Though the route towards a universal banking licence is a little less complicated than in previous years—as a corporate can apply for a small finance banking licence initially before seeking a broader role—the acquisition of a large, fully operative bank such as IDBI Bank opens up a fresh opportunity for entities. The lowering of the presence of the current promoters only makes the bank more attractive.

The Government of India seeks to divest 30.48 percent of its 45.48 percent stake in IDBI Bank and LIC (the promoter with management control) 30.24 percent of its 49.24 percent stake for a combined 60.72 percent stake strategic sale. After the stake sale is completed, the two entities combined are likely to continue to hold a combined 34 percent in the bank.

A complete exit of the promoters from the bank will depend on the valuations it draws in the initial rounds.

The potential bidders are likely to conduct due diligence before putting financial bids. The process is yet to start. The successful bidder, whether a sole entity or a consortium, is required to hold and lock-in at least 40 percent of the paid up and voting equity share capital of IDBI Bank, at all times, for five years from the date of acquisition of stake in IDBI Bank. The interested party must have also reported net profits in at least three of the last five fiscal years.

Numbers Tell A Story

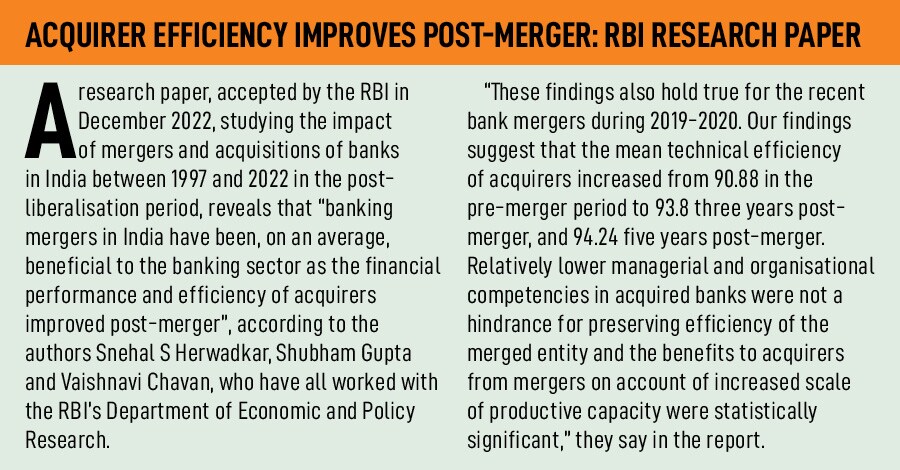

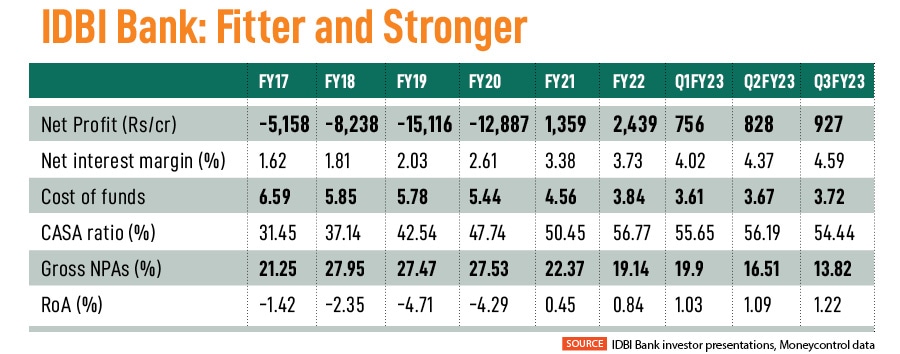

Some of the numbers make for good reading. IDBI Bank was faced with the challenge of deteriorating asset quality that dented its profitability and capital position, resulting in the Reserve Bank of India (RBI) placing it under the PCA framework, in May 2017, for a period of nearly four years. The PCA is like a quarantine period which weak banks are placed under until their financial health improves.

![]()

IDBI Bank’s Managing Director and CEO Rakesh Sharma explained how two critical issues—high NPAs (non-performing assets) and legacy corporate lending exposure—were tackled. “We crafted a comprehensive, multi-pronged strategy that focussed on transitioning to a capital-light business model entailing recalibration of the loan book in favour of retail loans while trimming down the corporate exposure. At the same time, the bank revisited its risk management and credit monitoring frameworks to ensure quality asset book going forward," Sharma tells Forbes India.

The asset quality for the bank stands improved. The gross non-performing assets (GNPA) ratio for the bank (as a percentage of total advances) has improved to 13.82 percent as of December-end 2022 from 21.25 percent in March-end 2017. More importantly, the net NPA ratio has improved to 1.07 percent from 13.21 percent in the same period. The net NPA as a percentage of net advances is better than the 1.3 level for all banks, according to RBI data.

Though the GNPA ratio is much higher than the average level for most other private sector banks (of 1 to 3 percent) and 5 percent for all banks, the huge positive for IDBI Bank is that “it has recognised all the pain", says an analyst with an equity research firm on condition of anonymity.

IDBI Bank has a current provision coverage ratio (PCR) of 98 percent as of December-end 2022, which means that the bank has kept aside funds and provided for capital to cover losses on NPAs.

But the quality of the asset book will need to be watched closely by the new investors.

In the lending book, IDBI Bank’s retail to corporate ratio in gross advances has improved to 67:33 in December-end 2022, from 63:37 in December 2021 and 40:60 in March-end 2017. But becoming a nimble, retail-focussed bank is still work-in-progress. Remove lending to agriculture and small businesses and the pure retail lending is 52 percent of the book.

The improvement in IDBI Bank’s asset quality has helped in lowering the credit cost (0.49 percent in Q3FY23) and improving yield on advances (9.27 percent in 9MFY23) compared to the 8.79 percent yield figure in 9MFY17.

The growth in the bank’s retail business and improving asset quality have contributed to improvement in net interest income (Rs8,151 crore for 9MFY23) and net interest margin (4.35 percent for 9MFY23). A fallout of this has led to improved profitability for the bank it has reported full-year profit for the last two financial years, after four successive years of losses. For 9MFY23, the IDBI Bank’s net profit stood at Rs2,512 crore, surpassing the net profit for FY22.

Post exit from PCA, the capital position of the bank has also improved. The Tier-1 ratio has improved to 17.6 in December-end 2022 from 7.81 percent as of end-March 2017.

Deposit Franchise and Network

The bank’s financials are improving, but the biggest advantages for a new suitor is IDBI Bank’s deposit franchise and its network. IDBI Bank has total gross advances of Rs170,323 crore and total deposits of Rs232,671 crore, as of December 2022. This gives it a loan-to-deposit ratio of around 73 percent—and adequate liquidity—though this level can improve to an ideal 80 to 85 percent.

The bank also boasts a wide pan-India presence with a network of over 1,900 branches and over 3,300 ATMs. The physical branch and ATM network are completed by digital solutions such as mobile banking and net banking.

![]() “The turnaround strategies adopted by the bank have not just helped in resolving the transient issues but also put in place several structural and systemic improvements," says Sharma. The CASA (current and savings account) ratio has improved to 54.4 percent in December-end 2022 from 31.46 percent at end-March 2017. This has helped the bank in driving down its cost of deposits (3.44percent) and cost of funds (3.72 percent) as of December-end 2022 earnings, enhancing its competitive edge and interest margins.

“The turnaround strategies adopted by the bank have not just helped in resolving the transient issues but also put in place several structural and systemic improvements," says Sharma. The CASA (current and savings account) ratio has improved to 54.4 percent in December-end 2022 from 31.46 percent at end-March 2017. This has helped the bank in driving down its cost of deposits (3.44percent) and cost of funds (3.72 percent) as of December-end 2022 earnings, enhancing its competitive edge and interest margins.

Analysts believe that the strong deposit franchise and the reach of the bank will become attractive, as both are time consuming for a new bank to build. “Potential interested private equity institutions look towards IDBI Bank due to its branch reach. The near-total provision for bad loans is positive and a new buyer would look towards some amount of recovery from these loans," says Kranthi Bathini, director (equity strategy) at WealthMills Securities.

“The books are better, the bank also commands improving return on assets of 1.22 percent in Q3FY23 compared to a -1.83 percent in Q3FY18," the banking analyst explains. “For a new investor, whether a private equity consortium or another bank, there is enough evidence to suggest that deposits will continue to grow for IDBI Bank and the path towards an improved retail-focussed loan book has been taken. The fact that LIC, as a promoter, will not exit completely, is a positive at this stage."

DIPAM Secretary Tuhin Kanta Pandey had tweeted in January that “multiple expressions of interest" have been received for the IDBI Bank disinvestment, without disclosing the names. Media reports suggest five, including Japan’s Sumitomo Mitsui Banking Corporation Group (SMBC Bank) and Oaktree Capital Management, have filed expressions of interest.

Canadian billionaire Prem Watsa-controlled Fairfax Financial Holdings—its Fairfax India Holdings Corporation has a majority in Thrissur-headquartered CSB Bank—has also shown interest in the disinvestment. Oaktree and Watsa did not respond to queries.

Financial bids for the disinvestment are likely to open in March and conclude by September, according to government responses to the media.

Work in Progress

But like every other company in transition, there are several pieces which are work in progress. Sharma admits the “immediate imperative is to bring the GNPA and NNPA ratios to less than 5 percent and 1 percent respectively". Another challenge for the bank will be to continue to build the retail liability franchise for the bank, which it has been doing since 2020. Sharma says the bank will “ensure that the overall loan mix remains between 60 percent and 65 percent of retail loans and 35 to 40 percent of corporate loans. To support its deposit growth, the bank will pursue retail term deposits in addition to CASA".

While business synergies will be easy to explore with the new buyer, the toughest aspects for the successful acquisition will be the manpower work culture and stepping up IT investment to boost digitisation and efficiency.

“Building the liability franchise, integrating work cultures and improving the technology operating system are the biggest challenges for the bank," the bank analyst says.

IDBI Bank has a market cap of Rs52,095 crore (as of February 23), with the stock price of Rs48.25 at the BSE. The stock found momentum from the 2022 low of 30.8 to rise 55 percent to Rs48 levels, but tends to slide on profit taking after all disinvestment-related news. IDBI has thus fallen 18 percent from its January 2023 high of 59 and now trades just 6 percent up from the Rs45 level a year ago.

![]()

The stock commands a valuation of 1.5x book. While it appears to be a fair valuation, most analysts and fund managers do not actively track the stock. “It is difficult to convince investors of how IDBI Bank should be valued above a State Bank of India or a Bank of Baroda stock," the analyst says.

He also questions the timing of the disinvestment, which if it closes in FY24, is very close to the general elections of 2024. “No government will want to deal with a situation of an acquisition gone wrong or irate bank employees," he adds.

The United Forum of IDBI Officers and Employees has launched a social media awareness campaign (#TogetherForIDBI), opposing the privatisation move, but without meaningful success.

But Sharma highlights the fact that IDBI Bank has been stepping up its IT investments in recent years. “The bank has chalked out an investment of Rs600 crore for digital initiatives," Sharma says, while also partnering with fintechs for implementation of projects such as virtual ATMs, account aggregator, pilot implementation of digitisation of Kisan credit cards and digitisation of supply chain finance.

Sharma is confident that IDBI Bank is “ready for take off at a very high speed. Furthermore, with the high provision, there are no hidden surprises for the bank as it is ring-fenced against shocks". Veteran banker Sharma’s CV certainly reads well, having successfully pulled IDBI Bank out of an abyss in 2018. But a new investor will have a tougher task ahead: To drive IDBI Bank into becoming one of the most efficient and profitable private sector banks, with limited promoter intervention.

“The turnaround strategies adopted by the bank have not just helped in resolving the transient issues but also put in place several structural and systemic improvements," says Sharma. The CASA (current and savings account) ratio has improved to 54.4 percent in December-end 2022 from 31.46 percent at end-March 2017. This has helped the bank in driving down its cost of deposits (3.44percent) and cost of funds (3.72 percent) as of December-end 2022 earnings, enhancing its competitive edge and interest margins.

“The turnaround strategies adopted by the bank have not just helped in resolving the transient issues but also put in place several structural and systemic improvements," says Sharma. The CASA (current and savings account) ratio has improved to 54.4 percent in December-end 2022 from 31.46 percent at end-March 2017. This has helped the bank in driving down its cost of deposits (3.44percent) and cost of funds (3.72 percent) as of December-end 2022 earnings, enhancing its competitive edge and interest margins.