Can Anil Agarwal's troubled Vedanta find a way out of its misery with a demerger

The $18-billion group has piled up over $15 billion in debt during its expansion, and the demerger might not be a way out in the immediate future. Here's why

Anil Agarwal has always been a tough cookie, a survivor of sorts.

Nothing else can possibly explain how the Bihar-born Agarwal built an empire spanning metals and mining over half a century, after starting as a trader in scrap metal in Mumbai. Today, his diversified conglomerate makes everything from steel and iron ore to aluminium and oil among others, at the $18-billion Vedanta Group. That’s why Agarwal’s remarkable story finds many takers who admire his risk appetite and grit in building up an empire from the bottom.

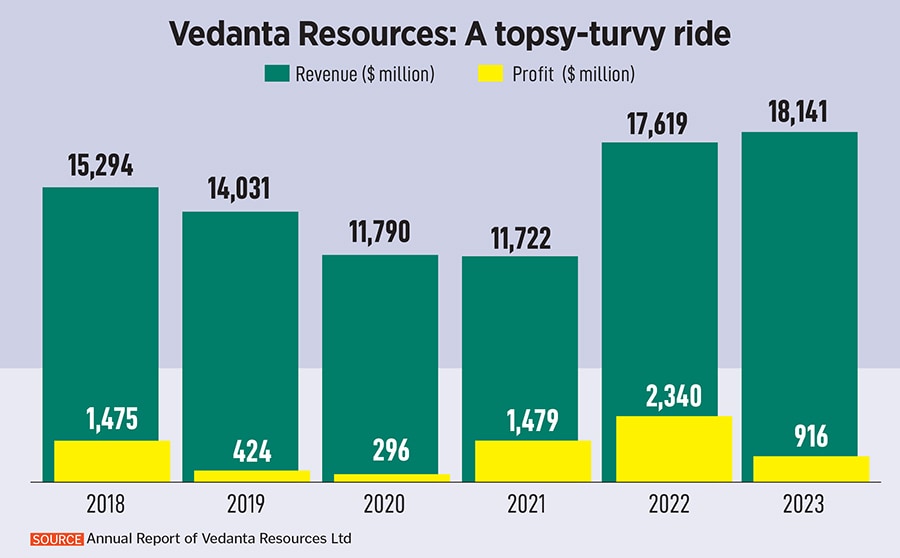

But that phenomenal growth had also come at a cost, something that’s come to haunt him as he turns septuagenarian, and leaving him to slug it out now. Vedanta Resources, Agarwal’s London-based parent company, has a debt problem, with over $15 billion in dues as of March this year, including over $8 billion at Vedanta Limited, the Indian company owned by Vedanta Resources. Vedanta Limited owns assets such as Hindustan Zinc Limited, Bharat Aluminium, Sterlite Copper, and Cairn Oil. As of March 2023, Vedanta Limited had a debt of Rs 66,182 crore ($8 billion), an increase of Rs 13,073 crore ($1.5 billion) since the year before that.

At Vedanta Resources, the parent arm, the standalone debt stood at some $7 billion in March, and Agarwal has been busy firefighting to pare it all down, after growing cynicism around repayment abilities. As of June, that debt level has come down to $5.9 billion. Still, Vedanta’s complex ownership structure involving dividend payments from group companies to keep the coffers running, and immediate debt repayment requirements for its maturing loans has meant that Agarwal just can’t find any breathing space.

Although he has consistently denied that to be the case, it"s perhaps that desperation, coupled with a deep desire to veer his business for the future, that has now led the billionaire to go for some serious restructuring of his business, a decade after he went on a consolidation spree.

The Indian arm, Vedanta Ltd, on September 29 announced a demerger of its businesses into six separate businesses, which it claims will unlock significant value for shareholders. “By demerging our business units, we believe we will unlock value and potential for faster growth in each vertical," Agarwal, Vedanta Group’s chairman, said in a statement. “While they all come under the larger umbrella of natural resources, each has its own market, demand, and supply trends, and potential to deploy technology to raise productivity."

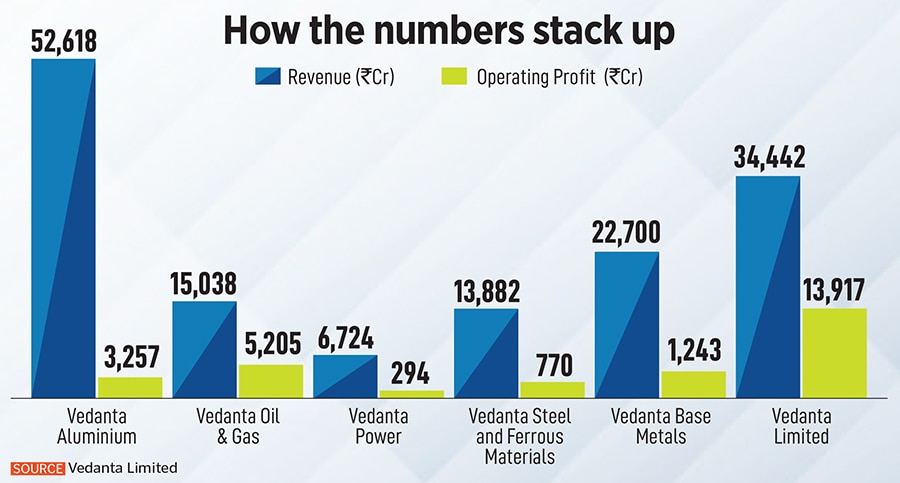

The six independent listed entities include Vedanta Aluminium, which currently boasts the largest smelting facility in the country, Vedanta Oil & Gas, which will comprise Cairn’s oil business in India, Vedanta Power, Vedanta Steel and Ferrous Materials, Vedanta Base Metals, and Vedanta Ltd. Vedanta Limited will continue to comprise Hindustan Zinc in addition to emerging as an incubator for new businesses, particularly the semiconductor business that Vedanta is trying desperately to set up.

For many months now, the London-based Vedanta has been under the scanner for its upcoming payments. In 2024, Vedanta must repay over $2 billion held in bonds including, $1 billion in January and August 2024. The year after, in FY25, there are debt obligations worth $3 billion.

“Vedanta Resources Limited (VRL)"s credit quality is constrained by its weak liquidity because of large refinancing needs and interest expense amid tightening financing conditions in global capital markets," Moody’s said in a report after downgrading the corporate family rating (CFR) of Vedanta Resources. “VRL"s consolidated debt/EBITDA leverage was 3.7x as of March 2023. Still, the company continues to face challenges in refinancing its debt, a reflection of reduced appetite from the lending community, and a key credit concern. VRL"s Caa category CFR reflects the company"s unsustainable capital structure, aggressive risk appetite, and weak financial management." A Caa rating on long-term obligations such as bonds means that they are of poor standing and carrying very high credit risk.

The Vedanta Group, which started as Sterlite Industries, a maker of telecom cables and fibre optics, went on an expansion spree in the early part of the millennium after acquiring numerous assets owned by the Indian government that was looking to disinvest its shares in loss-making public sector companies. These included the likes of Hindustan Zinc Limited, Madras Aluminium Company (MALCO), and Bharat Aluminium Company (BALCO). In 2006, Vedanta also bought a controlling stake in Sesa Goa, and five years later, a controlling stake in oil and gas company Cairn India, for $8.6 billion.

That acquisition of Cairn India, alongside its capital expansion, had largely led to a significant piling up of debt, with Vedanta Resources" debt swelling to $17 billion in 2012. Of its total gross debt of $17 billion that year, debt at subsidiaries stood at $7.7 billion with the balance in the holding company.

In contrast, five years before that, in 2007, Vedanta Resources’ total debt stood at $1.7 billion, growing to $2.9 billion in 2008 on the back of a bridge loan taken to acquire Sesa Goa. By 2011, the gross debt at Vedanta Resources rose to $9.8 billion, after rising to $8.2 billion the year before that. But it was really the $4.4 billion debt funding for Cairn, then the largest private sector crude producer in India that hit Vedanta hard.

“If you look at the overall number, we have one of the best balance sheets in the world," Agarwal told Forbes India in May 2023. “We have a debt-equity ratio of 1:2, which is very comfortable. We have put in $80 billion in cash in the last 25 years in the company. We have put $22 billion of cash in oil and gas. We have put $20 billion into zinc, $20 billion into aluminium, and $20 billion in the other business that we have."

Hindustan Zinc"s open cast mine at Rampura Agucha, Rajasthan. It was commissioned in 1991 as an opencast mine. It is located 230 km north of Udaipur, in the State of Rajasthan in India. Rampura Agucha is stratiform, sediment-hosted, high grade zinc & lead deposit.

Hindustan Zinc"s open cast mine at Rampura Agucha, Rajasthan. It was commissioned in 1991 as an opencast mine. It is located 230 km north of Udaipur, in the State of Rajasthan in India. Rampura Agucha is stratiform, sediment-hosted, high grade zinc & lead deposit.

“Against that, the total debt in the company is $13 billion ($6.5 billion at Vedanta Limited and $6.5 billion at Vedanta Resources Limited)," Agarwal had told Forbes India. Agarwal’s calculation of $13 billion is based on net debt, factoring in cash and cash equivalents to the gross debt. “Against that $13 billion, we make a profit of $8 billion. It is one of the best balance sheets. We have certain payments that are getting due, and we are very comfortable making those payments."

For many years, Vedanta had relied on Hindustan Zinc, a group arm, and dipped into its cash reserve to pay dividends to the promoter group. That reserve, too, has steadily seen a decline in recent years. Last year, Vedanta Limited received a staggering Rs 31,901 crore as dividend from Hindustan Zinc (HZL), leaving HZL with cash of only Rs 10,061 crore while borrowings stood at Rs 11,841 crore. Then, in July this year, Hindustan Zinc announced an interim dividend which would see HZL pay Vedanta nearly Rs 3,000 crore, adequate enough to meet some repayments.

"VRL has not made any meaningful progress on refinancing its upcoming debt maturities, in particular the $1 billion bonds maturing each in January 2024 and August 2024," Kaustubh Chaubal, a Moody"s senior vice president and lead analyst on Vedanta, said in a report on September 26.

It also hasn’t helped Vedanta that commodity prices, particularly for base metals such as aluminium, zinc, and copper, have seen a decline due to weak global demand, affecting cash flows. Vedanta Resources earns its revenues through brand fees and dividends from group companies. Of this, some $2.5 billion came from dividends last year. Among them, Hindustan Zinc is the group’s crown jewel, with its profits alone accounting for as much as the combined profits of the other group companies including aluminium, oil and gas, power, base metals, and steel.

“I think 24 months ago, any of energy transition, China Plus One, India"s growth, inward investment, resource nationalism were probably nascent themes, but probably not nearly as advanced as we see today, particularly in respect of the explosion of interest that we see," Omar Davis, the president for strategy at Vedanta, said during the investor call. “We see it in our asset base, I presume our peers do as well across India. So, our ability to point the company towards those pools of capital we began to feel was more constrained in our current format than it will be going forward in the new structure."

For many months, Vedanta has been trying hard to secure funds, and last raised some $850 million in a five-year loan deal with JP Morgan Chase & Co and Oaktree in May this year, as a crisis loomed large. Now, the London-headquartered company is also reportedly in talks with JPMorgan Chase and Standard Chartered Bank (StanChart) to secure a $3 billion refinancing facility.

But all that could have been avoided had the company managed to make HZL acquire the global zinc assets of Vedanta for $2.9 billion. The Indian government, which has a 30 percent stake in HZL, opposed the plan, forcing Vedanta to drop the idea.

“When you sell something, you come with a condition," Agarwal had told Forbes India about the Indian government blocking HZL’s plan. “I"m giving you x percentage now and after one year I"ll give 20 percent. The proper formula has been put into the agreement. We got all the clearances from the government. Then the government machinery says, don’t do it. Somehow this mindset that people will make more money has to go away."

With the demerger in place, Agarwal is hoping to unlock value and, in the process, build Vedanta into a debt-free group. Already, in 2022 the group had announced its intention to become a zero-debt company, something Agarwal likens to Tata Sons where various group companies make cash while the parent company remain free of debt, and instead focus entirely on expansion strategies.

“Vedanta is my dream," Agarwal had told Forbes India in May this year. “And I want Vedanta to be an institution that will be around for 500 years. The family will not be in the management. They can be the shareholders, but we have to have top-class management."

Still, even as Agarwal and Vedanta set out to do that, the recent demerger may not address the elephant in the room, and may be a tad bit late in averting the repayment crisis, especially since government approvals could take more than a year. “The demerger into different entities is expected to simplify the corporate structure, enhance risk mitigation framework, ensure autonomy, and improve transparency," brokerage firm, Motilal Oswal said in a report. “However, the debt positions at both Vedanta Limited and Vedanta Resources Ltd. remain unchanged. They continue to face refinancing/repayment risks, considering a substantial portion of debt maturing by CY25."

Interestingly, Vedanta’s ongoing demerger also comes at a time when the company’s much-celebrated foray into India’s lucrative semiconductor manufacturing plan has run into trouble. In February last year, Vedanta and Foxconn signed a pact to invest $19.5 billion to set up the semiconductor plant in the country.

The joint venture project was looking to manufacture 40 nm chips before it expanded into 28 nm chips since the process was similar. 40 nm and 28 nm chips contribute to over 66 percent of the global demand for chips and are used in ICT devices and electric vehicles (EVs), among others. But, In July this year, Foxconn pulled out of the project after many months of waiting for approval from the Indian government, which had been asking Vedanta and Foxconn to bring a technology partner with a production-grade licence and expertise in manufacturing.

“The demerger could make a partial divestment in different businesses easier, which would help VRL in deleveraging," Kotak Institutional Equities said. “However, the demerger by itself is unlikely to unlock any value, in our view."

Vedanta though insists that unlocking value is only one aspect. Apart from attracting investments, the company also reckons that its dividends and cash flows are expected to grow in the coming years with the demerger. Alongside, it also believes that the demerger will provide a platform for individual units to pursue strategic agendas more freely while making it easier for the market to value the companies easily.

“Vedanta is a cash-flow company," Agarwal had told Forbes India. “We make Rs 60,000 crore cash every year. Maybe one, or two companies in India make cash between Rs 50,000 to Rs 60,000 crore every year."

That’s also why Agarwal had previously compared his ongoing crisis to one where an audience waits with bated breath for a goal, only for it to be thwarted by the goalkeeper. “When people watch a football match, they"ll be on edge anticipating a goal, but that doesn’t happen because the goalkeeper is strong," Agarwal said about himself and the group. That may well be the case, and Vedanta might scrape through in the immediate future, especially if Agarwal’s’ past is anything to go by.

Can Agarwal really strike back if a goal went through? Perhaps not right away.

First Published: Oct 04, 2023, 12:51

Subscribe Now