IDBI Bank: Lot of value, difficult to extract

The legacy-rich IDBI Bank is finally ready for a new ownership. While the bank has turned profitable and provisioned for bad loans, the tricky path to growth and becoming a retail-focussed enterprise

The true test of the work that veteran banker and IDBI Bank managing director Rakesh Sharma and his team have put in—to not just turn around a bank that was once in an ICU-type state, but also make it an attractive asset to acquire—will be reflected in the coming months.

IDBI Bank, a subsidiary of Life Insurance Corporation of India (LIC), which by legacy has been largely focussed on corporate banking, is finally up for a strategic sale from its two promoters, LIC and the Government of India (GoI). This opens up a fresh opportunity for entities to acquire and operate a bank, where the Reserve Bank of India (RBI) has been sparing to grant a universal banking licence.

The 159-page preliminary information memorandum issued by the Department of Investment and Public Asset Management (DIPAM), Ministry of Finance, says interested parties can submit their Expressions of Interest (EoI) either as a sole bidder or as part of a consortium (with a maximum of four members).

An interested party must have a minimum net worth of Rs 22,500 crore ($2.85 billion, assuming the dollar at Rs 79) as per its latest audited financial statement. The lead member of a consortium should have a minimum shareholding percentage/participating interest of 40 percent in the consortium, while other members should have a minimum shareholding of at least 10 percent. The interested party also must have reported net profits in at least three of the last five fiscal years.

The successful bidder, whether a sole entity or a consortium, is required to hold and lock-in at least 40 percent of the paid up and voting equity share capital of IDBI Bank, at all times, for a period of five years from the date of acquisition of stake in IDBI Bank.

This is an attempt to attract only serious bidders for this legacy-rich bank. But as with previous processes for a banking licence, large industrial and corporate houses will, once again, not be permitted to participate in this bidding process, either on their own or as part of a consortium.

This is an attempt to attract only serious bidders for this legacy-rich bank. But as with previous processes for a banking licence, large industrial and corporate houses will, once again, not be permitted to participate in this bidding process, either on their own or as part of a consortium.

The GoI seeks to divest 30.48 percent of its 45.48 percent stake in IDBI Bank, and LIC (the promoter with management control) 30.24 percent of its 49.24 percent stake in the bank, for a combined 60.72 percent stake strategic sale. After the privatisation process is completed, the two entities are likely to hold a combined 34 percent in the bank.

While the last date to submit the EoI is December 16, the RBI will conduct its ‘fit and proper’ assessment, followed by other due diligence norms and the Ministry of Home Affairs security clearance. Financial bids are likely to be placed only by March 2023 and the privatisation is expected to be completed within the next six months, by September, say media reports.

The buzz to acquire this private bank is not loud at the moment. The reality is that privatisation of a government-owned enterprise—let alone a bank—is a rarity in India. The evolution of IDBI Bank from a development financial institution into a lender, and its 2019 re-classification as a private sector bank, after being acquired by LIC, is, strictly, also not privatisation.

The bank’s retail franchise may not be much to talk about. In the lending book, IDBI Bank’s retail to corporate ratio in gross advances has inched up to 63:37 in June 2022, from 62:38 a year earlier. But remove lending to agriculture and small businesses, and the pure retail lending is just 42 percent of the book. The bank is also yet to boost its digital lending platform.

“The current and savings account [CASA] book may not have galloped, but one has to remember that this bank was in the ICU," says a source close to the bank, on condition of anonymity. IDBI Bank was freed from the RBI’s Prompt Corrective Action (PCA) framework in March 2021, after nearly four years. This had impinged lending, business expansion and accessing costly deposits, which hurt profitability.

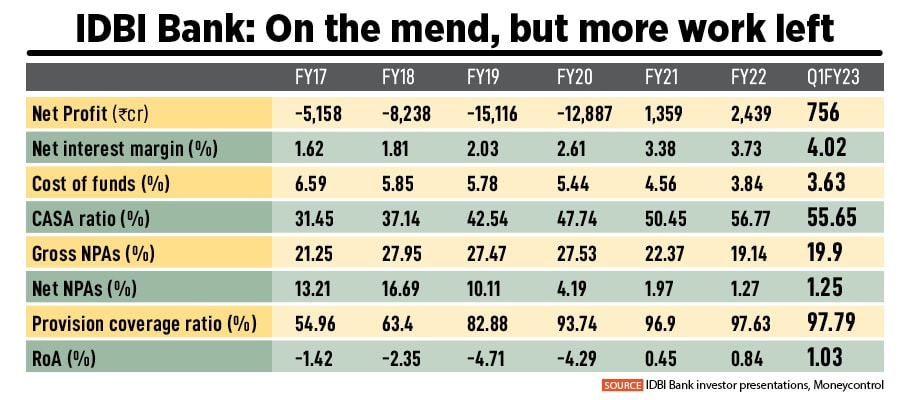

IDBI Bank has reported full-year profit for the last two financial years, after four successive years of losses (see table). Alongside, interest margins and the cost of funds have continued to improve, thereby increasing their return on assets. IDBI’s management declined to talk to Forbes India on the promoters’ divestment and future strategies due to being close to their silent period ahead of earnings.

Asset quality has been a concern for the bank, if one looks at the gross non-performing assets (GNPAs), which is at a high 19.9 percent for the 2022 June-ended quarter. This is much higher than the 5.9 percent level for all banks in March 2022, according to RBI’s financial stability report. But IDBI’s net NPAs as a percentage of net advances, at 1.23 percent, is better than the 1.7 level for all banks, according to RBI data.

But IDBI Bank has a current provision coverage ratio of 97.79 percent, which means it has kept aside funds and provided for capital to cover losses on NPAs. With a near 100 percent provided for, it is more prudent to judge IDBI’s NPAs at a net level. But the quality of the asset book will need to be watched closely by the new investors.

“The universal banking license, brand recognition and wide branch network are some of the key attributes that make the bank attractive to a possible suitor. The large liability base is another attractive proposition. However, it may remain monitorable upon the change in ownership," says Anil Gupta, senior vice president and co-group head, financial sector ratings, ICRA.

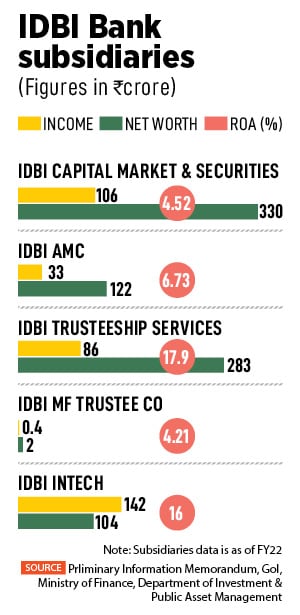

The rating agency has a positive outlook on the ratings of IDBI Bank, given the high provision cover on stressed assets, which drives expectations of healthy profitability and the ability to maintain a strong capitalisation profile. IDBI Bank has 1,874 branches across India, largely focussed in western and central India. All of IDBI Bank’s five subsidiaries are profitable.

Kranthi Bathini, equity strategist at WealthMills Securities, agrees that the bank has a strong brand reach and a good branch network across India, with decent core banking technology. “IDBI’s disinvestment exercise provides the opportunity for investors to participate in India"s strong financial growth and banking theme," Bathini tells Forbes India.

Going ahead then, the new investor or group of investors are likely to continue to retain the brand name IDBI, when the ownership changes. The GoI and LIC would, at least in the near term, continue to hold around 34 percent stake in IDBI Bank. This might undergo a change if fresh capital-raising activity is required in the bank, and the GoI or LIC does not want to partake in a rights issue.

Prior to finalising the information memorandum, the government had reached out to private buyout funds and institutions such as TPG Capital, Carlyle Group and Canadian billionaire Prem Watsa-controlled Fairfax Financial Holdings—it’s Fairfax India Holdings Corporation has a majority in Thrissur-headquartered CSB Bank—to determine investor interest in the stake sales, and held roadshows with several other investors too. Carlyle declined to comment on the IDBI divestment.

The possibility of a solo bank bidding for IDBI Bank—the way in which DBS Bank India bid for the ailing Lakshmi Vilas Bank and amalgamated it into itself—appears unlikely. The net worth required may not be an attractive proposition for a single bank. In DBS’s case, it had got the RBI’s blessings, and that is going to be a critical factor for any bidder to be elected the winner.

The possibility of two banks bidding jointly also appears unlikely, although there are speculations that Kotak Mahindra Bank and IndusInd Bank might appear interested. Both these banks are keen to expand swiftly and bridge the gap between them and the larger HDFC Bank, ICICI Bank and Axis Bank.

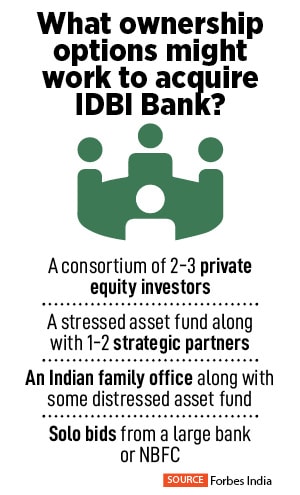

The possibilities that a private equity investor will form a consortium with other partners, or a stressed asset fund may combine with a strategic partner, are likely options. A local Indian family office could also join hands with a distressed asset fund (see table). “A number of them are talking to each other. There is phenomenal value in IDBI Bank, but to extract it is not easy," says the bank source.

The possibilities that a private equity investor will form a consortium with other partners, or a stressed asset fund may combine with a strategic partner, are likely options. A local Indian family office could also join hands with a distressed asset fund (see table). “A number of them are talking to each other. There is phenomenal value in IDBI Bank, but to extract it is not easy," says the bank source.

A potential consortium group will ideally need one investor with a long-term view (of more than 10 years) for the bank, alongside two or three other partners who may have near-term interest. A new investor will have to consider the fact that, in the near term, the GoI-LIC combine will hold near-35 percent stake in the new bank, and possibly have some presence in the new board when it is created.

IDBI Bank will also need to become more technology savvy and nimble, and decide on the geographies it wants to focus on. The quality of the new management, and ironing out culture gaps between the new owners and bank employees will be critical. “The investors can maximise the value of the bank by improving digital delivery of products and services, changing the product mix to segments with better yields while improving efficiency and cost structure," says ICRA’s Gupta.

The new investors will have to consider one limitation on shareholding. The information memorandum clearly states that the successful bidder “will be required to reduce/dilute its shareholding in accordance with the glide-path to be submitted by the QIPs at the stage II (RFP: request for proposal) of the process to align its shareholding in accordance with RBI’s 2016 ownership norms in private sector banks.

The valuation of the bank may be a tricky issue too. “Valuations will be determined by the number of bids received," says another banking source. If the bidding process is successful, then one can believe that the government will look to offload a portion of their stakes in public sector banks in coming years. But if bids are weak, it does not necessarily mean that appetite for these banks is weak, but that the structure of the ownership/bidding process will need to be revised.

The IDBI stock has risen about 30 percent from its 2022 low of around Rs 31 in June-end at the stock exchanges, but is still down 4.3 percent in calendar 2022. The stock has usually moved up on disinvestment news but slides later on profit taking.

For the bank and potential bidders, this is going to be a long road towards value creation. The financial data shows that the operational turnaround for the bank has taken place. But for a mid-sized bank to continue to grow the retail franchise, become digitally savvy and stay nimble is going to be tricky to execute for the new owner. There is a lot of work still to be done and the GoI-LIC combine will need to continue to co-operate with the new board to make this a success story.

First Published: Oct 11, 2022, 14:45

Subscribe Now