepy village, tucked some 163 km away from the national capital and 445 km from the state capital of Uttar Pradesh, the demand for bachcho ki chaddi (kids’ underpants) is quite high.

“Mami and Hoogi ka dus rupaya waala packet ka demand hai (There is demand for ₹10 packs of Mami and Hoogi)," says Mandal, alluding to MamyPoko pants and Huggies. “There are other brands too that fly off the shelves," claims the class V dropout, pointing towards a clutch of low-unit packs hanging from a slender rope at the store front: Tata Tea, Colgate, Sunsilk, Boroplus, Glow & Lovely, and Patanjali. A bunch of bright yellow packs of Maggi in a small basket breaks the dull monotony of the store. A string of ₹2 pouches of Nescafe too adds some colour. The facade of the shop is covered with an iron grill to keep the products safe from the monkey menace.

As Forbes India’s photographer clicks with his Nikon camera, a few kids who had assembled at the store out of curiosity break into a giggle. “Camera dekh (look at the camera)," says a 12 year old. “DSLR hai, aur remote flash trigger hai (it’s a DSLR with a remote flash trigger)," replies his friend, who checks the name of the model on his smartphone.

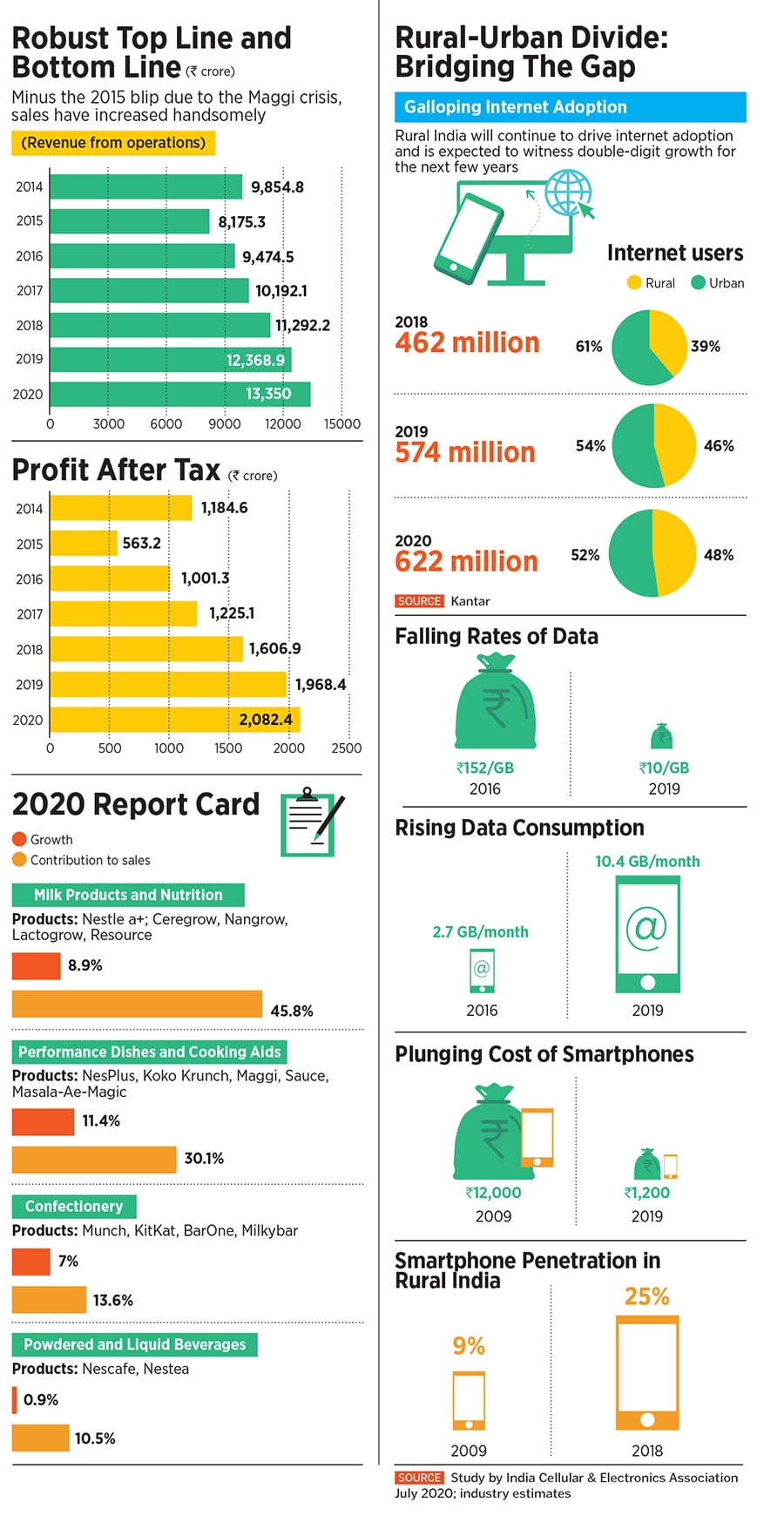

Five years back, in August 2016 in Gurugram, a bunch of analysts wanted to know Nestlé’s business model in India. It had been a year since the Maggi crisis—over 35,000 tonnes of noodles were voluntary withdrawn and destroyed over the alleged issue of excess lead in the product in 2015—and the Man Friday of the Swiss multinational giant was addressing the analysts’ meet. “We have to look at the reality of where we are and what portfolio we have to offer," declared Suresh Narayanan, chairman and managing director of Nestlé India. His pitch was clear. The maker of Maggi, KitKat and Nescafe was in no mood to shed its urban tag. After all, that’s where the ‘aspiring, seeking, inspiring and global consumers’ of Nestlé resided. Maggi noodles were largely consumed in the cities KitKat and Munch wooed urban millennials Milkmaid had takers among homemakers in the metros Nescafe had urban vibes to it and the milk and nutrition products of Nestlé appealed largely to young consumers in cities.

Papi Mandal sells Maggi, a Nestlé product, at her store in Meerut’s Chittawala Khaddar village[br]

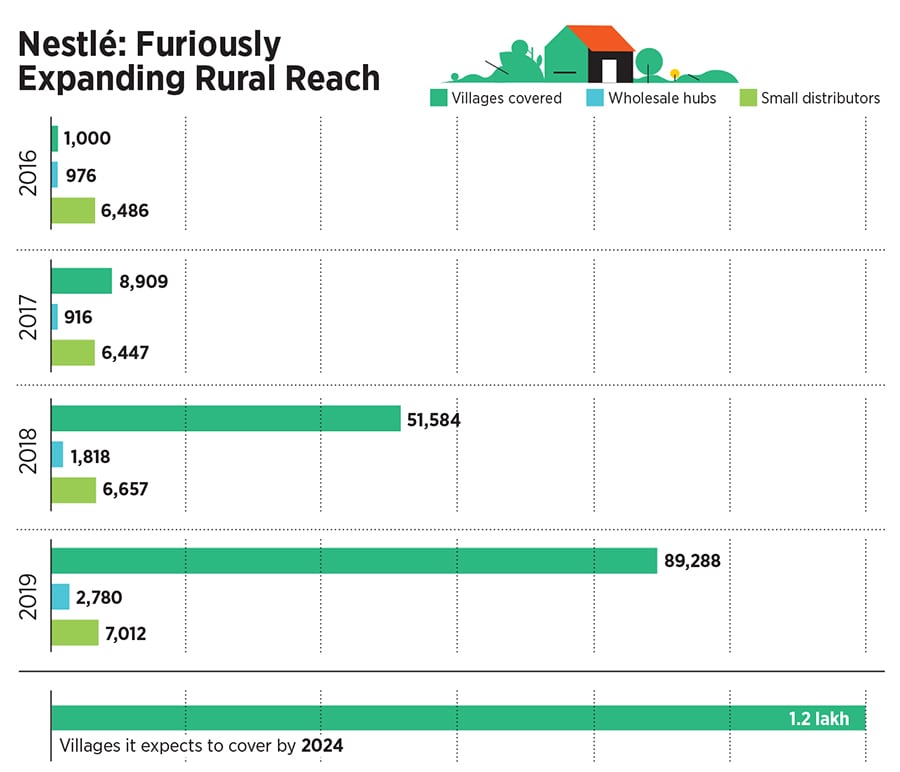

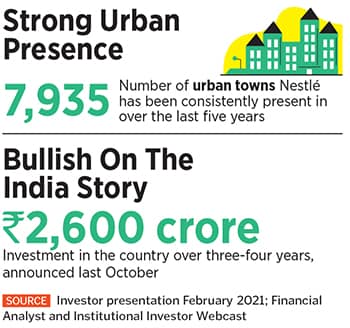

Nestlé’s product portfolio meant that the company had identified its target group: 315 million city residents. “This does not mean that Nestlé is going to be a clearly urban company with no rural contribution," Narayanan clarified. To be fair, Nestlé did have a rural reach, albeit of just 1,000 villages. The ground reality, he stressed, was that the growth vectors for Nestlé were loaded more towards the urban markets.

Two years later, in August 2018, Nestlé’s approach didn’t change much. “The strategy of going where the lion hunt is has not changed," Narayanan remarked at an analysts’ meet. The brand was still going where the consumer was. This time, though, Nestlé’s battery of brands was making its way into the hinterland. KitKat was getting into rural areas. So was Maggi. “Our nutrition portfolio is also getting into the rural market," he said. Nestlé was silently undergoing a transformation. The city slicker brand had hit the country roads. From 1,000 villages covered in 2016, the number jumped over 50 times to 51,584 villages.

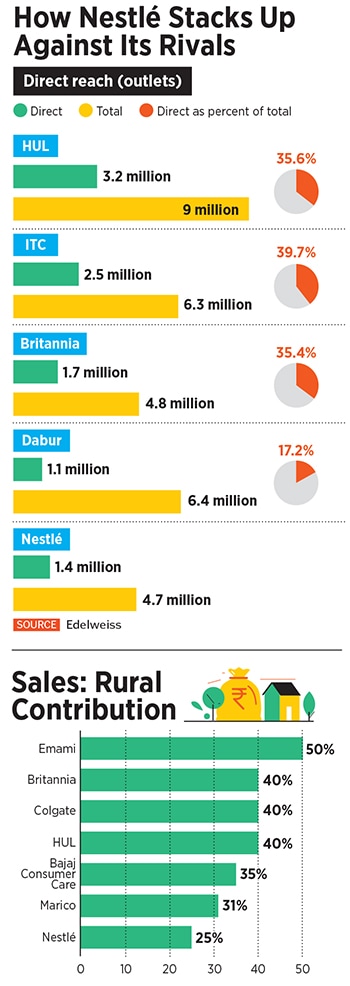

Nestlé’s top honcho was gradually getting a hang of how rural India was mimicking its urban counterpart. The digital divide in India was breaking down at an alarming rate. Rural and urban people, Narayanan underlined to the analysts, see the same advertisement. “We can call it the Jio effect where people tend to watch more videos." This, he stressed, is becoming a brand equaliser as far as brand aspirations are concerned.

Fast forward to March 2021. Nestlé has donned a ‘plural’ (urban plus rural) avatar. The world’s biggest food company is fanning across 89,288 villages to hunt for its next leg of growth. “Rural is an important dimension of the next phase of Nestlé," points out Narayanan.

Reason: The portfolio, reach, relevance, price point and convenience of most of the Nestlé brands resonate well with consumers in Bharat. “Today, rural India buys multipacks of Maggi," he tells Forbes India in an exclusive interview. “They are medium to heavy users of the brand," he asserts, explaining how the new paradigm has been changing the DNA of the company. If you look at the performance of the company, Narayanan underlines, in the last couple of quarters, Tier II, III and IV towns and rural areas have been growing at almost twice the rate, if not three times, of urban India. “The balance is gradually shifting."

Nestlé now gets around 25 percent of its revenue from rural India, lagging the industry mean of over 35 percent. The interesting part, though, is that the sales come on the back of only 30 to 40 percent of the products that the company has made available across the hinterland. The early success has made Narayanan more audacious in his approach, and ambition. “We are now targeting 120,000 villages," he asserts. The expansive reach is going to be equally matched by smart marketing. Nestlé will explore tailor-made products for semi-urban and rural markets. What this means is separate products, separate packs, and a different route to the market. “We are preparing ourselves for the future quite strongly," he says.

Nestlé’s big bet on rural India comes at a time when, especially during the pandemic year, villages showed immense resilience and growth for FMCG players. “Rural markets for FMCG performed much better than the metropolitans and smaller towns in 2020," says Sameer Shukla, executive director (retail intelligence, India) at NielsenIQ. The performance, he adds, comes on the back of multiple tailwinds, including good monsoon in the last two years, an increase in government spending on rural employment schemes, and the pandemic having negligible impact on rural activities. Gauging this trend, FMCG manufacturers are putting greater focus on rural markets where they are investing to increase their distribution reach, and are innovating with low-unit packs, and trade and consumer promotions, he adds.

For Nestlé, the foundation of a strong future was laid in 2017-18 when it adopted a ‘cluster’ approach to marketing. And it was the chinks in the armour that triggered the birth of a fresh approach and perspective. Till then, consumer targeting was influenced by precedents and performance. New products planning and launches were also based on largely legacy performances. The definition of big cities and large metros also underwent a change with the emergence of smaller towns such as Ranchi and Raipur as consumer power hubs. Nestlé badly needed to update its view on Indian consumers. The need of the hour was to look for ‘many Indias within India’.

This is what Nestlé did with its cluster approach. A fairly extensive exercise using big data and analytics was unleashed to map out every single area that the company operated in. The idea was to reach out to consumers more efficiently. What it also entailed was a sharper understanding of the users to know their demographic, typographic, attitudinal, media and shopping habits. “What sells where and who buys what and why were looked into," Narayanan pointed out in the analysts’ call in 2018.

What came next was mapping out the country into 15 clusters. While three of them were geographic branches, three others were billed as metropolitan clusters. The clusters were the prism through which every decision was made in terms of marketing. From consumer-led activities to distribution and brand-led initiatives, and even innovation-powered decisions, everything was filtered through the lens of clusters. “This made performance tracking a lot sharper," says Narayanan. The company was able to track what was working, and what wasn’t, within a geography. What this meant was quick decision-making. The message that perpetrated down the organisation was clear: Don’t waste time going after things that didn’t work. “Don’t keep trying it out in different geographies. Take it out, improvise and do something else," adds Narayanan.

The cluster strategy was complemented with a flurry of new launches and innovations. In the last five years, Nestlé entered into two new categories of breakfast cereals and malted drinks and launched around an unprecedented 80 new products such as Ceregrow, KitKat dessert delight, and baked noodles. “There are about 40 to 50 new projects we are working on, including new categories," says Narayanan. The innovation rate, he lets on, over the last five years is about three times the rate Nestlé had ever done in the past. Work was also done to tackle counterfeits in rural areas. A QR (quick response) code-enabled anti-counterfeit solution was created for Maggi’s Masala-Ae-Magic to ensure the authenticity of the pack. “We also initiated an awareness campaign titled ‘Har peela noodle ka packet Maggi nahi hota (every yellow pack is not Maggi)," informs Nikhil Chand, director (foods & confectionery) at Nestlé India. From participating in local haats (markets) to advertising in local languages, Nestlé started reaching out to rural consumers in a much more aggressive manner.

In spite of the fact that Nestlé is the last among the big FMCG players to chant the rural mantra, the clip at which the rural juggernaut has rolled on is astounding. Narayanan, though, doesn’t reckon that Nestlé is late in joining the rural party. He explains: Time, orientation and relevance of the brands in rural markets should also come before a company starts investing in the infrastructure. Colgate dental cream and Colgate toothpowder, he points out, had a lot of relevance in the rural market and that’s why Colgate had a strong rural distribution system. “As far as Nestlé is concerned, our convergence of aspirations started to happen over the last couple of years," he says. That’s why the presence of nutrition, milk and coffee portfolio is more ubiquitous now than what it was before.

Though Nestlé’s rural contribution to sales (around 25 percent) is the lowest among its peers—Dabur gets 47 percent—Narayanan is not worried. “If I am able to ramp it up quickly, the contribution would increase significantly," he says. Nestlé’s acceleration in rural India, he adds, happened only because of the interplay of two factors: There was a convergence of aspiration, and convergence of availability.

A joint study conducted by the World Economic Forum and Bain & Company in 2019 pointed out a seminal shift in India’s consumption landscape. “Aspirations are fast converging across urban and rural India," the report underlined, adding that internet and smartphones have significantly bridged the information divide between consumers in urban and rural India. Beyond the top 40 cities, the report titled ‘The future of consumption in fast growing consumer markets’ outlined, developed rural and small urban towns have a similar income profile. “At a given income level, both these consumer groups desire a similar standard of living, aspire a similar set of brands and are equally comfortable with technology-enabled consumption," it observed.

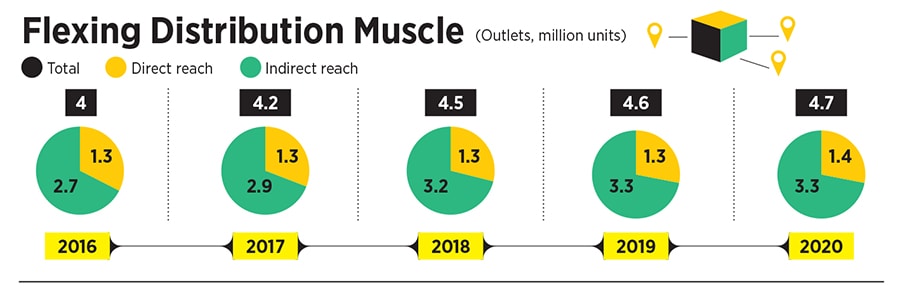

Back in Gurugram, Narayanan adds another insight. “Convergence of aspiration in the digital age has been far sharper than what we had imagined," he says. Today, the content on YouTube watched by a young person in any of the smaller towns or villages is not different from what is watched by their urban counterparts. Rural India will continue to drive internet adoption and is expected to witness double-digit growth for the next few years. Rising internet consumption, aided by tumbling data rates, plunging cost of smartphones and an increase in rural penetration of smartphones, has given wings to the aspirations of consumers in the hinterland. Thanks to the progress made by ecommerce, especially during the pandemic, goods are available at an arm’s length across villages. Nestlé’s rural footprint, Narayanan underlines, has expanded on the basis of five key vectors: Wider penetration expansion of the portfolio deploying suitable structure of people ensuring visibility of products where they matter and consumer connect in terms of campaigns and activations.

Industry analysts are not surprised by Nestlé’s success. Nestlé India, brokerage firm Edelweiss pointed out in its report in February, has been among the most consistent performers, clocking double-digit domestic sales growth in 12 of the past 13 quarters. In the fourth quarter of 2020, its domestic sales (10.1 percent year-on-year) outgrew peer Britannia’s 6.1 percent. “We continue to expect Nestlé’s high innovation and ‘premiumisation’ agenda, and cluster-based distribution strategy to hold it in good stead," it concluded.

Marketing experts too laud Nestlé’s early success in the hinterland. Being a late mover, they reckon, helps.

“Powerhouse brands can always find a market, even if they enter late," says Jessie Paul, chief executive officer of Paul Writer, a marketing advisory firm. Nestlé does not have an umbrella branding strategy. Each of its products is positioned as an independent brand. As a late entrant, it can leapfrog competition by not being tied down to a legacy distribution structure, and instead build one on the foundation of ecommerce, using a third-party distribution network, she adds.

In spite of Nestlé’s decent headway, the countryside is set to be full of surprises. Paul mentions one potential challenge for the Swiss major: A smaller portfolio of products compared to HUL, Dabur or ITC, which have more SKUs (stock keeping units) to offer the retailer they can, therefore, demand better shelf visibility. While Maggi and Milkmaid are generic terms for their category, other brands in Nestlé’s lineup will have to invest in building their recall against category leaders like Cadbury’s, Bru and Kellogg’s.

There is another red flag. Except Maggi, no other brand of Nestlé has a strong pull factor. The company, says a big stockist of a rival FMCG brand in Meerut, has not been aggressive in pushing its products. The massive reach among villages that it’s talking about is not direct. “It’s largely indirect reach, dependent heavily on the wholesaler and the small distributor," he explains. Another pain point is the absence of a dedicated rural sales team on ground. “Even if there is one, it’s invisible," the dealer adds. Rural, he continues, is a combination of pull and push. “One can’t be at the cost of other," he says, adding that the absence of low-priced units of most of the products in the milk and nutrition segment only adds to the company’s urban bias.

There might be another bend round the corner: Absence of more global brands in India. Though Nestlé has 35 billionaire brands—ones that sell more than one billion Swiss francs per annum—there are only nine of them in India. Nestlé does well in marketing scientifically-backed products, but most of its existing ones won’t be able to meet the new-age nutritional expectations unless they bring in new products from outside, reckons Jaspal Sabharwal, a private equity veteran and CEO of TagTaste, a sensory analytics and product development platform.

Narayanan lists a different kind of challenge. “For Nestlé, it is not about ‘what to launch’ but ‘when to launch’," he says. Pointing towards a rich bank of over 2,000 brands that Nestlé has globally, he underlines the massive product and innovation runway that the company has.

Meanwhile, back at Chittawala Khaddar village, Mandal knows what is best for her family: Trusted brands. Last year, she opted for a few small packs of some obscure Mango drink brand as it offered a hefty margin. The gambit backfired as nobody in the village wants to buy an unknown brand, however cheap that might be.

Trust, points out Narayanan, is back with a bang. Thanks to the pandemic, people are veering more towards trusted, safe and better nutrition brands. Nestlé is well-placed to benefit. “Nestlé’s time has come," he says. Underlining that focus on rural doesn’t mean that urban is off the radar, Narayanan says the company will woo consumers of all kinds: Urban, semi-urban, rurban and rural. But the V for victory will now have to start from the village.

First Published: Apr 05, 2021, 12:16

Subscribe Now