“It’s a brand I admired as a kid, so there is nostalgia and an emotional connect," he says. And even though he has no intention of selling them, (“I always say these will go with me to my grave," he says), the other motivation is, of course, that these cars hold and often appreciate in value. “You can’t compare it to an investment per se, but you can definitely look at it as something where your money will remain safe. Though more than the notional appreciation, it’s the time capsule experience that brings a smile to my face."

Classic cars have for long been a part of passion investments among the rich and among collectors, but social media awareness, the formation of car clubs and communities, and increasing opportunities to get the cars out regularly are driving further interest in them. According to an attitude survey conducted by Knight Frank’s The Wealth Report 2022, 11 percent of the investable wealth of Indian ultra-high net worth individuals (UHNWIs, whose net worth is $30 million or more) is allocated towards passion-led investments against the global average of 16 percent, and about 29 percent of Indian UHNWIs spent more on passion investments during 2021. Joy of ownership scored above investment returns, and was marked as the driving factor to collect investments of passion by the Indian ultra-rich.

The report adds that art was the most preferred investment by Indian UHNWIs, followed by jewellery and classic cars while luxury handbags and wines slipped from their earlier first positions to 5th and 7th respectively in 2021 (see table).

People have always been interested in classic cars, says Mumbai-based Kaizad Engineer, who restores, invests and trades in vintage and classic cars, and this interest had been on an incline even pre-Covid. “The change post-Covid is that since people have missed out on an entire year in their life, they are pushing towards getting something they have always desired. And they are probably spending a little more than they would generally," he says. Unsurprisingly, post-Covid, time is also of essence and people are looking to buy ready cars rather than go through the waiting period of restoring one. “The trend right now is people want ready cars to just buy them, and use them and be seen in them," says Engineer.

Classics and modern classics like Japanese cars from the 70s and 80s, American sports cars and German cars are popular (as a rule of thumb, early cars are referred to as veteran pre-Second World War cars fall in the vintage category and the ones after into classics and modern classics). “Vintage cars are difficult and more complex to drive, but classics from the 70s and 80s, especially Audis and Mercedes-Benz models, are still modern, and can be driven like regular cars, so a lot of young people are going for these modern classics, as they can relate to them better," says Srinivas Krishnan, communications professional and commentator on the automotive sector, who owns a 1960 VW Beetle.

And for collectors, as with art, so it is with cars—there has to be resonance and an emotional connect. “You buy art or a car to fill a hole in your soul rather than as an investment," he adds.

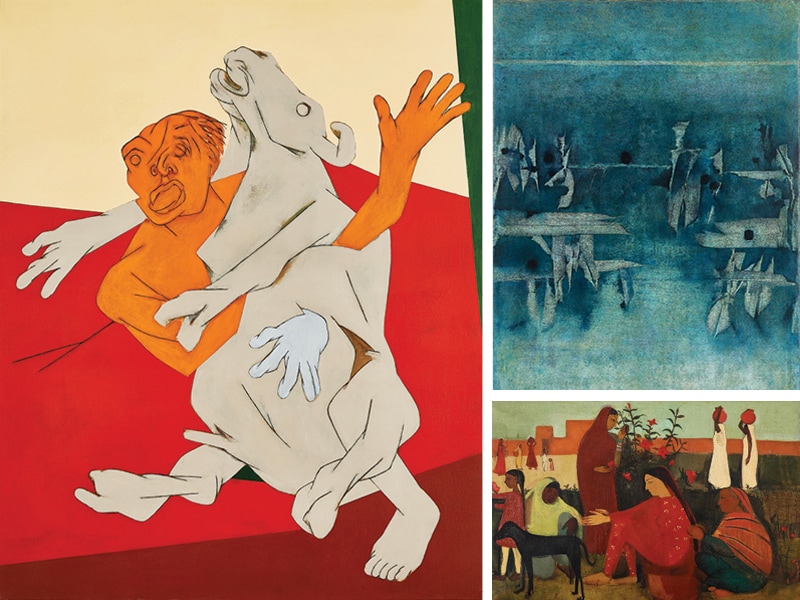

![]() The three most expensive works of art in FY22 were (top) V S Gaitonde’s Untitled 1969, oil on canvas, ₹42 crore (above) Amrita Sher-Gil’s Untitled 1938, oil on canvas, ₹37.8 crore (left) Tyeb Mehta’s Untitled 1995, acrylic on canvas, ₹32 croreImage: Saffronart

The three most expensive works of art in FY22 were (top) V S Gaitonde’s Untitled 1969, oil on canvas, ₹42 crore (above) Amrita Sher-Gil’s Untitled 1938, oil on canvas, ₹37.8 crore (left) Tyeb Mehta’s Untitled 1995, acrylic on canvas, ₹32 croreImage: Saffronart

Art of the Matter

The wheels put in motion by Covid also seem to have continued to roll in the art world. The Indian art market, both privately and at auction, had set new records in FY21. Though there was some concern that the buoyancy might be an anomaly and that the sector would take a hit in the aftermath of the pandemic, the results for FY22 have been even better, according to a recent report by IndianArtInvestor.com, an art market intelligence firm focussed on the performance of Indian art, tracking the sales of over 970 Indian artists.

Clocking a turnover of ₹1,025.6 crore, with the sale of 3,617 artworks, the market recorded a 15.9 percent rise in turnover and a 7 percent increase in the number of works sold from the previous year. In FY22, new world records were set for 157 Indian artists—more than double the previous financial year, indicating sharp growth and a widening of the buyer bracket.

![]()

The outbreak of Covid and its implications might have played a catalyst in spurring individuals and families into buying a few works of art, but the sustained interest suggests that people are looking at it with a little more seriousness. “The industry’s strong performance at a primary level, in addition to an already supercharged secondary trade market, is indicative of the seriousness of the collector/investor segment," says Arvind Vijaymohan, chief executive of Artery India, an asset advisory firm that manages the art investment holdings of a select set of high net-worth Indian families.

Vijaymohan recollects an episode, about six months ago, involving a generationally wealthy family that had decided to move into a new mammoth estate that would house the patriarch brothers and their children—some of them successful entrepreneurs in their own right at present. They decided that an 80-foot wall in the common entertainment hall should display an impressive work by MF Husain. The family wanted a single work of art, which was a tall, if not impossible request. “While Husain had created several monumental panels, these were usually site, or size-specific commissions—works that were unlikely to be resold," says Vijaymohan. They offered the family an alternative: To locate about a dozen works by the artist, that could be displayed salon-style on the wall to create an interesting visual narrative. Vijaymohan adds that this was the family’s first serious art acquisition.

The requests, he adds, are also coming in from younger collectors, between the ages of 32 and 45. Western-educated, followed by stints of work overseas, they have seen the museums of the world and have a high level of engagement with the arts. “They certainly want to live with a higher cultural dose and are willing to become patrons without much ado," he says.

![]() Amid insatiable demand, prices in the iconic fine wine region of Burgundy have been soaring to new heights

Amid insatiable demand, prices in the iconic fine wine region of Burgundy have been soaring to new heights

A Case for ‘Real’ Assets

When demand for fine wine went up during Covid, 2020 turned out to be a good one, but in the context of wine protecting value. In 2021, when people realised this is going to go on for another year, and they were not spending elsewhere, the demand went up further, with people splurging on and uncorking fine wines. “With lockdowns, expansionary monetary policy, no travel, low interest rates, and lots of disposable income, demand in 2021 was very strong," says Ratika Jai Mehra, senior relationship manager at Cult Wines, a wine investment firm. This reflected in a meaningful jump in performance in wine investments and the momentum, she adds, has continued in 2022 with the market at +14 percent YTD (year to date), and some regional performance even at +40 percent (Burgundy and Champagne).

![]()

In 2022, there is also the element of NFTs. Non-fungible tokens were seen as the next big thing, but the cryptocurrency crash seems to have brought people back to something more real. Mehra notes that early on in the year when people were making money in cryptocurrency, they were happy with the returns. “But after the crash, many people wanted to deviate and diversify into something that’s safer because at the end of the day, with wine, you own the asset," she says. After all, in a worst-case scenario, even if someone doesn’t make money on wine, there’s always the choice to drink it.

Vijaymohan agrees. “NFT is a notional product, it’s [not something] you can touch and feel," he says. And considering it is closely linked with crypto, for now it seems to have had its moment in the sun. However, NFTs reside within the tech domain that is driving the present and they cannot be ignored. They certainly will create a future that we cannot even begin to fathom, he says, though, he’d “probably wait till a few generations have been launched, stumbled, evolved and finally found a sound footing—not merely as the format to present an art form, but also with a clear position of how its trading can create unshakeable value".

![]()

New Uncertainties

If the uncertainty of the pandemic year made people realise and appreciate the finer things in life, the current uncertainties around the geopolitical situation, climate change, rising inflation and looming recession seem to be driving demand and playing out in a different way.

In wine, for instance, supply has been reducing due to climate change, such as frost in Bordeaux and Burgundy. Frost kills buds and affects fruiting, but since most big vineyards have fully automated and mechanised processes, they can still produce good wine in an average vintage. However, low production means the demand continues to keep the market and prices going.

In times of high inflation too, when discretionary spending reduces and trade of passion objects takes a hit, investments and prices are expected to remain steady. “Wine prices tend to plateau as trading halts. People hold their stocks until things stabilise and then trading starts again," says Mehra.

![]() A Rolex Daytona 116515ln with a special dial made of meteorite is one of Bhatt’s recent purchases

A Rolex Daytona 116515ln with a special dial made of meteorite is one of Bhatt’s recent purchases

The immediate impact of the [recession] tsunami that everyone is being asked to brace for could be that of extreme conservatism on both sides of the fence, for both buyers and sellers, adds Vijaymohan. Primary markets will record a sharp drop in sales as buying appetites recede and buyers wait for market points to correct. Except, of course, “for the opportunities that will emerge from the seller side where people are just desperate and have to let go".

Dillon Bhatt, head of international business development at investment consulting firm Millwood Kane International, who is also an avid watch collector, sees the looming recession as an opportunity for collectors to pick up extremely rare watches at reduced prices. As part of a small fund he is planning to put together or otherwise, Bhatt plans to help collectors build their passion. The fund will consist of high-end rare watches, mainly consisting of vintage and independent brands. “In the next five to seven years, post-recession, the market for these watches would be more appreciated and values should be worth considerably more," he says.

The Home Front

Real estate, too, has always been a part of diversification of portfolios for the ultra-rich, whether it be second or luxury homes or as an investment. According to the attitude survey conducted by the Wealth Report 2022, 29 percent wealth of Indian UHNWIs is allocated towards purchase of principal and second homes. Indian UHNWIs prefer to invest in properties in the domestic market (India) followed by the international markets of the UK, UAE and US. The survey also cited that 8 percent of the property portfolio was held overseas.

![]() Indian UHNWIs prefer to invest in properties in the domestic market (India) followed by the international markets of the UK, UAE and US Image: Christopher Pike / Bloomberg via Getty Images

Indian UHNWIs prefer to invest in properties in the domestic market (India) followed by the international markets of the UK, UAE and US Image: Christopher Pike / Bloomberg via Getty Images

While for “consumption purposes", points out Vivek Rathi, director-research, Knight Frank India, people buy real estate abroad if they have a child who has gone overseas for education, or if there is an affinity towards a culture or a political environment, “when it comes to investing, in the last year-and-a-half, because of the currency movement, the Indian market has become cheaper compared to the past." In this year alone, he adds, due to the depreciation of the rupee, there has been a 7 to 8 percent gain for any HNI based out of India.

While with the depreciating pound, there is also interest in opportunities in London real estate, says Bhatt. “We focus on London real estate because that’s where our expertise is. However, real estate is going to show a lot of opportunities globally in the next few years," he believes.

Real estate and other investments as a ticket to residence permits and citizenships of other countries have for long been options for those looking for ease of travel, children’s education or setting up a business in another country. As the pandemic unfolded, investment migration firms saw a spike in queries for such options from people looking for safer shores. Now, the queries may have normalised, but awareness has increased.

“We’ve seen a steady rise in inquiries specifically from India, more than double since before the pandemic," says Elizabeth Edwards, marketing manager at UK-based firm La Vida Golden Visas. India, she adds, is now their fourth-largest market worldwide, and “we receive well over one thousand inquiries a year from potential Indian investors". Experts point out that Indian passport holders only have visa-free access to 75 destinations worldwide, which equates to a mere 8.8 percent of the world’s GDP. “By investing in a Residency or Citizenship by Investment programme, they can more than double this figure and enhance their travel, business and education opportunities throughout the world," says Edwards.

![]()

Bhatt adds that awareness about the programmes available has gone up, and people are therefore quicker in making a decision. “They are not waiting around for new information. A lot of what we had to do before was educating the Indian market about the options, but now the clients that come to us are aware of what their options are, and they’re telling us what they prefer and want."

Investment migration historically was centred around people physically wanting to move. But in today’s day and age, besides the fact that families are increasingly becoming cosmopolitan and transnational, they also look at investment migration (or alternative residencies, as in the case of Indians since India does not allow dual citizenship), as an opportunity to build resilience, have a plan B in the current volatile macro outlook, and also achieve the ability to diversify their wealth and not keep all their assets in one jurisdiction, says Nirbhay Handa, group head of business development at investment migration advisory business Henley & Partners. In this age of uncertainty, aggravated by Covid, the war in Ukraine, climate change, the cost-of-living crisis, and political instability in numerous regions, “holding an alternative residence or citizenship", he says, “is the ultimate insurance policy and hedge against ongoing volatility."