How Axio is building a resilient buy now, pay later business

Zeroing in on embedded finance at the point of checkout, Axio's founders have built a sustainable business that's ready for more

You’ll find Axio in pleasantly surprising places—try the smartphone app of the French sports apparel and equipment retailer Decathlon, for example. Pick up a backpack for trekking, maybe, and at the checkout, there’s the option to pay in instalments—with Axio.

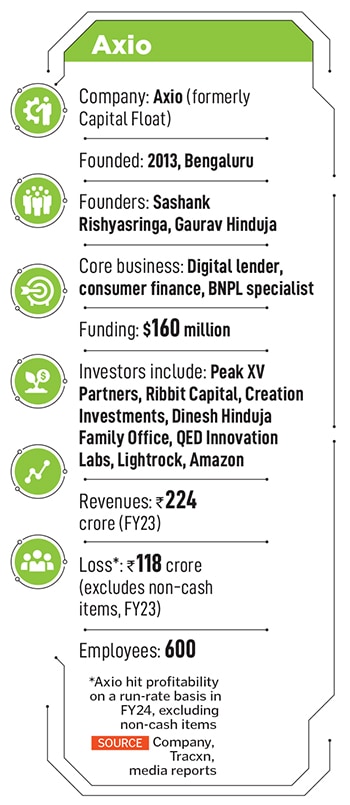

This wasn’t the case in the early years after Gaurav Hinduja and Sashank Rishyasringa, Stanford MBA mates, returned to India and started the company—then called Capital Float. With some competitors raising big investments, hitting unicorn status and what not, the fear of missing out had them try many different loan products.

To their credit, they didn’t break things and fail fast, but took a deep breath or two and found their niche in what is today popular as buy now pay later, or just pay later.

To their credit, they didn’t break things and fail fast, but took a deep breath or two and found their niche in what is today popular as buy now pay later, or just pay later.

Today, having hit breakeven on a run-rate basis in FY24, they are on the verge of becoming a profitably sustainable business. Some 10 million customers have taken a loan at one point or the other from the company since it was started about 10 years ago.

Also read: Sashank Rishyasringa and Gaurav Hinduja at axio on the credit fintech opportunity ahead

Their “embedded finance" approach makes purchases more affordable—be they urgent essentials or discretionary impulse buys. And it also helps increase conversion for merchants. "We use that to build a relationship with the next frontier of customers who are digitally active but not well served by the banking system," says Rishyasringa.

Axio has thousands of merchant partnerships, not only with niche operators—like Decathlon—but also some of the largest, mainstream ones, including Amazon, Xiaomi and the Tata group.

“The past year was probably one of the best years for the company," says Hinduja. “We have now become profitable as a business, at least in the last couple of quarters, and we are operating at scale," he says.

“The past year was probably one of the best years for the company," says Hinduja. “We have now become profitable as a business, at least in the last couple of quarters, and we are operating at scale," he says.

They got there by understanding the risk and collections deeply and building both the processes and the tech for effective collections—keeping bad loans down.

“They are getting super resilient," says Mridul Arora, partner at Elevation Capital, a VC firm that’s been one of Axio’s early investors. There’s also a frugality in the company’s culture, where, for example, “the founders don’t talk about it, but they didn’t take salaries" during some tough times, Arora says. He was making the point that, overall, deliberate attention has been paid to keeping costs down.

They now have deep, proprietary know-how to understand a customer’s creditworthiness in real time online, approve large numbers of people and control the bad loans months down the line to acceptable rates of 2 percent or lower, the entrepreneurs say. They are expanding into loans in health care, insurance and even offline opportunities.

Today, the relationship starts with checkout financing for a specific product. Over time, the same customers could return for bigger personal loans, for example “and that is a profitable business", Arora says. In time, the founders see Axio getting into secured loans as well.

First Published: May 15, 2024, 12:56

Subscribe Now