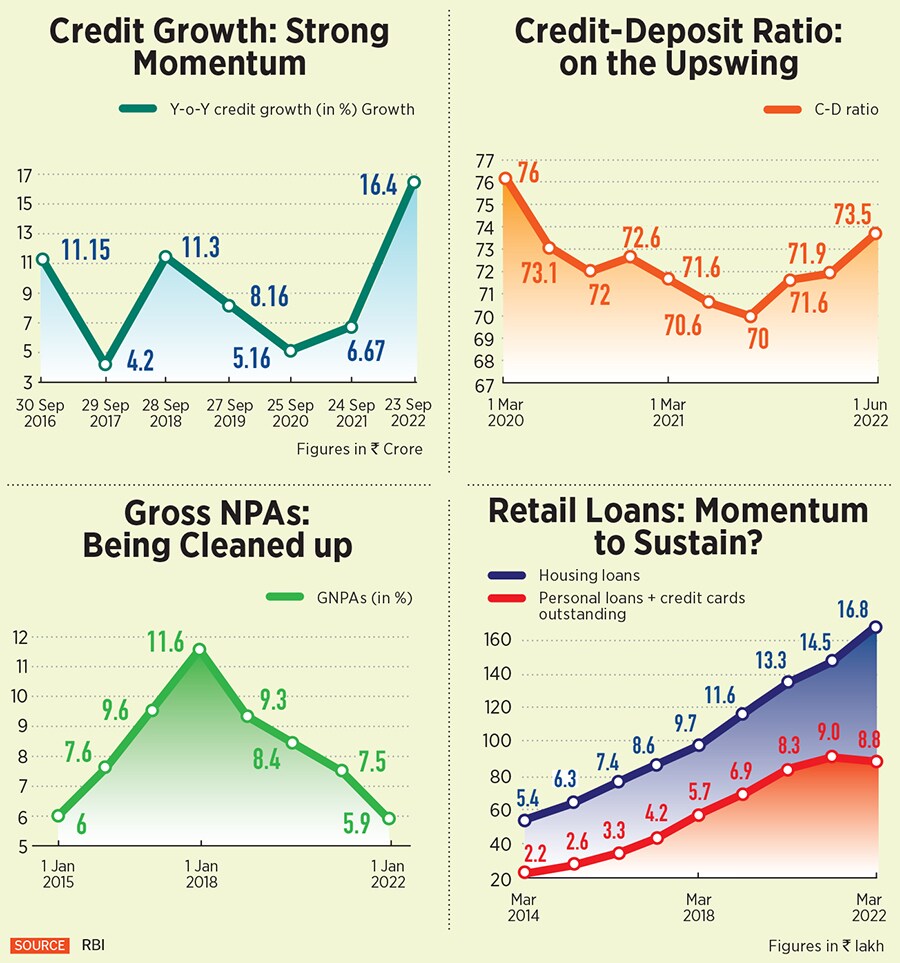

The three months to September saw a strong growth momentum led by a combination of growth in lending to retail, small businesses and working capital loans for corporates. Disbursements have been strong across both secured and unsecured segments—vehicle, home and personal loans. This comes even as interest rates on loans continue to rise.

In a still-rising-interest-rate environment, bankers and analysts see retail loans growth likely to continue for at least two more quarters for all banks. “Retail advances are in focus… they now account for just above 30 percent of all credit, up from 25 percent in FY18. There will be no letup, at least for the next two quarters," says Nitin Aggarwal, banking analyst at Motilal Oswal Securities. Housing demand is getting supported by vehicles and demand for unsecured loans is also coming back, he adds.

There could, however, be some uncertain times ahead for the microfinance space, which could hurt an already-ailing Bandhan Bank.

Kotak Mahindra Bank’s group president and head of consumer banking Virat Diwanji is also confident that secured loans growth would sustain. “The psyche of people post Covid-19 is that roti, kapda hai…. makaan karna hi hai (food and clothing aside, a home is a must)," Diwanji tells Forbes India. Individuals have also been using current properties to borrow in the form of loan against property (LAP), he adds. Home loans and LAP grew 40 percent year-on-year in Q2FY23.

In the secured lending space, as interest rates continue to rise and loans gets costlier, the eligibility of the salaried and the ability to borrow might become a constraint. But this is not clearly visible at this stage," says Diwanji.

By next March if the repo rate climbs to 6.5 percent (from 5.9 percent currently), home loan rates could well climb to above 9 percent, which might push potential customers to delay their decisions for a property. Diwanji also believes that in the secured business loans category, investments in the micro, small and medium enterprises (MSME) segment are sustaining and “unlikely to taper off".

The elephant in the room is the unsecured lending customer, where demand for new loans could see lower demand if interest rates continue to rise, Diwanji says. “On the asset side, there could be a marginal decline or demand could remain the same…. there will not be a dramatic increase or decline if interest rates continue to rise," he adds.

An Earnings Upgrade Seen

The overall non-performing assets (NPAs) for banks in India are down to a seven-year low of 5.9 percent in FY22, according to the Reserve Bank of India (RBI). This is likely to improve further to 5 percent by FY23-end and around 4 percent by FY24, according to Crisil estimates.

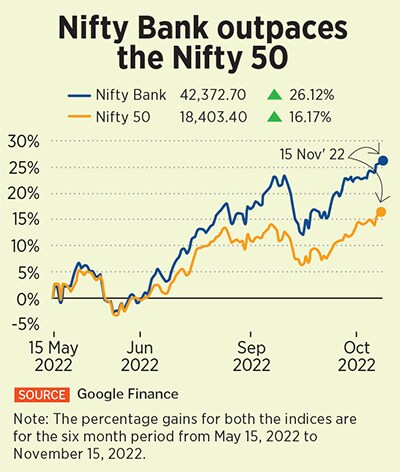

The reduced pressure on banks’ top management to deal with bad loans and focus on lending has clearly reflected in the Q2FY23 earnings. In the Motilal Oswal Financial Services (MOFSL) portfolio, the public sector and private sector banks have seen a Q2FY23 earnings upgrade of 12.3 percent and 2.7 percent respectively. Improved profitability and return on asset growth has started to get reflected in the stock prices of the top banks (see Nifty Bank chart).

![]() MOFSL estimates an FY23 earnings upgrade for both Axis Bank and ICICI Bank. This could mean a 17.1 percent upgrade for Axis Bank in FY23 estimated earnings, 3.4 percent for Bajaj Finance, 2.5 percent for Kotak Mahindra Bank and 1.4 percent for ICICI Bank. Some of the foreign equity research outfits such as CLSA, Goldman Sachs and Jefferies have all a ‘buy’ rating on Axis, after the September-ended earnings.

MOFSL estimates an FY23 earnings upgrade for both Axis Bank and ICICI Bank. This could mean a 17.1 percent upgrade for Axis Bank in FY23 estimated earnings, 3.4 percent for Bajaj Finance, 2.5 percent for Kotak Mahindra Bank and 1.4 percent for ICICI Bank. Some of the foreign equity research outfits such as CLSA, Goldman Sachs and Jefferies have all a ‘buy’ rating on Axis, after the September-ended earnings.

The Axis Bank stock has risen by 33 percent to Rs859 at the NSE from July 1 onwards, HDFC Bank stock is up by 19.8 percent to Rs1,622, ICICI Bank stock 29.7 percent to Rs913.2, SBI stock 29 percent at Rs601, Kotak Mahindra Bank stock 14.9 percent to Rs1,918, Yes Bank stock 35 percent to Rs17.05 and IDFC Bank stock 77.9 percent to Rs57.3, in the same period.

Nomura’s analysts Nilanjan Karfa and Punit Bahlani expect bank earnings growth trajectory to look better through FY23-24, with declining credit costs and loan growth holding up. This has been due to higher credit growth, which has seen banks’ earnings improving. Rising interest rates—190 bps since April –have helped banks increase profitability. “Lending rates on new loans have increased by 26 bps month-on-month (+ 96 bps since March), while new loan spreads are up by 5 bps month-on-month (down 6 bp since March)," the Nomura analysts say.

Net interest margins—the difference between the interest income generated by a bank on loans and the amount of interest given to lenders—have also been positive in the September-ended quarter, over the previous successive quarter. The net interest margin for Axis Bank rose by 36 bps, SBI 32 bps, ICICI Bank 30 bps, Kotak Mahindra Bank 25 bps and HDFC Bank 10 bps.

Besides margin growth and profitability increase, improved capital adequacy has also become a positive for private and public sector banks. “All the PSU banks have a cushion of over 100 bps over the regulatory requirement Tier 1 capital requirement of 7.6 percent. Five years back, only one-fourth or one-fifth of the PSU banks had that cushion," says Krishnan Sitaraman, senior director and deputy chief ratings officer, Crisil Ratings. Nearly 80 percent of private sector banks have a capital adequacy cushion of 300 bps over the Tier 1 capital requirement.

Deposit Rates to Rise Further

While concerns over lending may be limited even as rates continue to rise, banks will be tested on one front. How deposit growth pans out will be closely watched in the coming weeks. The problem is that credit growth has been growing at 17.9 percent year-over-year—nearly twice that of the deposit growth rate of 9.5 percent. Unless deposit growth picks up, banks will find it difficult to maintain a high credit growth.

Ashok Kothari, a self-employed interior designer, with monthly earnings deployed towards equities and Post Office Savings schemes, has decided to shift these to a fixed deposit with the public sector Central Bank of India. The bank—like most other banks in the country—has from November 11 hiked interest rates it offers for individuals (retail) by 60 bps to 6.15 percent for a year to less-than-two years. The Post Office scheme offered Kothari an annual interest rate of 5.5 percent.

Keen to channelise earnings into a safer financial instrument in a volatile financial market environment, Kothari says: “I decided to put my income back into a fixed deposit because of the current volatile stock market conditions and the need to provide safety to manage my monthly maintenance outgo of Rs7,000 per month for my Goregaon flat."

![]()

Investors have found better returns and safety in bonds, with India’s benchmark 10-year G-Sec bond yield at 7.38 percent on November 15 being higher than most banks’ fixed deposit rates. Banks are starting to offer high deposit rates, but they have edged up slower than lending rates. “So far in the last few quarters, banks have been managing [this scenario] because for a substantial period of time, deposit growth rates were higher than credit growth," says Crisil’s Sitaraman.

Krishnan expects to see banks continuing to raise deposit rates. “They will also raise wholesale term deposits as it will be easier to get bulk deposits and support higher credit growth," he says. “To support higher credit growth rate, they need higher deposit rates."

Axis Bank’s Bali is confident of “deposit growth picking up in second half of FY23". Kotak’s Diwanji agrees: “Banks will chase the liability. If the repo rate moves towards 6.5 levels, deposit rates will rise," he says and believes the RBI could pause on rates for one or two quarters after that and the decline in interest rates is expected to be seen after June 2023.

But future deposits’ action from banks will also depend on the intensity of RBI rate hikes and the commentary from the central bank. Motilal Oswal Securities’ Aggarwal believes the current rate hike cycle is unlikely to be an extended one and there could be a pause on rate action after the January 2023 policy meeting till mid-next year. “If inflation expectations are getting anchored then from a depositor’s mindset, banks may not need to pay them excessively to compensate for inflation. The commentary from the RBI governor will also be important," Aggarwal says.

RBI Governor Shaktikanta Das has been in the spotlight for being unable to keep inflation below the bank’s upper tolerance level of 6 percent. India’s consumer price index, which measures retail inflation, eased to a three-month low of 6.77 percent for October, according to official data. The US Federal Reserve’s commentary on future rate action has suggested that they too might move to a slower rate of increases.

In India, the unsecured lending space could face some stress in the coming months as rates are expected to rise further. But demand for consumption of goods and services is not likely to drop. Most banks appear to have learnt from the mistakes of the past—of aggressive lending, not accounting appropriately for riskier assets and the need to improve underwriting and risk management tools.

The developments relating to two ongoing mergers will also be watched closely: The HDFC Bank merger with HDFC and the merger of parent IDFC with IDFC First Bank. Valuations for both these banks will alter when the mergers are completed.

There are other issues that need to be monitored too. Corporate borrowing action, particularly in the form of debt, will also need to be monitored as the scope for the revival of a private capex cycle rises. “If a debt-funded capex cycle starts, then that needs to be monitored," says Crisil’s Sitaraman. In the last seven years, median gearing of Crisil Ratings portfolio of companies has come down to 0.5 percent from an earlier level of 1.1 percent. Gearing is the ratio which measures how much a company’s operations are funded using debt compared to equity.

Top bankers echo the bullishness of analysts for retail loan growth. Axis Bank’s Sumit Bali, group executive and head of retail lending and payments, says: “We have seen strong retail loan growth and expect this trend to sustain for the bank and the industry. It is indicative of the improved demand for consumption across most of our retail book." Axis Bank’s retail book grew 22 percent year-on-year and 3 percent quarter-on-quarter. “Credit card spends have been good across all categories (47 percent growth year-on-year) which imply good consumer sentiment," explains Bali.

Top bankers echo the bullishness of analysts for retail loan growth. Axis Bank’s Sumit Bali, group executive and head of retail lending and payments, says: “We have seen strong retail loan growth and expect this trend to sustain for the bank and the industry. It is indicative of the improved demand for consumption across most of our retail book." Axis Bank’s retail book grew 22 percent year-on-year and 3 percent quarter-on-quarter. “Credit card spends have been good across all categories (47 percent growth year-on-year) which imply good consumer sentiment," explains Bali. MOFSL estimates an FY23 earnings upgrade for both Axis Bank and ICICI Bank. This could mean a 17.1 percent upgrade for Axis Bank in FY23 estimated earnings, 3.4 percent for Bajaj Finance, 2.5 percent for Kotak Mahindra Bank and 1.4 percent for ICICI Bank. Some of the foreign equity research outfits such as CLSA, Goldman Sachs and Jefferies have all a ‘buy’ rating on Axis, after the September-ended earnings.

MOFSL estimates an FY23 earnings upgrade for both Axis Bank and ICICI Bank. This could mean a 17.1 percent upgrade for Axis Bank in FY23 estimated earnings, 3.4 percent for Bajaj Finance, 2.5 percent for Kotak Mahindra Bank and 1.4 percent for ICICI Bank. Some of the foreign equity research outfits such as CLSA, Goldman Sachs and Jefferies have all a ‘buy’ rating on Axis, after the September-ended earnings.