Can Indian startups take an Uber ride?

Uber's first annual profit since its public listing in 2019 and Zomato's third consistent quarter of profit have kindled hope for a similar performance by loss-making unicorns and startups

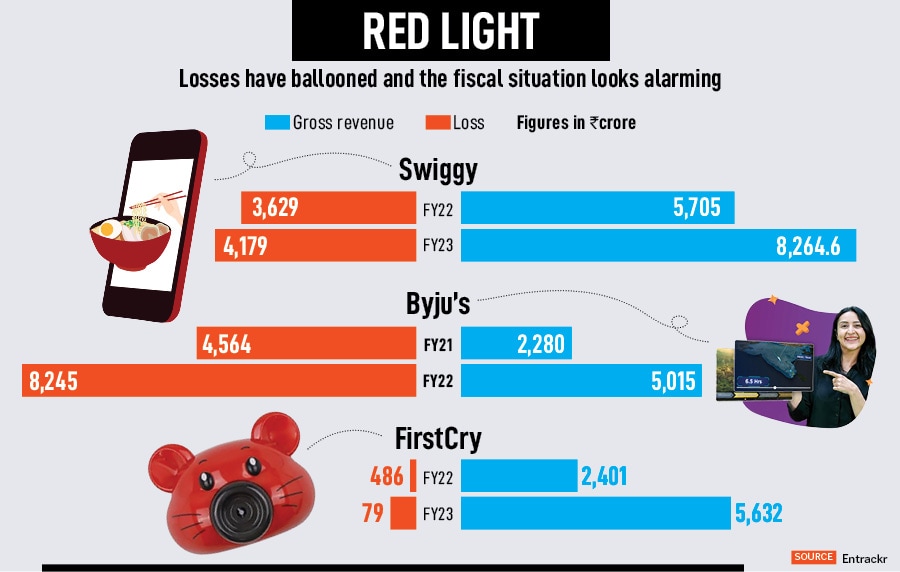

Uber’s strongest quarter (Q4), first annual profit since it went public in 2019, and phenomenal performance in 2023 has become the talk of the town globally. Back home, in India, a large section of venture capitalists and unicorn founders contend that Uber’s glowing report card offers a deep sense of optimism for a clutch of home-grown startups that have already hit the road to profitability and have been consistently trimming their heavy losses. But before we try to find out whether an Uber-kind of turnaround can be replicated by Indian startups, including unicorns, one must try to figure out how Uber--till 2022, it reportedly accumulated $31.5 billion in operating losses since 2014—posted profit.

To understand and appreciate the transition from ‘red’ to ‘black,’ one needs to revisit the ‘risk factors’ of the IPO prospectus, which Uber filed in April 2019. “We have incurred significant losses since inception," the ride-hailing major underlined in its filing. The company had incurred operating losses of $4 billion in 2017, and had accumulated a staggering deficit of $7.9 billion till December 31, 2018. The company, it added in the regulatory document, expected its operating expenses to increase significantly in the future. But Uber also underscored a grim reality that no investor would ever like to either read or hear. “We may not achieve profitability," the company candidly confessed in its filings.

Fast forward to February 2024. Uber posted its first full-year profit since going public in 2019. Dara Khosrowshahi, the chief executive officer of Uber, highlighted the achievement. “We delivered our strongest quarter ever in Q4, capping off our strongest year," he contended in the latest earnings call after declaring the fourth quarter and annual results. The CEO then went on to explain how the risk—which was so clearly mentioned in the IPO prospectus of 2019—got converted into reward.

The profit, obviously, came on the back of a strong performance. Look at the numbers. Uber crossed 2 billion trips in a single quarter for the first time—an average of nearly 1 million trips per hour—the top-line grew at healthy rate, with over $115 billion in gross bookings, and mobility posted its best quarter ever for gross bookings, MAPCs (monthly active platform consumers), active drivers, adjusted EBITDA, and adjusted EBITDA margin. But the not-so-obvious part is how Khosrowshahi, who became a reluctant CEO in 2017, went about trimming the losses and bringing Uber back into shape.

During the latest earnings call, the CEO gave a peep into a part of his meticulous strategy. “Our extensive cost actions in 2020 and 2021, combined with early caution on cost growth in 2022, allowed us to drive operating leverage," Khosrowshahi outlined. Since the second quarter of 2022, Uber adopted a more cautious stance on costs. “We added headcount very selectively, numbering in the hundreds," pointed out Khosrowshahi, adding that the company maintained the fiscal rigour throughout 2023. “Capital discipline will prove to be a decisive factor in improving growth and profitability outcomes for Uber," he said. “We’re far from complacent, and we look forward to accelerating our momentum in the year ahead," he concluded.

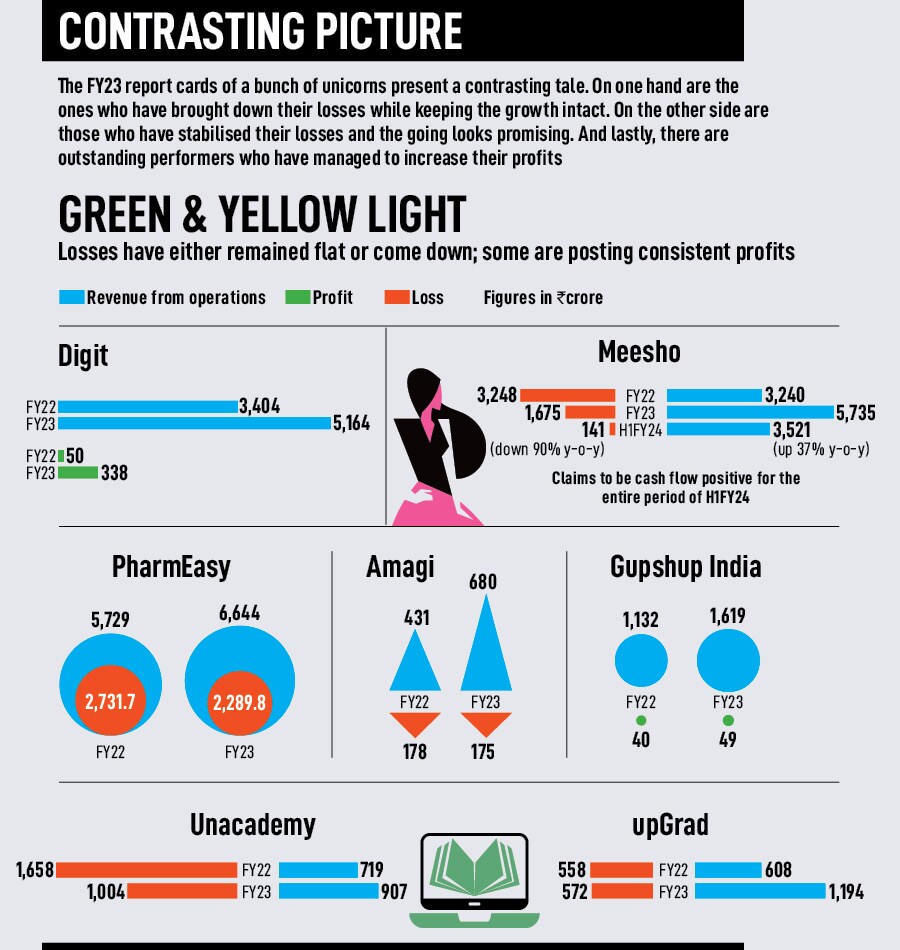

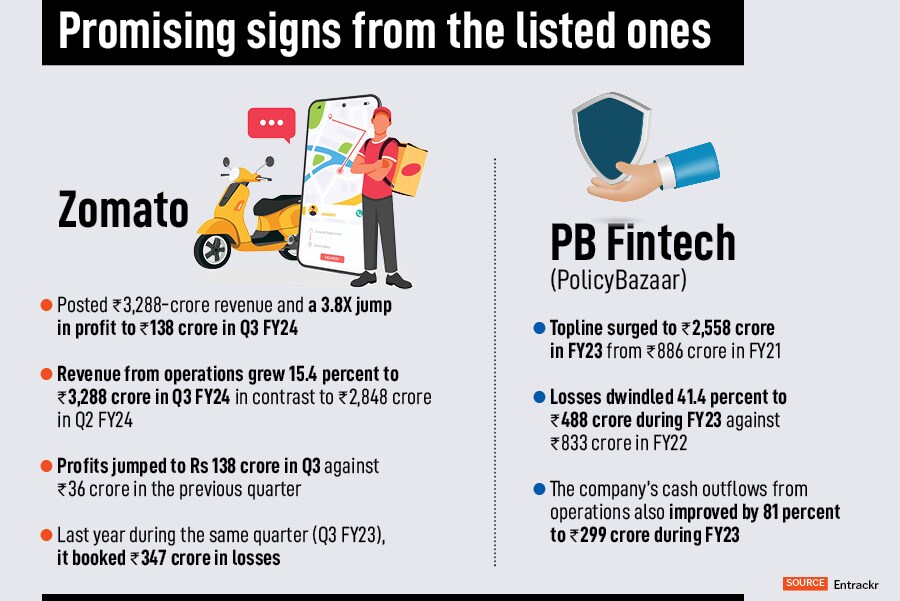

Back in India, Uber’s performance has kindled hope among VCs and founders that bleeding startups can get their house in order. And many, experts point out, have already embarked on the ‘realistic’ journey to profit. “Since 2019, 15 startups have been listed in the public market, with 8 already profitable at IPO and four achieving profitability in the past 18 months," claims Rahul Chowdhri, partner at Stellaris Venture Partners. Startups with IPO ambitions acknowledge that Indian public markets value profitable growth. In recent months, the venture capitalist reckons, Indian unicorns have been reporting profits, reinforcing the belief that sustained profitability is not merely a recent development but crucial for enduring success.

Take, for instance, the performance of Zomato, which posted its third straight quarter of profit in this month. The food delivery major posted Rs 3,288-crore in revenue and a 3.8X jump in consolidated net profit to Rs 138 crore in the third quarter of FY24. Last year during the same quarter (Q3 FY23), it booked Rs 347 crore in losses. In the letter to shareholders, CEO and founder Deepinder Goyal attributed the success to a slew of innovations that Zomato had rolled out over the last few quarters. “A lot of innovation in our business happens behind the scenes," he outlined in his letter. Though the innovations, he added, may not be obvious to a customer, they improved the customer experience. The company, he claimed, built a proprietary geo-location technology which leverages data on millions of deliveries and more accurately pinpoints customer location down to the last few metres. “Enhancements to this platform have led to a dramatic >30 percent decrease in drop location errors in the last 12 months," he added, pointing to another innovation. Zomato’s in-house customer support platform—One Support—automated most of the customer support workflows by leveraging data sets built over the years. “This led to about a 35 percent reduction in in-app query resolution time," he said, adding that such innovations have eventually led to about a 20 percent decline in order cancellations and rejections.

Beerud Sheth adds some perspective to the ‘profitability’ chatter. Tech companies, the co-founder of Gupshup contends, invest a lot in building products and creating a consumer habit for services. “It takes a lot of money and effort, and they are not profitable in the beginning. But as the operations scale up, the revenues increase but the costs don’t increase at the same proportion and rate. So once you get to a certain level of scale, you turn profitable," says the CEO of the conversational messaging startup which joined the unicorn club in 2021. At times, investors tend to be sceptical and are right in asking ‘when’ and ‘how long’, but the right kind of companies do turn the corner eventually and start posting consistent profits. Public market, he maintains, values such companies.

Also listen: Zomato, Meesho profits: Are they sustainable?

If the listed ones are posting profit or speedily moving towards that goal, a bunch of IPO aspirants too are cutting the flab. Take, for instance, Meesho. The horizontal ecommerce platform has brought down its losses from Rs 3,248 crore in FY22 to Rs 1,675 crore in FY23. A cut in loss, interestingly, didn’t happen at the cost of scale as revenue from operations jumped from Rs 3,240 crore to Rs 5,735 crore during the same period. The unicorn has maintained the momentum in FY24 as well by bringing down its H1FY24 losses by a staggering 90 percent y-o-y.

Indian startups, reckon VCs, have realised the importance of growing sustainably. “The ones who have got listed are already showing promising performance," says Karthik Reddy, co-founder and partner at Blume Ventures, one of India"s largest home-grown early-stage venture capital funds. “And the ones who are likely to hit the D-street over the next two years are already working on the profitability goals. Uber, he adds, went down the path of realising that they must do business in the way it is done: by making money. Ironically, Uber also showed its intent to focus on the core and get rid of the periphery when it reportedly sold its minority stake in Zomato for $390 million in August 2022. Two years later, the focus and intent has started to pay dividends. “They have shown it can be done," says Reddy.

Can Indian startups and unicorns do it? Will the profitability mindset take a back seat whenever the funding winter ends? Well, there is optimism that the founders would keep trekking the profitable route and journey.

First Published: Feb 09, 2024, 16:07

Subscribe Now