Around him, an uncle and a 36-year-old cousin had passed away due to Covid-19. “That’s when I knew that s*** had hit the fan," Garg tells Forbes India over a Zoom call. Back then, India’s seven-day moving average for Covid-19 cases was swelling up quickly and had crossed 200,000 cases a day. In contrast, that number had stood at less than 25,000 cases a day in mid-March. In Delhi, where Garg lives, the alarm bells had been sounded as the national capital was gasping for oxygen even as hospitals ran short of beds, exposing serious inadequacies in India’s health care infrastructure.

“Each one of us has lost someone close to us, and it’s been very painful," says Garg. “When you lose people so young, it is extremely tough. We knew we had to act. I was getting so many calls for oxygen concentrators and beds." Much of those requests came his way largely because his six-year-old startup, Moglix, was instrumental in ramping up PPE kits and N95 masks across the country during the first wave of Covid-19 in 2020. “We work with the largest manufacturing houses, and the first thing we did was to go after fixing the oxygen problem this time," he says.

Over the next few weeks in April, Garg and his team at Moglix began working with manufacturers of oxygen concentrators in India, while also sending charter flights to China and Germany to procure the concentrators. Since then, the company has procured some 6,000 oxygen concentrators, which Moglix has been selling to corporate and industrial houses in India. They, in turn, have been giving them to their employees on a group-sharing model, based on a template developed by Garg and Moglix.

“We have probably touched half a million lives through oxygen concentrators," says Garg. Once a concentrator is purchased, employees can use it on a rotational basis, ensuring its availability, especially at a time when there was a severe shortage. “We had created a template on sanitisation, delivery norms, and the standards of operating procedure for the concentrators."

Companies that procured oxygen concentrators from Moglix include consultancy firm EY, Grant Thornton, Tata Steel, Hero MotoCorp and Ford Motor Company, among others. “These could be for the employees or at a Covid-19 care facility that the companies were setting up," adds Garg. The model has now been taken forward by mobility platform Ola and the Give India Foundation to provide concentrators to those in need across cities.

![]() Moglix helps over 500,000 small-and-medium-sized businesses, and some 3,000 manufacturing plants across India, Singapore, the UK and UAE in their procurement for industrial goods

Moglix helps over 500,000 small-and-medium-sized businesses, and some 3,000 manufacturing plants across India, Singapore, the UK and UAE in their procurement for industrial goods

Image: Madhu Kapparath

That’s not all. Moglix, a company that Garg founded in 2015, is part of a consortium where 10 manufacturers have come together to ramp up oxygen concentrators to make India self-reliant in the segment. Oxygen was in severe shortage as cases peaked in the country during the second wave of Covid-19, inviting sharp criticism for the government in its handling of the pandemic. “We are working with them on both the global and domestic supply chain on raw materials," says Garg. “I think this issue of oxygen concentrators will be a done-and-dusted problem by June and / or July unless something else comes up in a few months. At least we’ll not be solving this same problem again."

Solving problems is something that comes naturally to Garg and it remains at the centre of his entrepreneurial journey. While numerous entrepreneurs chased the lucrative business-to-consumer segment as India’s startup boom began sometime after 2010, Garg saw an opportunity elsewhere in a segment many had stayed out of. Six years later, he has built an unlikely unicorn out of a business that is essentially an ecommerce platform for industrial tools and equipment used largely by businesses for their needs.

Moglix helps over 500,000 small- and medium-sized businesses and some 3,000 manufacturing plants across India, Singapore, the UK, and the United Arab Emirates in their procurement for industrial goods. In addition, the company also offers an end-to-end procurement solution, including resource planning and financing, while also helping with the maintenance, repair and operations supplies. Moglix claims to be the largest ecommerce platform of industrial goods in India. Among others, it counts Vedanta, Unilever, Air India and NTPC as its customers.

![]() Moglix’s network has over 16,000 suppliers and over 35 warehouses. Garg likens it to Chawri Bazar, one of India’s oldest wholesale markets for brass, copper and other hardware products

Moglix’s network has over 16,000 suppliers and over 35 warehouses. Garg likens it to Chawri Bazar, one of India’s oldest wholesale markets for brass, copper and other hardware products

On May 17, the company became India’s latest unicorn after it raised some $120 million in Series-E funding. Its backers include London-based hedge fund Falcon Edge Capital, Accel, Sequoia Capital, Tiger Global Management, Ratan Tata and Jungle Capital. In all, Moglix has raised $220 million so far.

Giving life to industrial tools

“I was one person sitting inside a manufacturing plant in Noida and trying to convert the idea from what’s inside my mind to talking to customers and things like that," recalls Garg as he turns back the clock to 2015. By April that year, he put together a small team and by July was ready to roll out Moglix. The company also raised seed funding from Ratan Tata and Accel Partners in addition to tying up with some 200 suppliers for launching a marketplace. Before that, the 42-year-old had spent over 15 years working across technology companies, of which the last five were with Google in Singapore and Japan. At Google, Garg led the programmatic advertising space for the tech giant. A graduate from IIT-Kanpur and the Indian School of Business (ISB), he also has 16 technology patents to his name in wireless communication in fact, he began his career designing wireless LAN Systems.

At Moglix, Garg chose to slug it out alone unlike many of his peers who often have co-founders. “I tried twice before (with co-founders), but those did not take off," he says. “So, this time I was firm that I’ll just get started and see what comes along. It was a conscious choice and thankfully I was third-time lucky."

The decision to look at the manufacturing sector, a category most new-age startup founders have given a miss, was also partly shaped by his father, a professional CEO who ran 16 manufacturing plants in Northern India. “I grew up in Faridabad, which is one of the largest hubs of manufacturing in the country," says Garg. “There was a marrying together of what I’ve grown into and what I learnt at different points in my career."

Then there was also the enormous potential that remained untapped in the manufacturing sector, particularly in bringing a much-needed digital interference and facilitating business-to-business (B2B) transactions, online. “I wanted to transform the B2B ecommerce space because with the kind of changes happening in the B2C segment, and with manufacturing infrastructure being a core part of the Indian economy, I felt there was an opportunity in procurement, supply chain and technology," says Garg. The company started with 10 categories before expanding to over 50 now. “For manufacturing to become a trillion-dollar economy, we need to reimagine and reconstruct this entire distribution. And that’s what we set out to do," he adds.

![]() Much like other unicorns, Moglix may have to bring in more external senior talent who understand B2B, procurement and supply chain business in the manufacturing sector

Much like other unicorns, Moglix may have to bring in more external senior talent who understand B2B, procurement and supply chain business in the manufacturing sector

It also helped that consumer behaviour was shifting towards online business as India’s internet penetration began seeing a surge, especially with the advent of more B2C businesses, including Flipkart and Amazon, among others. “We envisaged back then that given the entire internet penetration, it was the right timing for businesses to start to change because they’re typically laggard in terms of change," says Garg. “With Flipkart, Swiggy and others having changed consumer behaviour in terms of getting products ordered and delivered, the opportunity was only going to get better."

That’s precisely why investors have also been busy flocking to the company. “Historically, traditional industries such as manufacturing and construction have been slower to adopt technology compared to the significant tech leap taken by the B2C industry in the past decade or so," says Tejeshwi Sharma, principal at Sequoia India and an investor in Moglix. “The perks of digital technology—agility, transparency, efficiency, productivity, reliability—have largely been missing for these industries even though they form a significant and critical part of our economy. Which means that any company that attempts to leverage technology to modernise this space is seeing a massive target market."

Tightening the screws

Today, Moglix works with some of the largest manufacturing companies in the country and has become a one-stop solution for all their purchasing needs. “We continue to expand the category of products," says Garg. Among others, products sold on the company marketplace include saws, pumps, hammers, automotive supplies and hospital supplies. Purchases on the portal range from as low as ₹50 to ₹1 crore. “In that process, we had to build our warehousing, technology and the entire change management across some of these sectors which are not as tuned towards the change, because they are generally a little bit slower in adapting as opposed to a consumer who is probably moving very fast with new technologies coming up," adds Garg.

![]() Narly 65 percent of the company’s business comes from Tier II and III towns in the country. The rest is centred around manufacturing hubs to which the company sends its products. “A large number of products are accessed by small and medium scale enterprises and there is also a growing demand from households who are looking to purchase items such as electrical products," says Garg. While the company has its own logistics, it has also tied up with other partners to help with the delivery mechanism.

Narly 65 percent of the company’s business comes from Tier II and III towns in the country. The rest is centred around manufacturing hubs to which the company sends its products. “A large number of products are accessed by small and medium scale enterprises and there is also a growing demand from households who are looking to purchase items such as electrical products," says Garg. While the company has its own logistics, it has also tied up with other partners to help with the delivery mechanism.

“We are the Chawri Bazar for our customers," says Garg. Chawri Bazar is among the oldest wholesale market for brass, copper and other hardware products in Delhi. “We are used to having fashion and clothes being catalogued. Industrial catalogues did not exist before Moglix… companies need to buy these products to run their manufacturing plants and they are looking at buying directly from us. And we get it delivered to them."

In addition, the company is also fast expanding its business from a marketplace into what it calls an “operating system" for its customers with full-stack services covering procurement, packaging, supply chain financing and integrated software. That means Moglix has positioned itself as a one-stop solution for businesses in their procurement plans. “It is the consistency of the supply chain," says Garg. “It is the consistency of pricing because the offline market works on the mood of the seller on that day. When we started, we saw a distinction between classified behaviour and transaction behaviour."

Garg reckons that his company currently doesn’t have any competitors although IndiaMART’s businesses do overlap with Moglix’s at times. Noida-based IndiaMART is an online B2B marketplace that connects buyers with suppliers and largely remains a classified. “IndiaMART does connect suppliers, but it doesn’t deal with supply chain and procurement, and there are offshoots of companies that play into financing for raw materials and other things. Our best proxies remain the off-world of Chawri Bazars," says Garg. “The world has moved to a situation where the buyer wants to know if the product is available, its price and when it can be delivered. I am helping cut short all those conversations, the time gap between searching for a product and ordering your product."

India’s ecommerce B2B market is currently pegged at $1.7 billion, according to a report by consultancy firm RedSeer. It is expected to grow at 80 percent compound annual rate (CAGR) to reach $60 billion by 2025. By comparison, B2C ecommerce market is currently worth some $18 billion and is expected to grow at 40 percent CAGR. The country’s offline B2B market itself was estimated to be worth some $700 billion in 2018-19.

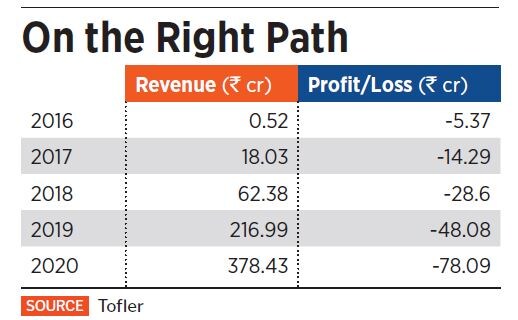

“The firm has done quite well, especially given the fact that the B2B market, though it has been around for many years, hasn’t had the same impact or mind share as B2C," says Yugal Joshi, vice president of Everest Group, a Dallas-based consultancy firm. “What is also interesting is unlike peers, especially in B2C, Moglix isn’t burning cash to chase revenue. Though it isn’t profitable, its losses haven’t ballooned."

In 2020, Mogli Labs Private Limited, the parent company for Moglix, posted revenues of ₹378 crore while losses stood at ₹78 crore. A year before that, revenues stood at ₹216 crore while losses stood at ₹48 crore. “We are fairly capital-efficient and see ourselves getting to Ebitda positive in the next two years. We are still fairly light on the capital burn for the journey we are on and the infrastructure investment that we continue to do," says Garg. “Unfortunately, many of the infrastructure investments in terms of software technology doesn’t get traditionally accounted as Capex."

Today, Moglix works with over 500 global enterprises to streamline their procurement and supply chain at more than 3,000 plants across infrastructure, metals and mining, oil and gas, chemicals, pharma, auto and FMCG, among others. In addition, it also boasts a supply chain network of over 16,000 suppliers and over 35 warehouses. “The key for the firm will be to enhance the tech quotient of SMEs that it works with," adds Joshi. “That isn’t going to be easy, but it is not impossible either. It may have to proactively invest in tech and business modernisation of select clients to scale up their and its own business. Much like other unicorns, it may have to bring in more external senior talent who understand B2B, procurement and supply chain business in the manufacturing sector."

Almost 80 percent of the products sold by Moglix are currently made in India, says Garg. “Moglix is operating in a business segment with a lot of potential," says Shobhit Srivastava, research analyst at Counterpoint Research. “B2B sourcing was a slow evolving sector in India and Moglix is acting as a stimulus in the segment. As manufacturing in India is on the rise with the ‘Make in India’ initiative, a lot of these SMEs and manufacturers will get direct access to big clients through Moglix. Companies looking for easier ways to source products are also benefiting from the process which saves time for both the suppliers and the sourcing company."

Over the next few years, Garg wants to increase the number of SKUs (stock keeping unit), a code to identify a specific type of product, from 500,000 to over 2 million, in addition to bringing on board nearly 10,000 brands. “The entire online business is less than 1 percent or maybe less than half a percent of the market," he says. “We think that between 15 percent and 20 percent of the market is there for the taking. We can go from here to almost like 20 or 25 times as an organisation."

It also helps that the company has a first-mover advantage in the sector, particularly in on-boarding new suppliers in the manufacturing sector. “Building a trusted platform in B2B ecommerce is the most challenging part, but Moglix seems to be doing well as its customer retention numbers paint a good picture for the future of the company," adds Srivastava.

In February 2020, the company launched Credlix, a supply chain financing platform for suppliers and manufacturers, and expects to help with over ₹1,000 crore of financing in the coming year. The digital supply financing platform from Moglix will provide quick collateral-free working capital solutions, exclusively to its suppliers, through its collaboration with banks. That means from credit application and credit risk assessment to payment approval and final disbursement, Moglix’s suppliers will get a single platform to manage their financial needs.

“We are still sitting on 100x opportunity from where we are as a company, both in India… and we are expanding globally," says Garg. “We are becoming an operating system for manufacturing organisations for procurement and supply chain and sales, which means that they are looking at us for technology, financing, supply chain and logistics."

That itself is a handful for Garg and his team for the next few years. And the third-time lucky entrepreneur is only getting started.

Image: Madhu Kapparath

Image: Madhu Kapparath Moglix helps over 500,000 small-and-medium-sized businesses, and some 3,000 manufacturing plants across India, Singapore, the UK and UAE in their procurement for industrial goods

Moglix helps over 500,000 small-and-medium-sized businesses, and some 3,000 manufacturing plants across India, Singapore, the UK and UAE in their procurement for industrial goods Moglix’s network has over 16,000 suppliers and over 35 warehouses. Garg likens it to Chawri Bazar, one of India’s oldest wholesale markets for brass, copper and other hardware products

Moglix’s network has over 16,000 suppliers and over 35 warehouses. Garg likens it to Chawri Bazar, one of India’s oldest wholesale markets for brass, copper and other hardware products Much like other unicorns, Moglix may have to bring in more external senior talent who understand B2B, procurement and supply chain business in the manufacturing sector

Much like other unicorns, Moglix may have to bring in more external senior talent who understand B2B, procurement and supply chain business in the manufacturing sector Narly 65 percent of the company’s business comes from Tier II and III towns in the country. The rest is centred around manufacturing hubs to which the company sends its products. “A large number of products are accessed by small and medium scale enterprises and there is also a growing demand from households who are looking to purchase items such as electrical products," says Garg. While the company has its own logistics, it has also tied up with other partners to help with the delivery mechanism.

Narly 65 percent of the company’s business comes from Tier II and III towns in the country. The rest is centred around manufacturing hubs to which the company sends its products. “A large number of products are accessed by small and medium scale enterprises and there is also a growing demand from households who are looking to purchase items such as electrical products," says Garg. While the company has its own logistics, it has also tied up with other partners to help with the delivery mechanism.