It all started in March, when the Covid-19 pandemic swept the globe, disrupting businesses big and small. Tewari, founder and CEO of the InMobi group, an ad-tech multinational, was rather distressed, uncertain about what the future held for him and his 1,700 employees. InMobi is India’s first unicorn—a feat that it achieved in 2011.

“I was extremely worried,” an emotional Tewari tells Forbes India. “We didn’t know whether we would have a business. What if the business was just not going to exist? What if costs ballooned? It was hard to predict.”

As with many companies that have since managed to tide over the storm, Tewari and his team also cut costs and repurposed the business. But it wasn’t easy. “I decided to be very, very transparent with people on what I was going through,” says Tewari, who’s dressed in a black sleeveless windcheater, T-shirt and jeans, at his home in Bengaluru. “So, I told them that I didn’t have a plan.”

Much of that was because he didn’t have any optimistic projection of where the business was headed. InMobi’s key markets—the US, China and Southeast Asia—were severely hit as those economies plunged into a recession. Tewari, the son of a former professor at IIT, knew that he had to ensure his employees weren’t hurt amidst the crisis, and there weren’t any layoffs. So, while there was a pay cut across the company, the founders took a deeper salary cut to ensure that the others weren’t as badly bruised.

“My first instinct was to make sure that no one is badly impacted,” the 43-year-old says. “I think in a very good way we braced for impact and then we said we cannot just be sitting ducks. That’s not who we are. So, let us go and convert this crisis into an opportunity.” Over the next few months, the InMobi group, which comprises three businesses—a B2B ad tech business InMobi, B2C app Glance and another B2B business, TruFactor—spent its time getting rid of unwanted costs, in addition to aggressively reaching out to its customers offering new solutions. The gamble worked, and Tewari says business is now back to normal.

![naveen tiwari naveen tiwari]()

“In our advertising businesses, we explored new categories of advertisers because the old ones were not as large anymore,” Tewari says. InMobi, the cash cow of the InMobi group, is an ad-tech platform that matches users to advertisers and helps developers monetise their apps, and provides insights to help advertisers and brands target users better. “Travel, airlines and retail went away. A lot of the traditional sectors were not there. But business did shift to new sectors such as productivity, entertainment and a bunch of other digital services. We went through this massive shift to essentially move our systems to support this.”

Around the same time, as countries went into a lockdown, it also helped that people had more time on hand. That’s when the company began paying more attention to its latest offering, Glance, an app that serves customised news, media content and games on the lock screen of a phone. “We knew we should do a lot more to show them entertaining content,” Tewari says. “We thought let’s go innovate on content.”

In December 2020, tech giant Google decided to invest $145 million in Glance, along with existing investor Mithril Partners, catapulting the two-year-old company to a unicorn status, making it Tewari’s second unicorn in a decade.

“I think we’ve come out exceptionally well out of the pandemic,” Tewari says. “The year ended on a high for us. With both our businesses, we had the best year. People stayed at home and businesses moved online. So, advertising dollars shifted towards an online mode. We were ready with making these changes to essentially pick that media money up. And therefore, we kind of thrived big time.”

Glance has 125 million daily active users, according to Tewari, making it the world’s eighth largest app. Tewari claims, on an average a user spends some 25 minutes on the app. “Ahead of us is just Pinterest and Twitter,” he continues. “We fall in the top 10 of the world’s largest consumer platforms.”

Building out Glance

The decision to begin work on Glance began in late 2016. It was then that a team of four from InMobi approached Tewari with an idea to build on the lock screens of mobile phones. “I looked at that and said, ‘Why don’t you guys tell me what we can do’,” Tewari says. While they came back with ideas, Tewari wasn’t certain how those could eventually be rolled out. “It was nothing great, but it showed me that there was potential to build something big out there,” he says. “All this time, the lock screen was a dead asset.”

That’s when the team began working on different ways to use the lock screen before zeroing in on an app that provides personalised content in multiple languages, including English, Hindi, Tamil, Telugu and Bahasa, on the lock screen of Android smartphones. The content includes trending news, across a range of categories such as entertainment, sports, fashion, and news, and is delivered in a visually rich format.

“So the realisation was what if there could be a way for us to think about the lock screen as a gateway for the internet for every consumer, instead of having to go into the phone and click a button,” Tewari says. “What if all the content from these apps went up to the cloud and I could use artificial intelligence to essentially put that content onto the lock screen, making the lock screen live.”

![inmobi tech inmobi tech]()

By early 2019, the app went live and raised its first round of capital in September 2019 with a $45 million investment from Mithril Capital. By December 2020, Google also invested in the company. The app currently comes pre-installed in five Android-based smartphone brands, including Realme and Gionee, and is in the process of partnering with a few more.

“Let me give you an example,” Tewari quips when asked why the app can’t be replicated or even developed by phone manufacturers, who can then make the Glance app redundant. “If you go back in history, WhatsApp was out in the open. People were using SMS. Still, no phone manufacturer went and purchased it. It was the same with Uber. But no car company bought it or developed something like that.”

Glance currently shares its revenue with phone manufacturers, who have been provided with an opportunity to monetise their surface, which they couldn’t earlier. That means, unlike earlier when the relationship between a phone manufacturer and a user remained limited to just the one-off purchase, now phone manufacturers can also monetise from content. “Whatever monetisation I do, I share the revenue with them,” Tewari says. “It’s not as if I’m alienating them.”

After the latest round of funding, Tewari and Glance are setting out to acquire more customers and going into newer markets apart from enhancing the company’s artificial intelligence (AI) capability and expanding its team. “We’re in India, Indonesia, Philippines, Thailand, and Malaysia. Southeast Asia contributes to 25 percent of our business,” Tewari says. In 2019, Glance also acquired short video platform Roposo for an undisclosed amount, giving it access to Roposo’s network of professional, vernacular content creators.

“It (Glance) goes down to 125 million users today, but has the potential to reach a billion people and phones in five years,” Tewari says. “We own Roposo and we can scale a lot more because of what happened with TikTok. We have access to millions of creators, but we’re not trying to compete in the short video war. Glance is like an AI-led television where live performances of the country can actually come together.”

That also means there is a massive commercial opportunity waiting to be tapped. “We’re trying to essentially bring commerce on top, something like an influencer-led commerce,” Tewari says. “So, we are creating a new economy of influencer-led commerce, which in China has contributed to 25 percent of its ecommerce market. That’s the impact we’re trying to have. We want to do that at a global level because we’re taking Glance global and that’s why we are excited.”![glance glance]() In December 2020, Google invested $145 million in Glance, making the two-year-old wcompany a unicorn[br]Glance was carved out as a separate arm in 2019 when Tewari and the team decided to create an umbrella group, the InMobi group. While InMobi, the flagship advertising-technology business, continues to be the cash cow and mainstay, Glance and data vertical TruFactor were created as separate subsidiaries to tap fresh capital. “The idea was that I’ll get different capital,” Tewari explains. “I don’t have to rely on the proceeds I’m making, but I can burn money because we saw some massive success here [Glance].”

In December 2020, Google invested $145 million in Glance, making the two-year-old wcompany a unicorn[br]Glance was carved out as a separate arm in 2019 when Tewari and the team decided to create an umbrella group, the InMobi group. While InMobi, the flagship advertising-technology business, continues to be the cash cow and mainstay, Glance and data vertical TruFactor were created as separate subsidiaries to tap fresh capital. “The idea was that I’ll get different capital,” Tewari explains. “I don’t have to rely on the proceeds I’m making, but I can burn money because we saw some massive success here [Glance].”

“From a business standpoint, not many players have been innovative around the mobile advertisement space,” says Pavel Naiya, a senior analyst with consultancy firm Counterpoint Technology Market Research. “Most of the innovations have been around optimisation of user flow and based on the data that is available. But when we talk about the next billion coming into using smartphones, many of them don’t have traces of their digital transactions or behaviour. In that sense, Glance has moved beyond software.” India currently has over 540 million smartphone users, a number that is expected to grow by 500 million in the next few years.

The Indian government’s ban on 200-odd Chinese apps, including TikTok, a direct competitor to Roposo, has helped. “Even advertisers are being careful about who they partner with, especially with issues surrounding Chinese apps and the focus on data sovereignty,” says Yugal Joshi, vice president at Texas-based consultancy firm Everest Group. “In that sense, it works out well for them. Glance has also been focusing on the vernacular medium with an eye on monetisation.”

Through Rough Times

Much of the focus on monetisation is a direct result of the company’s floundering fortunes, sometime in late 2016. “We were on the back foot then,” Tewari says.

Back then, the US Federal Trade Commission had said that InMobi had “deceptively tracked the locations of hundreds of millions of consumers, including children, without their knowledge or consent to serve them geo-targeted advertising”. The company was then slapped with a $4 million penalty, which was later slashed to $950,000 based on the “company’s financial condition”. Around the same time, questions were raised about the company’s uncertain future as it was burning cash and had to lay off people.

“In the strategy that we had, we were burning money,” Tewari says. “We were losing money and gaining market share. We were also not getting any investor love because external investors said they don’t know how long they have to fund this industry on losses. You enter a phase in an industry where investors are uncertain about where the space is going… just like what happened to ecommerce.”

![pavel naiya pavel naiya]()

Much of that, Tewari reckons, was because of a firm belief in the market that Google and Facebook would win the advertising market in the long run, particularly since they controlled over 70 percent of the market. “We didn’t believe that,” Tewari says. “But that doesn’t mean that they would fund us. People believe differently, so we went down this whole path of profitability and decided to be profitable, self-sufficient and self-reliant. We’ve been profitable now for the fifth year running.”

Around the same time, the company began focusing on strategy and partnerships. “We innovated on the culture, people practice and platform to not go down the same strategy as Google and Facebook,” Tewari says. “We said we will go down the path of transparency, independence and partnerships.” Today, as much as 65 percent of InMobi’s revenues come from the US and 20 percent from China. The remaining comes from the rest of Asia.

“India is about seven or eight percent of the market for us,” Tewari says. “But that’s also large. Of the global ad market, India is only 1.25 percent. So, we’re over-indexed in India from a global ad spends point of view.” In 2018, InMobi also struck a partnership with Microsoft that involved technology collaboration and combined go-to-market strategies.

“The market is too large,” Tewari says. “Google and Facebook own 70 percent of the market. But in a market that is $100 billion, going to $500 billion, I want to be one of the top players in the remaining 30 percent. If you can be a top player in a $120 billion market, it’s a massive opportunity.” Globally, spending on digital advertisements is expected to reach $389 billion in 2021 from $332 billion in 2020, according to New York-based market research firm eMarketer.

In addition, the company also began focusing on the consumer side. “The reason for the success of large companies like Google and Facebook is that they have their own users,” Tewari says. “We thought we should have our own users. Let’s innovate and that’s how Glance was born.” Today, Tewari says that the company is among the top performers in the SoftBank portfolio in India. “We are growing at 40 percent year-on-year and we maintain high margins, close to 40 percent,” Tewari says. “When I use the word profitability, at the group level we might still be loss-making because we have not taken money at Glance to essentially go for rapid growth.”

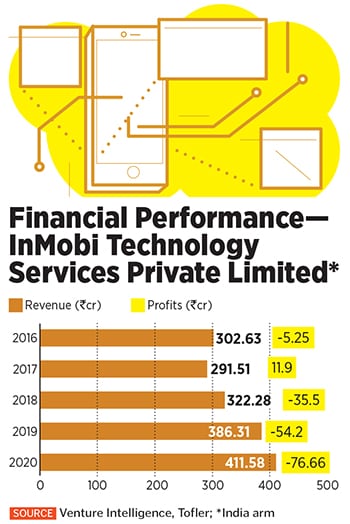

InMobi Pte Limited is the parent company of the group, based out of Singapore. It is also the majority shareholder in Glance. InMobi Technology Services Private Limited is the Indian arm of the group.

“Naveen’s business acumen and empathy are reflected in the way he has shaped the strategy and culture of InMobi group—successfully competing against ad-tech giants and growing a massive consumer internet business,” says Marcelo Claure, CEO of SoftBank Group International, & COO of SoftBank Group Corporation. “As an early backer, we are proud of what InMobi group has achieved in a short span under his bold leadership.”

Tewari has his hands full now and is looking to piggyback on the strategies laid out for the next few years, at InMobi and Glance. “I’m happy with the growth on both sides,” Tewari says. “I think I see a line of sight for the InMobi business which is to be multi-billion dollars in revenue and even get to half a billion dollars of profits. Glance will be one of the top 10 consumer properties, and it will move up that ladder alongside Snapchat or Twitter. It’s going to be a massive business and we’ll get to a billion-user platform.”

For now, Tewari and his group of co-founders are trying to figure out how TruFactor, the third arm, will play a role at the group. “I am more interested in making these (Glance and InMobi) massively large,” Tewari says. TruFactor is trying to help retailers leverage their data to create better experiences for consumers who come to shop. “It’s very focussed and trying to solve a deep problem,” he adds.

Besides, the company is also planning to list its ad-tech business. “We are actively looking at it,” Tewari says. “In the last two years, investor confidence has come back. They have realised that the belief they held of Google and Facebook taking over the market wasn’t true. There is a 30 percent market to go after and the ad-tech market is very hot from an IPO perspective right now. So, we’re closely evaluating.”

With two unicorns under his belt, is the IIT and Harvard-educated Tewari looking at another unicorn from his stable? “An idea has to be crazy enough,” he says. “It should alienate most people, and unless and until it doesn’t, it’s not a great idea. If everybody agrees to it, then the idea would be an average thing to do.”

Who better than Tewari to know that.

Naveen Tewari, founder and CEO, inMobi

Naveen Tewari, founder and CEO, inMobi

In December 2020, Google invested $145 million in Glance, making the two-year-old wcompany a unicorn[br]Glance was carved out as a separate arm in 2019 when Tewari and the team decided to create an umbrella group, the InMobi group. While InMobi, the flagship advertising-technology business, continues to be the cash cow and mainstay, Glance and data vertical TruFactor were created as separate subsidiaries to tap fresh capital. “The idea was that I’ll get different capital,” Tewari explains. “I don’t have to rely on the proceeds I’m making, but I can burn money because we saw some massive success here [Glance].”

In December 2020, Google invested $145 million in Glance, making the two-year-old wcompany a unicorn[br]Glance was carved out as a separate arm in 2019 when Tewari and the team decided to create an umbrella group, the InMobi group. While InMobi, the flagship advertising-technology business, continues to be the cash cow and mainstay, Glance and data vertical TruFactor were created as separate subsidiaries to tap fresh capital. “The idea was that I’ll get different capital,” Tewari explains. “I don’t have to rely on the proceeds I’m making, but I can burn money because we saw some massive success here [Glance].”