Can V Vaidyanathan's Midas touch turn IDFC into a banking behemoth?

The optics look good for IDFC, which announced a merger with IDFC First Bank, but Vaidyanathan will have to handhold the entity through what could be a tricky road ahead

V Vaidyanathan had always dreamt of being a fighter pilot in the Indian Air Force (IAF).

In fact, if not for a medical condition that he developed as a child, Vaidya would have probably spent much of his life inside cockpits or on tarmacs, mending the country’s fighter aircraft fleet. It was sometime during his growing-up years in Odisha that he fell from the terrace of his one-storied house damaging his prospects for a military career.

“It was not a life-threatening injury, but his left eye was damaged," Tamal Bandyopadhyay, the noted journalist, writes in his book Roller Coaster: An Affair with Banking. The family was given a two-month grace period by the IAF to surgically fix the eye before Vaidya could reapply. Vaidya’s father, who worked with Hindustan Aeronautics Limited, sold the family refrigerator for the surgery. “It went off well, but he still flunked the IAF medicals," Bandyopadhyay writes.

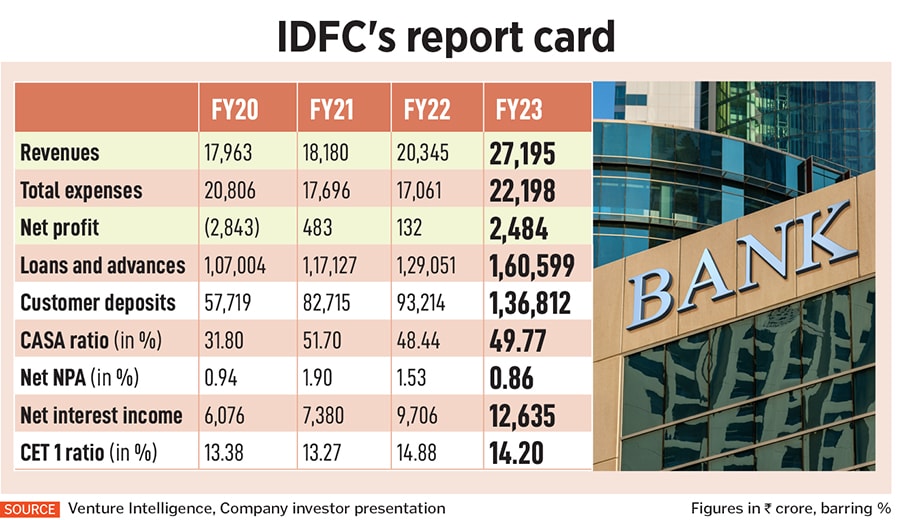

But Vaidya remained unfazed. In fact, if anything, his vision, and perhaps his clarity, was only going to get better from there. A career in banking followed, leading him to rewrite the rules of the game. A lean and balding straight shooter, who had a love for guitar and singing, Vaidya was readying for the big kill in India’s banking sector. As the CEO of IDFC First Bank, a five-year-old bank formed after the merger of IDFC Bank and Capital First, an NBFC, Vaidya has been instrumental in doubling the bank’s revenues, while taking the company out of the red, with deposits of nearly Rs 1.4 lakh crore.

And if the latest manoeuvre by the company is anything to go by, Vaidya is now preparing IDFC First Bank to take it into the big boys’ club. On July 3, a few days after infrastructure giant HDFC and banking behemoth HDFC Bank closed its merger to create an entity worth $157 billion, infrastructure financing company IDFC and IDFC First Bank announced a merger under which shareholders of IDFC Ltd will get 155 shares of IDFC First Bank for every 100 shares held in the former.

“The merger will lead to simplification of the corporate structure of IDFC FHCL, IDFC Limited, and IDFC FIRST Bank by consolidating them into a single entity and will help streamline the regulatory compliances of the aforesaid entities," IDFC First Bank said in a statement. “The merger will help create an institution with diversified public and institutional shareholders, like other large private sector banks, with no promoter holding." IDFC Limited, through IDFC Financial Holding Company Ltd, holds a 39.93 percent stake in IDFC First Bank, with IDFC Ltd being the promoter of IDFC First Bank.

In many ways, IDFC First Bank’s phenomenal success in recent years is a testimony to Vaidya’s grit and determination.

On his LinkedIn profile, Vaidya describes himself as someone who is aspiring to create “a world-class bank Indian Bank, guided by ethics, powered by technology and bank that is a force for social good". His own life is a testimony to the latter, with Vaidya having magnanimously given away millions of his shares to his employees, ranging from drivers to personal trainers, office support staff, and domestic workers. In February 2022, he parted with shares worth Rs 3.95 crore, while a year before that, he gave away 450,000 shares, then valued at Rs 2.43 crore to three people for them to buy homes.

In 2020, Vaidyanathan had pledged 100,000 shares in IDFC, then valued at close to Rs 30 lakh, to Gurdial Saini, his mathematics teacher from school, who lent him Rs 500 to travel from Chennai to Jharkhand to attend an interview at the Birla Institute of Technology (BIT Mesra). Vaidya graduated from BIT Mesra in 1990 to join Citibank where he rose through the ranks to become the business head of its auto division.

The fall of the millennium meant Vaidya left Citibank to join the KV Kamath-led ICICI Bank as the managing director of ICICI Financial Services Limited. By 2010, when he quit the ICICI group, Vaidya had already served as ICICI Bank’s head of retail lending business, and even found a spot on the board of the bank, making him the youngest executive director in ICICI Bank’s history at 38 years of age. “But he quit the group when he figured that it would be more than a decade to have a chance in the corner room," Bandyopadhyay writes. “The new CEO Chanda Kochhar was just 47."

In 2010, Vaidya bought into Future Capital Holdings, a loss-making, real-estate financing NBFC with a market capitalisation of Rs 780 crore, with a plan to later convert the NBFC into a bank. To fund his purchase of 10 percent stake, he borrowed Rs 78 crore by pledging his home and purchased the stock as collateral. His game plan was to emulate Uday Kotak’s tried and tested formula of building an NBFC to get a banking licence.

“He turned entrepreneur through an audacious leveraged buyout, funded by personal leverage of Rs 80 crore secured by the stock and his house, paying 13 percent interest for the loan, calculating that the value creation on turnaround will outrun the interest cost," Bandyopadhyay writes.

Soon, Capital First was on a different trajectory. Vaidya changed the business model to MSME financing and raised funds from private equity. He also shut down all non-core businesses, including broking and real estate financing. From losses of Rs 30 crore, the company’s profit grew to Rs 358 crore, with market capitalisation swelling from Rs 780 crore in 2010 to Rs 8,200 crore by 2018. In the meantime, Capital First"s retail loan grew from Rs 94 crore to Rs 29,600 crore by 2018 with 7 million customers.

In 2018, with a plan to convert Capital First into a Bank, Vaidya merged the NBFC with IDFC Bank. IDFC launched its bank in 2015 largely in its attempt to move beyond its core specialisation of infrastructure funding, as the infrastructure boom had turned to bust. Vaidyanathan was appointed the CEO and managing director of the merged entity.

Today, IDFC First Bank has resolved much of its legacy bad loans in infrastructure as well as tricky cases such as exposure to Vodafone Idea, Dewan Housing, and Reliance Capital it got its CASA engine ticking and started new businesses like home loans and credit cards that should, in time, gather pace. This is one of the few banks that has successfully been building balance sheet size and a diversified loan book after trimming down legacy infrastructure lending from IDFC and MSME exposure of Capital First.

By March 2023, its advances have grown 24 percent year-on-year, return on assets is up 105 bps to 1.13 percent and CASA ratio is at 49.8 percent, up from 8.7 percent on merger in 2018. Gross NPAs are at 2.51 percent in FY23 against 3.7 percent in FY22. The bank stands well capitalised with a CET1 ratio of 14.2 percent.

In five years since the merger with Capital First, IDFC First Bank has been able to show that its profit engine has strengthened dramatically. Net profit in FY23 soared nearly 18x to Rs 2,437 crore, which was on account of the increase in pre-provisioning operating profit, including treasury gains by 50 percent compared to FY22 and also lower provisions by 46 percent.

One of the key points of success has been that Vaidyanathan has successfully been able to wind down the infrastructure financing book of the bank to Rs 4,664 crore (2.9 percent of loans) in FY23 from Rs 26,832 crore (36.7 percent of loans) in FY18. Excluding the infrastructure financing book (which Vaidyanathan says is in run-down mode), the gross NPA and net NPAs for the bank would be even lower at 1.84 and 0.46 percent of the advances.

For every bank, the need for deposits is vital to fund existing and future growth. In IDFC First Bank’s case, at the time of the merger with Capital First in 2018, its deposit franchise was largely institutional (at 73 percent). The bank initially restrained its loan growth—growing just 5.1 percent between December 2018 and December 2021—to strengthen the liabilities franchise first. By 2023, the deposits profile had altered completely, with retail deposits now making up 76 percent of its customer deposits.

Customer deposits for IDFC First Bank grew by 47 percent year-on-year to Rs 136,812 crore. Annual CASA deposit grew 40.7 percent and term deposit was 54.2 percent.

As the RBI is expected to keep interest rates on hold in the coming quarters, banks are unlikely to aggressively keep hiking rates for fixed deposits in the coming months, to attract more depositors. Credit growth for banks in India continues to outpace deposit growth.

The RBI, in its June 2023 Financial Stability Report (FSR), has said deposits grew by 11.8 percent and credit growth by 15.4 percent. This trend is likely to sustain through FY24. Vaidyanathan believes IDFC First Bank is well-positioned to continue towards strong deposit growth. “Somehow our hit rate per branch is significantly better and now we got to allocate, figure out what is the reason," he told analysts during their April 29, 2023, earnings conference call. “It"s definitely a bank that is just seen as a really good brand."

Analyst Nitin Aggarwal, head of banking, insurance & financials research at Motilal Oswal Institutional Equities, says: “Growth for IDFC First bank has been on track and FY24 is not likely to be different. It has been able to raise deposits at a healthy pace, despite a lower branch reach and being a relatively new bank. Their execution has been good."

But while the optics for the bank look sound, a few things need to be managed better. One, the cost-to-income ratio (which impacts profitability—the lower the ratio, the more profitable the bank becomes). Though the cost-to-income ratio has been improving—from 95.13 percent in Q2FY19 to 72 percent in FY23, it is poorer than the larger banks—HDFC Bank and ICICI Bank (a C/I ratio of around 40 percent), or mid-sized banks—Bandhan Bank (39.5 percent), IndusInd Bank (45 percent) or RBL Bank (68.3 percent). Only Yes Bank clocks higher at 73.1 percent.

The other concern will be to maintain healthy asset quality. While, currently, it is on track to meet the guidance of 2-2.5 percent for Gross NPAs in FY24-25, they will have to manage that.

Besides the IDFC-IDFC First Bank reverse merger, the banking ecosystem is also seeing the mega-merger of parent HDFC with HDFC Bank. In IDFC’s case, while the merger plans had been known for a while, it will help create not just a simplified corporate structure but also a diversified one, with no promoter holding.

Several corporates stand out now with no promoter holding, including L&T and ITC, besides banks such as ICICI Bank, Karnataka Bank, and South Indian Bank.

In the case of the IDFC, its shareholders had, for years, publicly criticised the institution for delaying in unlocking shareholder value. But there were different reasons for the merger of HDFC with HDFC Bank.

The top leadership team at HDFC was starting to age and it could not afford a vacuum. Also In recent years, the RBI has been tightening the regulatory and capital norms for NBFCs, which includes HDFC. This meant that NBFCs could not really function within a lower level of regulation. Being part of a bank probably made more sense at this stage.

Also, the housing finance business continues to get competitive and the return on equity for HDFC has dragged since FY19. With strong cross-selling opportunities, the merger made more sense. About 70 percent of HDFC’s customers do not have a banking account with HDFC Bank, and, of the bank’s customer base of 83 million customers, only 2 percent have a housing loan with them. An additional 5 percent have a mortgage loan from other lenders.

We now have large corporate empires in India’s banking ecosystem—the HDFC Bank empire, Axis Bank empire, ICICI Bank empire, and the Bajaj Finserv-Finance empire—which offer considerable economies of scale in running largescale financial services operations in the form of data/technology, distribution muscle and the cost of capital. “It will put enormous pressure on everybody else that does not have this scale," Saurabh Mukherjea, founder and chief investment officer at Marcellus Investment Managers had told Forbes India earlier.

Eyes will now be on the much-delayed privatisation plan of IDBI Bank with possible suitors being Kotak Mahindra Bank and the Prem Watsa-led Fairfax India Holdings, the promoter of CSB Bank.

What that means for IDFC Bank is that the journey is only getting started. Vaidyanathan has done all the heavy-lifting, ploughing the bank through two large deals and building a brand. The road ahead may appear easier to navigate, but is a narrower, tricky one towards the top.

First Published: Jul 05, 2023, 11:28

Subscribe Now