Creating your digital business model

A digital business model expert describes the key questions today's leaders need to ask.

Image: Shutterstock[br]

Image: Shutterstock[br]

Q. You have said that digital transformation is actually not about technology. Please explain.

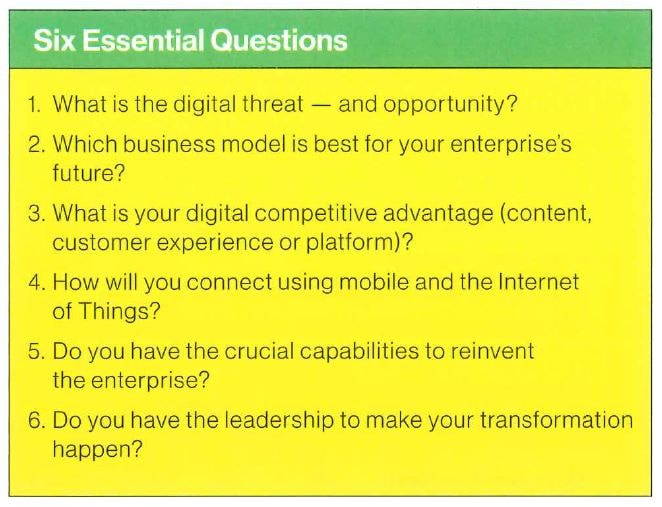

It’s really about change—and technology is just one aspect of that change. Before the internet, businesses operated primarily in a physical world of place. Today, all industries are shifting towards a world of digital space. Every organization must examine how it will move from place to space and engage its customers digitally. That means they will need new kinds of skills, resources and capabilities. In the end, the key question is not, What kind of technology do we need?’ but, What makes our enterprise great, and how can we use digital to convert that greatness into top performance?

Q. You have found that digital disruption comes in three varieties. Please describe them.

The first type of disruption happens when a new entrant—typically a start-up like Uber or Airbnb—comes into an existing market space and offers an exciting new value proposition. In banking, for instance, we are seeing fintech start-ups going after certain aspects of the big banks’ profits. At the moment, they"re really going after loans, which are particularly profitable for the banks.

The second form of disruption comes from a traditional competitor within your industry, but that organization changes its business model to become a much more formidable competitor. For example, Nordstrom has morphed from being a traditional department store into an attractive omni-channel business, combining the best of place (tangible, product based, customer-oriented transactions) and space (intangible, service based and oriented towards the customer experience). Banking, insurance, retail and energy companies are all struggling to find that perfect mix of place and space.

The third form of disruption involved crossing industry boundaries. It’s what happens when challengers come from completely outside of your industry. This form of disruption is the most difficult to predict. For example, think about the consortium of Amazon, JPMorgan Chase and Berkshire Hathaway that is trying to figure out what it can do in the healthcare space. These are not healthcare companies, but together, the three of them have some very strong capabilities, and they think they just might be able to do something to improve healthcare in the United States. People were very surprised when they indicated what they were going to focus on.

Q. Tell us about your Digital Business Model Framework (DBM).

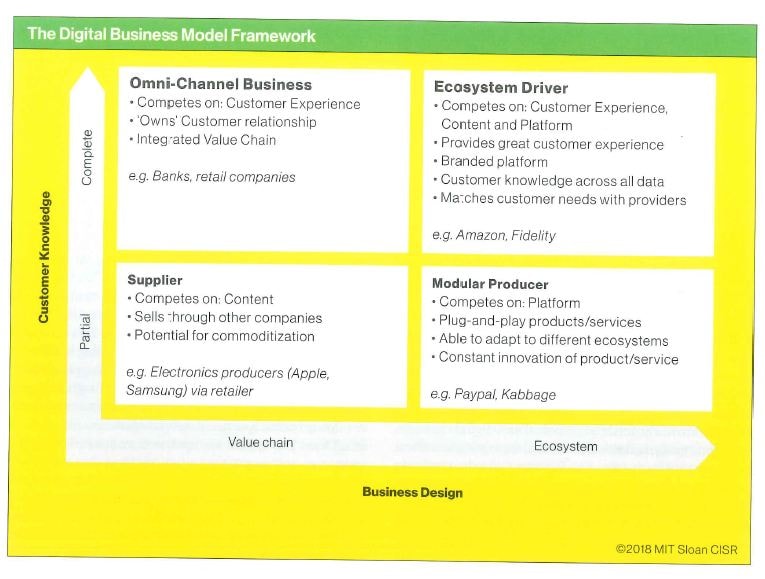

Our research shows that digitization is compelling companies to change their business models along two key dimensions. First, they are moving towards a better understanding of customers, including their needs and life events. It’s not just about demographics or purchase history anymore—but instead, what are their motivations for buying, and what kind of problems are they trying to solve?

The second key dimension involves moving from a controlled value chain orientation to a network orientation, or a web of relationships. This entails recognizing that you may not be able to provide everything your customers need, and that you can add value by partnering up with others who can provide complementary services.

These are the two key dimensions of ‘creating the next-generation enterprise’—and if you put them together in a standard two-by-two matrix, you get four business models. Q. Please describe those four business models.

Q. Please describe those four business models.

The first one is the Supplier, and this is a traditional business model where a producer sells through other enterprises. For example, TVs made by suppliers like Sony and LG, which are sold via a retailer like Best Buy or firms that sell insurance via independent agents (e.g. Chubb Group). Firms in this quadrant have at best, a partial knowledge of their end customer and typically operate in the value chain of another, often more powerful enterprise. This model is not going to disappear, but as enterprises continue to digitize, suppliers are likely to lose more power and be pressured to continually reduce their prices—perhaps accelerating industry consolidation.

The second is the Omni-Channel. These are businesses that provide customers access to their products across multiple channels, including physical and digital channels, delivering greater choice and a seamless experience. Great omni-channel businesses like Walmart and the big banks control an integrated value chain that offers multi-product, multi-channel customer experiences to address life events. The challenge for these companies is to move further up the vertical axis of the DBM, acting on increased knowledge of customers and their goals and life events.

The third model is the Modular Producer. Businesses that provide ‘plug-and-play’ products or services that can adapt to any number of ecosystems are modular producers. To survive, they have to be one of the best producers of their core activity (e.g. payments). For example, PayPal can operate in virtually any ecosystem, being ‘hardware agnostic’, mobile enabled and platform-based. While there may be many modular producers in an industry, typically only the top three or four make significant profits, while the others struggle, as it’s ultimately a commodity business.

Finally, there are Ecosystem Drivers, which establish a digital ecosystem—a coordinated network of enterprises, devices and customers that creates value for all participants. This model has higher revenue growth and net profit margins than the others, and not surprisingly, it is the toughest business model to achieve. Ecosystems are particularly powerful in retail (e.g. Amazon), but healthcare (e.g. Aetna), online entertainment (e.g. Netflix) and wealth management (e.g. Fidelity) all have powerful ecosystem-driver businesses. Going forward, customers of all kinds will increasingly prefer the efficiency of a ‘go-to’ digital ecosystem driver to conduct transactions in every domain.

Q. Does every company need to pick one of the four models?

They need to pick at least one but in fact, most large enterprises operate in more than one of these models. For example, not only is Amazon an ecosystem driver, it also provides services to other businesses, including fulfillment (it handles the warehousing, packing and shipping of one billion items) and technology capability (through Amazon Web Services), making it a Modular Producer as well.

Most banks operate in several quadrants—and often all four. The typical large bank acts as a supplier, selling mortgages and investment products. Most also work hard to improve their omni-channel offerings by reimagining the branch to be more of a customer acquisition, sales and advisory location, with most transactions done digitally. These same banks operate ad modular producers offering various services including payments and foreign exchange to many other enterprises. And finally, many banks have made forays into the ecosystem-driver model by offering more complete services for life events such as buying a house, owning a car or preparing for retirement. Q. Talk a bit about how an omni-channel business like Walmart interacts with an ecosystem-driver like Amazon.

Q. Talk a bit about how an omni-channel business like Walmart interacts with an ecosystem-driver like Amazon.

Here’s an example: My colleague recently ordered some barbecue coals on Amazon, not noticing who the seller was, and the package arrived a few days later in a box from Walmart.com. That’s the power of a great ecosystem, and it offers insight into how Walmart is both competing against and partnering with Amazon by providing products as a modular producer to Amazon’s ecosystem-driver model.

Q. You recommend that companies make an effort to move up and right on the DBM framework. Why is that so important?

Companies need to focus on two things: learning more about their customers and changing their business design to emphasize more partnering and more porous boundaries. At the moment, most businesses find themselves on the left side of our framework. Among the larger companies we studied, 46 per cent were suppliers, 24 per cent were omni-channel, 18 per cent were modular producers and 12 per cent were ecosystem drivers.

Retail and IT services have the highest percentage of ecosystems, while manufacturing and service industries are still early in their move up and to the right on the framework. Interestingly, smaller enterprises (with revenues less than $1 billion) are already further up and to the right on our framework than larger enterprises, with 31 per cent in the ecosystem-driver model and 36 per cent in the omnichannel model.

To move up and to the right, you can begin by enhancing the collection, consolidation and generation of insights about your customers—resulting in better customer experience and more targeted and successful offers. Then, you can start to move to the right by moving from providing services directly to the customer to becoming part of a web of relationships that provide a broader set of services, via partners.

Leading insurance company USAA did this brilliantly by helping its customers find their perfect car but they didn’t stop there: They linked people to car dealers with the desired car in stock, helped them negotiate the price, provided financing and sometimes facilitating delivery. The average savings for a USAA member is $3,385 off the recommended retail price. That is a prime example of how digital models create value for people.

Q. You have identified three key sources of competitive advantage in a digital business environment: content, customer experience and platforms. Please describe each.

Content is more than just news stories. It is whatever you provide to your customer. If you"re selling physical products, that would fall under content, as would information. There"s information that you pay for, like a newspaper subscription. On Amazon, part of their content is the product itself, and part of it is all the information around the product, like user manuals, customer reviews. Whatever the customer is consuming, that is content.

The customer experience is everything that wraps around your content to make dealing with your company a delight. Doing this well requires continually monitoring what customers are doing and what they say they want. That means investing in good user interfaces and creating opportunities for collaboration with customers.

Finally, your platform is the method by which you provide your content to customers. Companies need to develop and reuse—i.e. share across the enterprise, rather than reinventing for each area—digitized platforms. Without platforms, the IT units in companies might implement a new solution in response to every business need—creating a maze of systems that meet current needs but don’t scale enterprise-wide. Worse yet, the customer experience suffers as the customer gets a fragmented, product-based experience rather than a unified, multi-product experience. Think about your online banking experience today, where you can see all your accounts in one place—and how you used to receive individual paper statements for each account.

Q. Any parting advice for leaders?

What was key to us is that each of the digital business models has to do something really, really well. For example, if you"re a supplier, your competitive advantage is going to be your content, and if you are an omni-channel, it"s going to be your customer experience. Digital disruption is a wonderful—and critical—opportunity to help reinvent your enterprise.

Given the level of turmoil being caused by digital disruption of all varieties, addressing it has become a business imperative. It is time for leadership teams to evaluate the threats, understand the opportunities—and start creating new options for the future.

Stephanie Woerner is a Research Scientist at the Centre for Information Systems Research at MIT’s Sloan School of Management. She is the co-author of What’s Your Digital Business Model?: Six Questions to Help You Build the Next-Generation Enterprise (Harvard Business Review Press, 2018).

First Published: Oct 30, 2019, 15:06

Subscribe Now