Explained: Why are silver prices rising?

The worldwide market for silver has seen a supply shortfall for three years in a row leading to a rapid rise in prices

Unlike gold which is used mainly as a store of value, silver in addition to having an ornamental value also has industrial uses. It is used in manufacturing of electric vehicles, solar panels and in production of 5G antennas. The result has been steady demand in the range of 1,000 million ounces in the last decade.

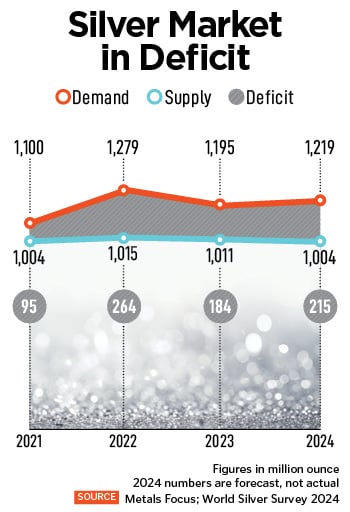

Over the last decade the market was evenly matched in terms of demand supply. For instance 2015 saw a deficit of 18 million ounces but 2016 saw a surplus of 55 million ounces. Compare this to the deficit of 184 million ounces in 2023 and it becomes clear why prices have risen rapidly.

Prices have risen by 60 percent in the last year to Rs 89,000 per kg.

Silver mining has been stagnant over the last decade even as usage has increased. In 2015, 897 million ounces were mined whereas in 2023, 824 million ounces were mined. Recycling has made up a portion of the shortfall with numbers rising from 147 million ounces to 179 million ounces in the same period. During this period industrial demand rose from 457 million ounces to 654 million ounces. Demand for photography, jewellery and silverware was stagnant.

Silver mining has been stagnant over the last decade even as usage has increased. In 2015, 897 million ounces were mined whereas in 2023, 824 million ounces were mined. Recycling has made up a portion of the shortfall with numbers rising from 147 million ounces to 179 million ounces in the same period. During this period industrial demand rose from 457 million ounces to 654 million ounces. Demand for photography, jewellery and silverware was stagnant.

Strikes in 2023 at mines in Mexico played a role in keeping supply restricted. The Penasquito mine run by Newmont and among the largest silver mines globally saw a four-month strike.

There is every likelihood that prices will keep rising. “There is a great deal of co-relation between silver and gold prices," says Lakshmi Iyer, CEO investments and strategy, Kotak Alternate Asset Managers. “Gold has touched an all-time high but silver is still 40 percent off those highs." This means there could still be some upside left.

Lastly, as prices have risen investors have piled on to silver ETFs. This has created its own demand as brokers have to keep aside physical silver against every buy order received. In 2023 net physical investment in silver stood at 243 million ounces or 37 percent of the industry demand for silver.

First Published: May 17, 2024, 17:32

Subscribe Now