This self-styled saviour of co-operative banks wants to buy the flailing Dhanlax

Will Anshumman Joshi's chequered past, including a jail term, prove to be the proverbial slip between the cup and the lip, or will he clear RBI's stringent filters?

Anshumman Joshi’s tryst with the world of business began as a teenager. Or so, he claims. Back then, as a 14-year-old student at the New Era Public School in Delhi, Joshi claims to have started a mobile reseller business out of the UK, employing a local there, and making some 300 quid as commission from various mobile companies. Then, by the time he turned 18, he claims to have started a travel business, offering cheap air tickets with a focus on markets such as Canada and the UK, with backend offices in India.

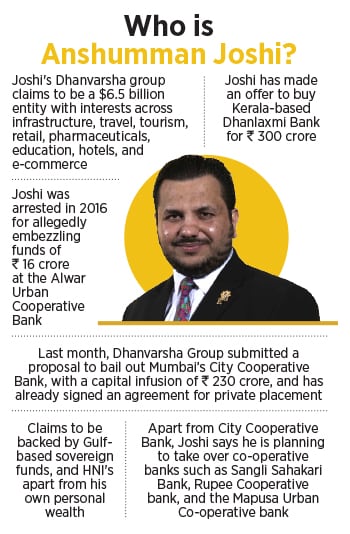

Since then, in the two decades that followed, Joshi has gone on to serve a jail sentence for something he claims he has never done, float a political party, become a chairman at a co-operative bank, change his name as per an astrologer’s advice, and is now gearing up for perhaps his biggest corporate battle ever. Joshi’s Dhanvarsha group, which he claims is a $6.5 billion entity, wants to buy out the publicly owned Dhanlaxmi Bank, a bank with an asset book of over Rs 14,000 crore.

“Business has always been in my blood," says Joshi, who often posts videos on Instagram flaunting his wealth, and is seen flanked by bodyguards. His Instagram account, which has over 33,000 followers, mostly has videos that border on megalomania, to meetings with officials of co-operative banks and news reports from little-known websites that portray him as a much-needed saviour for the co-operative banking sector.

Now, 33, Joshi has sent a proposal to buy the entire equity of Kerala-headquartered Dhanlaxmi Bank for a staggering Rs 300 crore. Dhanvarsha, the New Delhi-based group that Joshi runs, has offered Rs 11.85 per share, a figure Joshi is ready to revise as investors seek a way out of the bank that has been stuck in a quagmire lately. Dhanvarsha says that on acceptance of the offer, the company will conduct due diligence and submit a detailed proposal to the Reserve Bank of India.

“They have not yet responded to my offer," Joshi says. “We are planning a hostile offer. Once I get approvals from the RBI, which should be soon, I will buy the shares from the public." Joshi understands that any promoter can only hold as much as 26 percent in line with RBI’s rules, which means he says he is ready to make an offer to all the shareholders who might be looking to exit the bank. In a decade, the share prices of Dhanlaxmi bank have tanked over 80 percent, with a current market capitalisation of Rs 303 crore.

“They have not yet responded to my offer," Joshi says. “We are planning a hostile offer. Once I get approvals from the RBI, which should be soon, I will buy the shares from the public." Joshi understands that any promoter can only hold as much as 26 percent in line with RBI’s rules, which means he says he is ready to make an offer to all the shareholders who might be looking to exit the bank. In a decade, the share prices of Dhanlaxmi bank have tanked over 80 percent, with a current market capitalisation of Rs 303 crore.

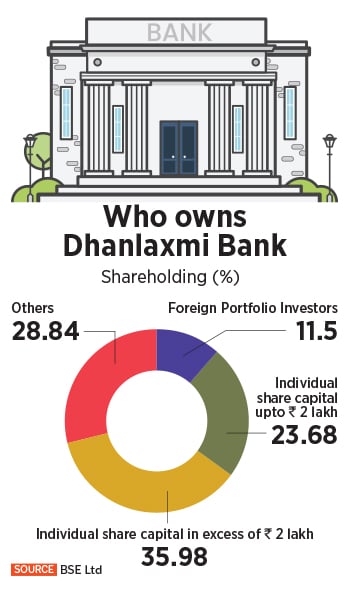

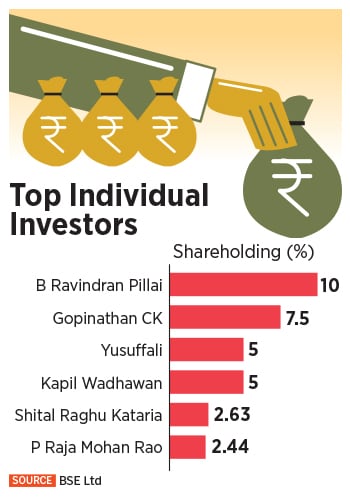

“I don’t want to own 5 percent share in the company," Joshi says. “I want major control." Currently, 100 percent of the bank’s stake is held by the public. Of this, Lulu Group chairman, Yusuff Ali, and Kapil Wadhawan of the scam-hit DHFL Group hold five percent each, while billionaire businessman Ravi Pillai owns 10 percent. If his plans to purchase stake in Dhanlaxmi don’t go through, Joshi says he will wait for the Enforcement Directorate to put up for auction the stake held by Wadhawan.

“Irrespective of whether the bank gets back on my offer or not," Joshi says, “I do know there"s a five percent equity of the Wadhawans that will eventually be attached by the Enforcement Directorate and that is going to go for an auction. I"m going to participate in that option whenever Enforcement Directorate puts that up."

Joshi currently doesn’t own any bank, or hold any position at any co-operative bank despite his claim of a saviour for co-operative banks, even though he has lined up plans to acquire as many as seven co-operative banks. A co-operative bank in which he was chairman, Sanmitra Sahakari Bank, was acquired by the Surat People’s Co-operative Bank in 2018, a move which Joshi claims was done illegally while he was in jail. In 2014, Joshi says he had become chairman of Sanmitra Sahakari Bank.“

Joshi currently doesn’t own any bank, or hold any position at any co-operative bank despite his claim of a saviour for co-operative banks, even though he has lined up plans to acquire as many as seven co-operative banks. A co-operative bank in which he was chairman, Sanmitra Sahakari Bank, was acquired by the Surat People’s Co-operative Bank in 2018, a move which Joshi claims was done illegally while he was in jail. In 2014, Joshi says he had become chairman of Sanmitra Sahakari Bank.“

In the past, there have been many who said they can buy out Dhanlaxmi Bank," a banking expert who has worked closely with Dhanlaxmi and several other banks, said on conditions of anonymity. “But the problem is simple. The RBI is not going to give clearance to someone simply because he has his pockets full. There is a serious vetting process and only those who are deemed fit and proper can be given permission. Second, Ravi Pillai is not going to allow anybody to come in as a buyer." Pillai with a personal wealth of $1.8 billion ranks 1,532 on the world’s top billionaires list. “Last, any acquisition above 4.99 percent needs approval from the RBI which is not an easy affair," he adds.

Joshi, who went by Abhishek Joshi, had changed his name sometime around 2016 to Anshumman Joshi. Although he says the decision was largely due to his astrologer’s suggestion, Joshi had been arrested in Alwar in Rajasthan over alleged embezzlement of funds at the Alwar Urban Cooperative Bank in 2016 where his brother had been chairman. His father was a director of the bank too.

News reports at that time said the Special Operations Group (SOG) of Rajasthan had arrested Abhishek Joshi, his brother, and his father in connection with a fraud of about Rs 16 crore. Joshi was also alleged to be the mastermind and reports also claimed that the 33-year-old was wanted in a multi-million identity theft case by the FBI. Reportedly, Joshi and his gang had invited applications for jobs in a company called Deutsche Group, after which prospective employees were asked to attach their identity cards, which were then used to apply for credit cards. "That was political vendetta by the then government in Rajasthan," Joshi adds. "These have never been proved."

Today, Joshi is the chairman of Dhanvarsha Group, a $6.5 billion conglomerate according to the company’s brochure filed with the Bombay Stock Exchange. Dhanvarsha’s business is spread across infrastructure, travel, tourism, retail, pharmaceuticals, education, hotels, and e-commerce, among others. Joshi also claims to be building residences in Goa, in partnership with some of the best-known hospitality companies in addition to a hospital, medical college, and over 60 schools.

Today, Joshi is the chairman of Dhanvarsha Group, a $6.5 billion conglomerate according to the company’s brochure filed with the Bombay Stock Exchange. Dhanvarsha’s business is spread across infrastructure, travel, tourism, retail, pharmaceuticals, education, hotels, and e-commerce, among others. Joshi also claims to be building residences in Goa, in partnership with some of the best-known hospitality companies in addition to a hospital, medical college, and over 60 schools.

His group companies, Joshi claims, include Dhanvarsha Payment Processing Ltd, set up in 2008, which offers payment gateway solutions to merchants and brought in some 6,300 merchants in the first year of operation, transacting over $72 million. Forbes India could not independently verify details about the company through the Registrar of Companies since a company of that name did not exist. Then there is Travelporrto, established in 2008 as a travel reservation company which Joshi claims to have brought sales revenue of Rs 1 crore on the first day of launch. Again, Forbes India could not extract details since a website or details on the Registrar of Companies couldn’t be found.

Among others, his group companies that contribute towards $6.5 billion include Godoggie Pvt. Ltd an FMCG company, Tara Monte Group of Hotels which Joshi claims to have sold now, and Dhanvarsha Capital Ltd. Then there is his role as an investor at Accept Express PLC and Credence First Bank Limited, a bank proposed in Sri Lanka. Joshi is also a director at Atlantic Fuelex Lanka Pvt.Ltd, a company that Joshi claims was set up to save the Sri Lankan government at least 20 percent on their import of crude oil.

Quite simply, Joshi wants to take over Dhanlaxmi bank to help him buy out a few co-operative banks that he has laid his eyes on.

In August, Joshi and his Dhanvarsha group entered into an agreement for a private placement of Rs 230 crore into The City Cooperative Bank, Mumbai, with plans to convert the bank into a small finance bank. The City Cooperative Bank, headed by chairman Anandrao Adsul, a politician from the Shiv Sena, has been under RBI directions largely due to its negative net worth and its capital adequacy falling below the threshold of 9 percent.

The City Cooperative Bank had earlier floated an expression of Interest (EoI) to identify a suitable equity investor willing to take over management control to revive the bank and commence regular day-to-day operations. “We are at a very advanced stage on that takeover," Joshi says. “The purpose behind it is very clear, that I would like to eventually have a banking SPV, to take over all the cooperative banks. That"s the whole purpose."

In the process, Joshi, the self-proclaimed saviour of cooperative banks is only keen on going after struggling co-operative banks that are under the purview of the RBI. This includes the Sangli Sahakari Bank, Rupee Cooperative bank, and the Mapusa Urban Co-operative bank (MUCB) that has been under liquidation since April 16, 2020, when the RBI cancelled its licence. In the case of Pune-based Rupee Cooperative Bank, the RBI had cancelled the license and directed the Registrar of Cooperative Societies to liquidate the bank in August. The central bank had imposed restrictions on Sangli Sahakari Bank in July, which includes a cap on withdrawals for the depositors.

“We are in the process of taking Sangli Sahakari Bank," Joshi says. “This is a small investment of about Rs 20 crore. In the Rupee cooperative bank, we have proposed an investment of Rs 410 crore. We also want to take over the Bengaluru-based Sri Guru Raghavendra Bank, and this proposal has gone to the RBI."

“We are in the process of taking Sangli Sahakari Bank," Joshi says. “This is a small investment of about Rs 20 crore. In the Rupee cooperative bank, we have proposed an investment of Rs 410 crore. We also want to take over the Bengaluru-based Sri Guru Raghavendra Bank, and this proposal has gone to the RBI."

This is precisely why Joshi wants to buy out Dhanlaxmi Bank although banking experts say the move will not really help. “The investment isn’t much," he says. “The benefit is that I can straightaway go ahead and take over all these banks and all these branched licences will come under this bank." Dhanlaxmi bank had, in March, received approvals from the RBI for opening 20 new branches, including seven in Kerala and four in Tamil Nadu. “These co-operative banks will give me 70 to 80 branches and expand in Maharashtra and the west."

But, to acquire a bank, the broad principles relating to ownership and governance of private sector banks require important shareholders, that is those holding five percent and above to be ‘fit and proper’ according to RBI guidelines. These include the applicant’s integrity, reputation, track record in financial matters, and compliance with tax laws. Then there is the question of whether the applicant has been the subject of any proceedings of a serious disciplinary or criminal nature or has been notified of any such impending proceedings or of any investigation which may lead to such proceedings.

“I don’t intend to be on the board of the bank," Joshi says. “I will only be the investor. “Those on my board will include former officials of RBI. including deputy governors and executive directors of banks."

To fund the acquisition of Dhanlaxmi Bank, Joshi says he is in the midst of setting up an Alternative Investment Fund.

AIFs are privately pooled investment vehicles which collect funds from sophisticated investors, whether Indian or foreign, for investing according to the market regulator, SEBI. “It’s going to be backed by certain Gulf-based sovereign funds and we already have a deal," Joshi says. “Along with other funds and family offices of many HNIs, we will build one of the largest banks in the world."

Existing rules do not stop commercial banks from buying a stake in co-operative banks, according to sector expert’s although they function under different licences. Co-operative banks in the country currently comprise urban and rural cooperative banks. Although not formally defined, urban cooperative banks refer to those located in urban and semi-urban areas. But, to become eligible for acquisition, these will first need to convert themselves into a corporate entity or a small finance bank, all of which requires approval from the RBI, say industry experts.

A 2020 amendment by the central government meant that the RBI, which had limited powers to regulate cooperative banks earlier, restricting its ability to take timely corrective action, could now regulate urban cooperative banks with retrospective effect from June 29, 2020, while for state cooperative banks and district central cooperative banks, it was effective from April 1, 2021.

“As an individual shareholder, if you want to increase your stake in a bank to even 5 percent, or for that matter when you cross 4.99 percent of the shareholding, you need clearance from the RBI," a sector expert tells Forbes India. “First, you need to become a shareholder, then a director, and then a promoter, and all of them will be vetted by the RBI. The board will be vetted as per fit and proper norms before individuals are taken up on that. When it comes to Dhanlaxmi Bank, the RBI will be extra careful."

“it is fairly certain that any acquisition will need to comply with RBI guidelines," the managing director at a ratings agency says. “The question is at what stage will the RBI step in. When Fairfax purchased 51 percent stake in Catholic Syrian Bank, they needed to keep RBI in the loop at every stage, even before they made the offer."

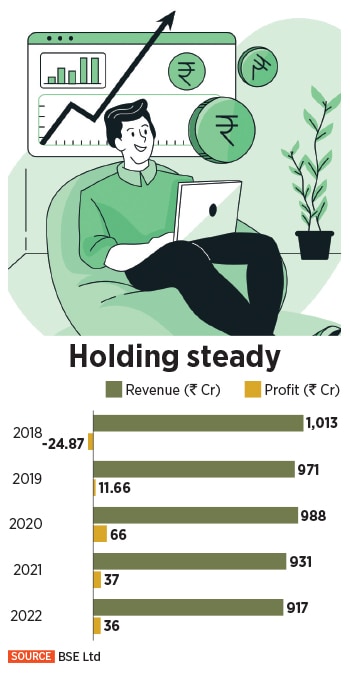

Dhanlaxmi Bank has been under close watch by the RBI for many years now. Over the past few years, a rift between the management and the shareholders had spiralled out of control and shareholders have often held the management responsible for the bank’s poor performance. “Essentially, the problem is that Dhanlaxmi is a Kerala-based bank, and as management, you really need to understand the local sentiments," the expert says. “You need to behave and act like a local to win over the shareholders which had been missing for many years."

In June, the bank held an extraordinary general meeting (EGM) called by a group of 11 minority shareholders who were unhappy with the working of the bank. In October 2020, the RBI approved the appointment of a committee of directors (CoD) to run day-to-day operations of DBL, after its shareholders voted against the re-appointment of its then managing director and CEO Sunil Gurbaxani. Finally, in January 2021, JK Shivan was appointed as the managing director and CEO.

Now, a plan to raise Rs 127 crore through a 2:1 rights issue to improve the bank’s capital adequacy ratio, has been stuck due to the lack of required members on the board of the bank. The bank has been unable to appoint new directors due to a legal tussle at the Kerala High Court, between the management and a group of shareholders.

At Dhanlaxmi, Joshi says, he wants to eventually refocus the business into that of gold loans, something akin to what companies like Muthoot and Manappuram have been focusing on. “I want the bank to grow in the business of gold lending, which is a fabulous business, and I would not be very keen on a lot of other secured assets," Joshi says. According to IIFL, the quantum of credit on bank loans against gold jewellery shot up from around Rs 34,000 crore at the end of March 2020 to nearly Rs 61,000 crore in 2020-21 and stood at around Rs 74,000 crore at the end of March 2022.

Assuming, he even takes control of Dhanlaxmi Bank, it’s not an easy task to acquire co-operative banks as Joshi expects it to be.

Experts reckon that co-operative banks need to become corporate entities or small finance banks before they can even be acquired by a bank, according to RBI regulations. As a co-operative bank, however, precedents have been laid out where some have merged to create a larger commercial bank. For instance, Development Credit Bank was started as a credit society in the 1930s.

Eventually, Diamond Jubilee Co-operative Bank Ltd merged with Ismailia Co-operative Bank Ltd and, in 1981, Ismailia Co-operative Bank Ltd was amalgamated with Masalawalla Co-operative Bank Ltd to form the Development Co-operative Bank Ltd. Later, Citi Cooperative Bank Ltd merged with Development Co-operative Bank Ltd and in 1995, Development Co-operative Bank Ltd was converted into Development Credit Bank.

Then, in July 2021, the Mumbai-based Centrum Group, received an in-principal approval from the RBI to take over the troubled cooperative lender PMC Bank, a co-operative bank, and re-launch it as a small finance bank. Centrum Group-promoted Unity Bank was given approval in January. “Every scheme of amalgamation will need to be vetted by the RBI at every stage," the banking expert says. “Now, if Dhanvarsha manages to acquire, let’s say 6 percent from the public, then the RBI, I am certain will find a way under the banking regulation act to bring it down."

Meanwhile, it’s not just Dhanlaxmi Bank that Joshi wants to go after. “I"ll also be participating in the disinvestment that the central government intends to bring," Joshi says. “I am planning to take over Karnataka Bank, Central Bank, and Indian Overseas Bank, whenever the proposals for disinvestments are cleared by the central government."

Joshi, of course, is making some tall claims. And, if the banking regulators’ oft seen strictness are anything to go by, it could all end up being a pipe dream.

First Published: Sep 28, 2022, 14:08

Subscribe Now