Post-mergers, big banks aren't gobbling up smaller ones. Not yet

Some bankers, analysts and housing finance experts foresee a consolidation in financial services, but it will be need-driven and neither widespread nor constant

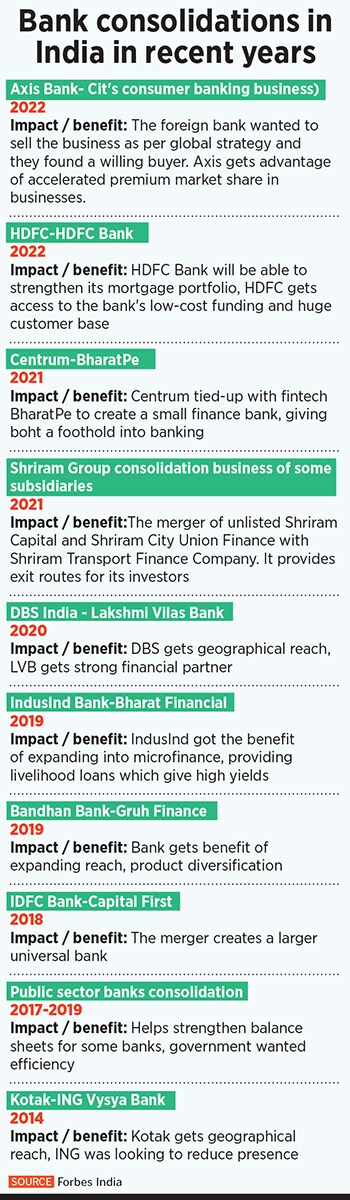

Two banking developments that took place in April—one, the proposed merger of Housing Development Finance Corporation (HDFC) with private sector lender HDFC Bank, being touted as a ‘one-in-a-lifetime’ deal and second, Axis Bank buying out Citi India’s consumer banking business—leads one to think more such are on the way. Combine this with the fact that India has just 12 state-owned banks, down from 27 earlier, through a forced consolidation by the government in 2019, and one might think it is a secular trend emerging. But a closer look at recent mergers suggests that other factors are playing out.

In September last year, Finance Minister Nirmala Sitharaman spoke about the need for 4-5 banks the size of State Bank of India (SBI), to meet the needs of a growing economy. The driving force for amalgamation (of banks) was that India needs not just a lot more banks, but a lot more big banks, she had said at that time.

In recent years, banks were not actively scouting for mergers and acquisitions because the larger players were going through their own challenges to improve asset quality and capitalisation levels after the non-banking financial companies (NBFC) crisis and the pandemic. With provision levels (excluding write-offs) improving to an average 71 percent for all commercial banks, the stress level which banks are likely to face can be better assessed.

“Now large banks, strengthened with improved balance sheets and P&L, have the confidence to go out and scout for acquisitions. Consolidation in the BFSI space is going to happen," says Anil Gupta, vice president of credit ratings agency ICRA.

A similar sentiment is echoed by Fitch India senior director Saswata Guha, colleague Siddharth Goel and Singapore-based senior director Elaine Koh. They believe the two recent deals “could encourage banks to turn to M&A. Large NBFIs could be acquisition targets, given their higher-margin products, large pools of priority-sector customers and loans, and potential cross-selling opportunities. However, the regulatory attitude towards such acquisitions will be an important factor in their success," they said in a non-rating commentary.

“It is inevitable that you will see consolidation. It is a symptom of what is going to continue to happen, it may happen in smaller transactions. You may not have the large scale of deals, as seen earlier. But a bank cannot be shrinking by market share and continue to compete in the future," says the CEO of an international bank, on condition of anonymity.

Gupta points out that barring the big four private banks (HDFC, ICICI, Axis and Kotak Mahindra), the market share of all the other private banks has stagnated at 12.5 percent for the past four years. “This is because of asset quality issues with the other private banks as well as that their ability to grow is constrained due to the higher cost at which they have to mobilise their liability book," he told Forbes India.

Gupta points out that barring the big four private banks (HDFC, ICICI, Axis and Kotak Mahindra), the market share of all the other private banks has stagnated at 12.5 percent for the past four years. “This is because of asset quality issues with the other private banks as well as that their ability to grow is constrained due to the higher cost at which they have to mobilise their liability book," he told Forbes India.

Several mid-sized private banks such as Yes Bank, RBL Bank, IndusInd Bank and Federal Bank have all struggled due to much higher cost of deposits in previous years (see chart), though these levels are starting to improve in recent quarters.

But smaller regional banks that have seen a financial turnaround in 2021 or had a favourable product mix have already been acquired. The 102-year-old Thrissur-headquartered Catholic Syrian Bank has seen a turnaround in business, pumped with capital from Canadian billionaire Prem Watsa’s Fairfax Group. Profitability, asset quality and the loan book have all improved significantly after the takeover in 2018.

Singapore-based DBS’s India arm acquired the Tamil Nadu-based crisis hit Lakshmi Vilas Bank (LVB) in November 2020 after an RBI structured amalgamation scheme. DBS gets LVB’s regional reach and the traditional strength of servicing small businesses and retail consumers.

Despite all of this, investment bankers and consultants should understand that it is not going to be rush hour for M&As just yet.

There were several factors which have played out for the boards of both the HDFC group companies to propose a merger. When first thought of in 2014, the regulatory environment was not conducive enough for such a deal. In recent years, the Reserve Bank of India (RBI) has been tightening the regulatory and capital norms for NBFCs, which includes HDFC. This meant that NBFCs could not really function within a lower level of regulation. Being part of a bank probably made more sense at this stage.

Also, the regulatory structure of the HDFC group was not in alignment with what the regulator thought was ideal for a bank. The promoter of a bank (in this case HDFC) and two of its subsidiaries owning 21 percent in the bank is not what the RBI wants. They probably want the lending business in a single entity within the group. A non-operative financial holding company is probably being seen as the more preferred structure for all licences to be issued for new banks.

Another reality is that HDFC Bank, though an aggressive private lender, has been a weak player in the mortgage lending space. Home loans form only about 6.2 percent of HDFC Bank’s productwise lending book and another 4.5 percent is loan against property, based on the bank’s December 2021 data. Add to all this, post-merger we could see a lower cost of funds for the mortgage business and that the bank will be able to cross-sell home and life insurance products.

The recent mergers in April and previous ones have a common thread. There is no widespread practice or possibility that larger or even mid-sized banks will merge with their peers.

Pankaj Agarwal, the banking and financial services analyst at Ambit Institutional Equities, says consolidation in the banking space might look like a pattern “but if you look closely at the mergers and acquisition deals over the last 3-5 years, one will realise they were specific and need-driven rather than being a secular, large theme".

“If a bank were to acquire the smaller asset of another bank, what are the parameters. Banks will look at what they can generate as returns from the asset and the cost of making it profitable, while also considering the valuation is not too steep," Agarwal adds.

In the recent Axis-Citi case, the foreign bank wanted to sell the business as per global strategy and they found a willing buyer. Last year, financial services group Centrum aligned with fintech Resilient Innovations (BharatPe) to create Unity Small Finance Bank, to get a foothold into banking activities.

In 2021, Shriram Group consolidated its financial services businesses with a merger of unlisted Shriram Capital and Shriram City Union Finance with Shriram Transport Finance Company (STFC). It streamlined the way for exits for its investors Ajay Piramal and TPG Capital. In 2019, micro-finance lender Bharat Financial was getting a good valuation and IndusInd wanted to expand into this space Kotak Mahindra Bank had also acquired a micro-finance company BSS Microfinance in 2016.

In 2021, Shriram Group consolidated its financial services businesses with a merger of unlisted Shriram Capital and Shriram City Union Finance with Shriram Transport Finance Company (STFC). It streamlined the way for exits for its investors Ajay Piramal and TPG Capital. In 2019, micro-finance lender Bharat Financial was getting a good valuation and IndusInd wanted to expand into this space Kotak Mahindra Bank had also acquired a micro-finance company BSS Microfinance in 2016.

In 2018, NBFC Capital First merged with IDFC Bank in 2018 to create a new bank IDFC First Bank. Going back to the Kotak-ING Vysya Bank 2014 deal, ING was looking to pare down their presence in India.

Earlier, banks were acquired for their branch strength but in the digital-focussed lending space, the need for branches is coming down. Most of the big banks are not adding any.

The RBI has kept banking licences on-tap for new entrants. If approvals for new types of banks had been closed, then it might push existing players to explore opportunities to grow faster inorganically.

A CEO of a mid-sized private sector bank does not expect major consolidation moves in the banking sector. “Consolidation will not happen and should not happen. India is making a huge mistake by merging state-owned banks with each other."

Privatisation of banks has always been a sensitive process for any ruling government to undertake, due to complex cultural issues, niche customer access and underwriting processes. India’s current plan to privatise two state-owned banks and one general insurer, which was announced in 2021, could not be completed in FY22 and is yet to be started.

The banker also said that consolidation of private sector banks will cause “an imbalance" with muscle power only with 6-7 large banks, while the rest run the fear of becoming mediocre and ineffective small regional banks.

He argues that the rationalisation for big banks is a “huge canard" spread by the larger banks themselves, who have pushed this theory that India needs only 4-5 large banks. India, he says, will instead, be better served by having all existing banks grow. India’s bank credit to GDP ratio is at 68 percent in December 2021.

Now for HDFC Bank, the tenor of its assets will move up and the loan book becomes stickier. “For every drop of sweat that HDFC Bank expends, they get greater bang for their buck," says Saurabh Mukherjea, founder of Marcellus Investment Managers.

Mukherjea says there are considerable economies of scale in running largescale financial services operations in the form of data/technology, distribution muscle and the cost of capital. “Now, four large empires are being built out: HDFC Bank empire, Axis Bank empire, ICICI Bank empire and the Bajaj Finserv-Finance empire. It will put enormous pressure on everybody else who does not have this scale," he added. “The bugle has sounded out loud and clear, either get big or die trying." This will particularly be true for the mid-sized to smaller banks and NBFCs.

Kotak Mahindra Bank: Kotak Mahindra Bank (KMB) stands as having built a very successful franchise in its near 20-year existence. But, in the last five years, most M&A news has only been speculative: First of a merger with rival Axis Bank in 2018 and then a takeover of IndusInd Bank in 2020. Founder Uday Kotak, has, for years, spoken about being open to growing the bank inorganically.

“There are three most important things that will drive future growth for Kotak. First being customer acquisition and customer experience, second is significant investment and growth in the technology, and the third and the most important is getting the right talent for a new future in financial services. We are in a sweet spot," said Dipak Gupta, joint managing director, Kotak Mahindra Bank.

Jaimin Bhatt, president & group CFO, Kotak Mahindra Bank, said, “In a marathon, if you run too fast, you get exhausted. If you run too slow, you never make it. In today’s fast-paced world of rapid advancements in technology, we need to be ahead of the curve in terms of product offerings to our customers. In the newer normal, we need to keep evolving however, developing technology involves money and time. Technology is quickly becoming obsolete. What is new today is old tomorrow and therefore at Kotak we are partnering and investing in promising companies working on innovative and game changing technologies which will be the backbone for our growth."

Being well-capitalised, profitable, its asset quality and cost of funds improving there could be no better time. But for KMB, valuation of an asset is an overpowering factor when it decides to acquire something. The bank remains risk-averse but Kotak cannot be blamed for that, as corporates had become careful in recent years while raising capital, equity or debt. The strong franchise can continue to be built up organically. Its competition is only with the other big banks—HDFC Bank, ICICI Bank and Axis Bank.

IDFC First Bank: Its loan book is growing but not too rapidly, but the positives for the bank are that core operating profit has nearly tripled since the 2018 merger which created the bank. On the corporate and infrastructure loan book, most of the legacy accounts have been dealt with successfully by its leader V Vaidyanathan. It can, like some of its peers, continue to grow organically in loan book size and CASA.

Bandhan Bank: With over 70 percent of its presence in semi urban and rural areas, Bandhan Bank’s loan book is skewed to serve the underbanked and unbanked. Though the bank aims to diversify its asset book, as per its “Vision 2025", currently it is too microfinance-centric. Bandhan has been active in M&A, first acquiring affordable housing company Gruh Finance in 2019 and expanding mutual funds business in 2022 through its parent Bandhan Financial Holdings, along with Singapore’s sovereign fund GIC and private equity firm ChrysCapital.

RBL Bank, IndusInd Bank: Need to continue to build their brand franchise. Both the banks need to drive low-cost deposit mobilisation and grow their asset book further, even as their focus on retail and small business loans.

What will become attractive acquisitions for some of the larger banks? ICRA’s Gupta says: “Banks which are low on RoA and hence cannot generate growth capital internally, or banks that are low on capital cushion and their ability to raise capital is constrained because of market price of share to book value being less than 1, can all be considered acquisition targets." Gupta declined to offer possible names.

But, in our view, some of the larger banks might consider some of the smaller, regional banks as emerging attractive bets (see table). But besides attractive valuations, shareholders’ push in these banks will drive any M&A as the management of regional banks or smaller finance companies might not be incentivised enough to do so.

The demand for mortgage loans has only been increasing in 2021, fuelled by a low interest rate regime, the normalisation of business activity and the need for a second home after the pandemic. The affordable housing segment is seen as a driver for growth but across semi-urban and rural areas.

State Bank of India has disbursed Rs 5.38 lakh crore worth home loans in the December-ended quarter. ICICI Bank, where mortgages forms over half of its retail loan portfolio, has seen a 23 percent rise in mortgage loans, at Rs 2.78 lakh crore in December-end 2021 quarter.

Experts are not ruling out consolidation in this segment too, particularly where tiny to mid-sized housing finance companies are unable to infuse substantial capital to grow in outstanding mortgage loan assets. In recent years, several HFCs have been involved in co-lending activity along with banks or NBFCs, to their customers.

Consolidation in this segment is definitely going to pick up post the HDFC merger action, experts say. “There will be consolidation over a period of time, especially for the smaller HFCs, which could see a buy-out of their portfolio or the complete company," says Sudhin Choksey, former housing finance head at Bandhan Bank and previously CEO of Gruh Finance.

Mainsh Shah, managing director and CEO of Godrej Capital, believes in consolidation but is not sure at what pace it will take place. “Consolidation in the financial services and housing finance space is on. To be a balance sheet player of size, the constant ability to raise debt at preferential rates is a real entry barrier," Shah says.

First Published: Apr 14, 2022, 14:36

Subscribe Now