Prashant Kumar: Rewriting the Yes Bank story

An unassuming leader, Prashant Kumar has led an ailing Yes Bank out of the woods on a steep trek to the top. He is exploring acquisitions to grow the bank and stay profitable, while building the depos

The demeanour of Prashant Kumar, the managing director and CEO of Yes Bank, contradicts what the financial institution has gone through in recent years–from a near run on deposits in early 2020 which led the Reserve Bank of India to announce a reconstruction scheme to avert any collapse, to infusion of fresh capital from leading banks, and a plan for the complete clean-up of its stubbornly high bad loans.

Kumar is noticeably calm he shifts to a sofa away from his massive desk at the side of a vast chamber at the Yes Bank corporate office in Santacruz, the backdrop view being regular hustle of flights from the Mumbai airport. His comfort might be coming from the fact that the bank—saddled with weak asset quality for years now—has planned a resolution for these bad loans through a transaction with private equity investment firm JC Flowers, announced on September 20.

Rising bad loans on a company’s balance sheet is always poor optics. They not only become non-earning assets and reduce the interest income for the bank, thus impacting return on assets and profitability, but they also reduce the confidence which stakeholders and potential investors visualise of the bank.

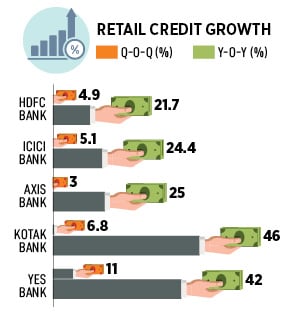

In the case of Yes Bank, between 2008 and 2015, it had expanded rapidly nationwide and lent indiscriminately and aggressively to all, including shadow-lenders and real estate developers. Corporate banking in Q4FY19 formed 65.6 percent of the loan book size. This type of lending had led to a weakening in asset quality, which became a solvency issue because its capital buffers were diminished due to the push for persistent high growth. It was akin speeding without seat belts.

By March 2020, when Kumar took charge of the bank as its CEO, the gross non-performing assets (GNPAs) for Yes Bank had surged to 16.8 percent as a portion of its total advances double that of the level for all banks in India. “A bank is never seen in the right manner by investors, when its GNPAs are much higher than those in the industry," Kumar, the former deputy managing director at State Bank of India, tells Forbes India.

As loans and credit flow worsened in the banking system since 2019, Yes Bank had seen a sharp 39 percent erosion in deposits in nearly 12 months: From Rs227,601 crore in March 2019 to Rs137,506 crore as of March 5, 2020. The loss of confidence called for quick action in the form of a cap on deposits, the RBI scheme for a reconstruction of the board and the infusion of capital from some of India’s strongest banks.

As loans and credit flow worsened in the banking system since 2019, Yes Bank had seen a sharp 39 percent erosion in deposits in nearly 12 months: From Rs227,601 crore in March 2019 to Rs137,506 crore as of March 5, 2020. The loss of confidence called for quick action in the form of a cap on deposits, the RBI scheme for a reconstruction of the board and the infusion of capital from some of India’s strongest banks.

Kumar and his team have managed to reduce GNPAs to 13.4 percent as of June 30, but it is still a high level to deal with. In the proposed transaction with JC Flowers, the Rs48,000 crore (which includes Rs15,000 crore of technical write-offs outside of the balance sheet) of the bad loan pool will be transferred to an asset reconstruction company (ARC) set up by Yes Bank and JC Flowers. Once the bad loans are transferred, the bank’s GNPA’s will fall to 1.5 to 2 percent by March-end 2023.

Yes Bank will pick up 19.9 percent stake in the Asset Reconstruction Company (ARC), and JC Flowers, the balance. Yes Bank’s net carrying weight—the cost of an asset less depreciated—is Rs8,300 crore. JC Flowers will give 15 percent of the bidding amount (approximately Rs1,670 crore) to Yes Bank. Since the net carrying value is lower than the assignment value, this cash would further bring down the value of the security receipts, which Yes Bank is going to carry in its books. “Whenever there is recovery in the bad loans, the SR value will keep reducing," Kumar says. The ARC transaction is likely to be completed in Q3FY23.

Yes Bank will pick up 19.9 percent stake in the Asset Reconstruction Company (ARC), and JC Flowers, the balance. Yes Bank’s net carrying weight—the cost of an asset less depreciated—is Rs8,300 crore. JC Flowers will give 15 percent of the bidding amount (approximately Rs1,670 crore) to Yes Bank. Since the net carrying value is lower than the assignment value, this cash would further bring down the value of the security receipts, which Yes Bank is going to carry in its books. “Whenever there is recovery in the bad loans, the SR value will keep reducing," Kumar says. The ARC transaction is likely to be completed in Q3FY23.

Yes Bank considered other options to resolve the bad loans issue, but they were “not suitable" Kumar says. One option was to sell these loans to an existing ARC. But the bank did not find viable options. The second option was to refer cases to the National Company Law Tribunal (NCLT), but delay in admission of cases and recoveries did not encourage the bank to explore this route.

Yes Bank then chose to set up their own ARC, which banks such as ICICI Bank and Kotak Mahindra Bank have done with mixed results. “We plan to start aggregating stressed assets from other banks later," Kumar says. Yes Bank has made recoveries of bad loans of Rs13,000 crore in the last two fiscal years.

Yes Bank is one of the few institutions to have seen the creation of two new boards in the space of over two-and-a-half years. In March 2020, the RBI had superseded the previous board and appointed two additional directors to the board, including RBI’s former deputy governor Rama Subramaniam Gandhi and Ananth Narayan, an associate professor at SP Jain Institute of Management and Research. In July, Gandhi and Narayan ceased to be additional directors—but remain on the board—after Yes Bank had decided to create a new board. The new board, which was approved by shareholders in July, has recommended that Kumar continue as managing director and CEO for an additional three years. This appointment awaits RBI clearance.

In coming quarters, two nominees—from the Carlyle Group and Advent International each—are expected to join the Yes Bank board, once their deals to invest into the bank are cleared by the RBI. Carlyle and Advent will get a 10 percent stake in the bank, with Yes Bank raising Rs8,898 crore through a combination of equity and warrants to funds affiliated with the two private equity investors. The move is seen to further improve the bank’s capital position and bring in strong strategic investors who would assist the growth strategy for the bank.

In coming quarters, two nominees—from the Carlyle Group and Advent International each—are expected to join the Yes Bank board, once their deals to invest into the bank are cleared by the RBI. Carlyle and Advent will get a 10 percent stake in the bank, with Yes Bank raising Rs8,898 crore through a combination of equity and warrants to funds affiliated with the two private equity investors. The move is seen to further improve the bank’s capital position and bring in strong strategic investors who would assist the growth strategy for the bank.

The Carlyle Group had eyed Yes Bank in 2019, prior to its near collapse. “The RBI-supported rescue operation was impressive in restoring stability in the system and helping Yes Bank to regain confidence. We saw the performance and felt that Yes Bank had been able to demonstrate traction on critical measures such as adequate loss recognition, credit growth and restarting its retail franchise, as customers came back," Sunil Kaul, managing director and financial services sector lead, Carlyle Asia, tells Forbes India.

“We believe that if the bank gets growth and confidence capital, better support for the management, and is given room to grow, especially in the retail and SME space, it can be a fantastic franchise," says Kaul, speaking on Zoom from Singapore.

Carlyle brings to the table access to a network of relationships, specialist advisors, experience with diverse fintech models, risk management systems, capital markets expertise, and suppliers of technologies. The deal awaits RBI clearance.

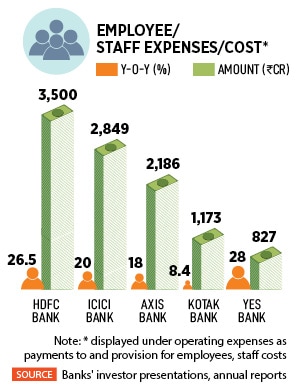

Two women on the Yes Bank board are playing critical roles in the future of the bank. Last year, Rekha Murthy, a former IBM director, joined Yes Bank to head its information technology department, giving a greater boost to digital banking. Nandita Gurjar, former global HR head of Infosys, joined the bank in 2022 she will have the challenging task to address Yes Bank’s recruitment concerns and to help retain the right talent for the bank.

Yes Bank has a high attrition rate estimated at 42.4 percent for FY22 in a September 22 report by Hemindra Hazari, an independent research analyst who writes for Singapore-based research platform Smartkarma. Yes Bank"s FY22 Sustainability report estimates total attrition of 40.61 percent for the twelve months to March 2022, including only voluntary exits.

“Attrition is a concern [for the bank]," Kumar admits. But he points out that Indian corporates, including banks, are facing the same pressure. “People are trying to explore new ideas, and wanting to take more risks," he says. Not limited to banking, India’s IT industry is plagues with an attrition rate close to 25 percent and it also continues to struggle with moonlighting (secondary jobs).

“Attrition is a concern [for the bank]," Kumar admits. But he points out that Indian corporates, including banks, are facing the same pressure. “People are trying to explore new ideas, and wanting to take more risks," he says. Not limited to banking, India’s IT industry is plagues with an attrition rate close to 25 percent and it also continues to struggle with moonlighting (secondary jobs).

Some of India’s top banks also face high attrition but it is lower than Yes Bank. For the year to March 2022, HDFC Bank saw a total attrition rate of 19.1 percent while Hazari, in his report, estimates the FY21 attrition rate for Axis Bank at 23.8 percent and 20.6 percent for IndusInd Bank.

The microfinance sector struggles even more here. The overall attrition rate for the sector was at 50.1 percent and 71.3 percent for probationers for the twelve months ending June 2022, according to industry body MFIN.

Hazari says: “In a retail bank, normally an attrition of 20-25 percent for the lower level staff, particularly entry-level sales and in the below-30 years age bracket, may be considered acceptable. When the attrition for lower staff or for new hires exceeds 25 percent in any bank, it is a symptom of poor human resource management."

In the case of Yes Bank it is possible that “the staff became disillusioned in the immediate post moratorium period, when business became difficult to garner, since the bank’s brand had been impacted this was followed by Covid-19 and combined with a virtual freeze on increments and bonuses," Hazari says.

Almost all banks have tried to address this problem by increasing salaries and compensation and re-skilling/training for career progression or post-pandemic, trying to address work-life balance. Yes Bank has an assessment centre—for the top management (President and above)—created with consultancy firm Mercer. “We have identified areas of improvement—training, interventions, mentorship, role change—for the person." Interventions and feedback is already being shared, Kumar says.

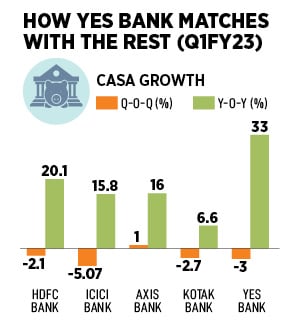

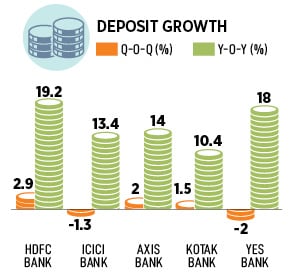

Building the deposit franchise, which is the ‘raw material’ value and profit driver for a bank, is going to be one of the key areas Kumar and his team needs to deliver on. The challenge will be taking on the larger private banks such as HDFC Bank, ICICI Bank or Axis, which are aggressive and have a strong on-the-ground presence.

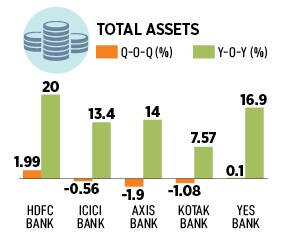

Yes Bank faced one test post-moratorium, in 2020-21, and came out unhurt. “It is one of the few brands where the trust was intact during the tough phase," says independent market analyst Ambareesh Baliga. The bank saw deposits growing by 55 percent in FY21 and 83 percent from FY20 levels. “We are growing our deposit franchise at double that of the industry," Kumar says, referring to the Q1FY23 data, with industry deposit growth at 9.5 percent.

Yes Bank faced one test post-moratorium, in 2020-21, and came out unhurt. “It is one of the few brands where the trust was intact during the tough phase," says independent market analyst Ambareesh Baliga. The bank saw deposits growing by 55 percent in FY21 and 83 percent from FY20 levels. “We are growing our deposit franchise at double that of the industry," Kumar says, referring to the Q1FY23 data, with industry deposit growth at 9.5 percent.

But sequentially, the bank has seen a contraction in deposit growth by three percent, to Rs 1,93,241 crore in June 2022 compared to Rs 1,97,192 crore in March this year.

Several mid- and small-sized banks have hiked deposit rates to attract customers, in reaction to the four RBI repo rate hikes this fiscal. Kumar will have to walk the tightrope of ensuring that as deposit rates increase, the cost of funds—at 5.1 percent in Q1FY23—do not escalate and hurt margins. Kumar is however confident of deposit growth: “Getting deposits to support the loan growth currently is not a challenge. The only thing is the pricing for all the banks would go up in line with the movement in the rate of interest."

Even as Yes Bank continues to build its liability side of the book, Kumar has the challenge of staying profitable for a sustained period. This will be a function of growing income, reducing the cost of funds and inefficiencies within the bank. Yes Bank turned profitable in FY22, the first time since the lifting of the moratorium, as provisioning on loans came down. Net interest margins remain muted, according to Crisil, at 2.3 percent for FY22 against 2.8 percent for FY21.

“Managing growth in a high interest rate regime at a suitable spread is difficult for the bank, as their deposit franchise is yet to really take off," a banking analyst says, on condition of anonymity.

Carlyle’s Kaul, however, argues that one should not forget where Yes Bank came from. “It is not like you can simply flip a switch. They have restarted the growth engine, got back much of the retail deposit franchise that was hurt by the restructuring and restarted investing in people and technology. This new capital will further support growth," Kaul says. “Profitability will come as it adds incremental business and better leverages its scale while running down the legacy, non-earning assets."

With the macro-economic environment still weak, central banks continuing to hike interest rates to battle inflation and a deficit liquidity scenario is not an ideal business environment to operate in. A mid-sized bank of Rs3-4 lakh crore balance sheet size, such as Yes Bank, is “vulnerable to shocks", says Kumar. To grow organically would take years, so the bank is explore growing in size inorganically.

“We will look at acquisitions, anybody who is in a business where we are not. It could be a microfinance institution, or a fintech, but we need to identify a good entity. Microfinance, driving on digital, can be very lucrative," Kumar says. India’s microfinance sector has seen a 30 percent year-on-year rise in the gross loan portfolio for June 2022, but the size of microfinance loans remaining unpaid after six months of their due date is at over nine percent or Rs27,180 crore of the total loan portfolio.

India’s banks, which have the largest market share (38.4 percent) of portfolio in micro-credit, have had a mixed experience in the microfinance space. Bharat Financial Inclusion Ltd (BFIL), a wholly owned subsidiary of IndusInd Bank, in 2021 faced allegations of lapses in governance and ‘evergreening’ of loans based on whistleblowers’ complaints to the RBI. The bank has denied any wrongdoing. Bandhan Bank, once a microfinance firm, has had no option but to diversify—over the past two-three years—into products and regions beyond microfinance, to avoid overdependence on one vertical.

Yes Bank’s banking outlets are largely concentrated in the northern and western region (64 percent combined) with negligible presence in eastern India (four percent), Northeast India (two percent), central India (13 percent) and south India (17 percent). “We may either open more branches in these regions or identify and acquire a smaller institution or fintech firm." Kumar says.

The Yes Bank stock has outperformed the Nifty Bank index, rising about 20 percent in the past six months (see chart). But despite the positive news of the bad loans transfer, the Carlyle/Advent investments and the creation of a new board, the stock is yet to rally. Weak economic conditions and poor equity sentiment have weighed in on the stock.

Baliga says “at every [Yes Bank] price level, some investor would have been stuck, who is probably waiting for a right level to exit". Also mature investors, who seek to accumulate the stock, are waiting for validation of improved corporate earnings to buy into the stock. Baliga also says the bank will need more capital for growth.

March 2023 will see the end of the share lock-in period for Yes Bank investors, when the bank will exit the RBI-led reconstruction scheme. It could see a churn in existing investors (see table), but improved corporate earnings will definitely give a boost.

Even while credit growth is expanding, Kumar is not succumbing for the ‘credit at any rate’ concept or compromise on lending to customers who pose a risk of going delinquent. “Banks have to be cautious in terms of growth otherwise the possibility of a stressed book will increase," he adds. “Topline is not our target. The target is profitability and credit quality."

Prashant Kumar and his team have completed an arduous leg of the trek. The second phase of the trek to the summit will not get any easier, but he has the experience and confidence to know how to balance for growth and ensure credit quality. He will need to take tough but prudent decisions and also back the team completely, if they are to complete this task.

First Published: Oct 03, 2022, 12:41

Subscribe Now