Big trading days: Online brokers disappoint

A surge in volumes puts to test the systems and processes of brokers. Users have little recourse

Users of Groww and Zerodha, the largest and second largest brokers in India, were irate on Monday morning. As the market started trading on June 3, users faced problems logging in and executing trades. This came on a day when the markets were in an exuberant mood on account of the exit poll results, which suggested a return of the Modi-led Bharatiya Janata Party (BJP) government.

Part of the problem lay with CDSL, the Central Depository Services (India) Limited, which is one of the two depositories mandated to store securities held in demat accounts. Brokers faced problems connecting with CDSL in the morning. As a result, a TPIN sent by CDSL, which users need to trade, was unavailable. This issue seems to have been resolved quickly. What is unknown is whether problems with logins persisted, and for how long.

While the problems on June 3 were frustrating to users, they were also part of a pattern where heavy trading days see broker systems going down. This is typically on account of two factors. The first are broadly classified as risk-based issues, where even though users are able to log in, share prices may not be correctly displayed, portfolios may take time to load, and trades may take long to place. Orders are in queue is a common message users see. These set of problems are primarily on account of the broker end.

“Architecturally, brokerage systems are quite complex and several larger brokers aren’t able to handle a sudden spurt in trading activity," says Tejas Khoday, co-founder and CEO of FYERS, an online broker. There are multiple API [application programming interface] integrations required.

This is where the planning capacity of the broker for big days comes into play. “Can we control the incident?" says Shanker Ramrakhiani, chief information security officer at IIFL Securities. “The answer is yes, but the organisation has to have the capacity to scale systems three or five times." This means that brokers have to be prepared for days where there is a rush of users in the system. This is typically seen on days like Budget day or when election results, including state election results, are announced.

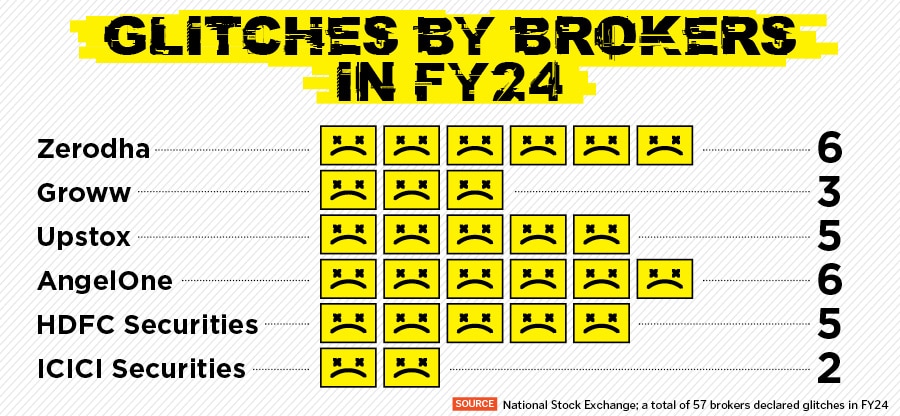

In light of users’ system outages, the regulator Securities and Exchange Board of India (Sebi) has mandated brokers to declare all technical glitches—where users are unable to access the broking system for more than five minutes. In FY24, according to data released by the National Stock Exchange (NSE), 57 brokers declared at least one glitch in their systems. Zerodha reported six glitches, Groww three and Upstox five in FY24.

Second, brokers are dependent on integrations with the exchanges as well as depositories like CDSL and NSDL. When an issue arises anywhere, it is usually the broker that is blamed. For instance, one of the issues on June 3 was the fact that users need a TPIN from CDSL to sell shares and those TPINs were not available.

While Sebi mandates that brokers must not have more than five glitches in a year, it is important to note that the definition of glitches is very wide. What the data doesn’t count is how long the glitch lasted, the reason for the glitch, and how many users it impacted.

An industry executive who spoke on the condition of anonymity compared this to the fact that airlines rarely train pilots on the CAT III instrumentation system to land during foggy days. It is not worth spending so much for a few weeks of flight disruptions. Similarly, brokerages, most of whom now offer free delivery based trades, don’t see it worth their while to spend on big disruption days.

Users transacting on online brokerages often ask for compensation for trades not executed on account of system outages. Here, brokers are quite clear that they facilitate trades and are not responsible for trades not going through. Users sign agreements that indemnify brokers. For those still aggrieved, there is the Sebi SCORES platform where complaints with supporting evidence can be filed. The claim then goes through arbitration and if the investor or trader is still aggrieved the claim can be litigated.

First Published: Jun 03, 2024, 18:19

Subscribe Now