Bleeding unicorns: Rising losses at startups

Rise in investor sentiment, however, means money to regain market share

Image: Shailesh Andrade / Reuters

Losses at indian unicorns continue to swell as they struggle for market share. Fortunately, with investors turning euphoric after a lull in 2016 and 2017, the unicorns have the firepower to expand operations and regain market share with discounts and promotions.

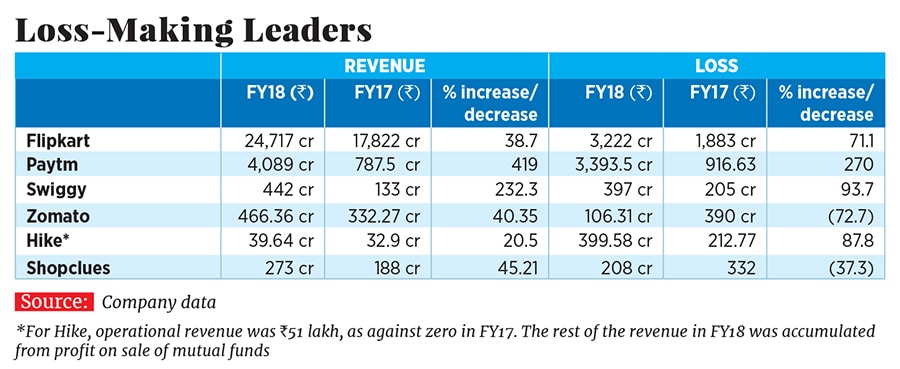

Flipkart, Paytm, Swiggy, Zomato, Hike and Shopclues together posted ₹7,726 crore in losses in the year ended March 2018. According to a YourStory report, Indian startups cumulatively raised about $13.7 billion between January and December 2017. This implies that losses posted by these six unicorns in fiscal 2017-18 accounts for about 9 percent of the funds raised by all Indian startups in 2017.

Losses have been particularly high for Paytm, a distant number three to Flipkart and Amazon, as its ecommerce business bleeds. So is the case with Swiggy, the fastest startup to become a unicorn, which is battling Zomato for market share.

Unicorns such as Pine Labs, Oyo, Byju’s, ETechAces (which owns PolicyBazaar and PaisaBazaar) and Freshworks are yet to post their annual results. Pine Labs and ETechAces were, however, profitable in FY17, while Freshworks posted a paltry ₹95 lakh in losses.With investors going for sectoral leaders, smaller businesses may have to sacrifice growth and conserve cash. For instance, a cash-starved Shopclues reduced losses in FY18, while revenue grew year-on-year by ₹85 crore, as against Flipkart Internet’s (the marketplace arm) ₹700 crore increase in revenue and Paytm Mall’s 100-fold increase in revenue to ₹775 crore.

First Published: Nov 06, 2018, 15:04

Subscribe Now