Foreign banks in India: Leaner, but battle-ready

Each banking crisis amplifies fears of a risk to financial stability and the capability of foreign banks to withstand it. In India, losing share in deposits and lending activity may not make for a pre

In the few weeks starting March, visualisations of 2008 had started to appear in peoples’ minds: Of large global banks shuttering, bankers getting fired and regulators taking collective action to arrest a contagion effect. The United States has already seen the collapse of three banks. Last month’s rescue of Swiss giant Credit Suisse by longtime rival UBS Group, through a $3.2 billion bailout, has increased the risk to financial stability. Inflation across most economies remains stubbornly high, which means interest rates will continue to rise and the impact of which on liquidity and the pace of growth is a given.

The Reserve Bank of India has, in its April 7 monetary policy meeting, already paused its interest rates hike cycle—the repo rate has risen cumulatively by 250 basis points in the last 11 months starting May 2022—in a move seen to assess not just the impact of these actions but also the evolving financial stability risks overseas. While public sector banks (PSBs) have been urged by the government to review their exposure to the external stress, they will need to assess risks, diversification of deposits and any asset-liability mismatches.

Foreign banking activity in India, which dates back to over 160 years, has a different issue to tackle. Each tremor to a global banking system triggers different responses from a bank operating outside its home market, but the messaging usually always originates from the bank’s headquarters. The cost of operations, the returns and regulatory compliance issues become issues of discussion. These have all become relevant issues for foreign banks to deal with in recent years.

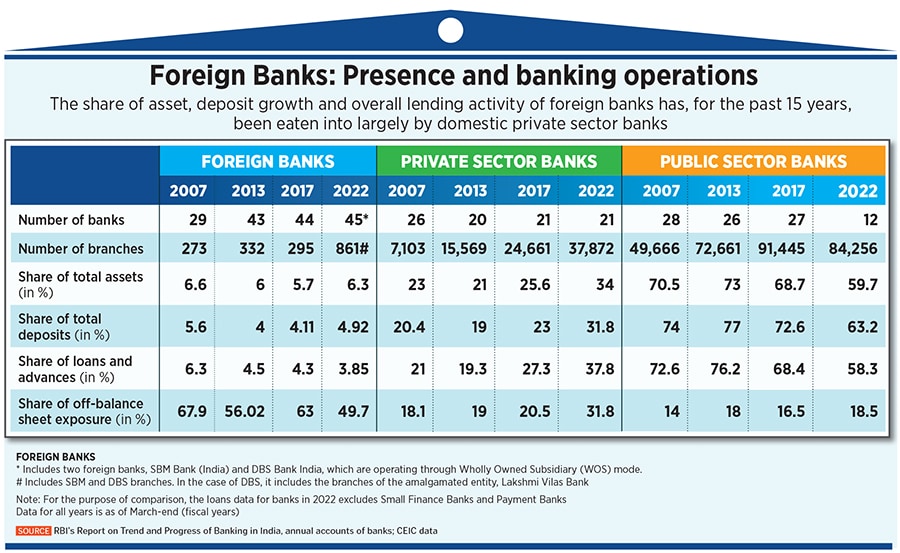

Foreign banks, at 45, constitute more than a third of the total of 137 scheduled commercial banks in India, which include public and private sector banks, payments banks, small finance banks and regional rural banks. Despite this meaningful presence for decades, they have just a 3.8 percent share of total loans and near five percent of total deposits, as of 2022 (see table). Their share of asset, deposit growth and overall lending activity has, for the past 15 years, been eaten into largely by domestic private sector banks.

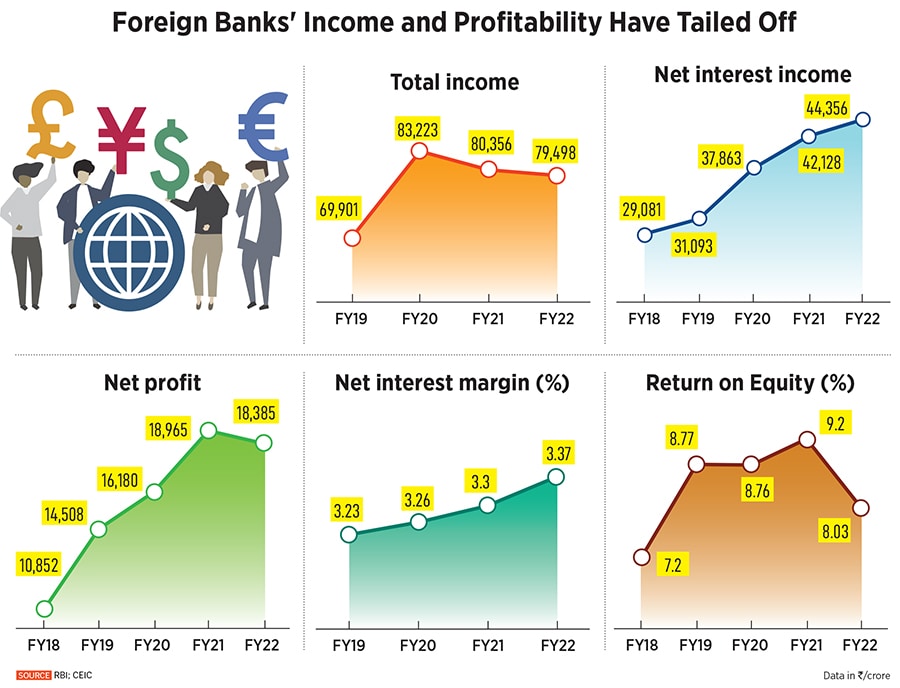

Income and profitability have also tailed off (see charts) in this period. Public Sector Banks (PSBs), plagued by weak balance sheets and high non-performing assets between 2013 and 2019, have also lost their share of business to a booming private sector led by HDFC Bank and ICICI Bank.

Several foreign banks have been, for different reasons, forced to shrink, merge or sell off some of their business in India as part of their global restructuring after the 2008 global slowdown. These have included Citibank India’s $1.4 billion sale of its consumer banking business to Axis Bank in 2022-23 and South Africa’s FirstRand Bank’s announcement in 2021 to exit banking but retain its representative office in Mumbai.

In 2016, the retail banking operations of Royal Bank of Scotland (RBS) India (now NatWest India) started to close in a phased manner. HSBC had trimmed several of its branches across India in 2015-16 as part of its global restructuring while in 2012, British bank Barclays shut its retail banking business in India to focus on corporate and investment banking and wealth management for the wealthy.

"One of the concerns that foreign banks have traditionally had is that being present across various countries, their growth strategies are not just dependent on regulations in India, but also developments in the rest of the world. The interest of foreign banks keeps shifting depending on macroeconomic conditions and policies," Shinjini Kumar, ex-country business manager for Citi consumer bank told Forbes India. Kumar is now a co-founder of financial services startup Salt.

Another challenge that foreign banks have faced both overseas and in India is devising a proper structure, post a restructuring or buyout. "Large organisations find it hard to shrink during difficult and uncertain times. Often they would have built a superstructure and then it is not easy to shrink it, as centralised costs tend to get loaded on to remaining businesses. Unless one takes a machete, and not a scalpel, to topple the superstructure—which is designed to manage a larger organisation—things get complicated," Rajesh Jogi, a former chief risk officer at RBS India/NatWest Group tells Forbes India.

For the newest casualty, Credit Suisse, the impact in India is not likely to be deep. Credit Suisse in India runs an investment banking business, along with wealth management and brokerage operations. Income for the Mumbai branch had fallen to Rs 803.6 crore in FY22 from Rs 898 crore in FY21, while net profit fell to Rs 189 crore from Rs 217.3 crore a year earlier.

There is bound to be a new structuring for its India operations, considering that its new parent UBS had reduced its global banking presence in Indian since 2013 and Credit Suisse still holds a banking licence. Here the acquirer’s decision will weigh strong. “When one looks to buy a jewel but want to refashion it in the image of the acquirer then it will throw away the benefit of the acquisition," a source at a European Bank says, declining to be named. Now UBS is getting a back-door entry into India, but it is quite likely that a banking decision will be made based on a broader, universal plan.

During British rule, several of the earliest foreign banks that came to India focussed on providing trade finance, external commercial borrowing, wholesale lending and working capital, investment banking and treasury activities. Even today, several of the American and European banks that operate in India are finding their competitive advantage in these niche segments that they continue to offer.

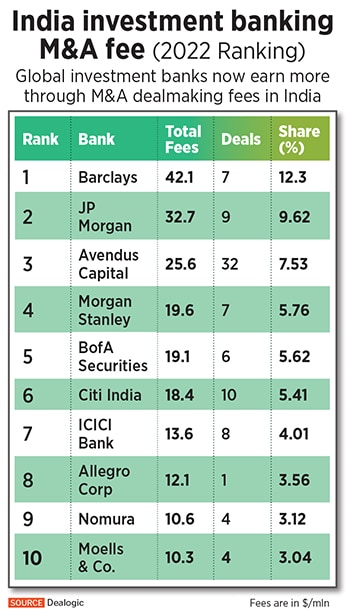

Jaideep Khanna, head of Barclays, Asia Pacific and country CEO, India, says Barclays has “continued to strength their market standing" across all verticals in 2022. “We have seen consistent growth in our investment banking over the past two years particularly a healthy growth in equity financing, structured credit and M&A business," Khanna tells Forbes India.

According to Dealogic, Barclays ended 2022 as a leader in M&A fees in India (see table) and global bonds, based on Bloomberg data. The list includes other heavyweights such as JP Morgan, Morgan Stanley, Citi, Bank of America Securities (BofA) and Nomura. Global investment banks now earn more through M&A deal making fees in India, than in China, indicating their shift away from the Chinese economy, which has yet to shrug off the impact of the Covid-19 pandemic.

According to Dealogic, Barclays ended 2022 as a leader in M&A fees in India (see table) and global bonds, based on Bloomberg data. The list includes other heavyweights such as JP Morgan, Morgan Stanley, Citi, Bank of America Securities (BofA) and Nomura. Global investment banks now earn more through M&A deal making fees in India, than in China, indicating their shift away from the Chinese economy, which has yet to shrug off the impact of the Covid-19 pandemic.

Khanna says its Global Service Centre in India has the largest employee pool outside UK, which delivers technology solutions and operational support for the Barclays’ clients and customers.

Foreign banks have traditionally been leaders in fee-generating businesses, a fact which central banks have always appreciated. Even after all the turmoil and changes, they can continue to have an edge in cross-border trade finance, forex or cross border investments.

One part of investment banking, the equity capital markets (ECM) business, has all but stagnated since 2022, as global investors continue to remain risk averse, post the continuing Russia-Ukraine war that has led to volatile oil prices and high inflation. Corporates have also hesitated in raising capital in this period due to poor liquidity and a high interest rate structure.

For 2022, ECM underwriting fees in India reached $203.1 million, down 30 percent from a record $291.7 million in 2020, according to Refinitiv data. For the first quarter-ended March 2023, ECM fees reached $50.0 million, up 15 percent from a year ago, but bankers who Forbes India spoke to are not confident of this trend sustaining for the rest of the year.

The number of foreign banks that have exited retail banking in India would seem to suggest that these were non-viable businesses, where cost-to-income ratios were coming under pressure. This is not completely the case. The rapid growth of domestic banks, from State Bank of India and HDFC Bank to Kotak Mahindra Bank and non-banking financial heavyweights such as Bajaj Finance, Shriram Finance and Aditya Birla Capital has only meant that foreign banks have often been left fighting for scraps.

Citibank India is one of the few foreign banks that built a sizeable and valued consumer banking franchise, comprising credit cards, retail banking, wealth management and consumer loans. Its acquirer Axis Bank has often called it a “gold standard" business. Citi, which commenced banking in India in 1902 from Kolkata, had six offices, 21 branches and 499 ATMs across 18 cities in India. Citi will continue to service large corporates and multinationals in India but in consumer banking will no longer source customers for Citi-branded products.

“I think what Citi had going for its consumer bank in India was a very strong brand and well established processes. The franchise was built with a lot of pride by iconic leaders who were pioneers," Shinjini says.

She adds the personal banking journey for foreign banks in India was not easy going because they “are not the dominant players and large Indian banks (as well as regulatory action) decide pricing for most part." In addition, the need to invest in technology both to upgrade and comply imposes costs. “It can feel like a drag, due to high costs, low revenues and because you are comparing with other geographies and business lines," she says.

Others such as DBS Bank India, HSBC India, Standard Chartered Bank India and Deutsche Bank India, amongst a few foreign banks, will continue to stay relevant in this space and try and grow this business.

The Reserve Bank of India (RBI), while framing the 2013 guidelines for subsidiarisation and expansion of foreign banks in India, has made it clear that the policy incentivised existing foreign banks to convert branches into wholly owned subsidiaries (WOS) which promises ‘near national’ treatment. This means that as a locally incorporated bank, the foreign bank will be allowed to open branches anywhere in the country (at par with Indian banks), except in sensitive regions. But ten years since the WOS guidelines only two foreign banks—DBS Bank and SBM Bank—operate through WOS in India. Factors such as priority sector lending compliance and inclusion rules are concerns which might have discouraged other foreign banks from going down that route.

DBS Bank India (DBIL) was the first among large foreign banks in India to start operating as a WOS since April 2019, after operating as a branch since entering India in 1994. The bank, with the amalgamation of troubled Lakshmi Vilas Bank (LVB), has 530 branches in 350 cities.

DBS Bank India’s (DBIL) Managing Director and CEO Surojit Shome says the WOS model and the LVB acquisitions has enabled them to accelerate growth, expand operations and build a wider footprint in India. Shome highlights a differentiated proposition in India with a “unique phygital (physical plus digital) model" which combines best-in-class digital capabilities and a physical network.

DBIL, which is well-capitalised with a 16 percent capital adequacy ratio, reported a 29 percent fall in net profit at Rs 222.6 crore for FY22, over the previous year, hurt by the LVB acquisition costs. Retail banking forms approximately 15 percent of its total revenues in FY22, compared to 8.3 percent in FY19, DBIL annual reports data shows. The total customer base for DBIL is now 3.2 million.

“Our plan is to grow our retail and SME businesses at a much faster pace, thereby rebalancing from a substantially large corporate dominated business to a 40:30:30 ratio (large corporate, SME, consumer)," Shome tells Forbes India. Currently, the large corporate book accounts for 55 percent while the remaining 45 percent is divided between SME and consumer segments.

Another bank, Standard Chartered Bank, has found the right mix of wholesale and retail banking in India, contributing 37.8 percent and 25.7 percent of total revenues, the balance coming from treasury operations.

Credit card growth has been steady for both domestic and foreign banks in 2022, analysts say. The overall January 2023 credit card outstanding has grown 29.6 percent year-on-year to Rs1,86,783 crore, according to RBI data released in March. After RBI’s 2022 guidelines on the closure of inactive cards, the banking system saw a net reduction in credit cards of around 2.9 lakh in September 2022 from the previous month, according to a Motilal Oswal report in September last year. The report showed that Kotak Mahindra Bank, SBI Cards, RBL and Axis Bank saw strong year-on-year growth as acquirers of new cards.

Servicing the wealthiest has always been a priority for foreign banks across different countries. But it has been seen as a high growth vertical in India in recent years. There is now a record number of Indians on the Forbes’ 2023 World’s Billionaires: 169 in total from 166 last year.

As with other segments of banking in India, this is a highly fragmented one, where pure foreign private wealth managers such as Julius Baer is one of the few with a meaningful franchise, with global assets under management of CHF 428 billion ($472 bln).

Ashish Gumashta, executive chairman of Julius Baer India says the last 12-18 months ‘have boded well" led by a good addition of new clients to both equity and fixed income asset classes. Gumashta forecasts India’s wealth management industry to grow at a 10-12 percent compound annual growth rate (CAGR) up to 2025, driven by factors such as increasing wealth, a growing middle class, and a rise in digital adoption.

“We have a unique franchise for the global non-resident Indian community. We realise that Indian families are becoming global, and we call this the ‘Global Indians’ segment. NRIs want to invest back in India, anywhere between 15-25 percent of their portfolio. Julius Baer as a pure private bank is best positioned to service these families in India and overseas. Our experience and focus on wealth gives us an edge and a unique opportunity to service this segment best," he adds.

Besides the presence of some foreign banks such as Barclays and Citi, this segment is crowded by domestic players including the IIFL Group, Kotak Mahindra, HDFC Bank, Avendus Capital, Nuvama (formerly Edelweiss) Wealth, ASK Wealth Management, and others.

The quality of service, the propensity of having a strong balance sheet and the ability to provide investors with offshore products—which has remained a strong point for several foreign banks—will continue to be differentiators. “But this is a tough market in terms of cost structures and while it is growing, it continues to be fragmented," the European bank source says.

As with some large multinationals, several of the foreign banks in the country are being led by an Indian (or Indian-origin) leader. This includes Hitendra Dave (HSBC India), Jaideep Khanna (Barclays India), Surojit Shome (DBS Bank India), Ashu Khullar (Citi India), Kaushik Shaparia (Deutsche Bank), Umang Papneja (Julius Baer) and Arun Kohli (Morgan Stanley).

Foreign banks will seek to ensure some form of continuity of their leadership in a still uncertain global economic environment. Most economists and global financial institutions forecast India’s economy to grow at 6-6.5 percent in FY24.

But there is almost no banker today who could say with conviction that we could not see more bank collapses in 2023. The year could still play out tough for the ECM business for investment banks. Globally, the real concern will be on future central banks’ rate actions if inflation turns out to be stickier-than-expected and does not moderate.

India could face concerns over slowing growth and export-dependency. Banks are likely to have shown a 15 percent credit growth, the sharpest in recent years and this trend could sustain into FY24. The ECM business aside, most of the foreign banks are likely to see growth in the key investment banking activity (including M&A activity), wholesale banking business and private wealth to service the ultra-rich. The year 2023, then, appears to just emerge better than it started.

First Published: Apr 10, 2023, 12:16

Subscribe Now